Overview

- The Fidelity Account

- Compare Online Brokers

- Awards & Recognition

- Compare Service Levels

- Margin Loans

- Fully Paid Lending

- FAQs

-

Technology

-

Pricing

Investment Choices

Stocks

-

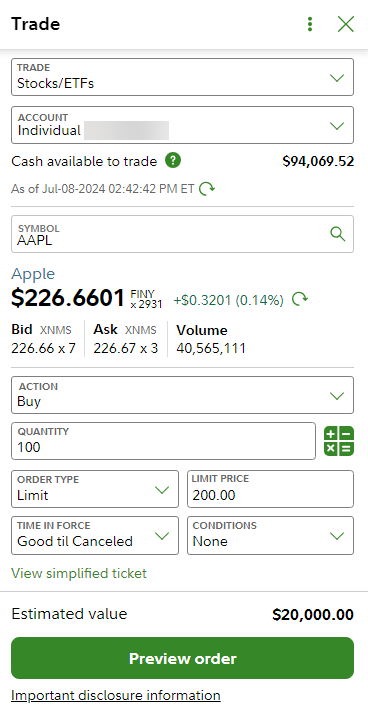

How do I place an order?

Log in and choose a trade typeLog In Required, then select an account, symbol, and action to start your order.

For illustrative purposes only -

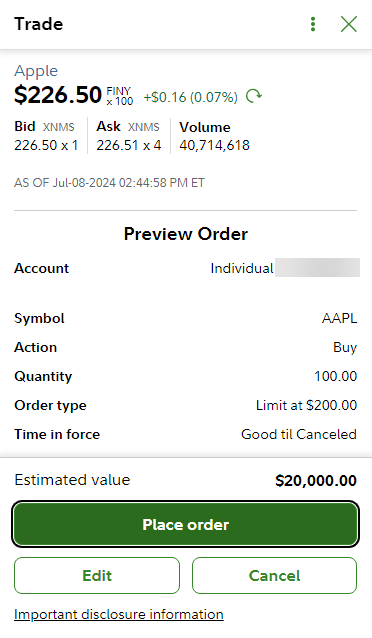

How do I preview an order?

Before you submit an order online, a preview screen allows you to review all the details of the order. You can edit or cancel the order before submitting it.

For illustrative purposes only -

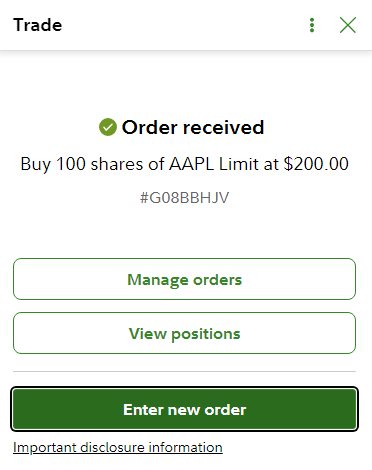

How is my order confirmed?

Once your order is placed, an order confirmation screen which contains your order number and details will be displayed. You can view it online after your order is placed. If executed, you will receive a trade confirmation via email.

For illustrative purposes onlyThe Order Status page is updated as soon as the order is executed. The trade confirmation is available online, on the next business day after execution of any buy or sell order, on your Statements pageLog In Required. It can also be mailed to you or sent by email.

For illustrative purposes onlyIf you do not have sufficient funds in your core account, you should not wait for the confirmation to reach you before initiating your payment. Once you view or receive your confirmation, examine it carefully and advise us of any discrepancy immediately.

-

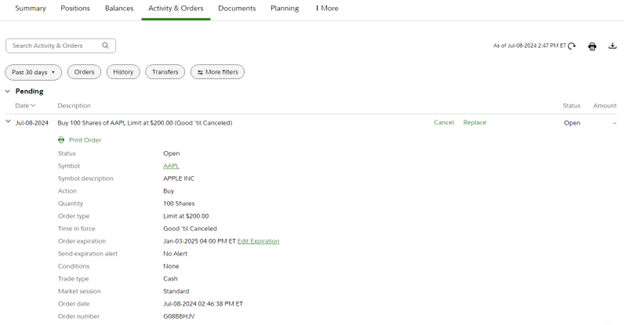

How do I review orders I have placed?

