With approximately $1.5 trillion in assets as of 2025,1 403(b)s are popular retirement savings accounts. While they're less common than 401(k)s, 403(b)s are still powerful tools for helping you reach your retirement goals, offering many of the same benefits as 401(k)s.

Here's what you need to know about 403(b) retirement plans.

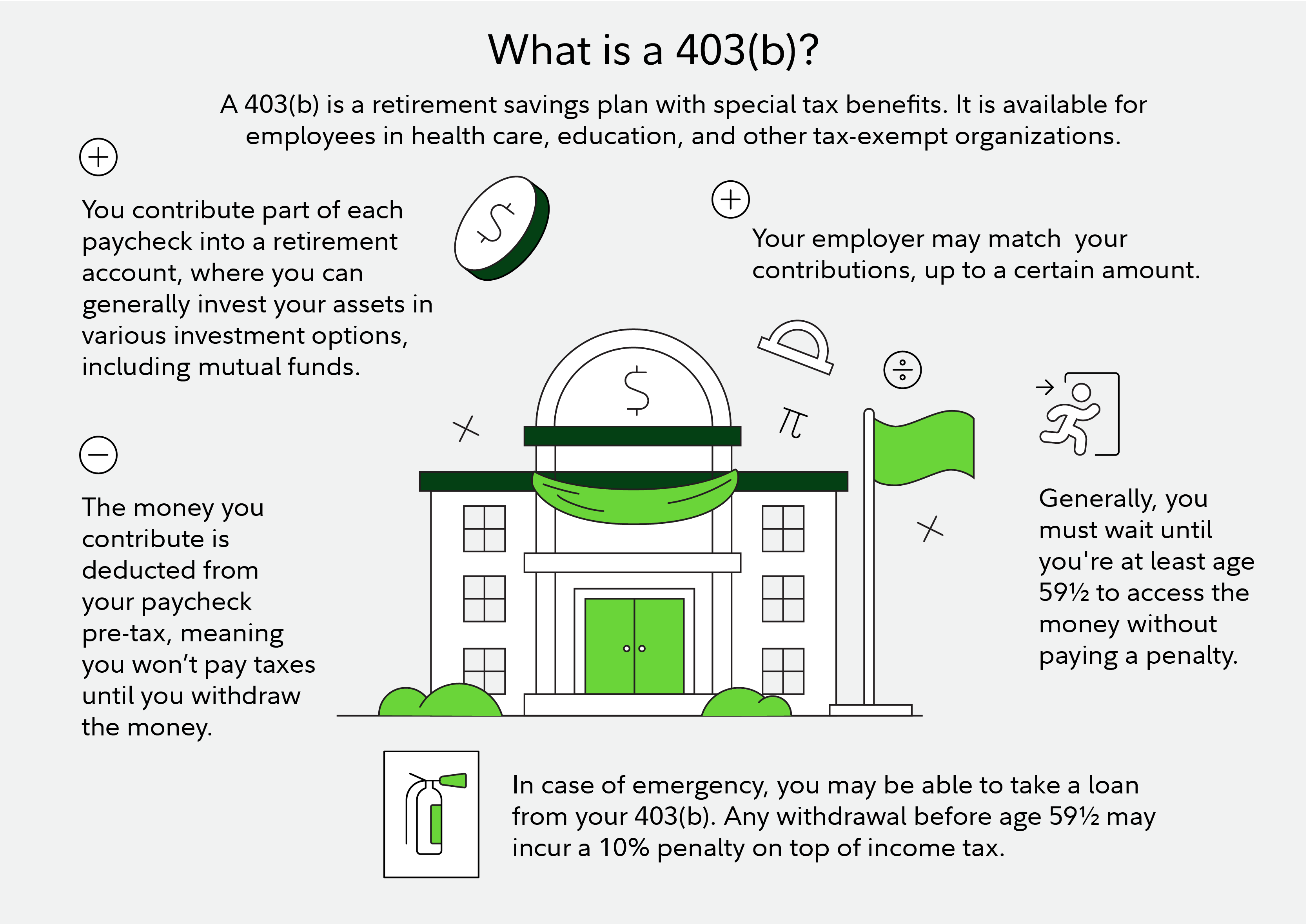

What is a 403(b)?

A 403(b) is a type of retirement plan available for employees in public schools, charitable 501(c)(3) tax-exempt organizations, and certain faith-based organizations. Employers provide access to 403(b)s to attract and retain workers.

If you don't have access to a 403(b), you can save for retirement using a different type of account. You may have access to a 401(k) through your work. Self-employed workers can open their own version of a 401(k), commonly called a self-employed 401(k). And anyone who earns an income (as well as their spouses) can contribute to an IRA.

How does a 403(b) work?

A 403(b) allows you to set aside money for retirement right from your paycheck. You can then invest your and any employer contributions in assets like mutual funds and annuities.

403(b)s also provide tax benefits. You can contribute pre-tax dollars directly from your paycheck, and your investments can grow tax deferred until you withdraw the money in retirement. Some employers also offer Roth 403(b)s, which let you contribute after-tax dollars. In exchange, you won't pay income tax on your qualified withdrawals,2 including investment earnings. A distribution from a Roth 403(b) is federally tax free and penalty free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59 1/2, disability, or death.

Not sure which to pick? See whether a Roth or traditional 403(b)—or both—makes sense for you.

