Put our research to work

Ranked #1 by Investor's Business Daily1 for industry-leading Research Tools and Investment Research, we offer insights and analysis to help your trading strategy.

Images are for illustrative purposes only.

Help improve your investment strategy

Find some of the best investments and analysis

Search investments with Stock & ETF screeners, and get an in-depth analysis with Stock Dashboard. To learn more about our stock research offering, watch the video.

Stock Dashboard

Get price action in charts, access fundamental analysis and see technical events from Recognia.5 Plus, learn about social media trends with Social Sentiment Score,6 and see independent research reports.

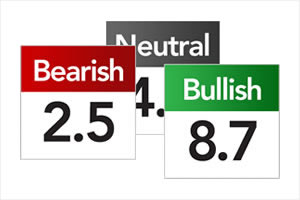

Validate your investing ideas with Equity Summary Score

Only Fidelity offers Equity Summary Score by StarMine® from LSEG.7 Now you can get stock ratings from top independent analysts consolidated into a single score. Learn more about Equity Summary Score now

A single score

Save time by using a single consolidated score instead of researching multiple analysts' reports.

Accuracy weighted

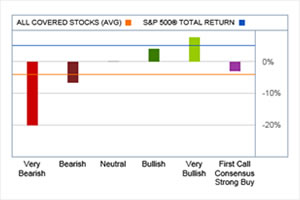

See each Independent research firm's performance within the stock's sector. Research firms that are more accurate are given a higher weight in the Equity Summary Score for that stock.

Transparent scorecard

See how the Equity Summary Score performed over time. For example, compare "Very Bullish" and "Very Bearish" stocks over a period of time.

Ready to put our research to work?

Research Stocks, ETFs, Mutual Funds, Options, Fixed Income, Markets and Sectors.

Not a customer? Open an account

Investor's Business Daily®, January 2024: Best Online Brokers Special Report. Fidelity was named Best Overall Online Broker, and also first in Trade Execution Speed and Price, Equity Trading Platform, Customer Service, Choices For Cash Management, Availability Of Account Types, Educational Resources, Research Tools, and Investment Research. Results based on having the highest Customer Experience Index within the categories composing the survey, as scored by 501 respondents. The survey was conducted by Investor's Business Daily's polling partner, TechnoMetrica Market Intelligence. © Investor's Business Daily, Inc. All rights reserved.

ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options. Supporting documentation for any claims, if applicable, will be furnished upon request.

The Equity Summary Score is provided for informational purposes only, does not constitute advice or guidance, and is not an endorsement or recommendation for any particular security or trading strategy. The Equity Summary Score is provided by LSEG StarMine, an independent company not affiliated with Fidelity Investments. For more information and details, go to Fidelity.com.