How do you choose between saving in a traditional retirement account and saving in a Roth? If you work for a large employer, you may be able to contribute to either a traditional 401(k) pretax, Roth, or both — if provided. If you're self-employed, or if a 401(k) or 403(b) isn't offered where you work, you may need to choose between a traditional or Roth IRA, or both.

While a 401(k), 403(b), and IRA are different types of accounts, most of the basic principles of a traditional and a Roth account apply to all. So, how should you choose between a traditional and a Roth account? It's a complex question, and you should consult with a tax professional to be sure.

Upfront considerations

- Will you need access to funds before age 59½? While you should strive to keep your retirement savings earmarked for retirement, sometimes life throws a curveball. Contributions to Roth IRAs including those rolled over from a Roth 401(k), can be accessed tax-free and penalty-free at any time. If you withdraw more than your contributions, you may be subject to taxes and penalties.

- Hoping to keep your assets invested in your retirement account for the duration of your retirement? Roth IRAs do not have required minimum distributions (RMDs), meaning you can continue to benefit from tax-free potential growth throughout retirement without having to take money out. RMDs in 401(k)s and traditional IRAs require distributions beginning at age 73.1

Tip 1: Tax rates - higher now or later?

Retirement accounts like 401(k)s, 403(b)s, and IRAs have a lot in common. They all offer tax benefits for your retirement savings, like the potential for tax-deferred or tax-free growth. The key difference between a traditional and a Roth account is taxes. With a traditional account, your contributions are generally pre-tax (401(k)) or tax deductible for IRA. They generally reduce your taxable income and in turn, lower your tax bill in the year you make them. On the other hand, you'll typically pay income taxes on any money you withdraw from your traditional 401(k), 403(b), or IRA in retirement.

A Roth account is the opposite: Contributions are made with money that has already been taxed (your contributions don't reduce your taxable income), and you generally don't have to pay taxes when you withdraw the money in retirement.2

This means you need to choose between paying taxes now or in retirement. You may want to get the tax benefit when you think your marginal tax rates are going to be the highest. In general:

- If you believe your marginal tax rate will be significantly higher in retirement than it is now, a Roth account may make sense, because qualified withdrawals may be tax-free.2

- If you believe your marginal tax rate will be significantly lower in retirement than it is now, a traditional account may be more appropriate, because you will pay a lower tax on your withdrawals.

- If you have no idea what your future marginal tax rate will be, Tip 2 below, which has to do with how you manage your money, can also help you decide. Splitting your retirement money between both types of accounts may be an idea for you too.

Tip 2: Money style - spender or saver?

Some people spend all of their available money; some people tend to save. How you manage your money can help you choose which type of account may make sense for you.

Assuming your income will be the same now and when you take withdrawals, traditional IRAs and Roth IRAs provide the same tax savings; however, traditional IRA tax savings can be used for spending this year while Roth IRA tax savings are realized in the future due to tax-free qualified distributions. Traditional 401(k), 403(b), and IRA contributions leave money in your pocket because they generally lower your current taxable income. These tax savings can help you reach your retirement goal only if you invest them. If you spend your tax savings, it's not going to help you when you retire.

On the other hand, a contribution to a Roth account reduces the amount of money left in your pocket compared with a similar contribution to a traditional account, because you pay taxes on your contributions up front. If you’re like many people who tend to spend their take-home pay, opting for a Roth and thus having less available to spend might be a good thing when it comes to your retirement savings. In other words, because you’ve already paid your taxes today, you get more to spend tomorrow.

There’s one more factor to consider: even if you do hold on to, and then invest, the tax savings from a contribution to a traditional account, where will you be able to invest it? If you end up investing it in a taxable brokerage account, the return you earn on that investment will typically be lower than it would be in a retirement account because of the taxes you’ll have to pay along the way.

