What we offer

Learn more

Stock FAQs: International Stock Trading

-

What stocks can I trade internationally, and on what markets?

When you sign up for international trading, most common stocks and exchange-traded funds (ETFs) listed in the following markets will be available to trade online:

Market Country Code  Australia

AustraliaAU  Austria

AustriaAT  Belgium

BelgiumBE  Canada

CanadaCA  Denmark

DenmarkDK  Finland

FinlandFI  France

FranceFR  Germany

GermanyDE  Greece

GreeceGR  Hong Kong

Hong KongHK  Ireland

IrelandIE  Italy

ItalyIT  Japan

JapanJP  Mexico

MexicoMX  Netherlands

NetherlandsNL  New Zealand

New ZealandNZ  Norway

NorwayNO  Poland

PolandPL  Portugal

PortugalPT  Singapore

SingaporeSG  South Africa

South AfricaZA  Spain

SpainES  Sweden

SwedenSE  Switzerland

SwitzerlandCH  United Kingdom

United KingdomGB Other types of exchange-listed securities such as rights, warrants, or different classes of stock (e.g., Class A, Class B) may not be available. Security type availability is subject to change without notice.

Order Details

International orders can be entered at any time but will only be eligible for execution during the local market hours for the security. International orders are limited to common stocks with the following order restrictions:- Day orders only—your order will only be in effect for the trading day, which corresponds to the hours of the primary exchange on which the security trades.

- Market or limit orders only

- Cash trades only (margin not available)

- No additional order instructions (e.g., all or none, fill or kill)

- Long buys or long sells only (no short sales)

International orders can be settled in your choice of U.S. dollars (USD) or the local currency.

For more on placing orders and order types, see the Trading FAQs.

-

How do I find a stock symbol and get a quote?

You can search International stocks with a known symbol or company name in the trading ticket window after enabling International Trading. Once signed up for International Trading, click the account you would like to trade in then select "International Trading" on the trade ticket. After that, you can use the symbol search box to enter a company name or known ticker symbol. Tip: only use the first word in the company name when searching, results will appear below. If you cannot find an International stock you are looking for, or if you have any issues trading once you have found the International stock. Please give our International Trading team a call for assistance at (800) 544-2976

International stocks use a different symbology than domestic stocks. To quote, research, or trade international stocks, enter the stock symbol, followed by a colon (:) and then the two-letter country code for the market you wish to trade in. For example, the company Fiat SPA Torino in Italy would trade under symbol F:IT for its ordinary shares. In Germany, it would trade under symbol FIAT:DE. This symbology can only be used to buy or sell stocks on the international trade ticket.

Quotes

Real-time quotes1 are available for international stocks using the Get Quote Tool along the top of Fidelity.com or within your International Stock Trading page. Although the real-time primary market quote is displayed, international orders may execute on the primary exchange, or they may execute on ECNs, ATSs or regional exchanges within the market.Primary Exchanges

Market Primary exchange Australia Australian Stock Exchange Austria Vienna Stock Exchange Belgium Euronext Brussels Stock Exchange Canada Toronto Stock Exchange or Ventures Stock Exchange Denmark OMX Copenhagen Finland OMX Helsinki France Euronext Paris Stock Exchange Germany Frankfurt Stock Exchange Greece Athens Stock Exchange Hong Kong Hong Kong Stock Exchange Ireland Irish Stock Exchange Italy Italian Stock Exchange Japan Tokyo Stock Exchange Mexico Mexican Stock Exchange Netherlands Euronext Amsterdam Stock Exchange New Zealand New Zealand Stock Exchange Norway Oslo Stock Exchange Poland Warsaw Stock Exchange Portugal Lisbon Stock Exchange Singapore Stock Exchange of Singapore South Africa JSE Limited (Johannesburg Stock Exchange) Spain Bolsa de Madrid (Madrid Stock Exchange) Sweden Stockholm Stock Exchange Switzerland Swiss Exchange United Kingdom London Stock Exchange -

How do I buy international stock?

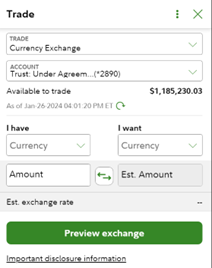

You must have sufficient U.S. dollars (displayed as Cash Available to Buy Securities) or 100% of the foreign currency needed to place an international stock order. These values can be found toward the top of the Trade Stocks – International Trade ticket. They are also included in the Balances and Positions pages.

