You've contributed to an IRA (or another type of retirement account)—congratulations. The next step is to invest that money—and give it the potential to grow. Fidelity believes one of the best ways to do that over the long term is by considering an appropriate amount to invest in a diversified portfolio of stock mutual funds, exchange-traded funds (ETFs), or individual stocks as you plan and implement an investment strategy that fits your time horizon, risk preferences, and financial circumstances.

While this article references IRAs, the same investment principles apply to other retirement accounts—including those designed for small business owners and freelancers.

As a general rule, the more time you have to save, the greater the percentage of your money you can consider allocating to stocks. For those closer to retirement, a healthy allocation to stocks may still be appropriate. These days retirement may last for decades, so the money will likely still need to grow for many years even after you retire.

It's important that the stock exposure you select matches your comfort with risk, your investment timeframe, and your financial situation.

How risk tolerance affects the amount allocated to stock

With creating your asset mix, you should feel comfortable that the ups and downs of the stock market won't undermine your ability to reach your long-term goals. That way you'll be less likely to panic and sell when stocks fall—because doing so can lock in losses and could make it harder to recover and reach your goals.

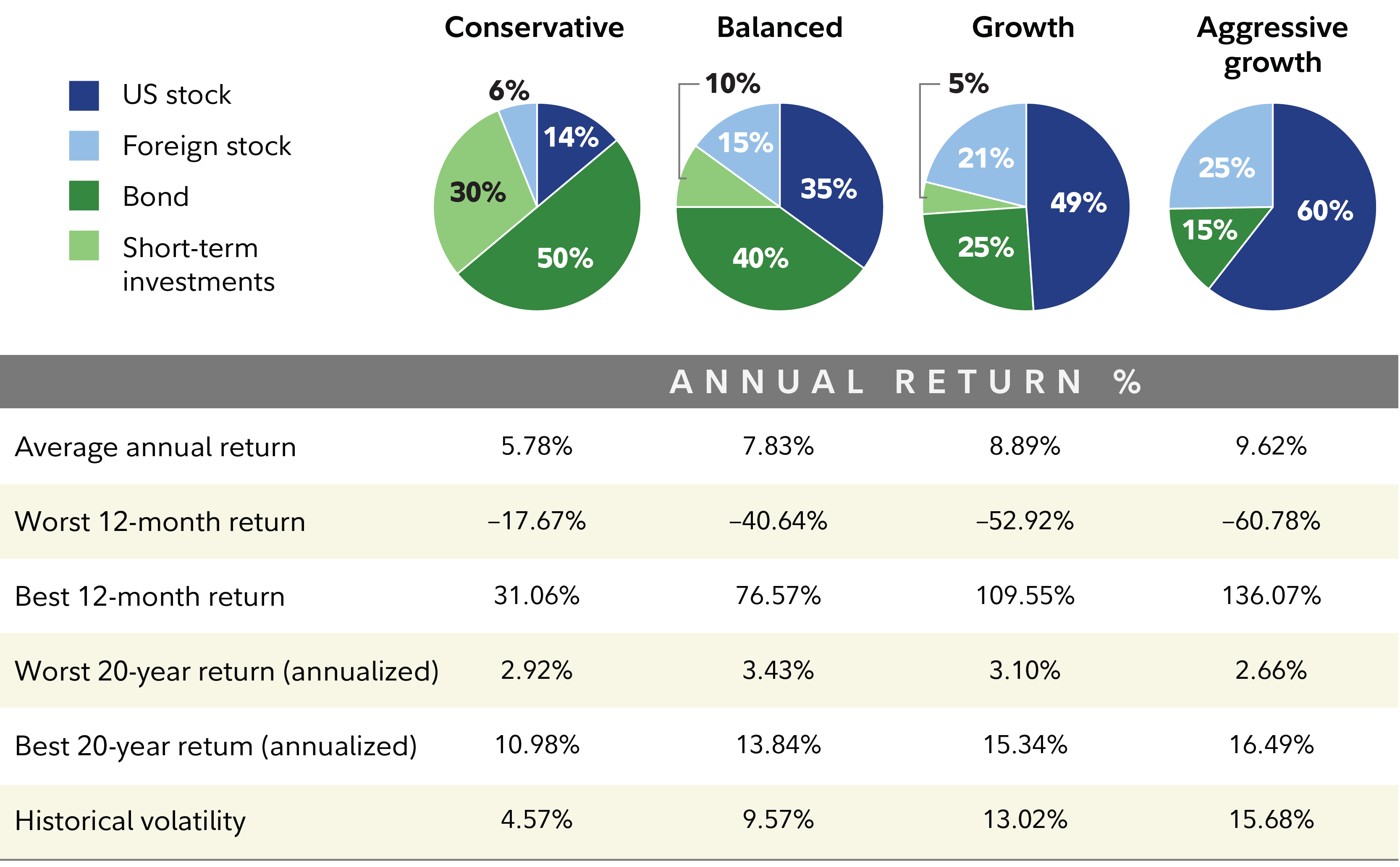

How much risk do you feel comfortable with? Take a look at the worst case market scenarios for the 4 different investment mixes shown. During the worst market year since 1926, the conservative portfolio would have lost the least—17.67%, while the aggressive portfolio would have lost the most—60.78%. The chart also shows how each investment mix performed over a long period of time, in different markets. The average return: 5.78% for the conservative vs. 9.62% for the aggressive mix.

Choose an investment mix you are comfortable with

How age affects how much to invest in stocks

Age can also be used as an initial guideline when determining how much to invest in stocks when you're investing for retirement. That's because the longer the money will be invested, the more time there is to ride out any market ups and downs. That could help realize the potential for growth in your investments, which may be an important factor in saving enough for retirement. In general, the younger you are, the heavier your investment mix could tilt toward stock—as much as you are comfortable with and fits with your time horizon, risk preferences, and financial circumstances. The chart shows how a $6,500 IRA investment could grow to $69,398 over 35 years.

All else being equal, as you get closer to retirement, you may want to adjust your allocation. Being too aggressive could be risky as you have less time to recover from a market downturn. As a general rule, in the absence of changes to risk tolerance or financial situation, one's asset mix should become progressively more conservative as the investment horizon shortens. However, investing too conservatively could limit the growth potential of your money. So, it may make sense to gradually reduce the percentage of stocks in your portfolio, while increasing investments in bonds and short-term investments.

