Simply put, investing can help you get ahead in life. It can be key to helping you grow your net worth over time and provide the kind of future for yourself and your family that you dream about. It has the potential to let you literally earn money in your sleep. So there's no doubt that it's worth your time to figure out how it all works.

However, when you're new, it's a lot. A lot of choices, a lot of new words and concepts (for help understanding them, check out our comprehensive glossary), and a lot of complicated, often-competing information to sift through. And because it has to do with risking your money, it can be stressful too.

But just because it can be complicated doesn't mean it has to be. There are actually only a few main choices you have to make to start investing. Let's break it all down—no nonsense.

Step 1: Figure out what you're investing for

You might be thinking, "But wait, shouldn't my first step be to find some hot, secret stock picks that I can ride to the moon?" But in truth, successful investing generally starts with what you're investing for, not what you're investing in.

Lots of people start off by investing for retirement. In fact, we believe that for many people, investing something toward retirement should be pretty high up on your financial to-do list (falling after making higher-interest debt payments and building up a cash buffer, for example; learn more about where investing should fall within your other financial priorities).

Although answering this question may not be as exciting as hunting down stock tips, it can help all the other pieces of your investing puzzle fall into place.

Step 2: Choose an account type

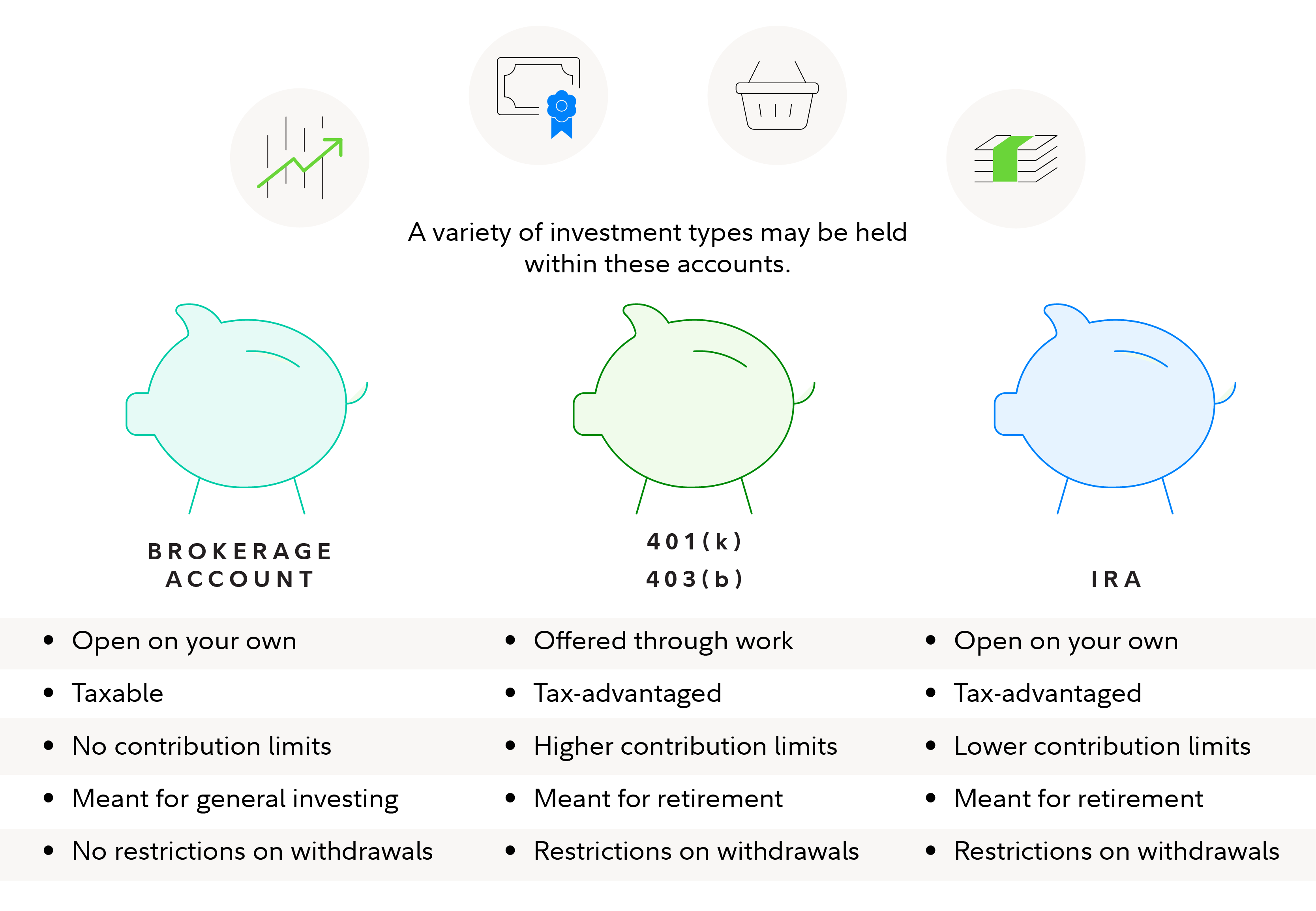

What you're investing for can also help you pick an account to open. Chances are, you'll want to start investing with one of these 3 main account types:

Brokerage account: When people talk about trading stocks, they're typically talking about doing so in a brokerage account. You can think of a brokerage account as your standard-issue investment account. Here are the basics:

- Pros—Flexibility. Anyone age 18 or older can open one. You can add as much money as you want to the account, whenever you want, and have access to a wide range of investment options. You can also generally withdraw any cash in the account whenever you want. Children aged 13 to 17 can also start learning about investing with a Fidelity Youth® Account. Their parent/guardian must have or open an account, and are responsible for their teen's activity.

- Cons—Taxes. While a brokerage account may be the simplest to open and start using, it is a taxable account. That means you generally have to pay taxes on any realized investment profits every year (like if you've sold investments for a gain, or received dividends or interest).

- When to consider. Brokerage accounts are most commonly used for investing and trading the full range of investment options for either specific goals or just building wealth as you’re accumulating assets. If you're investing for retirement, it generally makes more sense to first start with one of the next 2 account types. That said, as long as you choose an account with no fees or minimums, there's no harm in going ahead and opening a brokerage account so you have it at the ready. (Fidelity charges $0 account fees and has no minimums for opening or maintaining a brokerage account.1)

