The first few years of retirement can be a critical time for your portfolio. And the economic and market environment you retire into can set the course for the rest of your non-working years. Research shows that if you sell stocks early in your retirement years when markets are falling, it can have a permanent negative impact on your portfolio.

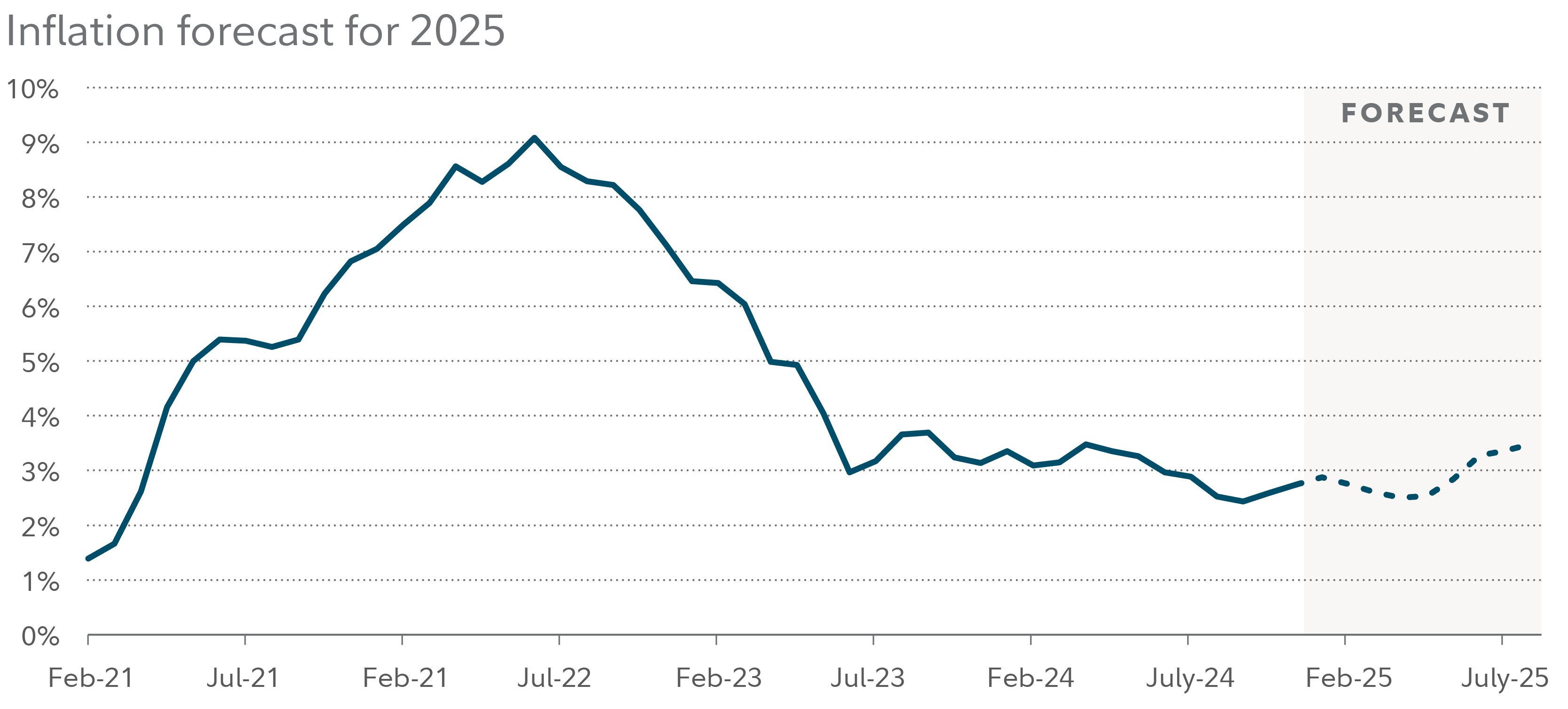

Also, inflation, which is expected to stay elevated well into 2025, according to Fidelity research, can eat away at the value of your savings by increasing the cost of everything from food to housing, gasoline, and even automobile repairs. So, if you’re worried that a recession and/or a falling stock market could drag your portfolio down, or that persistent inflation could eat into your retirement income, now could be a good time to review your financial plan.

