3. Surrender fees may apply.

4. This is for educational purposes only and is not an exhaustive list but is meant to capture the most common significant health concerns. All medical conditions current and preexisting would have an influence on insurability.

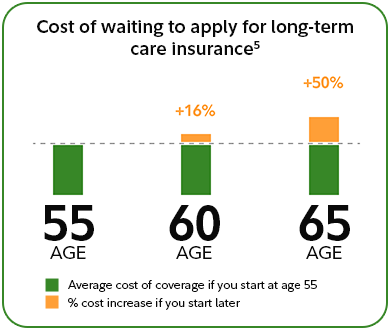

5. Based on a couple, both buying $175,000 initial benefit growing at 2% compounded annually. State: IL. January 2021.

* As of March 1, 2024, New York Life Insurance and Annuity Corporation both have an A.M Best rating of A++ (Superior) and a Standard & Poor's rating of AA+ (Very Strong). Nationwide Mutual Insurance Company has an A.M. Best rating of A (Excellent) and a Standard & Poor’s rating of A+ (Strong). Financial strength ratings are opinions from independent rating agencies of an insurer’s financial strength and ability to pay its insurance policies and contract obligations. They are not recommendations to purchase, hold, or terminate any insurance policy or contract issued by an insurer, nor do they address the suitability of any particular policy or contract for a specific purpose or purchaser. Ratings range from A++ to F for A.M. Best ratings, and AAA to CC for Standard & Poor's ratings, and are subject to change. For the latest ratings and definition of ratings, access

www.ambest.com and

www.standardandpoors.com.

The products and/or certain features may not be available in all states.

The purpose of this material is the solicitation of insurance and an agent/producer may contact you.

Some insurance products available at Fidelity are issued by third-party insurance companies, which are not affiliated with any Fidelity Investments company. These products are distributed by Fidelity Insurance Agency, Inc. A contract's financial guarantees are solely the responsibility of and are subject to the claims-paying ability of the issuing insurance company.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity insurance products are issued by Fidelity Investments Life Insurance Company (FILI), 900 Salem Street, Smithfield, RI 02917, and, in New York, by Empire Fidelity Investments Life Insurance Company®, New York, N.Y. FILI is licensed in all states except New York. Other insurance products available at Fidelity are issued by third party insurance companies, which are not affiliated with any Fidelity Investments company. Fidelity Insurance Agency, Inc. is the distributor. A contract's financial guarantees are subject to the claims-paying ability of the issuing insurance company.