The best retirement ever doesn't require millions of dollars, multiple homes, and dinners at fancy restaurants. What it does need is a vision and a plan.

Donna Dickinson had both when she started her career. Long-term planning and consistent saving helped her retire when she wanted, with the lifestyle she hoped for.

"I knew I wanted to be comfortable enough to not have to worry about money and be able to do what I wanted," Dickinson says of her retirement vision. "I started planning, saving, and investing as soon as I started working. My company offered retirement with full benefits when my age plus years of service equaled 90. I happily retired at age 57, 5 years ago, and have no regrets. That was my long-term goal and plan."

Donna was lucky. Her company offered matching 401(k) contributions and stock options that she was able to take advantage of. Plus, part of her retirement benefits package included contributions to health care coverage before she turns 65, when Medicare kicks in. "I do have a monthly contribution, but the company also contributes, making it affordable. I would not have been able to retire when I did otherwise," she says. Employer benefits can be critical to retirement success—and they're wildly variable. But visioning and planning are key as well. Whatever your career path looks like, preparing can help you seize the savings opportunities that present themselves. Fidelity has some guidelines to help you along the way.

Visualization: A powerful way to imagine your future

Knowing what you want and picturing yourself achieving your goal can help you see the steps you'll need to reach your destination. To get started visualizing your best retirement ever, consider these questions.

- What are you retiring to? Some people find inspiration by picturing family and friends, while others are inspired by animals, nature, or the promise of solitude.

- What do you want to do in retirement? What would you do if you could do anything you wanted? Could you estimate what that might cost? That could help you understand how much to try to save.

- How does retirement fit in with the rest of your goals? Realistically, retirement may not be your highest money priority all of the time. A financial plan can help identify money trade-offs and strategies for reaching multiple goals.

- Are you on track to hit your retirement goals? Where are your savings now compared to what you may need? This can be a scary number to contemplate, but facing it head-on can be empowering—whether you're on track or need to catch up.

Read Viewpoints on Fidelity.com: Boost your odds of a successful retirement

How to plan the best retirement ever by age

Having a vision can help you set a concrete goal for retirement. Once you've considered how you might spend your time and where you might be, you'll have a sense of how much that might cost. Your expenses in retirement and how many years your savings will need to provide income will help you set your savings goal.

Possible savings goal: Aim to save 1 times (1x) your annual salary by age 30.1 To learn more about Fidelity's savings factors, read: How much do I need to retire?