For illustrative purposes onlyForeign currency values are also shown on the Positions page.

Once entered, international stock and currency exchange orders are displayed on the Orders page along with your domestic security orders.

Note: International stocks must be bought and sold in the same market. For example, shares of a stock purchased in Germany could not be sold in France even though the company may trade on one or more exchanges in different markets.

-

What are board lots?

There are additional specifications regarding share quantities imposed by some exchanges. These are also referred to as board lots. A board lot is the number of shares defined as a standard trading unit. All orders placed in Canada, Hong Kong, and Japan must be entered in quantities that are multiples of the board lot or standard trading unit.

Board lot sizes for Canadian exchanges

Board lot sizes for orders on Canadian exchanges are determined based on the per share price of the security being traded.Trading price per unit Board lot size Less than $0.10 CAD 1,000 shares $0.10 to $0.99 CAD 500 shares $1.00 CAD or more 100 shares For example, the required board lot size for Canadian stocks trading between $0.10-0.99 CAD is 500 shares. To place an order to buy a Canadian security offered at $0.75 per share, your order quantity would need to be a multiple of 500 (the board lot size); e.g., 500 shares, 1,000 shares, 1,500 shares, and so on.

Board lot sizes for Hong Kong exchanges

The required board lot size for Hong Kong varies by security. The current range is 50–100,000 shares.Visit the HKEx to see the required board lot size for a particular security

Board lot sizes for Japanese exchanges

The required board lot size for Japan varies by security. Currently, the majority of securities trading on Japanese exchanges have board lot sizes of 1,000 shares. (In Japan, board lots are referred to as "trading units")To view the required board lot size for a particular security, check the website of the primary exchange on which the security trades:

Board lot requirements are usually the same for securities listed on both the Osaka and Tokyo exchanges.

-

What are tick requirements?

Tick requirements are minimum price increments at which securities can be traded. These increments vary by market, and are usually based on the closing price per share of the security from the previous session. All limit prices for a security must conform to the tick requirements of the market in which the security trades.

For example, the minimum tick requirement for a security trading at 60,000 yen on the Tokyo Stock Exchange is 100 yen. To place an order to buy that security, you would need to enter your limit price as an increment of 100, e.g., 59,900 yen, 59,800 yen, 59,700 yen, and so on.

Tick Sizes

Market Currency Price per share Tick increment Australia AUD 0–.1

0.10–0.50

0.50 and up0.001

0.005

0.01Austria EUR Any 0.01 Canada CAD 0–.495

0.50 and up0.005

0.01Denmark DKK 0-5.00

5.00-10.00

10.00-50.00

50.00-250.00

250.00-500.00

500.00-5,000.00

5,000.00-20,000.00

20,000.00-999,999,999.990.01

0.05

0.10

0.25

0.50

1.00

10.00

100.00Finland EUR Any 0.01 France EUR Any 0.01 Germany EUR Any 0.01 Greece EUR 0.00-3.00

3.00-60.00

60.00-999,999,999.990.01

0.02

0.05Hong Kong HKD 0–0.25

0.255–0.50

0.51–10.00

10.02–20.00

20.05–100.00

100.10–200.00

200.20–500.00

500.50–1,000.00

1,001.00–2,000.00

2,002.00–5,000.00

5,005.00–9,995.000.001

0.005

0.010

0.020

0.050

0.100

0.200

0.500

1.000

2.000

5.000Ireland EUR Any 0.001 Japan JPY 0–1,999

2,000–2,295

3,000–29,990

30,000–49,950

50,000–99,900

100,000–999,000

1,000,000–19,990,000

20,000,000–29,950,000

30,000,000 and up1

5

10

50

100

1,000

10,000

50,000

100,000Mexico MXN 0.00–999,999,999.9999 0.01 New Zealand NZD 0.00–0.20

0.20–999,999,999.99990.001

0.01Poland PLN 0.00-50.00

50.00-100.00

100.00-500.00

500.00-999,999,999.990.01

0.05

0.10

0.50Singapore SGD 0.00–1.00

1.00–3.00

3.00–10.00

10.00–999,999,999.990.005

0.01

0.01

0.02South Africa ZAR Any 1.00 Spain EUR 0.00-50.00

50.00-999,999,999.990.01

0.05Sweden SEK 0.00–5.00

5.00–15.00

15.00–50.00

50.00–150.00

150.00–500.00

500.00–5,000.00

5,000.00–999,999,999.990.01

0.05

0.10

0.25

0.50

1.00

5.00Switzerland CHF 0.00–10.00

10.00–100.00

100.00–250.00

250.00–500.00

500.00–1,000.00

1,000.00–5,000.00

5,000.00–999,999,999.990.01

0.05

0.10

0.25

0.50

1.00

5.00United Kingdom

(Shown in British pence. Stocks in the UK can be priced in British pounds (GBP) or pence. 1 GBP=100 p)GBP 0–9.99

