Overview

Investment Choices

Commitment to execution quality

Unmatched value with Fidelity's price improvement

![]()

Saves you money

Our price improvement1 can save investors $25.27 on average for a 1,000-share equity order.

![]()

Shows your savings

Easily see your savings for an individual order, as well as over multiple time periods, on our pricing summary.

![]()

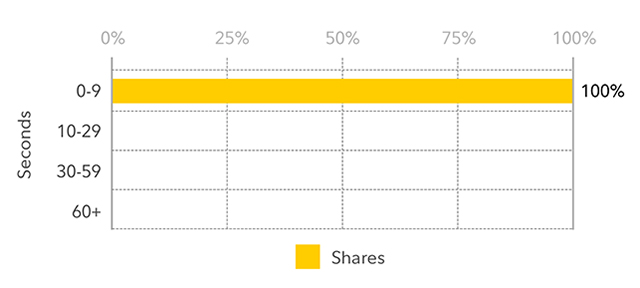

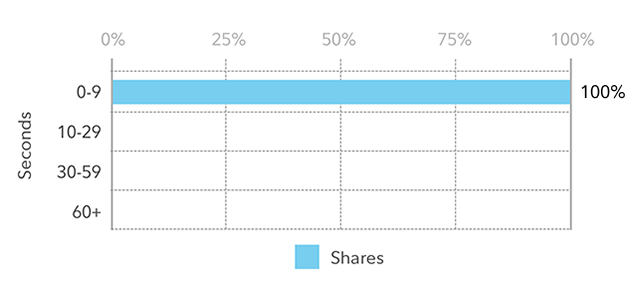

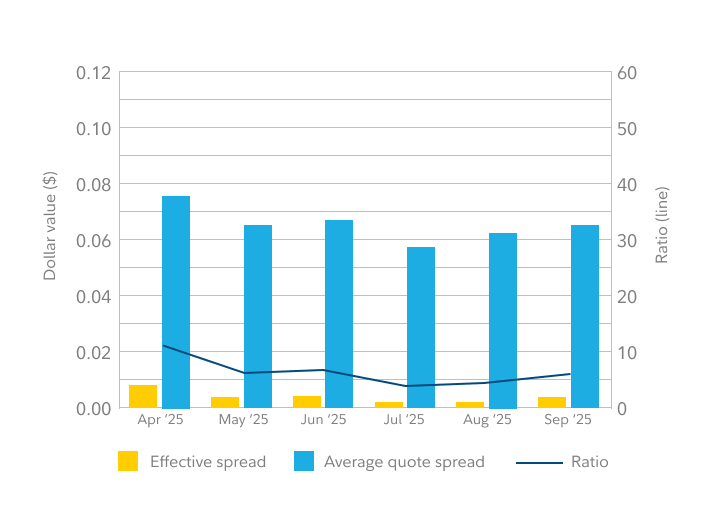

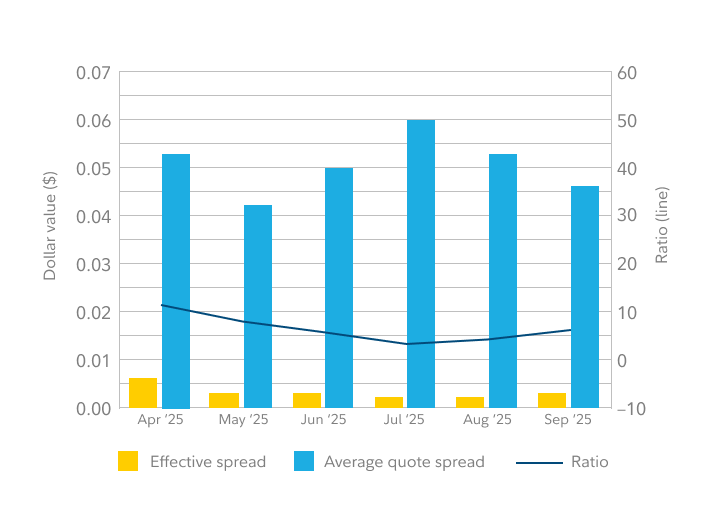

Shares for industry comparison

How it works

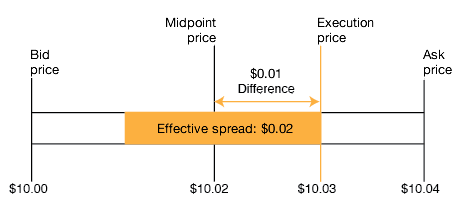

Price improvement occurs when a trade is executed at a better price than the best quote market price or National Best Bid and Offer (NBBO).

Watch this video to learn more.

Use price improvement for trading savings (2:57)

Rated #1 for Order Execution by StockBrokers.com in 2023.

Is your broker transparent on execution quality?

| Fidelity | TD Ameritrade | Schwab | E*Trade | |

|---|---|---|---|---|

| Saves investors $25.27 average per order for a 1,000-share equity order1 | Yes | ? | ? | ? |

| Shows what you save on a trade2 | Yes | No | Yes | No |

| Does not take payment for order flow from market makers for stock and ETF trades |  |

— | — | — |

? = Ask your broker.

Fidelity calculates $25.27 based on all market and marketable limit orders.1

See how the savings can add up

Average price improvement1

For a 1,000-share equity order

Whether you trade a lot or a little, Fidelity's price improvement can help you save.

The proof is in the numbers

| Price improvement

Percentage of shares that are price-improved: |

|

| 96.84%

How it's measured |

| Execution price

Percentage of shares that fall within the NBBO: |

|

| 99.12%

How it's measured |

|

|

Execution speed

Average execution speed: |

|

0.04

seconds

How it's measured |

| Effective spread

Average effective spread: |

|

| $0.0029

How it's measured |

Applying high standards on every trade

Our Order Flow Management Team ensures that your order goes to the top-performing market centers, seeking the best execution price.