Fidelity Basket Portfolios

Not your everyday basket investing

A faster, easier way to build and manage your portfolio with baskets. Build each basket with the stocks and ETFs you want, trade with one click, and manage it as one investment. More possibilities. More control.

Free 30-day trial, then $4.99/month. Cancel anytime.

Bringing your ideas to life

With the time you save, you can dig deeper into research and explore new possibilities to bring your ideas and strategies to life.

Get a sneak peek with our short video.

You're in control

Build, customize, and diversify on your terms. You select the securities, you decide the target weights, and you make changes when you want.

Faster and easier

Staying on top of your portfolio is effortless when you can manage lots of stocks and ETFs as one investment with baskets.

Be your own portfolio manager

Unlike investing in individual mutual funds and ETFs, benefit from direct ownership of your basket securities, and add and remove as you see fit.

-

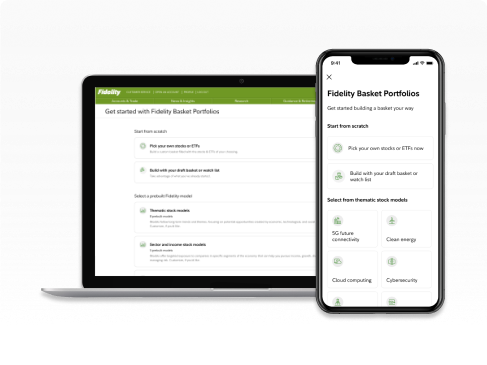

Choose

Pick the stocks and ETFs you want in your basket. Move positions you already own, choose prebuilt models from our experts, or leverage screeners and watchlists.

-

Invest

Take advantage of fractional shares and invest any amount you want. Set recurring investments to help reach your goals. Diversify with ease and trade your entire basket with one click.

-

Monitor

Track your basket like any other position in your account. Manage with a personalized dashboard, view analytics, and save time using advanced features.

Take advantage of prebuilt models developed by Fidelity experts

These models are developed using a proprietary process, and are reviewed and adjusted on an ongoing basis based on market movement.

Thematic stock models

Models follow long-term trends and themes, focusing on potential opportunities created by economic, technological, and social developments.

Sector & income stock models

Models offer targeted exposure to companies in specific segments of the economy that can help you pursue income, growth, diversification, and manage risk.

ETF model portfolios

Models offer a multi-asset class portfolio of stocks and bonds based on your risk tolerance. Choose a model with Fidelity-only ETFs or with Fidelity and iShares® ETFs.

No new account needed. No account minimums. Unlimited basket trading services.1

Create as many basket portfolios as you'd like and invest as little as $1.00 per security. Use an existing brokerage account or open a new one to get started.

Free 30-day trial, then $4.99/month. Cancel anytime.