Overview

Investment Choices

Stock Trading

Take advantage of our comprehensive research and low online commission rates to buy and sell shares of publicly traded companies in both domestic and international markets.

$0 commission for online U.S. stock trades

Equity trading

Choose from common stock, depository receipt, unit trust fund, real estate investment trusts (REITs), preferred securities, closed-end funds, and variable interest entity.

International trading

Trade in 25 countries and 16 different currencies to capitalize on foreign exchange fluctuations; access real-time market data to trade any time.

IPOs

Participate in new issue offering, including traditional initial public offerings, follow-on offerings, and secondary offerings.

Why trade stocks with Fidelity?

- $0 commission for online U.S. stock trades1

- Trading anytime, anywhere to stay connected to the markets and your investments with the Fidelity Mobile® App

- Experienced investment and trading specialists available 24/7

Tools and research

Online trading

Access research and make trades using our intuitive trading website.

Equity Summary Score (PDF)

Evaluate stock choices with the accuracy-weighted Thomson Reuters Starmine Equity Summary Score.

Advanced trading tools and features

Get details on trading applications designed for Active Traders, and learn about adding margin, options, short selling, and more to your account.

Fidelity® Basket Portfolios

Fidelity® Basket Portfolios

Not your everyday basket investing

A faster and easier way to build a basket of stocks and ETFs and manage it as one investment. More possibilities. More control.

Fractional shares

Fractional shares

Stocks by the SliceSM makes dollar-based investing easy. Own a slice of your favorite companies and exchange-traded funds (ETFs) for as little as $1.00.

Get started

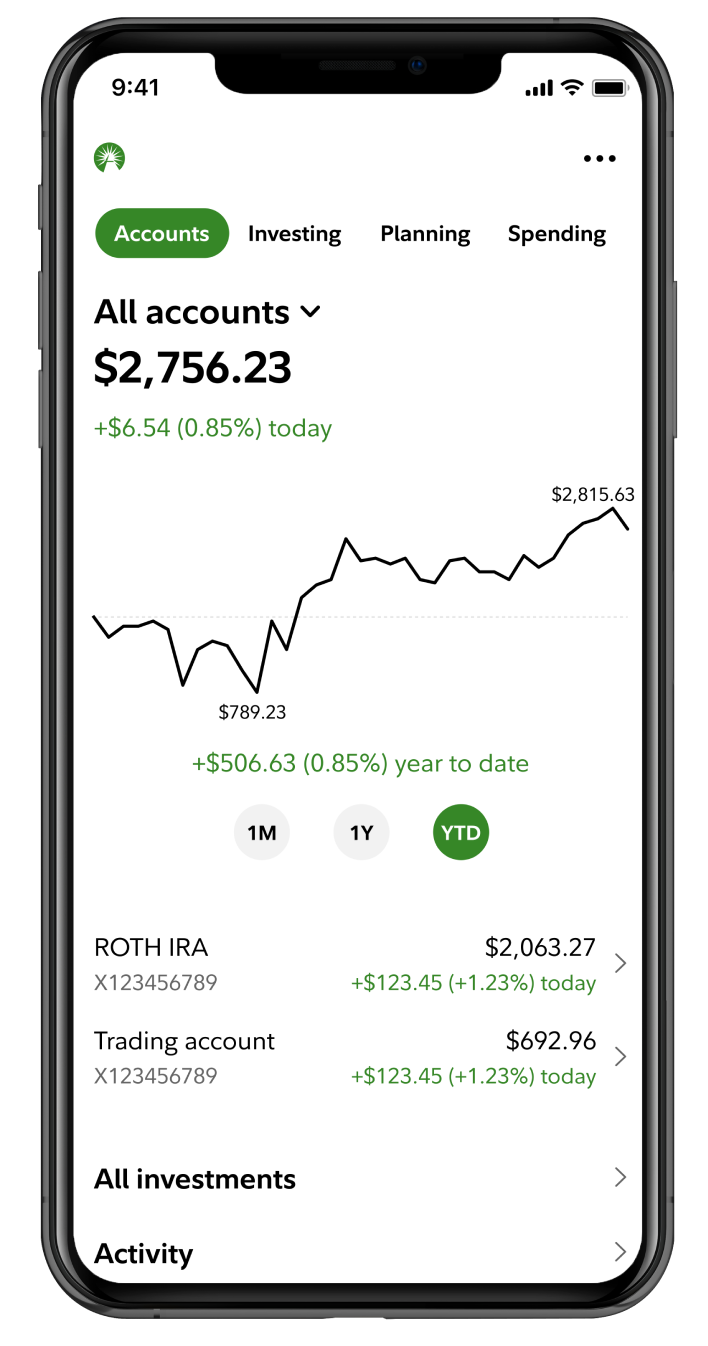

Stay connected to every aspect of the financial world and trade anytime, anywhere. Manage your portfolio and watch lists; research; and trade stocks, ETFs, options, and more from our mobile app.

Download the Fidelity Mobile® app now

Download the Fidelity Mobile® app now

5 strategic steps to help boost you from trader to savvy trader – educated, informed, and confident

Join our Trading Strategy Desk® coaches to help build your knowledge on technical analysis, options, Fidelity Trader+™, and more.