Ways to withdraw money in retirement

If you're retired that probably means no more regular paycheck, and you may need to turn to your investments for income. However, the impact of taxes is just as important to consider now as it was when saving for retirement.

The good news is that in retirement there may be more options to increase after-tax income, especially when savings span multiple account types, such as traditional retirement accounts, Roth accounts, and taxable accounts. The downside is that choosing which accounts to draw from and when can be a complicated decision.

"Many people are seeking ways to help reduce the taxes that they will pay over the course of their retirement," says Andrew Bachman, CFA®, CFP®, director of financial solutions at Fidelity Investments. "Your withdrawal strategy is critical. How and when you choose to withdraw from various accounts—workplace savings plans, IRAs accounts, and brokerage or savings accounts—can impact your taxes in different ways."

Taxes matter: How different accounts are taxed

| Taxable | Traditional | Roth | |

|---|---|---|---|

| Examples | Brokerage, savings | Traditional 401(k), Traditional 403(b), IRA, Rollover IRA, etc. | Roth 401(k), Roth 403(b), Roth IRA |

| Taxes to keep in mind when withdrawing | Capital gains taxes | Income taxes1 | None2 |

| Important factors |

|

|

|

** Withdrawals may increase income and impact other calculations such as Social Security taxation and Medicare premiums.

Finding the right withdrawal strategy

Many retirees ask is How long will my money last in my retirement? As a starting point, Fidelity suggests you consider withdrawing no more than 4% to 5% from your savings in the first year of retirement, and then increase that first year's dollar amount annually by the inflation rate.