Once you have placed an order, you can view its status online. View your portfolioLog In Required and select Activity & Orders from the menu in Portfolio Summary for your account. You can also view your order history or set up an alert to receive execution notifications.

-

How do I cancel, or cancel and replace an order?

If the order has not yet been executed, you can attempt to either cancel, or cancel and replace it. You can cancel an order by logging into your portfolioLog In Required and selecting Activity & Orders from the menu in Portfolio Summary for your account.

To cancel and replace an order, find the order that you would like to replace and choose Attempt to Cancel and Replace. On the following screen, you will be able to make changes to the order quantity, order type, price, time in force, and conditions.

About canceling and replacing

Orders are not canceled automatically by an identical order or an order at a different price for the same security. You must cancel a previous order if you place a substitute order. Fidelity cannot be responsible for any executed orders that you fail to cancel. A transaction resulting from a failure to cancel such an order will be applied to your account, and you will be responsible for that trade. Also, an attempt to cancel an order is subject to previous execution of that order. Cancellation requests are handled on a best-efforts basis. Confirmation of a cancellation order does not necessarily mean the previous order has been canceled, only that an attempt to cancel the order has been placed.By submitting a cancel and replace order, you are instructing Fidelity to cancel your prior order. Once we receive a verified cancel status for the original order, the replacement order is sent to the marketplace. Like Attempt to Cancel orders, Attempt to Cancel and Replace is subject to previous execution of the original order.

Fidelity reserves the right (but is not obligated) to cancel open orders when the limit price becomes unrealistic in relation to the market price. If an order is canceled, you may place a new order if you wish. Additional market conditions may warrant a cancellation of your order without prior notification. Some examples include, but are not limited to, exchange rulings, stock delistments, erroneous executions, corporate actions, stock halts or other abnormal market conditions. Establish a Fidelity AlertLog In Required to have notifications of trade events, including cancellations, emailed to you or sent to your mobile device.

-

Can I place orders when markets are closed?

You can place your brokerage orders when markets are opened or closed. However, orders placed when the markets are closed are subject to market conditions existing when the markets reopen, unless trades are made during an extended hours trading. Note: all orders placed in an extended hours trading session are valid only for that particular premarket or after-hour trading session. Any equity requirement necessary for trade approval will be based upon the most recent closing price of the security that you intend to buy or sell. Because of fluctuating conditions, the ultimate execution price may differ at times from the most recent closing price.

For orders placed prior to market open, Fidelity may wait for the primary exchange to open before commencing trading in a particular security.

Please use caution when placing orders while the market is closed. Securities may open sharply below or above where they closed the previous day. Fidelity reserves the right to refuse to accept any opening transaction for any reason, at its sole discretion.

-

Can I trade in extended hours?

Yes, Fidelity offers extended hours trading, which allows Fidelity brokerage customers to trade certain stocks before and after the standard market hours.

Orders for the premarket session can be placed from 7:00 a.m. to 9:28 a.m. ET. Short sale orders for the premarket are only permitted between 8:00 a.m. and 9:28 a.m. ET. Orders in the after-hours session can be placed from 4:00 p.m. to 8:00 p.m. ET. In the event that a market center becomes unavailable during an extended-hours session, Fidelity may submit orders to another eligible and available market center to maintain order flow. Thus, your order may be presented in any one of several market centers.

