Before you buy or sell a stock or ETF (aka placing a trade) it’s helpful to be familiar with some key terms like order types, time in force, and settlement. Understanding these terms may make it easier for you to build your plan and place your trade.

What are order types?

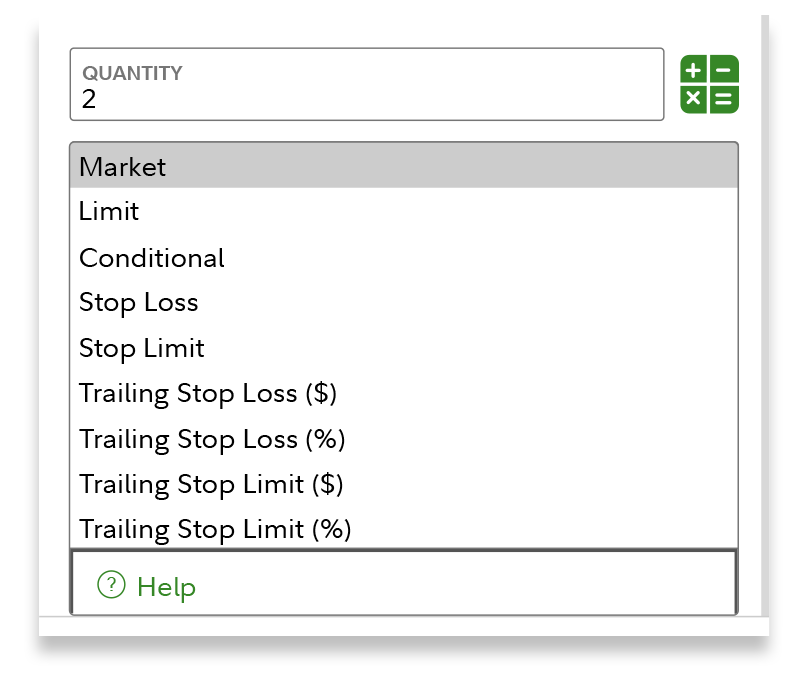

When entering a trade, you’ll be prompted to choose an order type. Depending on your strategy, different order types can affect the price and time at which you might buy or sell. Market and limit orders are 2 of the most common order types.

A market order is the fastest option. It gets your trade done at the next available price, but that price isn’t guaranteed. If you want more control over the price, a limit order might be the way to go. It lets you set the highest price you’re willing to pay (or the lowest you’re willing to sell for), though there’s no guarantee the trade will happen.

Still not sure? Check out different order types to learn what may be right for your trading plan.

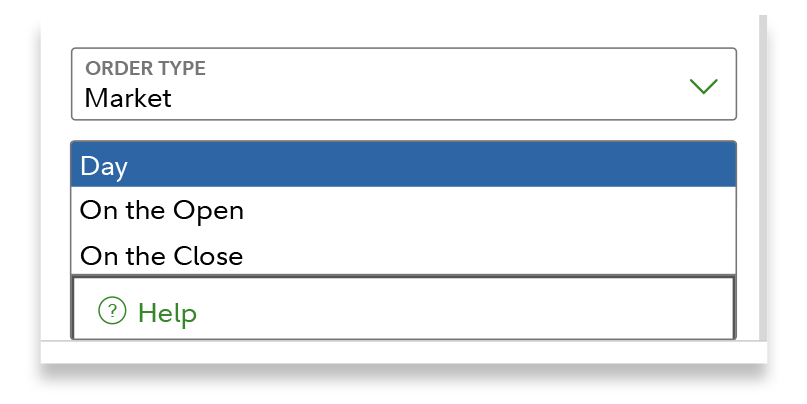

What is time in force?

Time in force is how long you want your order to stay open before it’s executed or expires. There are a few types to choose from, like day orders, and good 'til canceled (GTC). Knowing how time in force works can help you match your trading plan to your timeline.

How does settlement work?

When you buy a stock or ETF, the settlement date is when your trade is completed and the money for the trade is added to or removed from your account. Usually, transactions settle in one business day.

How to buy or sell stocks and ETFs at Fidelity

Follow these step-by-step instructions to place a trade in your Fidelity account.

