Who doesn't have a retirement dream? Yours may be as simple as sleeping late or riding your bike on a sunny afternoon, or as daring as jumping out of a plane at age 90. Living your retirement dream the way you want means saving now—and saving enough so you don't have to worry about money in retirement.

But how much is enough?

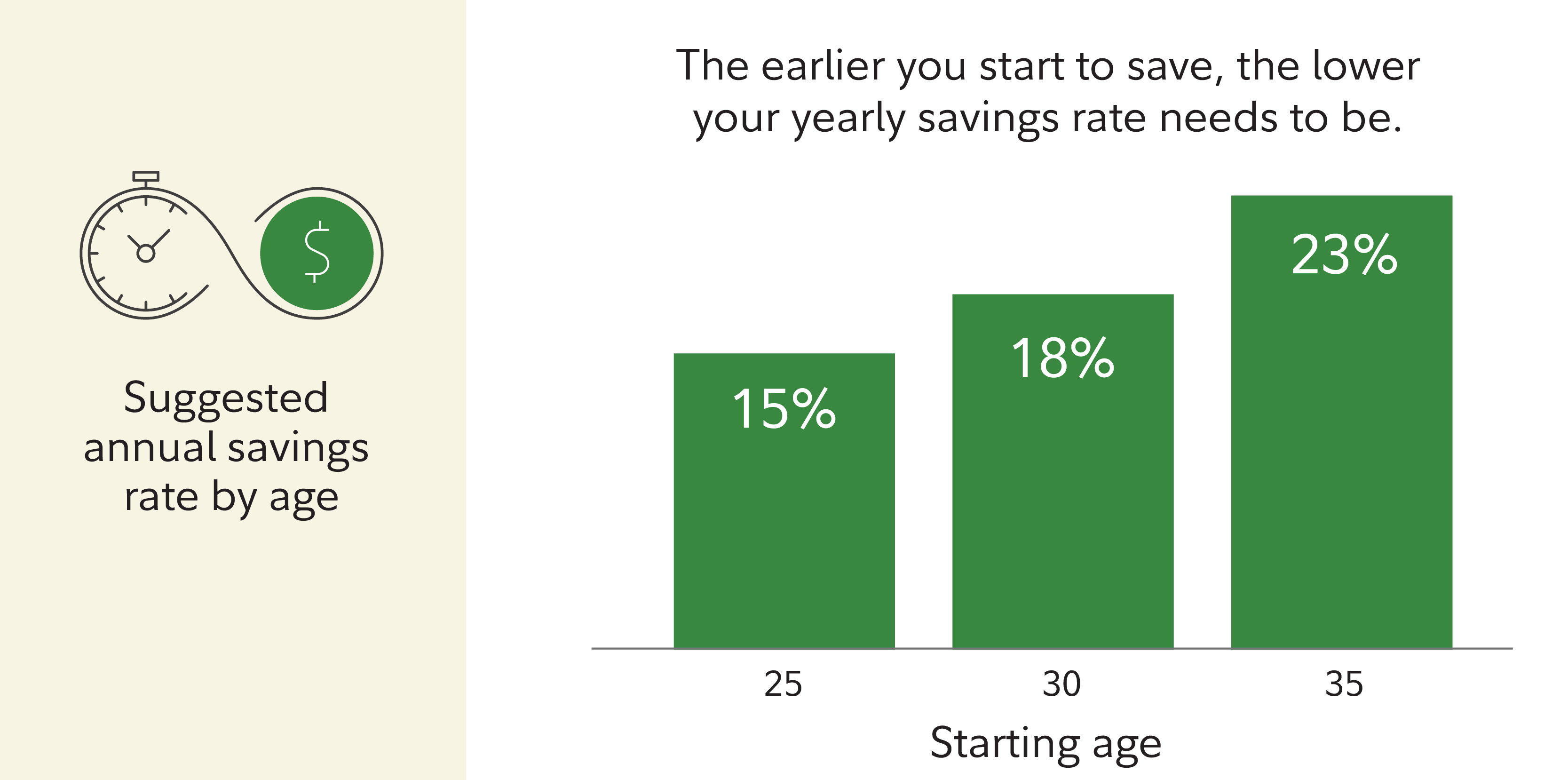

Our guideline: Aim to save at least 15% of your pre-tax income1 each year, which includes any employer match. That's assuming you save continuously for retirement from age 25 to age 67. Together with other steps, that should help ensure you have enough income to maintain your current lifestyle in retirement.

