What We Offer

Learn More

Fidelity Fund Portfolios—Diversified

Whether you want to pick your own funds or prefer the hands-off approach, we'll help you explore ways to select the portfolio that works for you.

Questions?

- 800-343-3548 800-343-3548

- Chat with a representative

Two paths to a diversified portfolio

Here are two strategies to help you create a diversified portfolio that may be suited to your needs—risk-based model portfolios constructed for a hypothetical investor to use as inspiration, and single-fund strategies that we manage so you don’t have to do the research and rebalancing.

Use our model portfolios to help generate ideas

If you prefer to pick the funds you want in your portfolio, our model portfolios* show one way you might construct a well-diversified portfolio of Fidelity mutual funds based on your risk tolerance and financial situation. These combinations provide illustrations of potential opportunities for greater potential risk-adjusted returns over the long term.

How you invest starts with choosing an asset mix that is in line with your current circumstances and your short- and long-term goals. You can also find these, and other, model portfolios in our Planning & Guidance Center, which can help you determine the right mix for you. If you know your asset mix, you can select it below.

*As of 12/5/2025

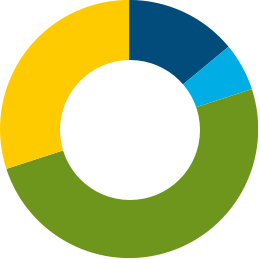

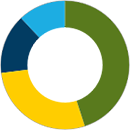

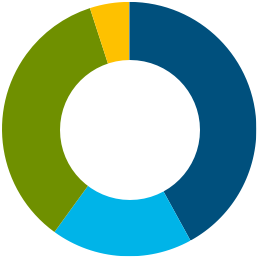

This asset mix may be appropriate for investors who want to minimize the effect of market fluctuations by taking an income-oriented approach with some potential for capital appreciation.

This asset mix may be appropriate for investors who want to minimize the effect of market fluctuations by taking an income-oriented approach with some potential for capital appreciation.

Asset Mix

|

14% Domestic Stock

6% Foreign Stock

50% Bonds

30% Short Term

|

|---|

| Asset Type | Fund Name | Allocation |

|---|---|---|

| Bonds | Fidelity Corporate Bond Fund (FCBFX) | 6.00% |

| Bonds | Fidelity Intermediate Bond Fund (FTHRX) | 10.00% |

| Bonds | Fidelity Intermediate Treasury Bond Index Fund (FUAMX) | 8.00% |

| Bonds | Fidelity Investment Grade Bond Fund (FBNDX) | 9.00% |

| Bonds | Fidelity Mortgage Securities Fund (FMSFX) | 5.00% |

| Bonds | Fidelity Total Bond Fund (FTBFX) | 12.00% |

| Foreign Stock | Fidelity ZERO International Index Fund (FZILX) | 6.00% |

| Domestic Stock | Fidelity Large Cap Value Index Fund (FLCOX) | 7.00% |

| Domestic Stock | Fidelity Nasdaq Composite Index Fund (FNCMX) | 7.00% |

| Short Term | Fidelity Government Cash Reserves (FDRXX) | 30.00% |

The primary objective of these model portfolios is to provide a representation of just one way you might construct a well-diversified portfolio of Fidelity mutual funds based on a particular risk tolerance level. Each of these model portfolios attempts to closely match the risk levels (volatility), asset class weights (stocks, bonds, and short-term), equity sector weights (technology, cyclicals, etc.) and foreign stock holdings (which are part of the stock allocation) of the eight target asset mixes shown here. Learn more about our target asset mixes and model portfolios and see our methodology (PDF).

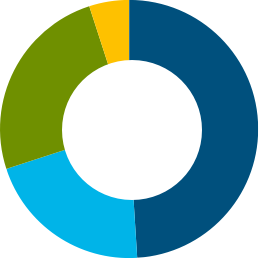

This asset mix may be appropriate for investors who want to seek an income-oriented strategy and the potential for capital appreciation (with a slight priority on capital appreciation) and who can withstand moderate fluctuations in market values.