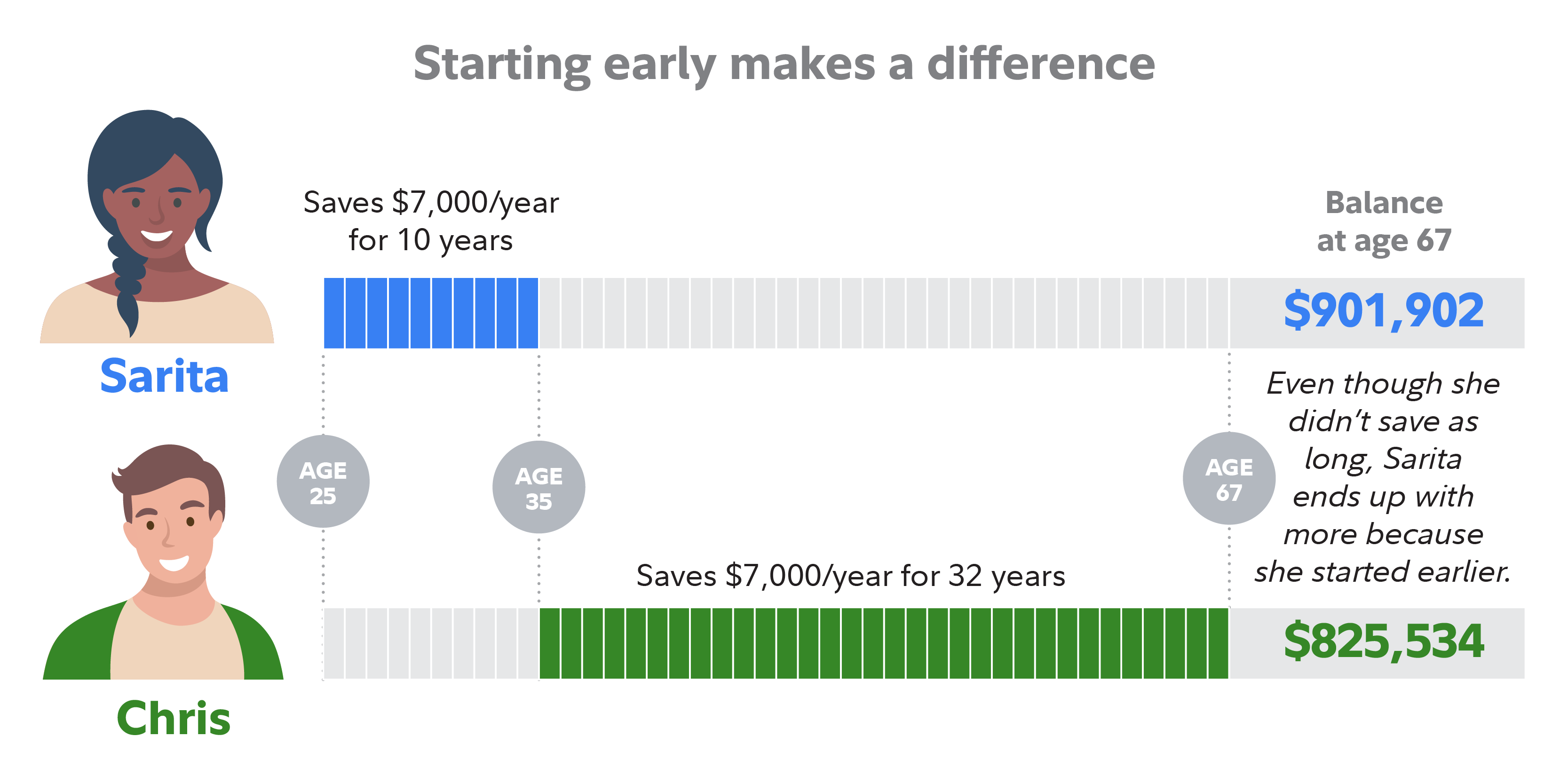

Take advantage of time and the potential of compounding growth. When it comes to long-term saving, time is a powerful force and it's on your side. The earlier you begin saving and investing, the lower your savings rate can be throughout your career thanks to the power of compounding.

Make the most of savings with tax-advantaged accounts. At this life stage money can be scarce, but saving and investing what you can in a tax-advantaged account will pay off later in life. After all, the less you pay in taxes the more potential you have to grow that money. Examples of tax-advantaged accounts include IRAs, workplace savings plans like 401(k)s, and health savings accounts (HSAs).

Your HSA, if you have one, can be a particularly powerful savings vehicle for retirement due to its triple tax advantage: Contributions are made on a pre-tax basis or you can take a deduction for contributions made yourself (rather than through payroll deductions by your employer), investments in the account have tax-free growth potential, and withdrawals are tax-free when used for qualified medical expenses now or in retirement.2

Read Viewpoints on Fidelity.com: 5 ways HSAs can help with your retirement

Fidelity's guideline: Save 15% of your income annually, including any match you get from your employer. This assumes you start saving at age 25 and plan to retire at age 67.3

If 15% is too much, start where you can. If you get a match from your employer, aim to contribute enough to get the entire match and then increase your contribution rate each year until you get to 15%.

Also, make sure to invest that money for long-term growth potential. Over the long term, stocks have historically had higher returns than bonds or cash. In your 20s, consider investing in a diversified mix of investments with a significant portion devoted to stocks. Investors with many years before retirement have time to ride out the ups and downs in the market, and the potential compounding and growth stocks can provide may help you reach your retirement goals. But balancing the growth potential of stocks with your own ability to tolerate risk is critical to staying invested for the long term.

Read Viewpoints: Investing ideas for your IRA

Possible savings goals: Aim to save 3 times (3x) your annual salary by age 40 and 4x by age 45.

Try to ramp up your savings. This is a busy time of life for many people, but it's also a time when your income may be on the rise. If you're not saving as much as you'd like or may need, try increasing your contributions each year when you can. For example, if you get a bonus or a raise, consider dedicating at least a part of it to retirement savings.

Find more tax-advantaged ways to save. Try to save as much as you can in tax-advantaged accounts like a 401(k), IRA, and HSA.

If your company offers stocks options or nonqualified deferred compensation plans, they could also be a way to help supercharge your savings if you've maxed out your other retirement accounts.

Read Viewpoints on Fidelity.com: Make the most of company stock in your 401(k) and The basics of nonqualified deferred compensation

If most of your retirement savings is in traditional pre-tax savings vehicles like IRAs and 401(k)s, it can sometimes make sense to convert some of the money into a Roth IRA and/or Roth 401(k). You will need to pay income taxes on the converted amount, but withdrawals in retirement are tax-free, giving you more flexibility to reduce your overall tax bill in retirement. There are many considerations before doing a Roth conversion, including your current and future tax brackets.

Read Viewpoints on Fidelity.com: Do you earn too much for a Roth IRA? and Backdoor Roth IRA: Is it right for you?

Think about speaking with a tax professional to understand if/when this strategy could be good for you.

Continue investing for potential long-term growth. With a decade or more before you are likely to retire, you may want to keep the majority of your retirement portfolio in a diversified stock portfolio.

Read Viewpoints on Fidelity.com: 3 keys to choosing investments

Possible savings goals: Aim to save 6 times (6x) your annual salary by age 50 and 8x by age 60.

Use catch-up contributions. People over age 50 can take advantage of catch-up contributions to their retirement accounts. In 2025, the IRA contribution limit is $7,000 with an additional $1,000 catch-up contribution allowed for people over 50 years old.