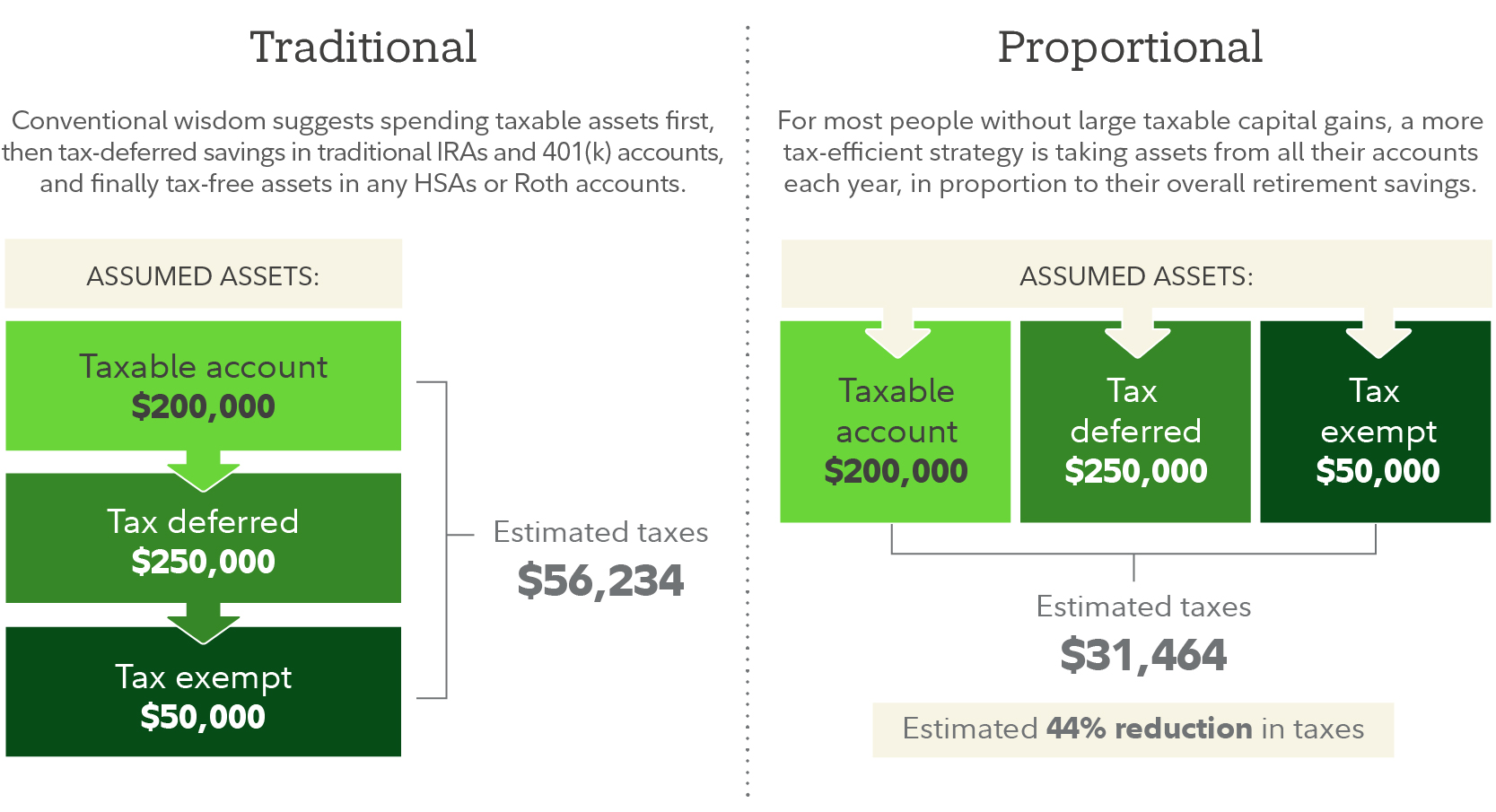

There are several approaches you can take to determine from which account you should withdraw your money. The traditional approach is to withdraw first from taxable accounts, then tax-deferred accounts, and finally Roth accounts where withdrawals are tax free. The goal is to allow tax-deferred and Roth assets the opportunity to grow over more time.

For most people with multiple retirement savings accounts with differing tax-treatments, a better approach might be proportional withdrawals. Once a target amount is determined, an investor would withdraw from every account based on that account’s percentage of overall savings. The effect is a more stable tax bill over retirement and potentially lower lifetime taxes and higher lifetime after-tax income.

For others, accelerating taxable withdrawals into years with a zero percent capital gains tax rate while managing withdrawals from tax-deferred and Roth accounts (to not cross into higher tax brackets), may produce the best results.

Across any of these strategies, the important thing is to pick an objective to measure their effectiveness, such as the total amount of taxes paid, and measure each strategy against one another.

To get started, consider these simple strategies that may help you get more out of your retirement savings, depending on your situation.