401(k): This is an employer-sponsored plan for investing for retirement, and may be the most readily available investment account you encounter. If your employer offers one, they will likely make sure you have all the information you need, and may offer help with enrollment. If you're not sure if you have access to a 401(k), check with your employer's HR department. Some people may instead have access to a 403(b) or 457(b) account, which are similar. Here are the tradeoffs:

- Pros—Tax benefits, plus potentially free money, easy. 401(k) plans offer tax-advantaged investment growth potential with relatively high contribution limits. This means that you can contribute to the account pre-tax, and you generally don't pay any taxes while your money is sitting in the account potentially growing. Instead, you only pay income taxes when you take withdrawals. Contributing to a traditional 401(k) account can also lower your taxable income for the year the contribution is made—so you can save for the future and potentially lower your tax bill.

Your 401(k) may offer a Roth option as well. Here, you contribute after-tax but qualified withdrawals of earnings are generally income tax-free. Many employers will also match your contributions, up to a certain amount—it's like free money to encourage you to contribute. And making contributions is easy through payroll deductions.

- Cons—Rules and restrictions. There are rules to follow on how much you can contribute, and strict rules on when and how you can take money out. You may also be limited in what investments you can buy, and you can't necessarily buy specific stocks.

- When to consider. For most people, the benefits easily outweigh the drawbacks. Many people start investing for the first time in these accounts. Chances are that if your employer offers a 401(k) or similar account, it's worth your while to invest in yours.

Self-employed? Learn more about small-business retirement plans.

Individual retirement account (IRA): This is an account for retirement that you can open and invest in on your own (i.e., not through work). Although there are different types of IRAs, here we're focusing on traditional IRAs, which you can think of as the plain-vanilla kind. Here's what you need to know:

- Pros—Tax benefits and flexibility. Traditional IRAs come with similar tax benefits as 401(k)s. There are a couple of differences: You can’t contribute pre-tax, but you may get a tax deduction for the year your contribution is made. You also often get a bit more flexibility and control than you do with a 401(k). For example, you can pretty much contribute whenever you feel like it, and contributions for the previous calendar year can be made up to the current year's tax filing deadline (typically April 15). You also may have more investment choices, and can typically even trade individual stocks.