Fidelity will accept limit orders in the extended-hours trading sessions; all other order types are ineligible for trading during extended-hours. Good ‘til canceled (GTC) orders are not available for extended-hours trading sessions. Orders placed during Fidelity’s premarket sessions that are not filled by the end of the session at 9:28 a.m. ET are automatically canceled, unless trading is halted prior to that time. You must re-enter these orders during standard market hours if you still wish to have Fidelity execute the trades. Orders placed during Fidelity’s after-hours market sessions that are not filled by the end of the session at 8:00 p.m. ET are automatically canceled, unless trading is halted prior to that time. You must re-enter these orders during the premarket or standard market hours if you still wish to have Fidelity execute the trades.

-

What are the risks of trading in the extended hours sessions?

Trading during extended-hours may pose greater risks than the risks you take when you trade during standard market hours. You should review and understand these risks prior to engaging in extended-hours trading.

Liquidity. Liquidity is the level of trading activity and the volume of investments available for trading. In general, the greater the liquidity of an investment, the greater the chance an order to buy or sell will be executed successfully. You may see reduced liquidity during extended-hours trading sessions that prevents your orders from being executed, in whole or in part, or you may experience a less favorable price than you might receive during standard market hours.

Price volatility and price spreads. Price volatility refers to the speed and size of changes in the price of a security. There may be more volatility in premarket and after-hours hours trading than in the standard market session, which may prevent your order from being executed, in whole or in part, or you may experience a less favorable price than you might receive during standard market hours. Price spread is the difference in prices between what you can buy a security for and what you can sell it for. Lower liquidity and higher volatility in extended-hours sessions may cause greater spreads for a particular security than that same security might experience during normal trading hours.

Access to other markets and market information. Not all market centers are connected in extended-hours trading sessions, and not all market centers offer extended-hours trading during the same time periods. This means it’s possible that there’s greater liquidity in a particular security or a more favorable price in that security in another market center. Access to quotes and trading information in other market centers may be limited during extended-hours sessions. Additionally, other participants in the extended-hours sessions may be placing orders based on news or other market developments outside the standard market hours, and this may affect the price of securities in extended-hours trading. Keep in mind that news stories and related announcements, coupled with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of a security. Before you place an order during an extended-hours trading sessions, you need to decide whether you have enough current information to determine a limit order.

Price variance from standard market hours. Orders you place in the extended-hours markets are available at prices generally based on the supply and demand created by other sellers and buyers participating in the extended-hours sessions. Therefore, execution prices in the extended hours sessions may not necessarily match pricing available in the standard daytime trading session. You might pay more, or receive less than you would compared to trades in standard market hours. You will not, however, receive an execution price that is worse than your established limit order for the extended-hours sessions.

Time and price priority of orders. Orders in the extended-hours sessions are generally handled in a price/time priority manner. Orders are first prioritized according to price, with the orders at the same price ranked based on the order entry time. There is no Reg NMS trade through protection during the extended-hours sessions, so price/time priority is set by each market center, not across market centers. This may prevent your order from being executed, in whole or in part, or prevent you from receiving as favorable a price as you might receive during standard market hours. If you change your order, your change is treated as a cancellation and replacement, which may cause it to lose its time priority.

Communication Delays. If there is a high volume of orders, increased number of communications being sent, or other computer system problems, you may experience delays or failures in communication that cause delays in or prevent access to current information about the investments you’re considering, or in executing your order.

-

How do I receive proceeds from sales?

Fidelity will credit the proceeds of a sale to your core account on the settlement date. Proceeds will automatically be used to pay down any margin debt if you have any, and the balance will remain in your core account. You may also have a check for the proceeds mailed to you or have proceeds sent via EFT or bank wire.

Brokerage customers with Checkwriting may write checks against the proceeds of a sale on or after the settlement date. This amount is reflected in the Cash Available to Withdraw balance.

-

How do I pay for trades?

Retirement accounts

Trades placed in retirement accounts must be paid for from assets present in the core account at the time of placing the trade.Brokerage accounts

Trades placed in a brokerage account are settled according to these rules:- We will settle the trade with the balance in your core account if no other funds are received.