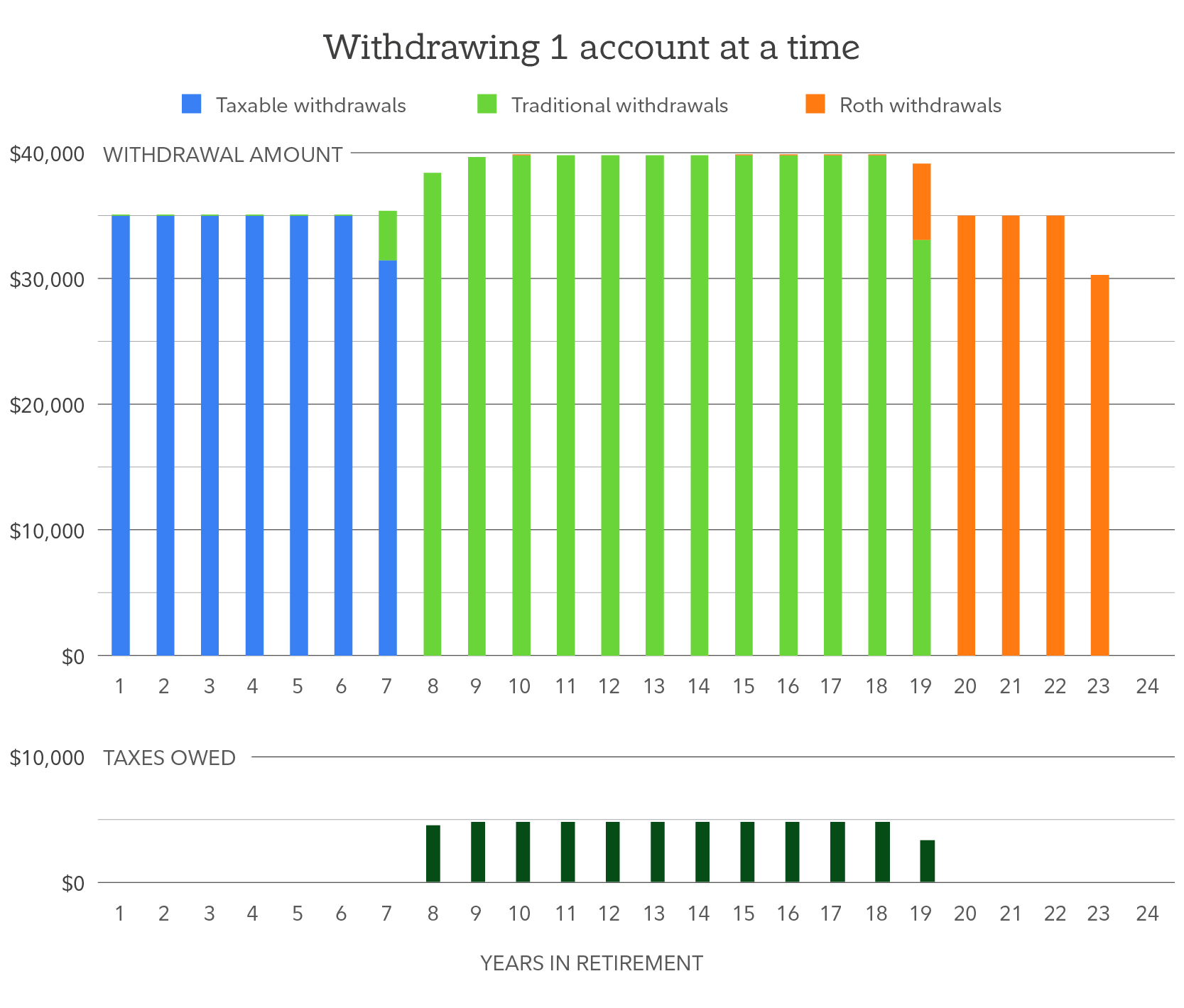

Traditional approach: Withdrawals from one account at a time

To help get a clearer picture, let's take a look at a hypothetical example: Joe is 62 and single. He has $200,000 in taxable accounts and $80,000 in cost basis, $250,000 in traditional 401(k) accounts and IRAs, and $50,000 in a Roth IRA. He receives $25,000 per year in Social Security and has a total after-tax income need of $60,000 per year. Let's assume a 5% annual return.

If Joe takes a traditional approach, withdrawing from one account at a time, starting with taxable, then traditional, and finally Roth, his savings would last nearly 23 years and he would pay just over $56,000 in taxes throughout his retirement.

Withdrawing from one account at a time can produce a "tax bump" midway in retirement.

With the traditional approach, Joe hits an abrupt "tax bump" in year 8 where he pays about $5,000 in taxes for 11 years while paying nothing or very little for the first 7 years and nothing when he starts to withdraw exclusively from his Roth account.

