Research shows that investors who stick with a disciplined long-term investing strategy tend to outperform those who constantly jump in and out of the market. But sometimes taking the long view can be challenging—particularly during tumultuous times in the financial markets or even in your own life.

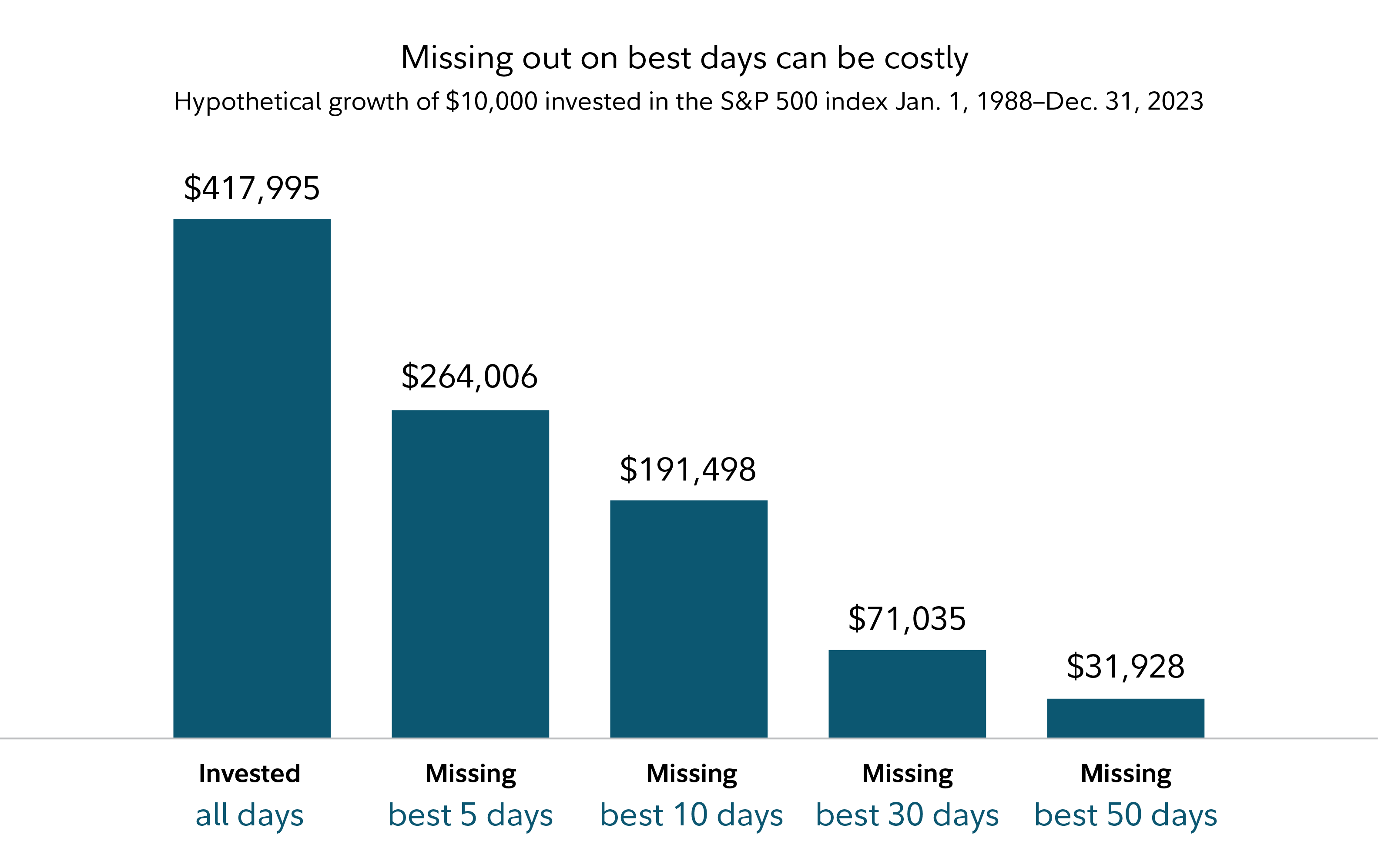

Emotions—excitement when the market is up or fear when the market is down—can wreak havoc on your investment decisions, leading you to buy high and sell low or miss out on rapid recoveries that begin during uncertain times. However, history shows that when investors attempt to time the market to maximize gains and minimize losses, they often end up doing the exact opposite.