10.00–499.75

500.00–999.50

1,000 and up0.01

0.25

0.50

1.00Swiss Blue Chip Segment stocks may have different tick increments than non-blue chip securities.

Limit orders must be entered based on the appropriate currency unit size.

-

Do some exchanges have additional requirements?

Japanese exchanges

To manage volatility, the Tokyo Stock Exchange and the Osaka Securities Exchange set “daily price limits” for all securities. These limits create a price range outside of which a security may not trade on any given day. Limit prices must also fall within this range. The exchanges determine daily price limits based on each stock’s “base price”—its price at the close of the previous market session. (In some cases, when buy and sell orders are significantly imbalanced, either exchange may assign a “special quote” to be used as the base price.) For specific price limits for all base prices, see the table below.As an example, suppose you want to buy a hypothetical Japanese stock—ticker XYZ—which closed on the previous trading day at 1,250 yen. As shown in the table below, the daily price limit for a stock with this base price is 300 yen. This means that the maximum potential upside or downside for XYZ on the day is 300 yen (for a maximum trading range of 950–1,550 yen). As a result, your limit price for XYZ must also fall between 950 and 1,550 yen.

Base price (JPY)2 Daily price limit (JPY)3 0–99 +/− 30 100–199 +/− 50 200–499 +/− 80 500–699 +/− 100 700–999 +/− 150 1,000–1,499 +/− 300 1,500–1,999 +/− 400 2,000–2,999 +/− 500 3,000–4,999 +/− 700 5,000–6,999 +/− 1,000 7,000–9,999 +/− 1,500 10,000–14,999 +/− 3,000 15,000–19,999 +/− 4,000 20,000–29,999 +/− 5,000 30,000–49,999 +/− 7,000 50,000–69,999 +/− 10,000 70,000–99,999 +/− 15,000 100,000–149,999 +/− 30,000 150,000–199,999 +/− 40,000 200,000–299,999 +/− 50,000 300,000–499,999 +/− 70,000 500,000–699,999 +/− 100,000 700,000–999,999 +/− 150,000 1,000,000–1,499,999 +/− 300,000 1,500,000–1,999,999 +/− 400,000 2,000,000–2,999,999 +/− 500,000 3,000,000–4,999,999 +/− 700,000 5,000,000–6,999,999 +/− 1,000,000 7,000,000–9,999,999 +/− 1,500,000 10,000,000–14,999,999 +/− 3,000,000 15,000,000–19,999,999 +/− 4,000,000 20,000,000–29,999,999 +/− 5,000,000 30,000,000–49,999,999 +/− 7,000,000 50,000,000 or more +/− 10,000,000 Hong Kong exchanges

To manage volatility, the Hong Kong Stock Exchange requires that all limit orders meet very specific pricing requirements. These requirements effectively set up ranges for each security within which all limit prices must fall. When entering a limit price for a Hong Kong-traded stock, there are two requirements your order will need to meet: the Spread Rule and the 10%–900% Rule. For additional information about the Spread Rule and the 10%–900% Rule, see the HKEx rules and regulations. -

What is currency trading?

Currency trading is when you buy and sell currency on the foreign exchange (or Forex) market with the intent of benefitting financially from the fluctuation in exchange rates.

Currency prices are highly volatile. Price movements for currencies are influenced by, among other things: changing supply-demand relationships; trade, fiscal, monetary, exchange control programs and policies of governments; United States and foreign political and economic events and policies; changes in national and international interest rates and inflation; currency devaluation; and sentiment of the marketplace. None of these factors can be controlled by you or any individual advisor and no assurance can be given that you will not incur losses from such events.