403(b) advantages

403(b)s provide employees with many retirement savings benefits, including:

Automation Saving for retirement can be challenging, especially when there are multiple steps, such as transferring money into the retirement account and then selecting investments. With a 403(b), you can set a dollar amount or percentage of your paycheck to be automatically transferred from each pay cycle. That means the money never hits your bank account, where you might be tempted to spend it on other things. 403(b)s let you automate investing, making it a simple way to put saving for retirement on cruise control.

Employer contributions As an employee benefit, some organizations will contribute to your 403(b). This may be a set amount regardless of how much you contribute yourself, or you may receive an employer match. A match is when your employer contributes to a retirement account based on what you save each year. For example, an employer could contribute $1 for every $1 you put in or $1 for every $2 you contribute.

If your employer has a 403(b) match, try to prioritize putting enough in your 403(b) to take full advantage of it. A match provides additional funds to your account that can potentially benefit from compounding returns and grow more over time.

Compounding Compounding is when your investment returns earn returns of their own, giving you the potential to grow your money significantly over years and decades. Plus, because 403(b) contributions are typically pretax, you're starting with even more money to potentially grow over time.

The earlier you start, the longer your funds have to compound and grow, increasing the potential snowball effect of compounding.

403(b) contribution limits

For 2025, employees under 50 can contribute up to $23,500 of their salary to a 403(b) account. The limit rises to $24,500 for 2026. Certain employees may be eligible for additional catch-up contributions.

Catch-up contributions Almost all retirement accounts allow you to sock away a little extra once you reach age 50. For employer-sponsored retirement plans, like 401(k)s and 403(b)s, those 50 to 59 or 64 or older are eligible to contribute up to an additional $7,500 in 2025 as a catch-up contribution, and up to an additional $8,000 in 2026. In both years, those between 60 and 63 are eligible to contribute instead up to $11,250 as a "super" catch-up contribution if your plan allows it. (Note that starting in 2026, those with 2025 wages of greater than $150,000 must make their catch-up contributions to a Roth balance. This means high earners may no longer receive an upfront tax break when making catch-up contributions.)

A 403(b) can give your contribution limit an extra oomph than a 401(k) if you've been at the same employer offering the 403(b) plan for at least 15 years, regardless of your age, again provided the plan documents allow for it. If you meet this requirement, you may be able to save up to an extra $15,000 (in up to $3,000 installments over different years).

The exact amount you can contribute in additional catch-up contributions each year may be reduced based on your previous contributions to plans with your employer. For example, if you have worked for your employer for 15 years but contributed $75,000 or more over that period to retirement plans with that employer, you would not be able to make additional contributions using this provision.

As you can see, the exact amount you may be eligible to contribute can get complicated to figure out. If your plan offers this catch-up provision, your plan sponsor should be able to help you determine how much you can save this way. Make sure to keep in mind too that your total contributions cannot exceed the combined employer-employee contribution limit, which is $70,000 for 2025 and increases to $72,000 for 2026. This limit apples to employee payroll deferrals plus any employer contributions, and excludes employee catch-up contributions.

Most 403(b) plans have guardrails that keep you from overcontributing each year. If yours doesn't, you'll want to be sure to correct any excess savings by the time you file your taxes. Otherwise, you'll be taxed on the excess contribution when it goes in and a second time when you withdraw in retirement. If you make a withdrawal before age 59½, you may owe a 10% early-withdrawal penalty as well.

403(b) withdrawal rules

Since they provide tax incentives to help you save for retirement, 403(b)s set strict guidelines for when you can make withdrawals.

You can make penalty-free withdrawals once you reach age 59½, though you'll still owe income taxes if you made pre-tax (aka traditional) contributions to a 403(b). Before then, you'll have to pay a 10% early-withdrawal penalty—plus any applicable income taxes—in all but a few situations.

You may be able to avoid an early withdrawal (and its associated penalty) if your plan allows you to take out a loan from your 403(b) balance. But keep a few things in mind:

- You still have to pay yourself back, including interest.

- As with anytime you take money from your retirement fund, you will miss out on potentially years of compound returns, which may shortchange your retirement plans.

- If your employment situation changes, you'll have to repay it by the time you file taxes for the year you lost or left your job—or potentially even less time, depending on your plan's guidelines. If you can't repay the loan, it's considered a withdrawal, and you may owe taxes and be on the hook for a 10% penalty as discussed above if you're under 59½.

Required minimum distributions (RMDs)

Like traditional IRAs and all other workplace retirement accounts, 403(b)s eventually require that you make withdrawals. Normally, this is when you turn 73, though some long-standing plans may have an extension to 75.3 Alternatively, if you're still working for the organization that holds your 403(b), you can delay withdrawing the assets in that 403(b) plan until you retire.

RMDs for 403(b)s are determined based on your total retirement account balance and your IRS-calculated life expectancy. If you have contributions to your 403(b) from prior to 1987 and your plan has separately accounted for these amounts, you do not need to include these contributions in your RMD calculations until the later of the year you turn 75 or April 1st of the year after you retire. Note that earnings and gains related to pre-1987 contributions must be included in your RMD calculations from the beginning. If you don't take the RMD you are required to each year, you may end up owing 25% of the amount not withdrawn in penalties in addition to potential taxes on the amount withdrawn in the future. This penalty can be reduced to 10% with a withdrawal of the unwithdrawn RMD amount within 2 years.