For 2025, the IRS contribution limits for HSAs are $4,300 for individual coverage and $8,550 for family coverage. If you're 55 or older during the tax year, you may be able to make a catch-up contribution, up to $1,000 per year. Your spouse, if age 55 or older, could also make a catch-up contribution, but will need to open their own HSA.

The 401(k) contribution limits for 2025 are $23,500 for pre-tax and Roth employee contributions and $70,000 for combined employee and employer contributions. Employees age 50 and above can make an additional employee contribution of up to $7,500. For those between ages 60 and 63, that additional employee contribution increases to a max of $11,250 as of 2025.

If you have a workplace savings plan, you may be able to make after-tax contributions to bolster your savings.

Read Viewpoints on Fidelity.com: What to do with after-tax 401(k) contributions

Diversify your investments. As you approach retirement, you will likely want to build more stability into your portfolio, balancing the long-term growth potential of stocks with the steady income that bonds can provide. Spreading your investing dollars across several types of investments (generally stocks, bonds, and short-term investments), known as diversifying, may not boost performance—it won’t ensure gains or guarantee against losses—but it has the potential to improve returns for the level of risk you’re targeting.

How does it do that? By possibly smoothing out the ride and providing some cushion against the big swings that can happen in the stock market. As you approach retirement, it can be a good idea to reduce the amount of stocks in your investment mix and build up the amount invested in bonds and short-term investments.

Another way to diversify when you’re investing for retirement could be with a target date fund. Target date funds provide a diversified mix of investments in one fund that gradually shifts to a more conservative mix as the target date nears, and beyond.

Learn about Fidelity's target date funds, Fidelity Freedom® Funds.

Consider where your income will come from in retirement. It can make sense to have a plan in place before you retire so there are no surprises.

Fidelity's guideline: For most people, Social Security and pensions (if you're lucky enough to have one) will provide an income base in retirement, with the rest coming from savings. But how much should you assume will come from savings? Fidelity's estimate is to save enough to replace at least 45% of your preretirement income,4 after accounting for Social Security and pensions.

We believe a solid retirement income plan should provide 3 things:

- Predictable income from Social Security, pensions, and/or annuities to ensure core expenses are covered

- Growth potential from investing a portion of savings to meet discretionary spending and legacy goals

- Flexibility to refine your plan as needed over time

Read Viewpoints on Fidelity.com: 3 keys to your retirement income plan

Get help making informed decisions about retirement by answering a few questions in this comprehensive guide covering Social Security, cash flow, investing, Medicare, and more: Retirement Decision Guide

Retirement savings goal: Aim to save 10 times (10x) your annual salary by age 67 if that is the age you plan to retire.

Managing health care costs: Retirement planning conversations should include a discussion of the impact long-term care costs have on individuals and their family's future.

On average, according to the 2025 Fidelity Retiree Health Care Cost Estimate, a 65-year-old individual may need $172,500 in after-tax savings to cover health care expenses in retirement.

Consider annuities: To cover your income needs, particularly your essential expenses (such as food, housing, and insurance) that aren't covered by other predictable income like Social Security or a pension, you may want to use some of your retirement savings to purchase an income annuity.5

Read Viewpoints on Fidelity.com: How to feel financially secure in retirement

Look for ways to beat inflation: Social Security and certain pensions and annuities help keep up with inflation through annual cost-of-living adjustments or market-related performance. Additionally, choosing investments that have the potential to help keep pace with inflation, such as growth-oriented investments (e.g., stocks or stock mutual funds), Treasury Inflation-Protected Securities (TIPS), real estate securities,6 and commodities,7 may make sense to include as a part of an age-appropriate, diversified portfolio that also reflects your risk tolerance and financial circumstances.

Fidelity's guideline: As an estimate, aim to withdraw no more than 4% to 5% of your savings in the first year of retirement, then adjust that amount every year for inflation.8

Read Viewpoints on Fidelity.com: 5 ways to help protect retirement income

Be aware of required minimum distributions (RMDs): Certain retirement accounts require you to take minimum distributions starting at age 73. The RMD age will increase again to 75 in 2033. These are the types of accounts that require RMDs: Traditional IRAs, 401(k) and 403(b) plans, and SIMPLE and SEP IRAs (but not Roth IRAs). The annual deadline is December 31, but you may delay taking your first RMD up until April 1 of the year after you turn 73.9 It's important to know, however, that if you choose to wait until April 1 for your first RMD, it will mean taking 2 RMDs that year—one in April and one by the December 31 deadline. That additional income could have tax consequences for you.

From saving to living

Successfully saving and investing for retirement is a lifelong journey. Sometimes the going will be easy and sometimes it may seem tougher. A clear sense of purpose can help you stick with it consistently through good times and bad.

No matter how elaborate or succinct, the only way to realize your retirement vision and achieve your goals is by continuing to choose them as a priority for your money.