Start small—think big

$0 commissions for online US stock and most ETF trades, and no account fees to open a retail brokerage account.

Pick an investment

Enter a company name or a ticker symbol into the search field to learn more about it.

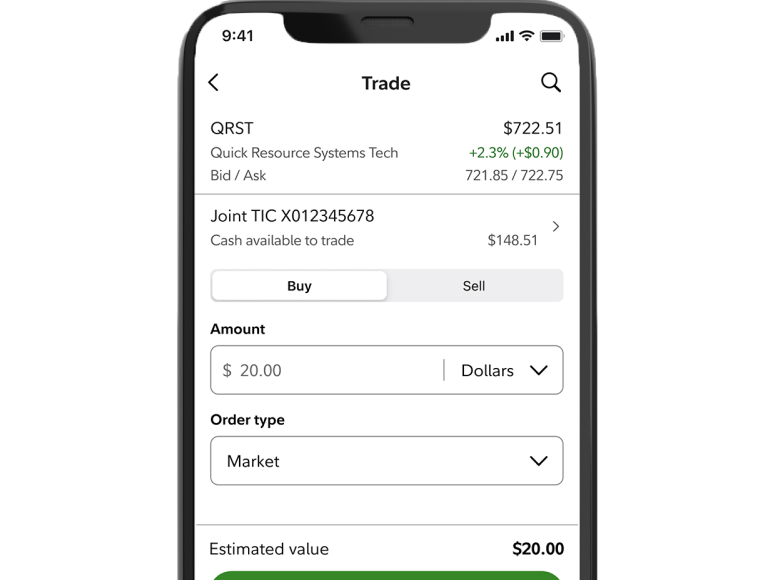

Enter a dollar amount

Once you've decided what to buy, enter the dollar amount you’re comfortable investing, starting at just $1.

Make it a habit

Adding recurring investments can help make it even easier to reach your goals over time.

Investing account

FDIC-insured savings account

How this chart works

Each type of account has its own unique set of potential benefits and limitations that you should consider before deciding what type is right for you.

Interact with the slider to increase or decrease the monthly contribution to discover how the money could grow in an investment account vs an FDIC savings account. The monthly contribution is how much you want to invest every month. In this chart it is set at $50, but you can move the slider from $0 to $580 to see how your contributions could grow over time. For example, a $50 monthly contribution in an investment account could grow to $60,999 in 30 years compared to $19,121 in a traditional savings account, using end of month compounding.

This example is for illustrative purposes only and does not represent the performance of any security. The assumed rate of return is not guaranteed. Investments that have potential for a 7% rate of return also come with risk of loss. Past performance does not guarantee future results.

* FDIC: National Rates and Rate Caps

1079524.1.14

Get started with fractional shares

Choose an investment and set a dollar amount. We’ll calculate the fractions for you.

The power of fractions

Investing with fractional shares lets you buy portions of US stocks or ETFs based on dollar amounts, making them ideal for smaller investments.

- Simplicity: Invest by dollar amount instead of share quantity.

- Empowerment: As little as $1 can buy a slice of a more expensive asset—start a portfolio using fractional shares of your favorites.

- Diversification: Spread smaller amounts across different investments to help lower overall risk.

Learn more about fractional shares

We'll help you take the first steps

Get invested

A few questions can help you decide

Find the right next steps for you and your money. Choose an option that best fits your situation and explore next steps.

Build a lasting routine

Set your fractional investing on repeat

Apply the principles of seasoned investors to help build growth-boosting habits. Use recurring investments to automatically add fractional shares to help your portfolio potentially grow over time.

Take your investing mobile

Our award-winning1 app gives you mobile access to a broad range of investments, expert insights, and tools to help you make smart investing, saving, and financial planning decisions.

Learn more about the Fidelity Investments mobile app