- Cons—Rules and restrictions. There are rules and restrictions on who's eligible to receive a tax deduction for contributing to their traditional IRA, how much you can contribute each year, and how and when you can take money out. Also, if you do decide to open an IRA, you may have to spend some time deciding which type of IRA to open.

- When to consider. An IRA may be a good choice if you don't have a 401(k) or similar option at work. A traditional IRA, in particular, may be a good option if you expect to be in a lower tax bracket when you retire.

- Roth IRAs may be a good choice for investors at the beginning of their careers because that can be when your income and tax bracket is lowest. Taking a tax deduction may not give you as much benefit as the potential tax-free compounding over decades. We can help you determine which type of IRA, a traditional or a Roth, would be a good fit for you in the account selector.

Still with us? You're doing great. And the next step is simpler—promise.

Step 3: Open the account and put money in it

The nuts and bolts of this step aren't too complicated, but you do still have some decisions to make.

Decision: Where to open your account? If you're opening a 401(k) then this part's easy: You'll open it through work, with whatever company is handling your employer's 401(k). With an IRA or brokerage account, you'll need to choose a financial institution to open your account with. (Here's how to open an account if you choose to go with Fidelity.)

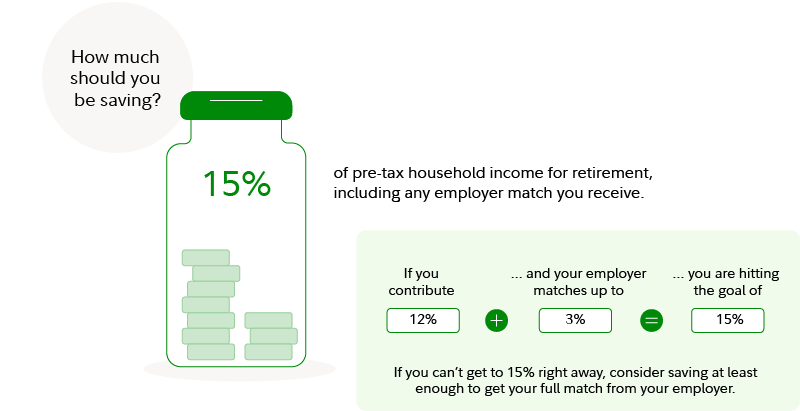

Decision: How much money to invest? With a 401(k), you contribute through payroll deductions, meaning the money is taken out of your paycheck automatically. You decide how much of your pay to contribute. If your employer offers matching contributions, consider investing at least enough to capture the full amount of the match. For example, if your employer offers a dollar-for-dollar match up to 3%, you would contribute 3% to take full advantage.

If you're opening an IRA or brokerage account, you can start by depositing a chunk of money, and then add to that when you're ready. If it’s possible to make regular, recurring contributions, you can take advantage of dollar-cost averaging. That’s a strategy where you invest your money in equal portions at regular intervals. Your investments occur regardless of the changes in price for the stock or other investment, potentially helping reduce the impact of volatility on the overall purchase. There are no minimums to open an IRA or brokerage account with Fidelity.1

There's no one magic number for how much you need to start investing, or how much you should add each month, because the right number varies depending on your income, budget, and what other financial priorities you're juggling. But if you're getting stuck on this step, remember that starting small is better than not starting at all.

Investing a little bit every month and gradually increasing that amount over time, as you get more comfortable, is a fine way to go. Fidelity suggests eventually aiming to save an amount equal to 15% of your income toward retirement each year (including any employer match). If you decide to invest in a brokerage account or IRA, consider setting up automatic contributions so you keep investing every month.

Step 4: Pick investments

This is the step that tends to trip people up. It can feel like other people know some secret to picking investments—like there's a trick that can help you choose only the best ones. But here's the truth: There isn't.

