Invest smart from the start with a brokerage account

$0 account fees2

Keep your money working toward your goals.

$0 commissions

Trade US stocks and ETFs commission free online.1

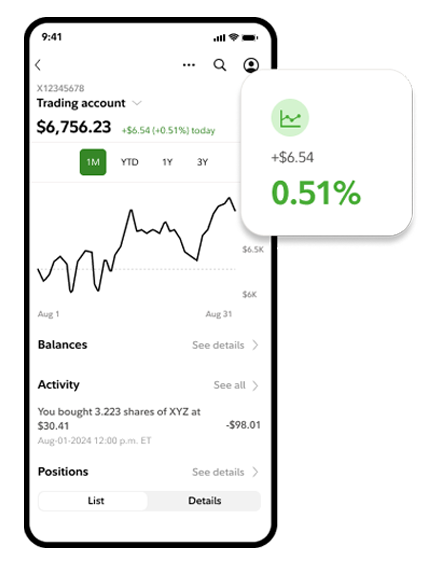

Trade any amount

Buy US stocks and ETFs for as little as $1 with fractional shares.3