- If your core account balance is too low to cover the trade, you may:

- Add funds to your core account.

- Pay for your trade with your margin account, if you have one.* Your margin account will be used automatically if it contains sufficient marginable securities to pay for your purchase.

To avoid using your core account balance to settle a trade, deposit additional money via electronic funds transfer, check, or wire transfer to Fidelity.

Fidelity reserves the right to require 100% of the purchase price in your account to cover special purchases or first-time trades (e.g., stocks under $5, or one-day-settlement products). Retirement accounts are not eligible for margin.

* We reserve the right to require equity of up to 100% of the proposed trade's value in any account. Fidelity may waive this requirement for customers with previous Fidelity credit history or mutual fund assets on deposit. First-time traders with Fidelity Brokerage Services LLC, are required to deposit at least 25% of the value of the trade. Retirement accounts require 100% of the proposed trade's value at the time the trade is placed. -

How do I deposit securities to my Fidelity Account®?

Endorse the certificates exactly as they are registered on the face. The registration must correspond with the name as shown on your brokerage account.

Write "to National Financial Services LLC" on the line between "appoint" and "attorney" on the back of your certificate. (National Financial Services LLC is the clearing agent for Fidelity Investments.) Write your brokerage account number on the top right face of the certificates.

Only originals (no photocopies) are acceptable. Make sure to keep all paperwork together in the same package.

Send the certificates to this address:

- Fidelity Investments

Attn: Banking Services

Mail Zone KC1N

100 Crosby Parkway

Covington, KY 41015

For security, you may send your certificates by registered mail.

Securities not in good order

Securities that are not in good order are not negotiable, and proceeds from their sale cannot be released to you until the certificates have cleared transfer. - Fidelity Investments

-

What are the order settlement dates?

The settlement date is the day on which payment for securities bought or certificates for securities sold must be in your account. Settlement dates vary from investment to investment; please see the table below for details.

When you buy a security, payment must reach Fidelity by the settlement date.

When you sell a security, Fidelity will credit your account for the sale on the settlement date.

Most securities settle in one business day. For these securities, you must have sufficient cash or margin equity in your account when your order is placed.

-

What are market-wide circuit breakers?

The securities markets have circuit breakers that temporarily halt trading in all securities in the event of a severe market decline. In the event of a decrease in the S&P 500® Index at pre defined circuit breaker levels, securities will be temporarily halted at each circuit breaker level once per day.

Circuit breaker level S&P 500 Index decline percentage Market impact 1 7% 15-minute trading halt* 2 13% 15-minute trading halt* 3 20% Trading halted for all securities until the next trading day *Note: Level 1 and 2 circuit breakers do not halt trading after 3:25 PM ET.

Fidelity routes your stock orders to various market centers/exchanges, which may differ in the way they will be handling orders while a market-wide circuit breaker is in effect. Fidelity will continue to communicate the status of any open trades via the Orders page of your portfolio. However, due to market/security volatility, the status of your order may be delayed.

-

What are individual stock price bands (Limit Up-Limit Down)?

In order to address extraordinary market volatility in individual securities, the securities markets have also implemented a Limit Up-Limit Down mechanism that will prevent trades in certain stocks from occurring outside of specified price bands.

Trades for individual exchange-listed or National Market System (NMS) stocks will be prohibited from occurring at a set percentage higher or lower than the average security price in the preceding five minutes during certain market hours. The following has been effective since December 8, 2013:

Securities included Trading hours Average security price Price band percentage Price band percentage during market open/close* All NMS stocks, excluding rights and warrants (Tier 2) 9:30 a.m. ET – 4:00 p.m. ET More than $3.00 10%** 20% $0.75 and up to and including $3.00 20% 40% Less than $0.75 Lesser of $0.15 or 75% $0.30 or 150% (upper band only) * Price band percentages will generally be doubled at the market open (9:30 a.m. ET – 9:45 a.m. ET) and at the market close (3:35 p.m. ET – 4:00 p.m. ET) to accommodate more typical trading patterns during those time periods.** Tier 1 securities (stocks in the S&P 500 Index, Russell 1000 Index and certain ETPs) priced over $3.00 utilize a 5% price band.Fidelity routes your stock orders to various market centers/exchanges, which may differ in the way they will be handling orders during periods of time when a Limit Up-Limit Down halt is in effect. Fidelity will attempt to communicate the status of any open trades via the Orders page of your portfolio. However, due to market/security volatility, the status of your order may be delayed.

