If you're approaching retirement—or are already there—it's important to think about protecting what you've saved and ensuring you'll have enough income throughout your retirement. You worked hard to get to retirement so you want to be able to enjoy it without having to worry about money, which means thinking ahead and planning for a retirement that may last 30 years or longer.

Here are 5 tips to help manage what can affect your income in retirement.

1. Plan for health care costs

With longer life spans and medical costs that have historically risen faster than general inflation—particularly for long-term care—managing health care costs is important for retirees. Retirement planning conversations should include a discussion of the impact long-term care costs have on individuals and their family’s future.

On average, according to the 2025 Fidelity Retiree Health Care Cost Estimate, a 65-year-old individual may need $172,500 in after-tax savings to cover health care expenses in retirement.

Many people will live longer and have higher costs, and the average cost for health care expenses doesn't include long-term care (LTC) expenses. Having a dedicated pool of money for long-term care expenses may be an important consideration to cover them.

As reported by the US Department of Health and Human Services, nearly 70% of those aged 65 and older will require some type of LTC services—either at home, in adult day care, in an assisted living facility, or in a traditional nursing home.1 According to the CareScout 2024 Cost of Care Survey,2 the national median cost of a private room in a nursing home3 is about $127,750 per year, assisted living facilities4 average $70,800 per year, and home health care homemaker services5 are $75,504 per year.

Consider long-term-care insurance: Insurers base the cost largely on age, so the earlier you purchase a policy, the lower the annual premiums. Some companies or policy types charge an annual premium for life, while others accept single pay or a predetermined number of payments. It is also important to research the financial strength and stability of the company you select, as well as investigate other potential options for funding LTC costs.

To learn more, read Viewpoints on Fidelity.com: Long-term care: Options and considerations

If you're still working and your employer offers a health savings account (HSA), you may want to take advantage of it. An HSA offers a triple tax advantage:6 You can save pretax dollars, which can grow and be withdrawn tax-free (federally) if used for qualified medical expenses—currently or in retirement.

To learn more, read Viewpoints on Fidelity.com: 3 healthy habits for health savings accounts

2. Expect to live longer

As medical advances continue, it's quite likely that today's healthy 65-year-olds will live well into their 80s or even 90s. This means there's a real possibility that you may need 30 or more years of retirement income and recent data suggests that longevity expectations may continue to increase. People are living longer because they're healthy, active, and taking better care of themselves.

Without some thoughtful planning, you could outlive your savings and have to rely solely on Social Security for income. The average Social Security benefit for a retired worker currently is around $2,008 a month, and that may not cover all your needs.7

To learn more, read Viewpoints on Fidelity.com: Longevity and retirement

Consider annuities: To cover your income needs, particularly your essential expenses (such as food, housing, and insurance) that aren't covered by other guaranteed income like Social Security or a pension, you may want to use some of your retirement savings to purchase an income annuity. It can help you create a simple and efficient stream of income payments that are guaranteed for as long as you (or you and your spouse) live.8

To learn more, read Viewpoints on Fidelity.com: 3 keys to your retirement income plan

3. Be prepared for inflation

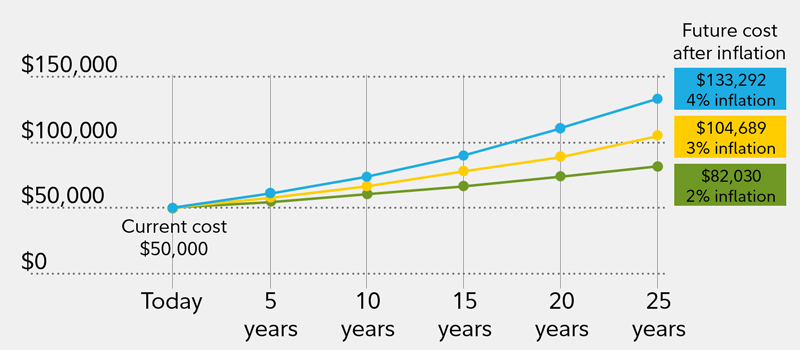

Inflation can reduce the purchasing power of your money over time. Inflation affects your retirement income by increasing the future costs of goods and services, thereby reducing the future purchasing power of your income. Even a relatively low inflation rate can have a significant impact on a retiree's purchasing power.

Consider cost of living increases: Social Security and certain pensions and annuities help keep up with inflation through annual cost-of-living adjustments or market-related performance. Choosing investments that have the potential to help keep pace with inflation, such as growth-oriented investments (e.g., stocks or stock mutual funds), Treasury inflation-protected securities (TIPS), real estate securities, and commodities, may also make sense to include as a part of an age-appropriate, diversified portfolio that also reflects your risk tolerance and financial circumstances.

The cost of inflation

Even a low inflation rate can reduce the purchasing power of your money.