The gap is due to a combination of not investing at the right times, fees, and fund selection—in short, such investors strayed from their disciplined investing strategies. Put simply, letting emotions govern your investment decisions can jeopardize your long-term returns.

"When you make an emotional decision, it might feel satisfying in the moment, but you may be sacrificing your long-term goals," says Larry Rakers, group leader in Fidelity's Strategic Advisers group.

So how can you manage the negative impact of emotional decision-making on your portfolio? Creating a disciplined investment plan that suits your individual goals, risk tolerance, and life situation; choosing an appropriate mix of investments; and finding the right way to manage your investments can help give you the confidence to stick to your plan, even in times of market turbulence or upheaval in your personal life.

Key 1: Create a tailored investment plan

In order to determine whether you’re on track to meet your savings goals, you first have to define those goals. Your goals may include accumulating enough savings to comfortably last through retirement, saving up to buy a dream home, or building a lasting financial legacy. Defining your goals will make it easier to measure both where you stand today and where you stand relative to the future you envision.

Consider how much you think you’ll need in order to accomplish your goal, as well as the time frame you have to save. For instance, creating a financial legacy to pass along to your grandchildren is likely to require a longer-term plan than saving for your children’s college tuition 10 years from now. Once your goals are set, Fidelity’s planning and guidance tools can help you identify how likely you are to reach your goals. If your savings aren’t on track to meet your goals, Fidelity can help you identify ways to improve your chances of success.