Options order handling

Options trading is not subject to the Limit Up-Limit Down price bands. However, options market centers/exchanges have modified their trading rules to accommodate the impact of Limit Up-Limit Down on underlying securities. In certain circumstances, options market centers/exchanges will halt trading in related options in conjunction with stock exchanges when a stock has been halted in response to Limit Up-Limit Down procedures. During Limit Up-Limit Down conditions, options exchanges may accept or reject option market orders entered during the halt depending on the trading state of the underlying security.

Mutual Funds

-

How do I buy, sell, or sell to buy mutual funds?

Placing a mutual fund trade online is easy. The order isn't "official" until you review all the information and click Place Order.

There's never a commission for Fidelity mutual fund trades, though other fees and expenses may apply. See the fund's current prospectus for details. You can place a mutual fund trade anytime.1

-

Where is the mutual fund trading screen?

The mutual fund trading screen can be found by following this path: Accounts & Trade > Trade tab (log in required) or by clicking the Trade button in the black navigation bar.

-

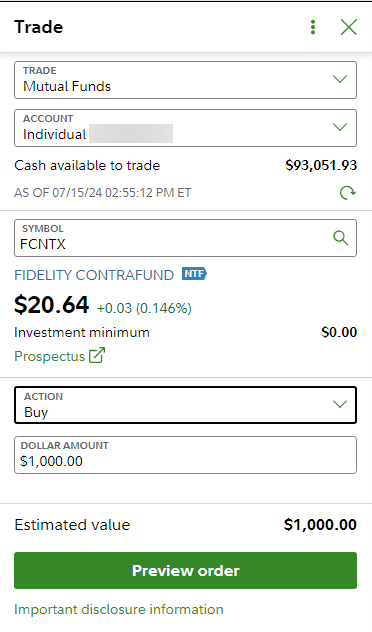

How do I place a trade?

You have three options for placing a trade:

- You can buy a mutual fund.

- You can sell a mutual fund you own.

- You can sell a mutual fund you own, and use the proceeds to buy a mutual fund within the same family (exchange) or from a different fund family (cross family trade).

For illustrative purposes only -

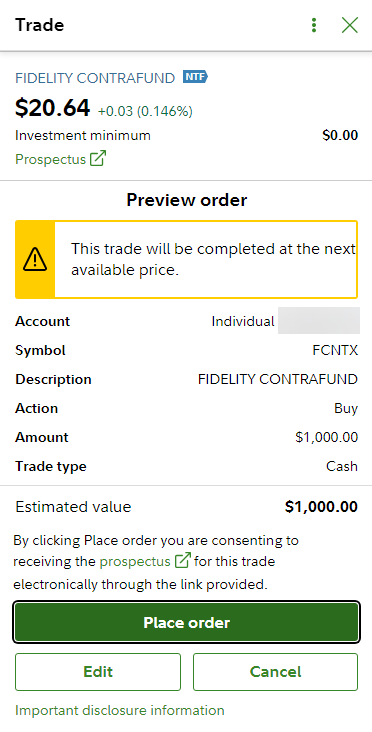

How do I preview my order?

After entering information about the fund you want to buy or sell, click Preview Order to review your order before you place it. You can change or cancel your order on the Order Verification page.