This asset mix may be appropriate for investors who want to seek an income-oriented strategy and the potential for capital appreciation (with a slight priority on capital appreciation) and who can withstand moderate fluctuations in market values.

Asset Mix

|

21% Domestic Stock

9% Foreign Stock

50% Bonds

20% Short Term

|

|---|

| Asset Type | Fund Name | Allocation |

|---|---|---|

| Bonds | Fidelity Corporate Bond Fund (FCBFX) | 4.00% |

| Bonds | Fidelity Intermediate Bond Fund (FTHRX) | 10.00% |

| Bonds | Fidelity Intermediate Treasury Bond Index Fund (FUAMX) | 10.00% |

| Bonds | Fidelity Investment Grade Bond Fund (FBNDX) | 10.00% |

| Bonds | Fidelity Mortgage Securities Fund (FMSFX) | 4.00% |

| Bonds | Fidelity Total Bond Fund (FTBFX) | 12.00% |

| Foreign Stock | Fidelity International Value Fund (FIVLX) | 3.00% |

| Foreign Stock | Fidelity ZERO International Index Fund (FZILX) | 6.00% |

| Domestic Stock | Fidelity Equity-Income Fund (FEQIX) | 6.00% |

| Domestic Stock | Fidelity Large Cap Value Index Fund (FLCOX) | 6.00% |

| Domestic Stock | Fidelity Nasdaq Composite Index Fund (FNCMX) | 10.00% |

| Short Term | Fidelity Government Cash Reserves (FDRXX) | 20.00% |

The primary objective of these model portfolios is to provide a representation of just one way you might construct a well-diversified portfolio of Fidelity mutual funds based on a particular risk tolerance level. Each of these model portfolios attempts to closely match the risk levels (volatility), asset class weights (stocks, bonds, and short-term), equity sector weights (technology, cyclicals, etc.) and foreign stock holdings (which are part of the stock allocation) of the eight target asset mixes shown here. Learn more about our target asset mixes and model portfolios and see our methodology (PDF).

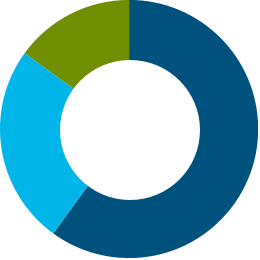

This asset mix may be appropriate for investors who want to seek income and the potential for capital appreciation (with a slight priority on capital appreciation) and who can withstand moderate fluctuations in market values.

This asset mix may be appropriate for investors who want to seek income and the potential for capital appreciation (with a slight priority on capital appreciation) and who can withstand moderate fluctuations in market values.

Asset Mix

|

28% Domestic Stock

12% Foreign Stock

45% Bonds

15% Short Term

|

|---|

| Asset Type | Fund Name | Allocation |

|---|---|---|

| Bonds | Fidelity Total Bond Fund (FTBFX) | 11.00% |

| Bonds | Fidelity Intermediate Treasury Bond Index Fund (FUAMX) | 13.00% |

| Bonds | Fidelity Intermediate Bond Fund (FTHRX) | 11.00% |

| Bonds | Fidelity Investment Grade Bond Fund (FBNDX) | 10.00% |

| Foreign Stock | Fidelity International Value Fund (FIVLX) | 7.00% |

| Foreign Stock | Fidelity ZERO International Index Fund (FZILX) | 5.00% |

| Domestic Stock | Fidelity Large Cap Growth Index Fund (FSPGX) | 4.00% |

| Domestic Stock | Fidelity ZERO Large Cap Index Fund (FNILX) | 7.00% |

| Domestic Stock | Fidelity Mid Cap Growth Index Fund (FMDGX) | 4.00% |

| Domestic Stock | Fidelity Equity-Income Fund (FEQIX) | 7.00% |

| Domestic Stock | Fidelity Nasdaq Composite Index Fund (FNCMX) | 6.00% |

| Short Term | Fidelity Government Cash Reserves (FDRXX) | 15.00% |

The primary objective of these model portfolios is to provide a representation of just one way you might construct a well-diversified portfolio of Fidelity mutual funds based on a particular risk tolerance level. Each of these model portfolios attempts to closely match the risk levels (volatility), asset class weights (stocks, bonds, and short-term), equity sector weights (technology, cyclicals, etc.) and foreign stock holdings (which are part of the stock allocation) of the eight target asset mixes shown here. Learn more about our target asset mixes and model portfolios and see our methodology (PDF).