How did we come up with 15%? First, we had to understand how much people generally spend in retirement. After analyzing enormous amounts of national spending data, we concluded that most people will need somewhere between 55% and 80% of their preretirement income to maintain their lifestyle in retirement.1

Not all of that money will need to come from your savings, however. Some will likely come from Social Security. So, we did the math and found that most people will need to generate about 45% of their retirement income (before taxes) from savings. Based on our estimates, saving 15% each year from age 25 to 67 should get you there. If you are lucky enough to have a pension, your target savings rate may be lower.

Here's a hypothetical example. Consider Joanna, age 25, who earns $54,000 a year. We assume her income grows 1.5% a year (after inflation) to about $100,000 by the time she is 67 and ready to retire. To maintain her preretirement lifestyle throughout retirement, we estimate that about $45,000 each year (adjusted for inflation), or 45% of her $100,000 preretirement income, needs to come from her savings. (The remainder would come from Social Security.)

Because she takes advantage of her employer's 5% dollar-for-dollar match on her 401(k) contributions, she needs to save 10% of her income each year, starting with $5,400 this year, which gets her to 15% of her current income.

Is 15% enough?

That depends, of course, on the choices you make before retirement—most importantly, when you start saving and when you retire. Any other income sources you may have, such as a pension, should also be considered.

Now that you know a savings rate to consider, here are some steps to think about that can help you get to it.

1. Start early

The single most important thing you can do is start saving early. The earlier you start, the more time you have to give your investments the potential to grow—and recover from the any of the market's inevitable downturns.

If retirement is decades away, it may be hard to think or care about it. But when you are young is precisely the time to start saving for retirement. Even though it can be a challenge to save for the future, giving your savings those extra years of growth potential could make the struggle worth it—every little bit you can save helps.

2. Delay retirement

Our 15% savings guideline assumes that a person retires at age 67, which is when most people will be eligible for full Social Security benefits. If you don't plan to work that long, you will likely need to save more than 15% a year. If you plan to work longer, all things being equal, your required saving rate could be lower.

Other steps to take

The road to retirement is a journey, and there are steps you can take along the way to catch up. Here are 6 tips to get started:

- Let Uncle Sam help. Make the most of tax-advantaged savings accounts like traditional 401(k)s and IRAs. Your contributions are made before tax, reducing your current taxable income, meaning you get a tax break the year you contribute. Plus, that money can grow tax-free until you withdraw it in retirement, when it will be taxed as ordinary income. With Roth 401(k)s and IRAs, your contributions are after tax, but you can withdraw the money tax-free in retirement—assuming certain conditions are met.4 If you have a high deductible health plan (HDHP) eligible for a health savings account (HSA), consider contributing to an HSA to cover current and future health care expenses. HSA contributions are pre-tax and tax-deductible. Plus, when you use money saved in an HSA on qualified medical expenses now or in retirement, the withdrawals—of contributions and any investment returns—are tax-free.5

- Max and match. Got room to up your 401(k) and IRA contributions before you hit the relevant annual contribution limit? Increase your automatic contributions as much as possible. At the very least, take advantage of your company match if you have one. That's effectively "free" money. Learn more on Fidelity.com: IRA contribution limits

- Take the 1% challenge. Upping your saving just 1% may seem small, but after 20 or 30 years it can make a big difference in your total savings. For example, if you are in your 20s, a 1% increase in your savings rate could add 3% more6 to your income in retirement. Read Viewpoints on Fidelity.com: Just 1% more can make a big difference

- Catch up. If you're age 50 to 59 or 64 or older, be sure to make the most of catch-up contributions to your retirement savings plans. For 2025, employees in those age ranges can contribute an extra $7,500 over the $23,500 limit for their 401(k), 403(b), or other employer-sponsored savings plans for a total of $31,000. And as of 2025, those between ages 60 and 63 are eligible to contribute up to $11,250 as a catch-up contribution, if their plan allows, for a total of $34,750. If you have an IRA, in 2025 you can contribute an extra $1,000 in addition to the $7,000 contribution limit for a total of $8,000.

- Size up your portfolio. Market movements can shift your investment mix. Too much in stocks can increase your risk of loss—too little can undermine growth potential. Aim to have a diversified mix of investments. At least once a year, take a look at your investments and make sure you have the right amount of stocks, bonds, and cash to stay on track to meet your long-term goals, risk tolerance, and time horizon.

- Consider your investing style. If you don't have the skill, will, or time to actively manage your investments, consider an age-based target date fund or managed account. There are also target risk funds, or target allocation funds, that offer a diversified mix of investments across asset classes. You pick the level of stock market risk you'd like based on your risk tolerance and the fund managers do the rest.

Make savings a priority

Keep your eye on your dreams. Do the best you can to get to at least 15%. Of course, it may not be possible to hit that target every year. You may have more pressing financial demands—children, parents, a leaky roof, a lost job, or other needs. But try not to forget about your future—make your retirement a priority too.