For illustrative purposes only -

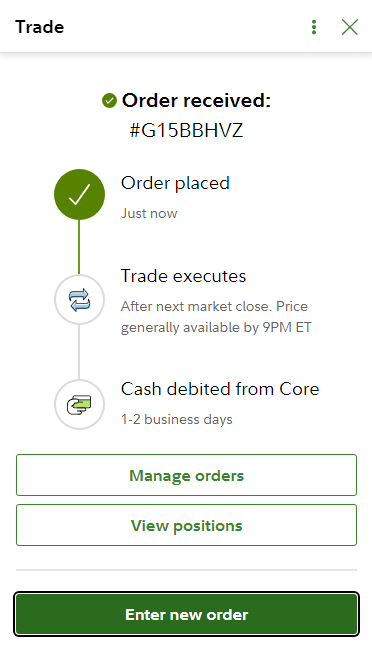

Where is my order confirmation?

After you place your trade, the confirmation screen confirms the order details. You can receive a trade confirmation via e-mail.

For illustrative purposes only -

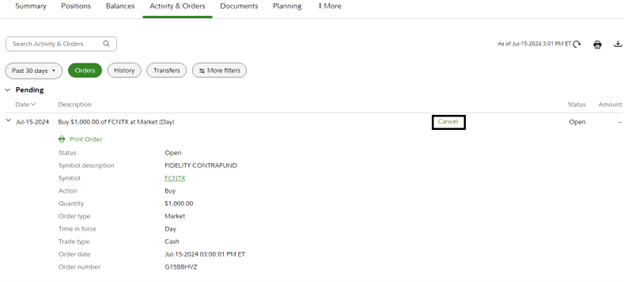

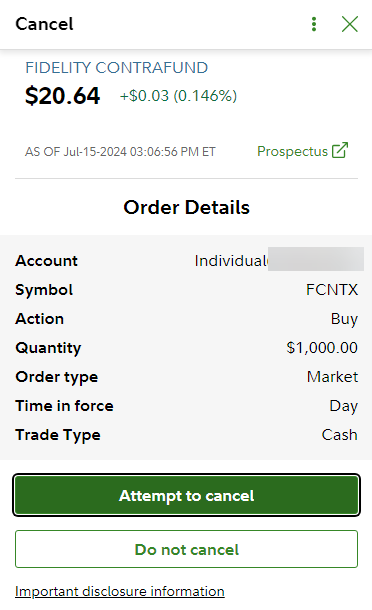

How do I cancel an order?

You can attempt to cancel an unexecuted order after it has been placed. To do this, go to the Orders page, select your order, and choose Cancel.

You must request a cancellation of your order before the closing price is calculated. For Fidelity Funds, the Attempt to Cancel has to be initiated before 4 p.m. on the day of the trade. Pricing times for non-Fidelity funds vary. To check pricing rules, see the fund's prospectus.

For illustrative purposes only -

How are funds priced?

Mutual funds are priced based on the next available price. For Fidelity funds that price daily, the next available price is calculated based on the 4 p.m. market close. Non-Fidelity funds may have different policies. See the fund's prospectus for more information.

-

Do I need to "sell" from my Core account to create cash for my mutual fund purchase?

You do not need to "sell" from your Core account to create cash to purchase a mutual fund. For brokerage accounts, the trade will settle automatically if there is enough cash available in your Core account.

-

What's a fund family?

A group of mutual funds, each typically with its own investment objective, managed and distributed by the same company.

-

Can I sell a non-Fidelity fund and buy a Fidelity fund with the proceeds?

You can sell a non-Fidelity fund and buy a Fidelity fund with the proceeds. This type of transaction is called a cross family trade, where you sell mutual fund assets in one mutual fund family to purchase mutual fund assets in a different fund family. The settlement date for the sale portion of the transaction is one business day later than the trade date. Therefore, the purchase takes place on the next business day following the sale. On the sale of your mutual funds, you will receive the next available price, and on the purchase of your mutual funds, you will receive the next business day's price.

-

What is Fidelity's Excessive Trading Policy?