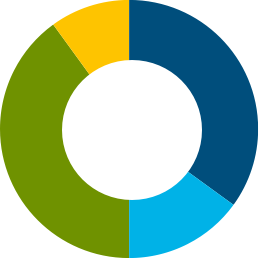

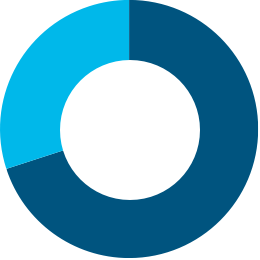

This asset mix may be appropriate for investors who want the potential for capital appreciation and some growth and who can withstand moderate fluctuations in market value.

This asset mix may be appropriate for investors who want the potential for capital appreciation and some growth and who can withstand moderate fluctuations in market value.

Asset Mix

|

35% Domestic Stock

15% Foreign Stock

40% Bonds

10% Short Term

|

|---|

| Asset Type | Fund Name | Allocation |

|---|---|---|

| Bonds | Fidelity Intermediate Bond Fund (FTHRX) | 9.00% |

| Bonds | Fidelity Intermediate Treasury Bond Index Fund (FUAMX) | 13.00% |

| Bonds | Fidelity Investment Grade Bond Fund (FBNDX) | 9.00% |

| Bonds | Fidelity Total Bond Fund (FTBFX) | 9.00% |

| Foreign Stock | Fidelity ZERO International Index Fund (FZILX) | 5.00% |

| Foreign Stock | Fidelity International Value Fund (FIVLX) | 10.00% |

| Domestic Stock | Fidelity Equity-Income Fund (FEQIX) | 10.00% |

| Domestic Stock | Fidelity Large Cap Growth Index Fund (FSPGX) | 5.00% |

| Domestic Stock | Fidelity Mid Cap Growth Index Fund (FMDGX) | 6.00% |

| Domestic Stock | Fidelity ZERO Large Cap Index Fund (FNILX) | 9.00% |

| Domestic Stock | Fidelity Nasdaq Composite Index Fund (FNCMX) | 5.00% |

| Short Term | Fidelity Government Cash Reserves (FDRXX) | 10.00% |

The primary objective of these model portfolios is to provide a representation of just one way you might construct a well-diversified portfolio of Fidelity mutual funds based on a particular risk tolerance level. Each of these model portfolios attempts to closely match the risk levels (volatility), asset class weights (stocks, bonds, and short-term), equity sector weights (technology, cyclicals, etc.) and foreign stock holdings (which are part of the stock allocation) of the eight target asset mixes shown here. Learn more about our target asset mixes and model portfolios and see our methodology (PDF).

This asset mix may be appropriate for investors who want to seek moderate growth and income and who can withstand moderate fluctuations in market values.

This asset mix may be appropriate for investors who want to seek moderate growth and income and who can withstand moderate fluctuations in market values.