Investing is actually a lot like creating a healthy diet. Most people should focus on getting a broad range of common-sense investment types rather than placing all their bets on a small number of "high-promise" investments. After all, turmeric and açai may be superfoods, but they still shouldn't be the only things you eat. Many people can be well-served by investing in a broad range of stocks and bonds—with more money in stocks if they're young or investing for a goal that's a long time away (read more about figuring out your big-picture investment mix).

But if you're new to the investing grocery store, how do you figure out what to put in your cart? There are 3 basic methods:

- Individual stocks and bonds. This is the most complicated and labor-intensive way, but it's what many people think of when they hear "investing." If you want to go this route, you'll need to learn about researching stocks, building a diversified portfolio, and more. It's doable, but it can take a lot of time to build your portfolio. Fortunately, there are easier ways for beginners to get started if you don’t have the time or desire to research individual investment options.

- Mutual funds or ETFs. Mutual funds and ETFs pool together money from many investors to purchase a collection of stocks, bonds, or other securities. You can use them like building blocks, putting a few together to create a portfolio. Or, you can buy an all-in-one fund, which is an easy-to-manage diversified portfolio in a single fund. If you're investing in a 401(k) or IRA, one option to consider is a target date fund—an all-in-one professionally managed fund that's specifically designed with a target retirement date in mind.

- Hire a professional manager. If you're getting stuck, consider getting help. While this may sound like it's only an option for the wealthy, there are low-cost options that can meet your needs too. For example, robo advisors like Fidelity Go® can offer low-to-no-cost professional management because the day-to-day money management is handled by computers rather than live humans.

And of course, plenty of people end up deciding to use some mix of those options—like investing in funds with their retirement money, but perhaps also picking individual stocks with a small portion of their money. There's nothing wrong with mixing and matching. Whatever options you're considering, just be sure also to consider any fees, expenses, or commissions.

Step 5: Buy the investments

Game time, folks. Planning and research are great, but in the end, you also have to take the plunge. For stocks, mutual funds, and ETFs, you'll generally look up the investment's ticker symbol—a string of 1 to 5 letters that's unique to that investment—then decide on a dollar amount or number of shares to buy. If you're getting stuck on this step, check out a more detailed walk-through of the process or some frequently asked questions. Also, if you go the robo advisor route, you may be able to skip the look-up part of the process, depending on the account type.

In a 401(k), it's often easiest to set up your investment choices when you're setting your regular contribution amount, in which case your money will be invested in the choices you've selected automatically, corresponding with your pay cycle. Keep in mind that fund exchanges and payroll election are two different steps; you can exchange a fund but it won't automatically change your payroll election, and vice versa. It's also important to note that with a 401(k), the lineup available is selected by the plan sponsor, which makes it easier because the available options can be less overwhelming. Once you make your payroll deduction election, your funds will be automatically invested until you change that. This is the only type of investment account that works this way; with other accounts, you need to manually set up auto-investing capabilities.

Step 6: Relax (but also keep tabs on your investments)

You're now an investor! Give yourself a pat on the back, but also try to keep up your momentum by continuing to build your knowledge base.

Now that you have a portfolio, try to remember that it's normal for investments to bounce around over the short term. In fact, there's evidence that the more often you check your investments, the riskier they seem, because you notice more of these short-term blips.2 Try to stay focused on the big picture, like your long-term investing goals and your total portfolio's performance.

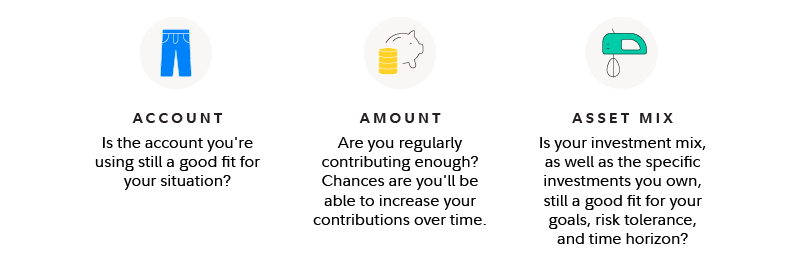

Over time, you'll want to periodically (at least annually) check in on your plan, including:

If that still feels like a lot, you don't have to do it all alone. You may be able to work with a financial professional through your retirement plan at work, or with a firm like Fidelity. There are plenty of options to choose from if you feel like you could use some guidance.