Fidelity has long discouraged excessive trading by mutual fund investors. Excessive trading can be expensive and burdensome for long-term shareholders. Please refer to each fund's prospectus for additional information.

Order execution

-

How do I know at what price my order will get executed?

This depends on what type of security you are trading. See the Mutual Funds section above for information about mutual fund pricing.

For equity and options trading, the execution price you’ll receive will be dependent on a number of factors. For many equities and options, the most recent price might be from seconds ago, though it could be minutes, hours or even days, for less liquid securities. Instead of relying on the most recent, last trading price, a better indication is the bid price and ask price. The ask price is often referred to as the offer price.

The NBBO (National Best Bid and Offer) is a consolidated quote that represents the highest bid and lowest offer for a security across all exchanges and/or market centers. It is updated continuously during market hours. Along with the bid price and ask price, there is also an indication of size, representing how many shares are willing to be bought (bid size) and sold (ask size) at those prices. For equities, the size indicated should be multiplied by 100. A bid size of 5 actually represents 500 shares willing to be purchased at the bid price.

If you are placing a market order (hoping to receive the next available price), the NBBO is an indication of the price you could receive. For buy orders, the best offer price is the best indication of the price at which an order is likely to be filled. The best bid price is the best indication of the price at which a sell order will be filled. However, if the size of your buy order is larger than the size available at the ask, you should expect that some of your order might execute at a price higher than the ask.

In addition, there are various market conditions that can cause orders to be executed at better or worse prices than the bid and ask. While the bid and ask price are displayed to investors and other market participants, there can also be non-displayed orders at, inside, or outside of the bid and ask prices. There is the potential that your order will execute against a non-displayed order that is resting between the bid and ask, which could improve your execution price. For orders placed prior to market open, Fidelity may wait for the primary exchange to open before commencing trading in a particular security. Also, in fast market conditions, there could be orders ahead of yours that deplete all available shares at the bid or ask, moving prices in or out of your favor by the time you place your trade. News events, market volatility, market outages, and other circumstances can all impact the execution price that you receive. You should always use caution with market orders as securities prices can change sharply.

-

What is price improvement?

Price improvement occurs when a market center is able to execute a trade at a price lower than the ask (for buy orders) or higher than the bid (for sell orders). It is associated with trades that are immediately marketable (limit orders that can immediately execute based on current market prices, as well as market orders). In addition to measuring execution speed and the likelihood of your order being filled in its entirety, we strive to send orders to venues that are most likely to be able to price improve orders.

-

What types of orders are eligible for price improvement?

Equity, single-leg option, and multi-leg option trades can receive price improvement. Equity and single leg option orders that are executed while the market is open will display an estimate of the total dollar value of price improvement that you received, if any, based on the bid ask at the time your order was submitted. If your order is not immediately marketable, for instance if you place a limit or stop order away from the current bid ask, the price improvement indication will not be displayed. This is because as seconds or minutes pass, market conditions change, and your execution price is more a reflection of those changing conditions than it is of true price improvement.

-

How is the price improvement indication calculated?

For buy market orders, the price improvement indicator is calculated as the difference between the best offer price at the time your order was placed and your execution price, multiplied by the number of shares executed. Due to the time difference between when your order is placed versus when it is executed, the best offer price may be different at each of these times. This price improvement calculation should be considered informational and is not used for regulatory reporting purposes.2

- For example, if the bid ask is $49.95–$50.00 at the time you place your order, and your trade to buy 300 shares executed at $49.99, you received a price improvement of $3.00, compared to the ask price of $50.00.

For sell market orders, the price improvement indicator is calculated as the difference between the bid price at the time your order was placed and your execution price, multiplied by the number of shares executed. As noted above, the bid price at the time of order entry may be different from the bid price at the time of order execution; therefore, the price improvement indication may differ from the actual price improvement that your order may receive.