But don't forget that growth remains important even as you approach and then enter retirement—after all, your retirement could last 3 decades or more. But with retirement nearer, investors must balance that need for growth against the need to protect what they have saved.

To learn more about building an asset mix that fits you, read Viewpoints on Fidelity.com: How to start investing

Why every year counts

Hypothetical pretax growth of one IRA contribution

How financial situation can affect how much to invest in stocks

If your goal is retirement in 20 years, your ability to take risk in a retirement account would be higher than in the account you use to pay your monthly bills. Your retirement account has time to recover from setbacks, and any immediate losses could be recovered. In your bill-paying account, a loss could very well jeopardize your ability to pay rent next month.

If the outlook for your financial situation seems uncertain, it can make sense to have a relatively lower allocation to stocks.

What kind of investor are you?

Don't have the time, expertise, or interest it would take to choose investments and maintain an appropriate mix of investments in your IRA? Consider a professionally managed target date or asset allocation fund.

Target date funds let an investor pick the fund with the target year closest to their expected retirement. The target date fund manager then selects, monitors, and adjusts the investment mix over time. Asset allocation funds can be another simple way to diversify your portfolio using a single fund. In these funds, the manager sets and maintains a fixed asset mix.

For those doing it on their own, a diversified mix of investments is important. That way, a portfolio isn't dependent on any one type of investment, although diversification does not ensure a profit or guarantee against loss. If you want to do it yourself, consider funds that hold a mix of investments in companies both big and small, from different parts of the world, and in different industries and sectors.

Low-fee investments that simply track the broad market through a benchmark index, may also be worth considering.

Get started

When saving for something really big, like retirement, it's important to get invested as soon as possible. That's because time is one of your biggest assets when investing for the long term.

Here are 3 ways to help get started when investing in an IRA.

- Use our tools. Get an analysis of your current portfolio, assess your financial situation, and find ideas to help you create an appropriate investment strategy in our Planning & Guidance Center.

- Choose investments. For those who want to invest in mutual funds or ETFs, there are a number of ways to choose. - Search and compare funds with Mutual Funds Research. - Get ideas with Fund Picks from Fidelity®. - Search and compare ETFs.

- Let someone else do the work. For those who prefer to have an investment professional manage an IRA, learn about Fidelity® managed accounts.

Put your money to work

Across most investment time frames, investing for growth matters. The potential for growth in your investment mix can be vital to helping you save enough to live the life you want in retirement. Ultimately, the appropriate asset mix is one you can live with—one that reflects your risk tolerance, investment horizon, and financial situation.