Asset Mix

|

42% Domestic Stock

18% Foreign Stock

35% Bonds

5% Short Term

|

|---|

| Asset Type | Fund Name | Allocation |

|---|---|---|

| Bonds | Fidelity Intermediate Bond Fund (FTHRX) | 8.00% |

| Bonds | Fidelity Intermediate Treasury Bond Index Fund (FUAMX) | 11.00% |

| Bonds | Fidelity Investment Grade Bond Fund (FBNDX) | 11.00% |

| Bonds | Fidelity Total Bond Fund (FTBFX) | 5.00% |

| Foreign Stock | Fidelity International Value Fund (FIVLX) | 12.00% |

| Foreign Stock | Fidelity ZERO International Index Fund (FZILX) | 6.00% |

| Domestic Stock | Fidelity Large Cap Growth Index Fund (FSPGX) | 5.00% |

| Domestic Stock | Fidelity Equity-Income Fund (FEQIX) | 10.00% |

| Domestic Stock | Fidelity Mid Cap Growth Index Fund (FMDGX) | 6.00% |

| Domestic Stock | Fidelity Nasdaq Composite Index Fund (FNCMX) | 7.00% |

| Domestic Stock | Fidelity ZERO Large Cap Index Fund (FNILX) | 14.00% |

| Short Term | Fidelity Government Cash Reserves (FDRXX) | 5.00% |

The primary objective of these model portfolios is to provide a representation of just one way you might construct a well-diversified portfolio of Fidelity mutual funds based on a particular risk tolerance level. Each of these model portfolios attempts to closely match the risk levels (volatility), asset class weights (stocks, bonds, and short-term), equity sector weights (technology, cyclicals, etc.) and foreign stock holdings (which are part of the stock allocation) of the eight target asset mixes shown here. Learn more about our target asset mixes and model portfolios and see our methodology (PDF).

This asset mix may be appropriate for investors who have a preference for growth and who can withstand significant fluctuations in market value.

This asset mix may be appropriate for investors who have a preference for growth and who can withstand significant fluctuations in market value.

Asset Mix

|

49% Domestic Stock

21% Foreign Stock

25% Bonds

5% Short Term

|

|---|

| Asset Type | Fund Name | Allocation |

|---|---|---|

| Bonds | Fidelity Intermediate Bond Fund (FTHRX) | 5.00% |

| Bonds | Fidelity Intermediate Treasury Bond Index Fund (FUAMX) | 8.00% |

| Bonds | Fidelity Investment Grade Bond Fund (FBNDX) | 12.00% |

| Foreign Stock | Fidelity ZERO International Index Fund (FZILX) | 7.00% |

| Foreign Stock | Fidelity International Value Fund (FIVLX) | 14.00% |

| Domestic Stock | Fidelity Equity-Income Fund (FEQIX) | 9.00% |

| Domestic Stock | Fidelity Large Cap Growth Index Fund (FSPGX) | 5.00% |

| Domestic Stock | Fidelity Large Cap Value Index Fund (FLCOX) | 5.00% |

| Domestic Stock | Fidelity ZERO Large Cap Index Fund (FNILX) | 15.00% |

| Domestic Stock | Fidelity Mid Cap Growth Index Fund (FMDGX) | 6.00% |

| Domestic Stock | Fidelity Nasdaq Composite Index Fund (FNCMX) | 9.00% |

| Short Term | Fidelity Government Cash Reserves (FDRXX) | 5.00% |

The primary objective of these model portfolios is to provide a representation of just one way you might construct a well-diversified portfolio of Fidelity mutual funds based on a particular risk tolerance level. Each of these model portfolios attempts to closely match the risk levels (volatility), asset class weights (stocks, bonds, and short-term), equity sector weights (technology, cyclicals, etc.) and foreign stock holdings (which are part of the stock allocation) of the eight target asset mixes shown here. Learn more about our target asset mixes and model portfolios and see our methodology (PDF).

This asset mix may be appropriate for investors who seek aggressive growth and who can tolerate wide fluctuations in market values, especially over the short term.

This asset mix may be appropriate for investors who seek aggressive growth and who can tolerate wide fluctuations in market values, especially over the short term.