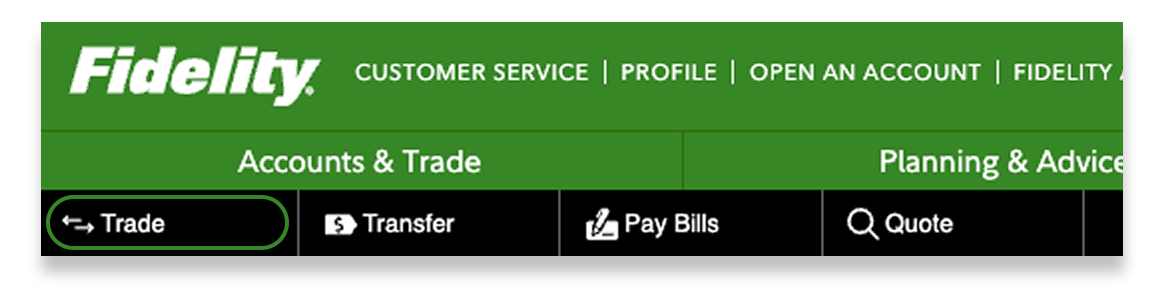

Start from Trade

1. Start by logging in to your Fidelity account. Select the Trade button from the top navigation bar.

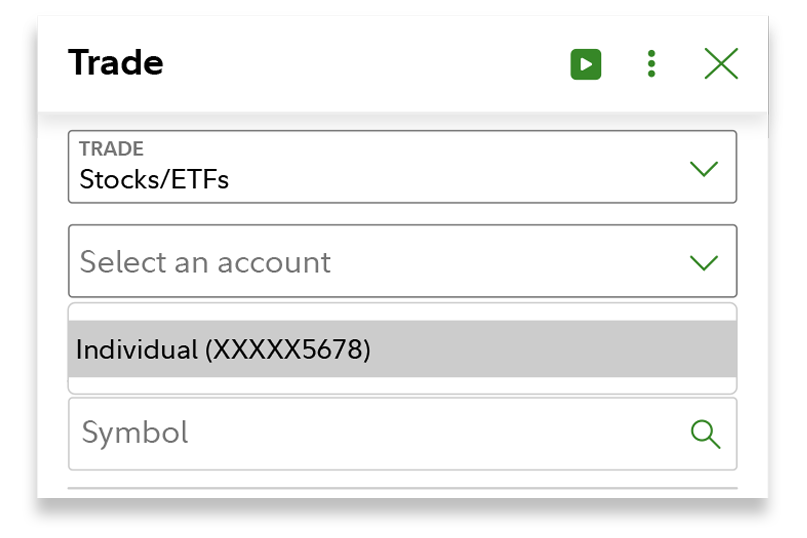

2. Select the account you want to trade in.

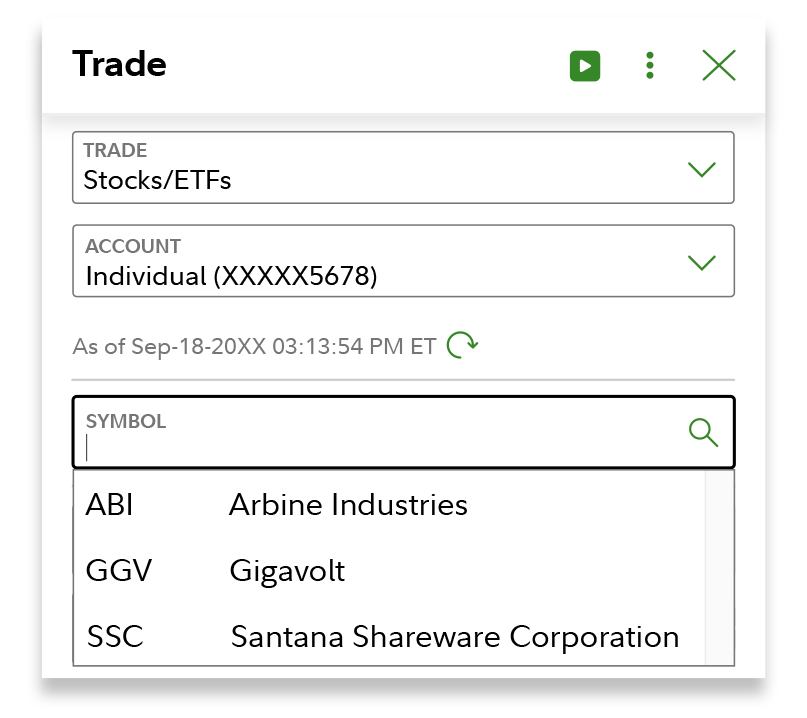

3. Look up the symbol.

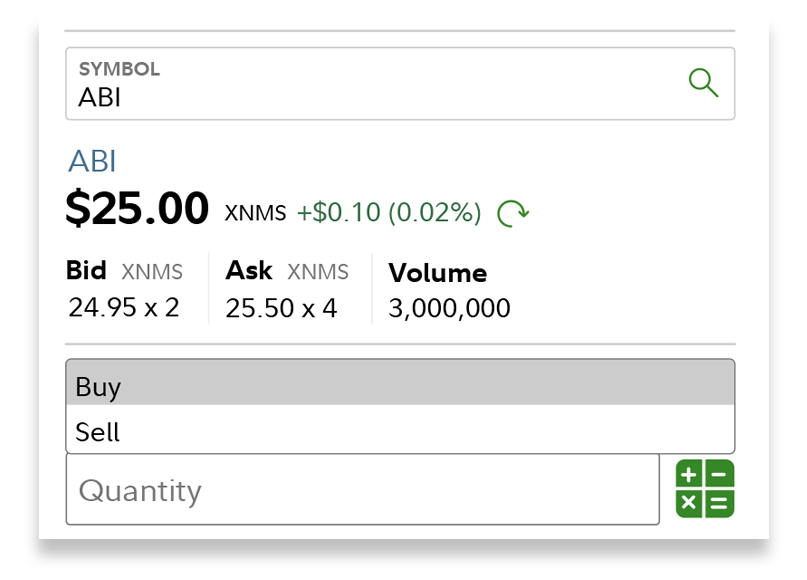

4. Select the Action (Buy or Sell).

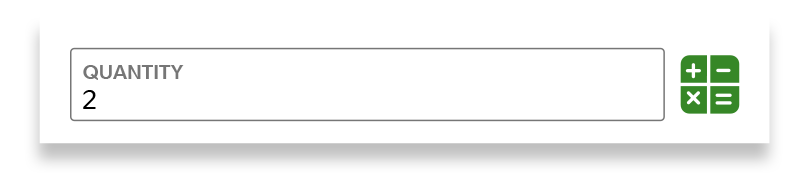

5. Choose the Quantity.

6. Choose an Order type.

7. Choose the Time in force.

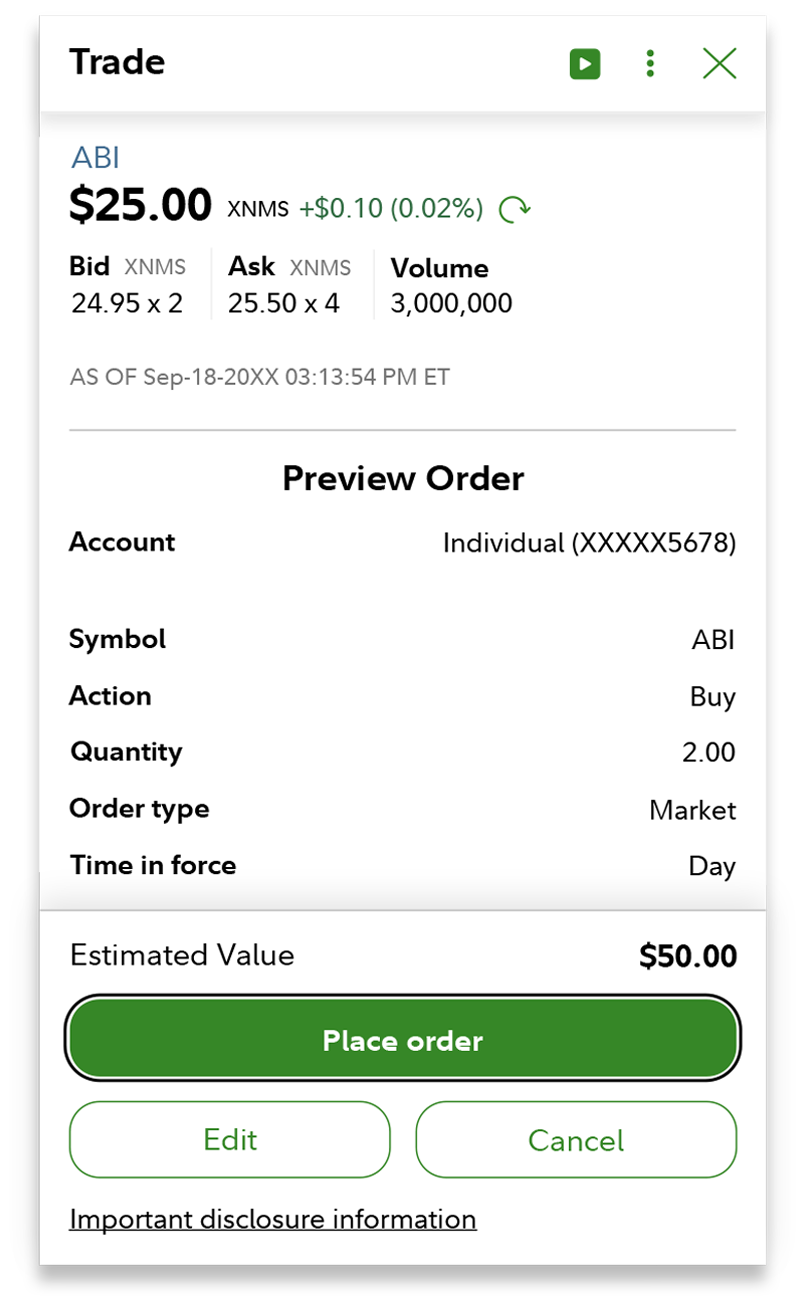

8. Now that all the information is complete, select Preview order and if all looks good, select Place order.

Congratulations—you’re all set!

You can always check the status of your orders in Activity & Orders. Investing consistently is a meaningful way to build good financial habits. If you want to make things even easier, you can set up recurring investments with Fidelity so your money gets invested on a regular schedule.

And remember, determining how often you monitor and manage your investments should be part of your plan. If you’re looking for more ideas, check out our 5-step trading guide.

Prefer to watch a video? Here’s a quick video that shows you how to place a trade.