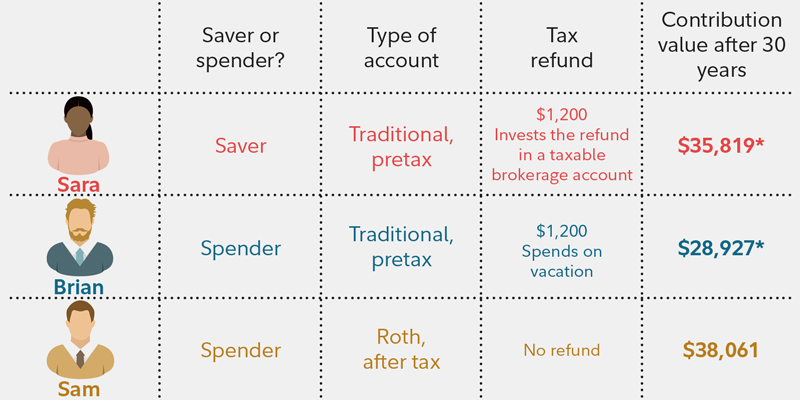

The following hypothetical illustration can demonstrate how this works. Consider investors: Sara, Brian, and Sam. They each will save $5,000 this year, invest the money in an IRA earning a constant 7% per year, and then compare their balances 30 years from now. Sara uses a traditional IRA, and she is a disciplined saver. She will invest the tax refund she gets for contributing to a traditional IRA in a taxable brokerage account. Brian and Sam, unlike Sara, are both spenders, meaning they tend to spend whatever pay they take home, including whatever tax refund their IRA contributions may help generate. While Brian, like Sara, uses a traditional IRA, Sam uses a Roth IRA.

Which type of account may be right for you?

As you can see, Brian has the lowest balance after 30 years, since he chose the traditional IRA and spent the entire tax refund that he received as a result of his use of the traditional IRA. His $5,000 contribution grows to $38,061, but when he withdraws the money in retirement, he has to pay about $9,134 (or 24%) in taxes—so he ends up with $28,927.3

Sara ends up with more than Brian because she invests her $1,200 tax refund in a brokerage account. However, the returns in a brokerage account are lower because of the effects of taxes along the way—in this case, we will assume the returns are 6% per year instead of 7%. After paying taxes on the proceeds from her traditional IRA in retirement, she has the same amount as Brian: $28,927. After investing her refund and getting a 6% annual return, Sara will have $6,892 in her taxable account after 30 years, so she'll have a total of $35,819.3,4

Sam ends up with the most. His Roth IRA, like Sara and Brian's traditional IRAs, grows to $38,061, but unlike them he doesn't have to pay any tax when he withdraws the money. The Roth IRA gives Sam two advantages over the other investors:

- First, the Roth IRA captured all of Sam's tax savings—so unlike Brian, he's safe from the temptation to spend it before retirement.

- Second, unlike Sara, Sam was able to ensure that all of his savings were able to grow at the 7% rate in the retirement account.

This shows that in some cases, a Roth IRA might actually be an easier way to reach your savings goals, because for those who are tempted to spend—like Brian—it removes temptation; and even for those who are not—like Sara—it can lead to higher after-tax returns.

Remember, that's not the whole story. Our example doesn't take into account possible changes in Sara, Brian, and Sam's future tax rates. If, in retirement, any of them were in a lower tax bracket than they are now, at age 35, that would tend to tilt the scales in favor of a traditional IRA. Conversely, if any of them were in a higher tax bracket in retirement, that would tend to favor a Roth IRA. Also remember that coverage by a 401(k) plan will impact how much a Traditional IRA contribution is deductible.

Finally, note that this example uses a Roth IRA. The ability to contribute to a Roth IRA is phased out at higher incomes; not everyone may qualify to contribute to a Roth IRA.4 Workplace accounts like a 401(k) or 403(b) don't have these income limits on Roth contributions when an employer offers the option. It's important to find out what you can do before deciding what you should do when it comes to these accounts.

For more information on the difference between traditional and Roth IRAs and their contribution limits, read Viewpoints: Traditional or Roth IRA, or both?

What about both?

Historically, employee match and profit sharing contributions from your employer 401(k) or 403(b) were made to a traditional 401(k) or 403(b), even if you only made Roth contributions. Now, if the plan allows, you may elect Roth employer contributions, so, depending on your situation, you may already be contributing to both types of accounts. Check with your employer to determine your plan rules and, if needed, consider updating your contributions to better reflect your intent.

To learn more about how to reduce taxes on retirement income, read Viewpoints on Fidelity.com: Tax-savvy withdrawals in retirement.

Deciding

It's important to know the numbers and think about your current and future tax rates when planning for retirement. It's also important to know yourself and the way you handle money.