Proportional withdrawals

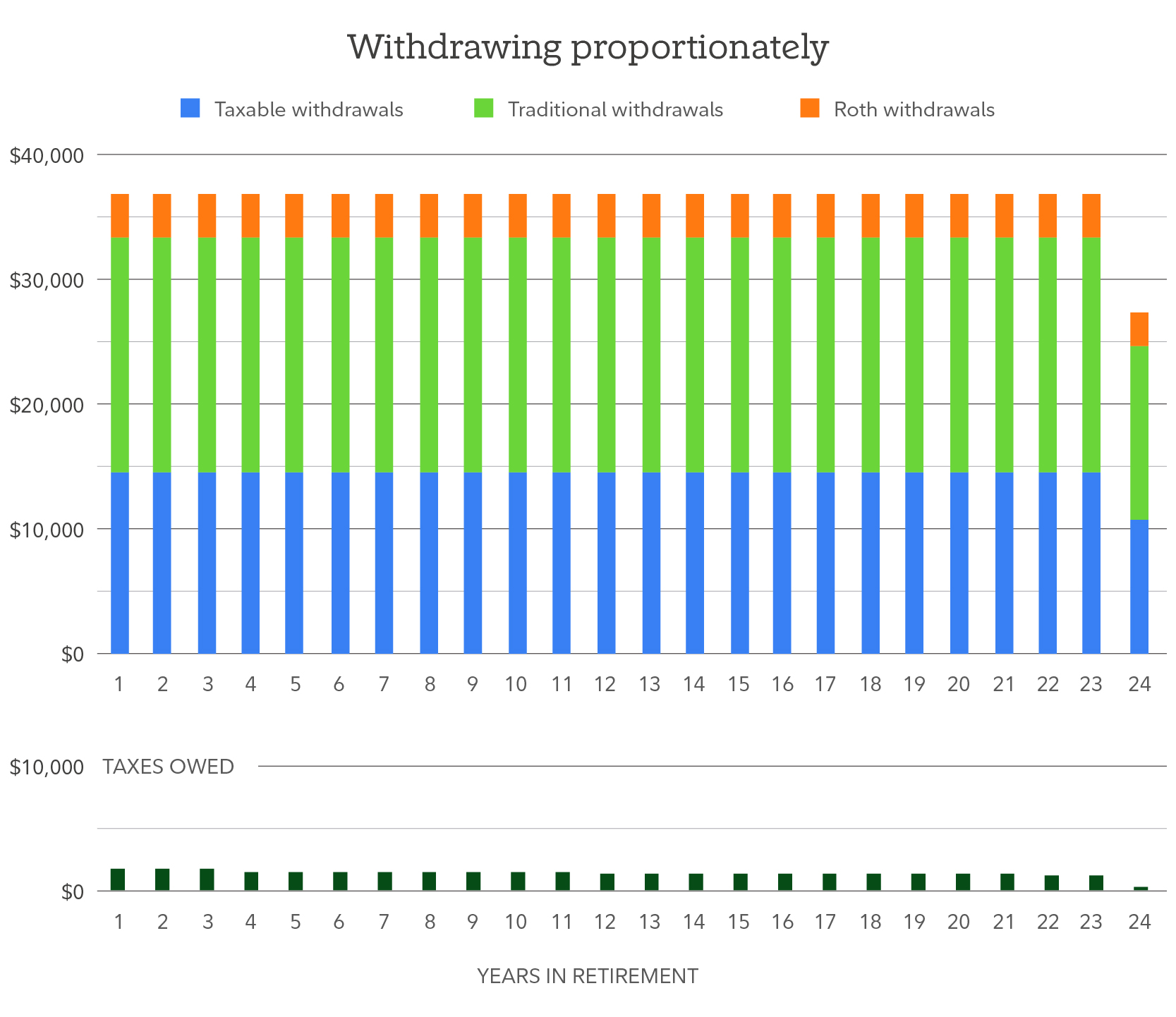

Let's consider the proportional approach. This strategy spreads out and dramatically reduces the tax impact, thereby extending the life of the portfolio from just under 23 years to almost 24 years.

In this scenario, a proportional withdrawal strategy in retirement can cut taxes.