Settling Orders

Fidelity’s International Trading offering gives you the ability to settle international trades in the local currency, and allows you to gain foreign currency exposure by enabling you to hold and exchange between the following 16 currencies:- Australian dollar (AUD)

- British pound (GBP)

- Canadian dollar (CAD)

- Danish krone (DKK)

- Euro (EUR)

- Hong Kong dollar (HKD)

- Japanese yen (JPY)

- Mexican peso (MXN)

- New Zealand dollar (NZD)

- Norwegian krone (NOK)

- Polish zloty (PLN)

- Singapore dollar (SGD)

- South African rand (ZAR)

- Swedish krona (SEK)

- Swiss franc (CHF)

- U.S. dollar (USD)

The euro is the local currency for the following markets: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Portugal, and Spain.

At the time of a trade for an international stock, you can choose to settle the trade in U.S. dollars or in the local currency. If you settle in U.S. dollars, a “linked” foreign currency exchange order will automatically be executed when your stock trade order fills entirely, or at the end of the trading session if your order fills partially. If your stock trade does not fill at all or if you choose to settle in the local currency, no currency exchange will take place.

In addition to the standard market volatility that every security—whether domestic or foreign—is exposed to, your potential return can be affected by fluctuations in the foreign currency against the U.S. dollar. For example, you might have a 10% gain in the value of a Japanese stock that you settled in yen, but at any given time, the Japanese yen might have depreciated in value against the U.S. dollar, thus offsetting your gain.

Also note that interest is not paid on foreign currency positions.

-

What are the international stock commissions and fees?

The costs associated with international trading include:

- A commission charged on the trade that covers any clearing and settlement costs and local broker fees.

- Additional fees (i.e., stamp duty, transaction levy, trading fees) that are specific to some foreign exchanges and will be identified as Other Fees at the time of the trade.

- A foreign currency exchange fee if U.S. dollar is chosen as the settlement currency (see above for more information).

International trading commissions (charged by market in the local currency)

Country Market Online rate Rep-assisted Australia AUD 32.00 70.00 Austria EUR 19.00 50.00 Belgium EUR 19.00 50.00 Canada CAD 19.00 70.00 Denmark DKK 160.00 420.00 Finland EUR 19.00 50.00 France EUR 19.00 50.00 Germany EUR 19.00 50.00 Greece EUR 19.00 50.00 Hong Kong HKD 250.00 600.00 Ireland EUR 19.00 50.00 Italy EUR 19.00 50.00 Japan JPY 3,000.00 8,000.00 Mexico MXN 360.00 960.00 Netherlands EUR 19.00 50.00 New Zealand NZD 35.00 90.00 Norway NOK 160.00 400.00 Poland PLN 90.00 235.00 Portugal EUR 19.00 50.00 Singapore SGD 35.00 90.00 South Africa ZAR 225.00 600.00 Spain EUR 19.00 50.00 Sweden SEK 180.00 480.00 Switzerland CHF 25.00 65.00 United Kingdom GBP 9.00 30.00 View the Fidelity brokerage commission and fee schedule (PDF) for full details.

There may be additional fees or taxes charged for trading in certain markets and the list of markets and fees or taxes is subject to change without notice. These fees or taxes are included in the Estimated Commission section on the Trade Verification page and/or on your trade confirmation. Possible additional fees or taxes include:

Hong Kong

Transaction Levy: 0.004% of principal per trade

Trading Fee: 0.005% of principal per trade

Stamp Duty: 0.10% of principal per tradeUnited Kingdom

PTM Levy: 1 GBP per trade where principal amount is > 10,000 GBP

Stamp Duty: 0.50% of principal only on purchasesSingapore

Clearing Fee: 0.04% of principal per tradeSouth Africa

Securities Transfer Tax: 0.25% of principal on purchasesFrance

Financial Transaction Tax: 0.40% of principal on purchases of French securities, including ADRsSpain

Financial Transaction Tax: 0.20% of principal on purchases of Spanish securities, including ADRsIreland

Stamp Tax: 1.00% of principal per trade on purchases of Irish securitiesItaly

Financial Transaction Tax: 0.10% of principal on purchases of Italian securities, including ADR'sCurrency exchange fees

If you choose U.S. dollars as the settlement currency for your international stock trade, a foreign currency exchange fee (in the form of a markup or markdown) based on the size of the currency conversion will be charged when the foreign currency exchange executes.Amount of currency exchange in U.S. dollars Currency exchange fee (basis points) > $1M 20 bps $500–$999K 30 bps $250–$499K 50 bps $100–$249K 75 bps < $100K 100 bps If you plan on trading regularly in a specific market, you may want to consider exchanging a certain amount of currency to avoid currency exchange fees on each trade. For example, let’s say you plan on trading primarily in Hong Kong. Rather than settle your trades in U.S. dollars and pay a foreign currency exchange fee on each transaction, you could do a single, larger currency exchange transaction of your U.S. dollars into Hong Kong dollars.* This would allow you to settle each trade in the local currency, Hong Kong dollars, which may allow you to potentially reduce your overall trading costs.