Asset Mix

|

60% Domestic Stock

25% Foreign Stock

15% Bonds

0% Short Term

|

|---|

| Asset Type | Fund Name | Allocation |

|---|---|---|

| Bonds | Fidelity Total Bond Fund (FTBFX) | 7.00% |

| Bonds | Fidelity Investment Grade Bond Fund (FBNDX) | 8.00% |

| Foreign Stock | Fidelity International Value Fund (FIVLX) | 15.00% |

| Foreign Stock | Fidelity ZERO International Index Fund (FZILX) | 10.00% |

| Domestic Stock | Fidelity Equity-Income Fund (FEQIX) | 5.00% |

| Domestic Stock | Fidelity Growth & Income Portfolio (FGRIX) | 5.00% |

| Domestic Stock | Fidelity Large Cap Growth Index Fund (FSPGX) | 13.00% |

| Domestic Stock | Fidelity Large Cap Value Index Fund (FLCOX) | 6.00% |

| Domestic Stock | Fidelity Mid Cap Growth Index Fund (FMDGX) | 5.00% |

| Domestic Stock | Fidelity Mid Cap Value Index Fund (FIMVX) | 5.00% |

| Domestic Stock | Fidelity Nasdaq Composite Index Fund (FNCMX) | 5.00% |

| Domestic Stock | Fidelity ZERO Large Cap Index Fund (FNILX) | 16.00% |

The primary objective of these model portfolios is to provide a representation of just one way you might construct a well-diversified portfolio of Fidelity mutual funds based on a particular risk tolerance level. Each of these model portfolios attempts to closely match the risk levels (volatility), asset class weights (stocks, bonds, and short-term), equity sector weights (technology, cyclicals, etc.) and foreign stock holdings (which are part of the stock allocation) of the eight target asset mixes shown here. Learn more about our target asset mixes and model portfolios and see our methodology (PDF).

This asset mix may be appropriate for investors who seek very aggressive growth and who can tolerate very wide fluctuations in market values, especially over the short term.

This asset mix may be appropriate for investors who seek very aggressive growth and who can tolerate very wide fluctuations in market values, especially over the short term.

Asset Mix

|

70% Domestic Stock

30% Foreign Stock

0% Bonds

0% Short Term

|

|---|

| Asset Type | Fund Name | Allocation |

|---|---|---|

| Foreign Stock | Fidelity ZERO International Index Fund (FZILX) | 12.00% |

| Foreign Stock | Fidelity International Value Fund (FIVLX) | 18.00% |

| Domestic Stock | Fidelity Equity-Income Fund (FEQIX) | 6.00% |

| Domestic Stock | Fidelity Growth & Income Portfolio (FGRIX) | 5.00% |

| Domestic Stock | Fidelity Large Cap Growth Index Fund (FSPGX) | 14.00% |

| Domestic Stock | Fidelity Large Cap Value Index Fund (FLCOX) | 7.00% |

| Domestic Stock | Fidelity ZERO Large Cap Index Fund (FNILX) | 19.00% |

| Domestic Stock | Fidelity Mid Cap Growth Index Fund (FMDGX) | 5.00% |

| Domestic Stock | Fidelity Mid Cap Value Index Fund (FIMVX) | 6.00% |

| Domestic Stock | Fidelity Nasdaq Composite Index Fund (FNCMX) | 8.00% |

The primary objective of these model portfolios is to provide a representation of just one way you might construct a well-diversified portfolio of Fidelity mutual funds based on a particular risk tolerance level. Each of these model portfolios attempts to closely match the risk levels (volatility), asset class weights (stocks, bonds, and short-term), equity sector weights (technology, cyclicals, etc.) and foreign stock holdings (which are part of the stock allocation) of the eight target asset mixes shown here. Learn more about our target asset mixes and model portfolios and see our methodology (PDF).

Help simplify the process with our single-fund strategies

If you don't want to research which funds fit your needs and then do the ongoing rebalancing work necessary to maintain your portfolio, then Fidelity's single-fund strategies might be right for you.

Fidelity Asset Manager® Funds

Fidelity Asset Manager® Funds allow you to choose an asset mix based on your own risk tolerance and offer diversification across multiple asset classes.

Fidelity Freedom® Funds

Fidelity Freedom® Funds, also called target date funds, are single-fund investment strategies that can help take the guesswork out of building and maintaining an age-based retirement portfolio.