4. Position investments for growth potential

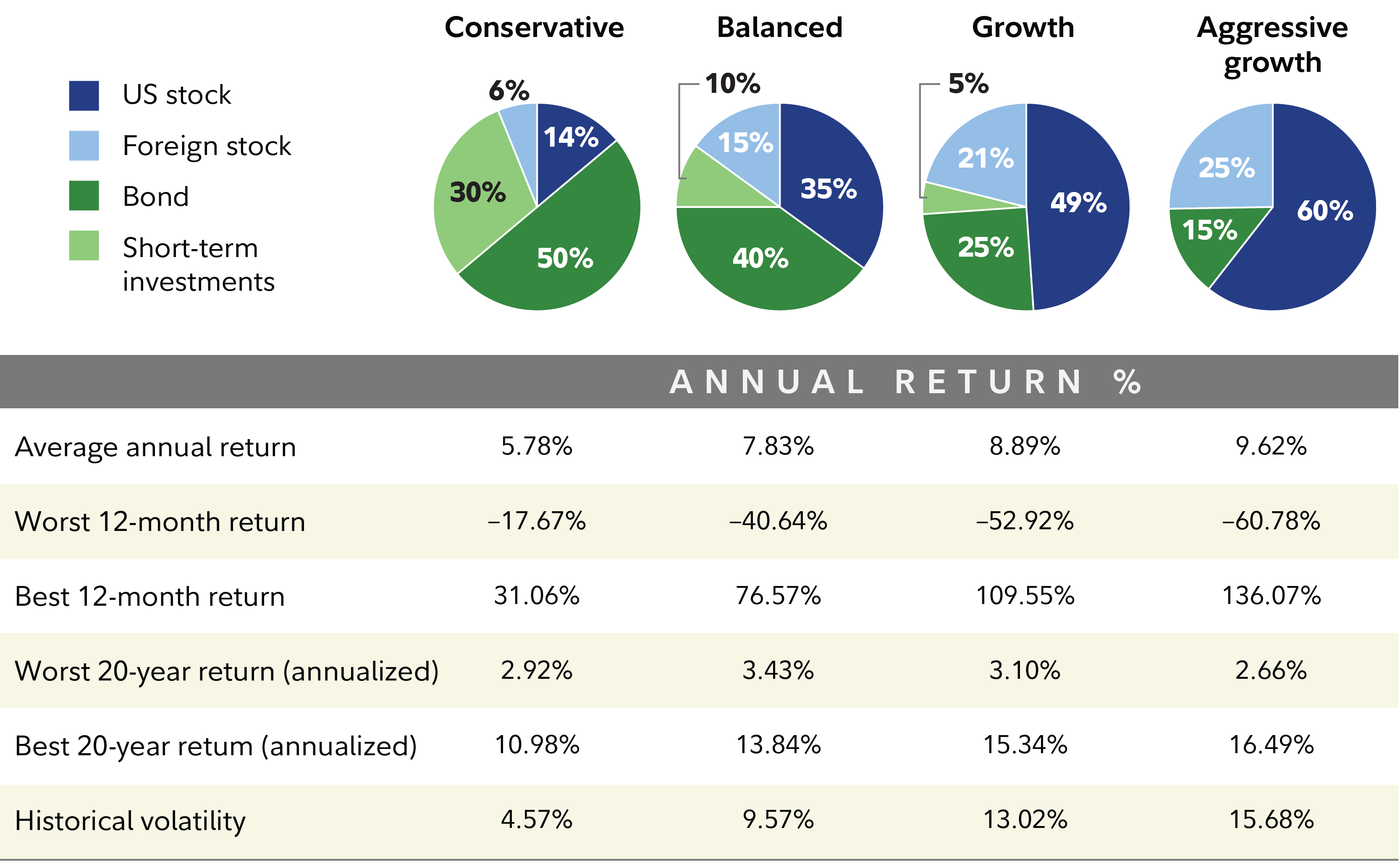

Overly conservative investments can be just as dangerous as overly aggressive ones. They expose your portfolio to the erosive effects of inflation, limit the long-term upside potential that diversified stock investments can offer, and can diminish how long your money may last. Alternatively, being too aggressive can mean undue risk of losing money in down or volatile markets.

An investment strategy (asset mix) that seeks to balance growth potential and risk (return volatility) may be the answer. You should determine and consistently maintain an asset mix that reflects your investment horizon, risk tolerance, and financial situation.

The following sample target investment mixes show illustrative blends of stocks, bonds, and short-term investments with different levels of risk and growth potential. With retirement likely to span 30 years or longer, you'll want to find a balance between risk and growth potential.

Consider diversification: Depending on how comfortable you are with market volatility, your financial situation and how long you plan to invest, you could build a diversified mix of stock, bonds, and short-term investments. Doing so may provide you with the potential growth without taking on more risk than you're comfortable with. However, diversification and asset allocation don't ensure a profit or guarantee against loss. Get help creating an appropriate investment strategy by working with a Fidelity professional or utilizing our Planning & Guidance Center.

5. Don't withdraw too much from savings

Spending your savings too quickly can also put your retirement income at risk. For this reason, we believe retirees should consider using conservative withdrawal rates, particularly for any money needed for essential expenses.

To be confident that savings can last for 20–30 years in retirement, consider withdrawing no more than 4%–5% from savings in the first year of retirement, then adjust that percentage for inflation in subsequent years.

Consider a sustainable withdrawal plan: Work with a Fidelity professional to develop and maintain a retirement income plan or consider an annuity with guaranteed lifetime income8 as part of your diversified plan, so you won't run out of money, regardless of market moves.

To learn more, read Viewpoints on Fidelity.com: How can I make my retirement savings last?

You can do it

After devoting many years to saving and investing for your retirement, switching from saving to spending that money can be stressful. However, it doesn't have to be that way if you manage these 5 key guidelines for your retirement income.