Key 2: Invest at the right level of risk

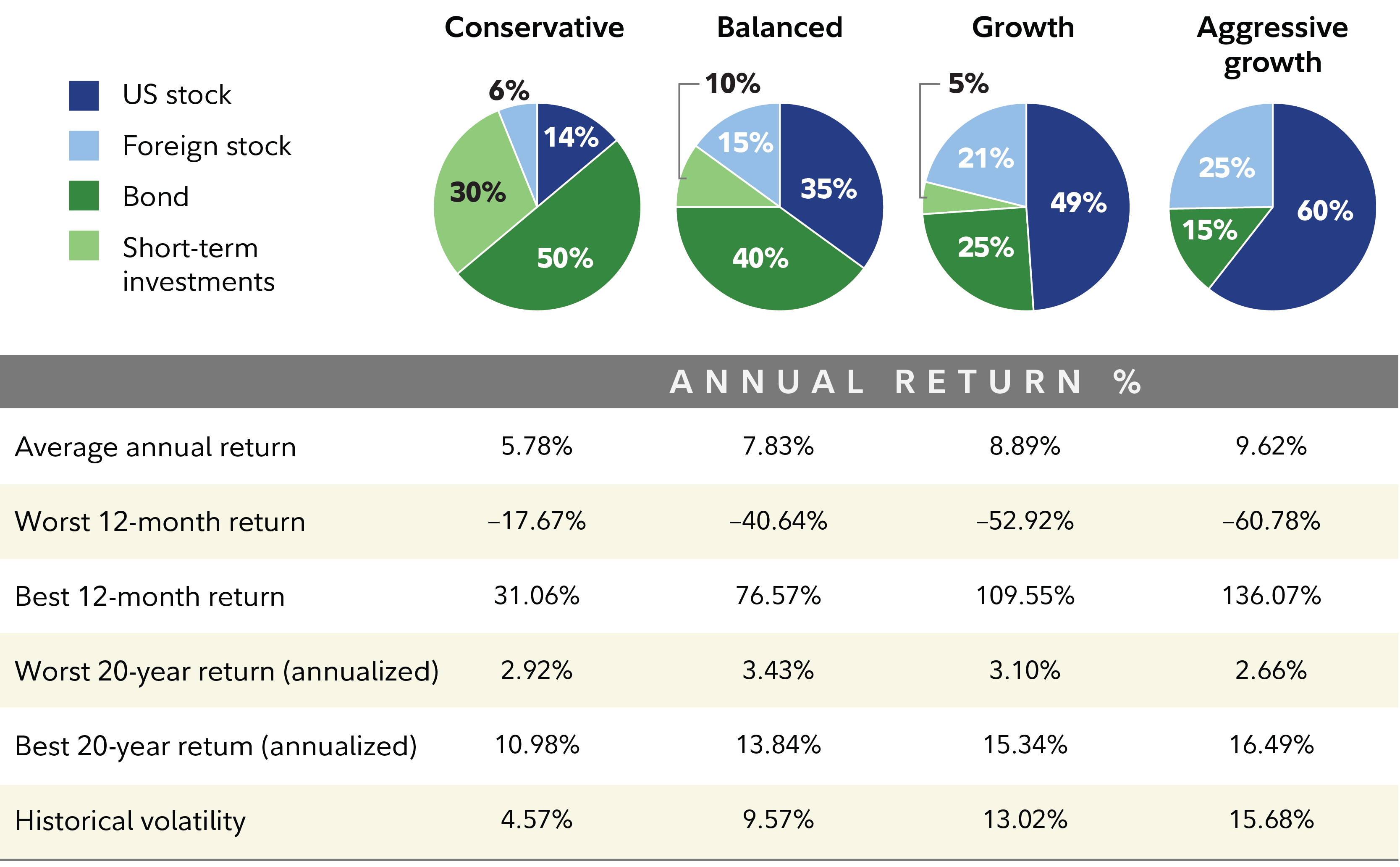

Knowing what you’re saving for and how long you have to invest for that goal will help you determine an appropriate level of risk for your investments. While all investments carry some level of risk, finding the right mix of stocks, bonds, and short-term investments that makes the most sense for you involves weighing the trade-offs between growth and risk.

Generally speaking, the more risk you’re willing to tolerate, the larger gains—and steeper losses—you can reasonably expect. That’s one reason investors focused on longer-term goals may be able to be more aggressive and invest in a mix that has a larger portion of stocks. That’s because time may let an investor ride out any bumps in the market.

And while diversification and asset allocation can never guarantee that you won’t experience a loss, investors who expect to be in the market for less time may be more concerned with protecting what they have from a drop in value. In such situations, a more conservative blend of investments with a higher allocation to bonds and short-term investments would likely be more appropriate. While history suggests that these assets can’t match the growth potential of stocks, they also generally hold up better during market downturns.

You may be juggling several short- and long-term goals at once, from saving for retirement to building emergency savings. Consider how much of your investment portfolio you want to allocate to more conservative options with less risk of loss versus to more aggressive options with more growth potential. As you move closer to your goal, consider adjusting your asset allocation to build in more protection from the market’s ups and downs.

Choose an investment mix you are comfortable with

Key 3: Manage your plan

Managing your own investments can be a challenge. However, the process of investing can be made easier by adopting a consistent, repeatable strategy that you stick to no matter what happens in the markets.

You have options to manage your investments. You can do it yourself, including taking the time to research investment options and make choices about what to buy and when to buy it. Another option is to outsource the management of your plan to a professional. Doing so may help provide that extra level of discipline that inspires you to stick to your plan.

If you do choose to manage your own portfolio, you will need to:

- Research—Evaluate different investment options to find products that fit your asset allocation strategy.

- Select investments—Choose what to buy and when.

- Monitor—Evaluate your investments periodically for changes in strategy, relative performance, and risk.

- Rebalance—Revisit your investment mix to maintain the risk level you are comfortable with.

- Manage taxes—Decide how to implement tax-loss harvesting, tax-savvy withdrawals, and asset location strategies to manage taxes.

The process of creating a plan, choosing investments, and managing your portfolio is a complex one—but it's worth it.

"Once you have a plan you feel confident in, you'll be better positioned to weather the ups and downs of the market," says Rakers. "And you’ll be less likely to make those emotional decisions that get so many investors in trouble."

5 steps toward your goals

1. Identify your personal and financial goals.

2. Use the Planning & Guidance Center to evaluate whether you're on track to meet your goals.

3. Determine:

- What protection means to you and how important it is.

- What growth means to you and how important it is.

- Appropriate investments that align with your preferences.

- Who will manage your investment portfolio.

4. Implement your plan with the appropriate mix of investments to balance your financial needs and investment priorities.

5. Set up regular reviews with your Fidelity investment professional to help refine your portfolio when there are changes in your lifestyle and personal situation.