*Note: A currency exchange fee would still apply to the initial currency exchange from U.S. dollars to Hong Kong dollars.

-

How are exchange rates displayed?

The currency exchange rate is the rate at which one currency can be exchanged for another. It is always quoted in pairs like the EUR/USD (the euro and the U.S. dollar) or USD/CAD (the U.S. dollar and the Canadian dollar). This is a standard used across the industry. The first currency of a currency pair is called the “base currency,” and the second currency is called the "quote currency." The currency pair shows how much of the quote currency is needed to purchase one unit of the base currency. Most of the time, the U.S. dollar is considered the base currency, and quotes are expressed in units of US$1 per quote currency (for example, USD/JPY or USD/CAD). The only exceptions to this convention are quotes in relation to the euro (EUR), the pound sterling (GBP) and the Australian dollar (AUD). These three are quoted as dollars per foreign currency and are represented as EUR/USD, GBP/USD, AUD/USD.

For example, the EUR/USD rate represents the number of USD one EUR can buy. If the current rate for EUR/USD is 1.381683 and you are converting EUR to USD, you would receive approximately 1.381683 U.S. dollars for each euro you exchange (1 x 1.381683). Conversely, if you are converting USD to EUR, you would receive approximately 0.7237 euros for each U.S. dollar (1/1.381683).

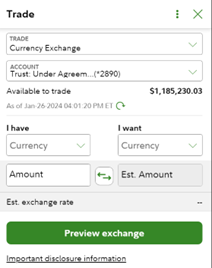

Currency exchange rates can only be obtained by inputting the following information on the Currency Exchange ticket:

- Quantity

- From currency

- To currency

For illustrative purposes only -

Where do I view my international trading balances?

All foreign currency and international stock balances will be listed in your Positions. You can also sort by currency to display all currencies and foreign stocks with exposure to that currency.

-

What is the difference between international stock trading and foreign ordinary share trading?

With international trading, most common stocks and exchange-traded funds (ETFs) listed in Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Singapore, South Africa, Spain, Sweden, Switzerland, and the United Kingdom are available to trade online directly in the local market.

Foreign ordinaries are shares issued by a foreign corporation that trade on a foreign exchange. These shares can be traded in the over-the-counter (OTC) market through a U.S. market maker. Below are characteristics, including specific fee information, related to foreign ordinary share trading.

International stock trading Foreign ordinary share trading Account requires international trading access. Requirements are non-retirement brokerage accounts.

Does not require international trading access

Symbols include root symbol, followed by a colon (:) and then the two-letter country code for the market you wish to trade in. For example, the company Fiat SPA Torino, in Italy would trade under symbol F:IT for its ordinary shares.

Symbols are five characters ending in “F”

Tradable only through Trade Stocks – International trade ticket

Tradable only through the domestic trade ticket, Trade Stocks – Standard Session

Orders can execute on the primary exchange, or they may also execute on ECNs, ATSs (automatic trading systems) or regional exchanges within the market which is determined by a local broker in each country.

Orders are executed by U.S. market makers, with the exception of Canadian listed stocks.

Orders are executed in the local currency.

Orders are executed in U.S. dollars.

Trades are settled in U.S. dollars or local currency.

Commissions are charged by market in the local currency.

- A commission charged on the trade that covers any clearing and settlement costs and local broker fees

- Additional fees (i.e., stamp duty, transaction levy, trading fees) that are specific to some foreign exchanges and will be identified as Other Fees at the time of the trade

- A foreign currency exchange fee if U.S. dollar is chosen as the settlement currency

Commissions charged are based on the U.S. domestic stock commission schedule. Please see Stocks section in the online commission schedule.

- Foreign stocks that are not DTC eligible are subject to an additional $50 fee.

- Foreign exchange fees are embedded in the execution price of the stock.