"This approach provides Joe an extra year of retirement income and costs him approximately $31,500 in taxes over the course of his retirement—a reduction of over 40% in total taxes paid on his withdrawals in retirement," explains Bachman.

By spreading out taxable income more evenly over retirement, you may also be able to reduce the taxes you pay on Social Security benefits and the premiums you pay on Medicare.

For more help, you can estimate the potential effect of retirement income strategies on your taxes with Fidelity’s Retirement Strategies Tax Estimator.

Expecting relatively large long-term capital gains?

Spreading traditional IRA withdrawals out over the course of retirement lifetime may make sense for many people. However, if an investor anticipates having a relatively large amount of long-term capital gains from their investments—enough to reach the 15% long-term capital gain bracket threshold—there may be a more beneficial strategy. First, use up taxable accounts, then take the remaining withdrawals proportionally.

The purpose of this strategy is to take advantage of zero or low long-term capital gains rates. Tax rates on long-term capital gains (applied to assets that are held over 1 year) are 0%, 15%, or 20% depending on taxable income and filing status which can be substantially lower than ordinary income tax rates applied to withdrawals from tax-deferred account.

To learn more about tax brackets, read Fidelity Viewpoints: 2025 and 2026 tax brackets and federal income tax rates.

How to help reduce taxes

For the 2025 tax year, single filers with taxable income up to $48,350, the long-term capital gains rate is 0%. If taxable income is between 48,351 and $533,400, the long-term capital gains rate is 15%.

Important to note: The amount of ordinary income from other sources, such as tax-deferred account withdrawals, impacts long-term capital gain tax rates.

Meet Jamie, a hypothetical single filer with $27,000 in ordinary income and $5,000 in long-term capital gains in the tax year 2025. After taking advantage of the $15,750 standard deduction, she will have $11,250 ($27,000 minus $15,750) subject to 10% income tax, but her $5,000 in capital gains will be taxed at 0%. Estimated total tax due: $1,125.

To get a closer understanding of how income impacts capital-gains rates, let’s also meet David. David is a hypothetical single filer who has $63,000 in ordinary income and $5,000 in long-term capital gains in 2025. After the $15,750 standard deduction, his first $11,925 of taxable income will be taxed at 10%, the next $35,325 of ordinary income at 12%, and, because of his higher income tax bracket, the $5,000 in long-term capital gains will be taxed at 15%, or $750. His estimated total tax due: $6,181.50.

The big difference: Jamie pays zero on her long-term capital gains because her taxable income is below that key threshold of $48,350, but David pays 15% on his $5,000 because of his higher earnings.

Jamie and David: See how their income is taxed

| Jamie | David | |

|---|---|---|

| Ordinary income | $27,000 | $63,000 |

| Long-term capital gains | $5,000 | $5,000 |

| Tax on long-term capital gains | $0 | $750 |

| Income taxed at 12% rate | $0 | $35,325 |

| Income taxed at 10% rate | $11,250 | $11,925 |

| Estimated total tax paid | $1,125 | $6,181.50 |

Retirees who could qualify for the 0% capital-gains tax rate and who have substantial long-term gains, may want to consider using their taxable accounts first to meet expenses and withdrawing up to the 0% capital-gains tax bracket limit. Once the taxable accounts are exhausted, the proportional approach can then be applied, or a more sophisticated approach that manages tax-deferred account withdrawals to a specific income bracket.

Additionally, this strategy allows investors to keep their assets in more tax-efficient accounts for a longer period of time while moving assets out of the their less tax-efficient taxable accounts. However, if considering this strategy, investors should still be mindful of any required minimum distributions (RMDs) they may need to take from traditional accounts in order to avoid penalties.

Plan ahead

It is important to try different strategies due to the personalizing factors of your financial plan. Some factors may include your:

- taxable income level before withdrawals.

- withdrawal need.

- distribution of assets across taxable, tax-deferred, and Roth accounts

- retirement plan duration.