- For example, if the bid ask is $49.95–$50.00 at the time you place your order, and your trade to sell 300 shares executed at $49.97, you have received a price improvement of $6.00, compared to the bid price of $49.95.

The calculation for price improvement on limit orders will reflect not only the quoted bid or ask price at the time your order is submitted, but also the limit price that you use. Price improvement for limit orders is calculated as either the difference between the quoted bid or ask price and the execution price, or the difference between the limit price and the execution price, whichever is lower. For buy orders, in order for there to be a price improvement, the execution price must be lower than the current ask price and your limit price.

- For example, if the bid ask is $49.95–$50.00 at the time you place your order to buy 300 shares at a limit of $49.99, and your order executes at $49.97, you have received a price improvement of $6.00, based on your limit price of $49.99. Had the order executed at $49.99, there would have been zero price improvement since the execution price wasn’t better than both the quoted ask price and your limit price. Alternatively, if you enter an order to buy at a limit of $50.02 and the order executes at $49.97, you have received price improvement of $9.00, based on the ask price of $50.00.

Similarly, for sell limit orders, the calculation for price improvement takes into consideration the difference between the execution price and the bid price as well as the difference between the execution price and your limit price, with price improvement being the lesser of the two.

- For example, if you enter an order to sell 300 shares at a limit of $49.97 when the bid ask is $49.95–$50.00, and the order executes at $49.98, you have received a price improvement of $3.00, based on the limit price of $49.97.

In order to help ensure that order execution is the top priority, the quoted bid ask is captured separately from the trade execution process. In rare instances, the quote may not be captured for the price improvement indication calculation by the time the order is executed. When this happens, the price improvement indication will not be calculated on your order.

Depending on the price per share and the liquidity of the security, price improvements can be bigger or smaller than the examples provided.

For stock and option orders with wide bid-ask spreads, there is a wider range of prices at which your order could execute inside of the spread. With more room between the bid price and ask price, there is the potential, though not a guarantee, that the execution price will be more significantly below the ask or above the bid than for products with tighter bid-ask spreads. In such cases, the price improvement indicator may appear larger than usual. Market conditions are a large contributing factor to the amount of the price improvement indication in these instances.

-

What does Fidelity do to ensure the best execution price on my orders?

Fidelity works to ensure that orders receive the best possible execution price by routing orders to a number of competing market centers. This is done by supervising order-flow routing activities, monitoring execution quality, and taking corrective action when venues aren't able to meet our quality standards. To learn more, see our Commitment to Execution Quality.

-

How are "Expert Market" securities and other securities in the over-the-counter (OTC) market handled?

Based off of Securities and Exchange Commission (SEC) requirements, Fidelity blocks buy orders and opening transactions in "over-the-counter" ("OTC") securities classified as "Expert Market", "Grey Market", and "Caveat Emptor." "Expert Market" securities are ones where the company has failed to make current financial and other company information publicly available. "Grey Market" securities are ones that have a lack of investor interest, company information, or regulatory compliance. "Caveat Emptor" securities are ones that are deemed by the OTC Markets Group to have reason for additional care and thorough due diligence should be performed before making an investment decision.

If a security you hold becomes classified as "Expert Market", "Grey Market", or "Caveat Emptor", you may notice that quote information is limited and that pricing not provided on the security, which may impact the market value of that security in your account. Any new orders to sell3 will be treated as Grey Market securities when sent for execution and will not be displayed. There may be difficulty or delays in processing your order, which could execute at a price that differs significantly from the last price provided.

For more information:

- Review the Stock Screener on the OTC Markets website to identify whether you hold any "Grey", "Caveat Emptor" and "Expert Market". This information is subject to change.

- Review the SEC's press release.

More information

Stock FAQs

Learn more about international stock trading and IPOs.

Fidelity Trader+™ FAQs

Get details on our most powerful trading experience yet. Available at no cost across your devices.

Fidelity Learning Center

Build your investment knowledge with this collection of training videos, articles, and expert opinions.