If your order is routed to a Canadian broker, certain additional fees may apply:

- Limit orders – a local broker fee is incorporated into the limit price by the Canadian broker.

- Market orders – a local broker fee is incorporated into the execution price.

- Foreign exchange fees are embedded in the execution price.4

-

What is an American Depository Receipt (ADR)?

An ADR is a security that trades in the U.S. and in U.S. dollars, but represents claims to shares of a foreign stock. The ADR is created by a bank that purchases foreign stock and then issues receipts of that company in the U.S. for trading on an exchange or over the counter (OTC) market.

ADR dividends are paid in U.S. dollars, but are subject to foreign tax withholding.

-

What are ADR fees?

An ADR fee is a fee imposed by the custodian bank of the ADR to offset the administrative costs involved in sponsoring the ADR. The transaction will show up as "Fee Charged" and will list the ADR and the amount of the fee. For dividend-paying ADRs, the fee is often assessed at the time of the dividend. To learn more about the amount and timing of ADR fees, see the ADR's prospectus.

-

What are withholding taxes?

Countries generally impose withholding taxes on dividends paid to foreigners. Many countries—including the United States—offer a dollar-for-dollar tax credit for the amount withheld to avoid double taxation of these funds.

-

What withholding rates apply?

Withholding tax rates may vary country to country. The United States has tax treaties in place with many countries that offer favorable rates or even exemptions from withholding tax. In general, the following tax rates may be applied to withholding:

- Exempt. The foreign country may recognize certain account registrations—such as tax-deferred retirement accounts—to be exempt from withholding tax altogether.

- Favorable. The foreign country may recognize certain account types to be eligible for favorable or reduced withholding rates. These are often referred to as treaty rates.

- Unfavorable. If the foreign country determines that a particular distribution is ineligible for a preferential treatment, a global or unfavorable rate is applied, resulting in the maximum withholding tax rate.

-

What rules apply to Canadian withholding tax?

The Canada Revenue Agency (CRA) allows Fidelity to automatically apply favorable withholding tax rates if all of the following conditions are met:

- The account holder is a nonresident of Canada who is either an individual who has an address in a country with which Canada has an applicable tax treaty.

- Fidelity has a complete permanent address on file that is not a post office box or care of address.

- Fidelity has no contradictory information on our files.

- Fidelity has no reason to suspect the information is incorrect or misleading.

If you do not meet these criteria, you may still be eligible for reduced withholding by certifying your eligibility for treaty rates, or applying for an exemption directly with the CRA. You can print or download the appropriate forms at Fidelity.com/forms.

-

How does the foreign currency transfer service work?

The amount of currency you request is transferred in-kind (e.g., euros to euros) between financial institutions. Transfers are processed as a wire via the Society for Worldwide Interbank Financial Telecommunications (SWIFT).

-

Are there fees associated with a foreign currency transfer?

While Fidelity doesn't charge a fee for this service, other financial institutions may if they're involved.

-

What currencies are supported?

Australian dollar (AUD)

British pound (GBP)

Canadian dollar (CAD)

Danish krone (DKK)

Euro (EUR)

Hong Kong dollar (HKD)

Japanese yen (JPY)

Mexican peso (MXN)

New Zealand dollar (NZD)

Norwegian krone (NOK)

Polish zloty (PLN)

Singapore dollar (SGD)

South African rand (ZAR)

Swedish krona (SEK)

Swiss franc (CHF) -

How do I transfer foreign currency held in my Fidelity account to another institution?

You'll need to contact a Fidelity International Trader at 800-544-2976 to complete the transaction.

-

How do I transfer foreign currency held at another institution to my Fidelity account?

To transfer to your Fidelity account, start the process at the financial institution that holds the currency. Review the Incoming SWIFT Wire Instructions. Use this page to select the institution you're transferring from and the desired country/currency.

-

How do I set up Outgoing Currency Wire Standing Instructions on my account for future transfers using the same currency and account?

Complete the Outgoing Foreign Currency Standing Instruction Form (PDF) and return it to your local Investor Center, either in person or through the mail, with a Medallion Signature Guarantee. Once you've established standing instructions, call the International Trading Team at 800-544-2976 to send the currency.

More information

Read more FAQs about trading online at Fidelity.

Get details on using our advanced trading tools.

Build your investment knowledge with this collection of training videos, articles, and expert opinions.