Fifty years ago, most Americans shared a common view of retirement. You left the 9-to-5 job and transitioned into your "golden years," a period of roughly 10 to 15 years, give or take, to live off your pension plan and enjoy life. Now it’s hard to say what retirement is. For many it can stretch 30 years or more and involve a series of new and different chapters that form various mosaics of leisure, work, and giving back to society.

"I think we're going to completely redefine retirement or get rid of the concept altogether," says Laura Carstensen, founding director of the Stanford Center on Longevity, in an interview. "The old model just won't work anymore."

Here she shares her insights on how Americans are redefining retirement, and what it may mean for individuals, employers, and society at large.

How rapidly has longevity changed, and how has that shift affected society?

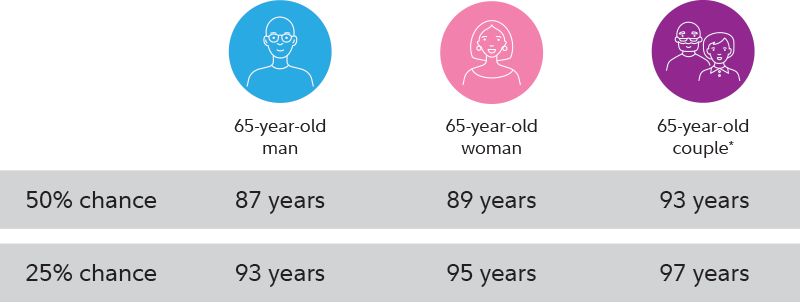

Life expectancy throughout most of human evolution was somewhere between 18 and 20 years. Life was short. By the mid-1800s life expectancy had reached the mid-30s in the United States, and in 1900 it was 47 years. By the end of the century, life expectancy had reached 77. It gained 30 years in one century—that's unprecedented. More years were added to average life expectancy in the 20th century than all the years added in all prior millennia of human evolution combined. Most of the gains in the first half of the century resulted from reducing childhood mortality, but since 1950 life expectancy at 65 has been rising as well. In fact, life expectancy has increased by about 3 months a year for some time (see chart below).

I think most people are thinking about growth in longevity in terms of an aging population's burden on society. But I think we have the opportunity to look at it another way—to reshape current models so that we live decades longer than our ancestors in a way that improves quality of life at all ages.

Longevity

Source: For illustrative purposes. Fidelity estimates longevity using date of birth, gender, and the Retirement Plans (RP) mortality tables most recently published by the Society of Actuaries. These tables are based on the mortality experience of US pension plans. Among the most recent set of tables, identified as RP-2014, we use the Healthy Annuitants table, updated periodically to reflect mortality rate improvements. Our longevity estimates are not tailored to a specific individual or situation, do not reflect additional factors that could increase or decrease your life expectancy (such as your health, lifestyle, and family history), and should not be considered definitive.

How might we reshape our understanding of retirement to suit longer lives?

Most people can't save enough in 40 years of working to support themselves for 30 or more years of not working. Nor can society provide enough in terms of pensions to support nonworking people that long. I'd like to see us move in a different direction: toward a longer, much more flexible working life, with more part-time work, in which people could come in and out of the workforce and have greater opportunities for education throughout their lives.

What's wrong with the current model of work?

Right now we pack everything in the middle. At the time we're working our hardest, we're also raising our children, and some people meanwhile are taking care of older relatives. Then at age 65 we say, "Bingo: time for retirement and leisure." It doesn't surprise me that a lot of people look forward to retirement: Not working looks pretty appealing when you're working that hard. But once people retire they have to figure out what to do with themselves. For the first 50 years of life, there are lots of guideposts—people know roughly when they're supposed to get married, work, have children, and so on. But then after retirement age nothing is written. Having that blank canvas can be hard for people.

What if instead we changed work so that we could work much longer? In this way, longer life spans are an opportunity to really improve quality of life for everyone.

Are there benefits to working longer in some capacity?

Extending our work lives would benefit us in a few ways. Under the current model, people retire and watch their nest egg go down for 30 years. That makes people nervous, even if it's a big nest egg. But if you keep a toe in the workforce, you can spend more comfortably because you still have some income, and you're better protected against inflation, because wages tend to rise. There's a lot of comfort and security in knowing you have some money still coming in.

Work is also good for us psychologically. It's good for people to wake up in the morning and know there's a place that needs them. And increasingly we're learning that engagement is good for cognition. Brains benefit from learning, from stimulation, from engaging, from doing new things. A lot of studies have shown that retirement corresponds with a drop in cognitive functioning.

At the Center on Longevity we did a study where we looked at cognitive functioning in people who work full time, retire, and then come back to work, or continue to work. The study showed that people who continue to work have better cognitive performance than people who retire. In other words, it doesn't look like retirement is good for your mind.

Interestingly, though, people who retired and then went back to work did just as well cognitively as people who continued to work straight through. To me, that shows that taking a break is okay; it's the shutting down and saying, "I'm done, I'm finished," that is not good psychologically.

Having older people stay in the workforce would also benefit society. I believe we can't afford to have our most experienced, knowledgeable workers move out of the workforce. We're at a point in history where we need all hands on deck. We need people to contribute to society, and most people want to.

How can employers adjust to this new reality?

I'd love to see global companies begin to offer people the benefit of a glide path from their main career into something else. We're also going to need employers to provide flexible and part-time options for people. Germany is doing some really interesting things in this area. Their workforce is shrinking, so they're having to think about how to appeal to older workers. So BMW and Mercedes plants have begun redesigning workplaces so they're more comfortable for older workers—adding more comfortable seating and improving ergonomics and lighting to make working easier on older people.

How can we reshape our thinking on aging?

It's very hard for humans to plan 20 and 30 years out. I think people should take it 10 years at a time. At age 50, start asking yourself, "What do I want to be doing at 60? And then at 70?" And then you start to put into place a planning apparatus so you can get there.

How do people who can't work longer fit in?

Aging societies will have more people who are frail and disabled. Over time, we'll do better at keeping people healthier longer. But in the meantime, we will have higher disability rates and an aging society. To me, that means we need to find ways that people can work from home, and that workplaces can support people with disabilities so that they can continue to work. There are very few people who are so disabled that they're not able to do anything. I would like to see us be more generous to people who are disabled, and at the same time encourage people to be productively engaged for as long as they can be.

We should all also do what we can to prepare better for periods of disability by saving. So many of us are still living our lives with the presumption that we'll follow a "typical" life path—you go to college, you get married, you buy a house, you have kids, and you save for retirement. We're forgetting that the new model looks a little different than that, and that most Americans aren't following that traditional path anymore. We've got to begin to think about how our lives might look different, and what the challenges and opportunities of a new model might be.