The tricky part is that inflation, recession, and falling markets can each have a different impact on your portfolio. As a consequence, the strategies for dealing with them can differ, and may sometimes seem to work in opposition to each other.

For example, during inflationary times, you might consider boosting the growth part of your portfolio by investing in stocks, which historically have outpaced inflation. But during recessionary times, stocks tend to lose value. Since people nearing and in retirement may now be facing all those challenges, it's important to build a portfolio that attempts to manage both risks in tandem.

Here's a look at how you can tackle the triple challenge of inflation, recession, and falling markets, so you can keep your retirement plan on course.

Stick to a financial plan

The core of any well-constructed financial plan is to have a good understanding of cash flows; that is, all sources of income and expenses, says David Peterson, Fidelity's head of advanced wealth solutions. In the first year of retirement, aim to withdraw no more than 4% or 5% of your retirement savings. Each year after that, it's generally considered sustainable to adjust the dollar amount of that first withdrawal for inflation.

Typically, Fidelity suggests trying to cover essential expenses in retirement with “guaranteed” sources of income like Social Security benefits, pensions, and annuities. Then cover discretionary expenses with income sources that might be variable, like investment income or income from real estate.

This means if the income doesn't come in, you can cut back on these more optional expenses without threatening your overall livelihood. And this may also allow you to avoid tapping into your portfolio, which ideally you'd avoid withdrawing from during periods of market volatility. Bigger withdrawals early in retirement might inhibit your portfolio's recovery when markets eventually rebound. "Drawing down a portfolio too much during times when market values are decreasing can be devastating to its ability to generate enough returns later to ultimately cover expenses over a lifetime," Peterson adds.

Now's a good time to take a close look at your budget and carefully assess your spending. Also, make sure you have emergency savings set aside in a liquid account with 6 months to a year of estimated living expenses in cash, which can help in the face of a market downturn.

"It's always a good idea to review your financial plan periodically regardless of the economic environment," says Brad Koval, director of financial solutions at Fidelity Investments. "In periods of market downturns, you may want to spend less, and in periods when markets are doing really well, you may consider spending a little more, as long as you are managing your income around those events and not overdrawing."

Read more in Viewpoints: How can I make my retirement savings last?| 3 steps to prepare for inflation and recession | ||

| 1. Long-term asset allocations should be based on time horizon, risk tolerance, and financial situation. | 2. Essential expenses should be covered by guaranteed income in retirement, including Social Security, pensions, and annuities. | 3. Discretionary expenses can be covered by withdrawals from savings. |

|

|

|

Make the best use of cash

It may have made sense to simply hold cash in a standard checking or savings account when rates were less than 1% and there were few better short-term options. But with interest rates still higher than they were several years ago, consider money market funds and certificates of deposit (CDs), which currently offer more attractive returns than standard bank deposit products, according to Federal Reserve Economic Data as of February, 2025. However, it's important to understand the overall risk profile of your portfolio. Consider going through the financial planning process with a financial professional to understand how adding different investments can affect the different goals you may have for your portfolio.

Many CDs are offering yields of 4% or more, as of March 31, 2025. You can also consider building a CD ladder, which might include CDs that mature at different times, such as in 6 months, 12 months, 18 months, and 2 years. When a CD in the ladder matures, it essentially gives you an opportunity to reevaluate your cash needs. You can take maturing principal to pay for living expenses, or to reinvest in longer-dated CDs, or some other investment.

"This is an opportunity to better manage your cash given the fact that bond yields are currently near the healthiest they've been in 15 years," says Naveen Malwal, an institutional portfolio manager at Fidelity.

Read more about CDs in Viewpoints: What are CDs? Or shop for CDs now.

Bond strategies

While higher inflation might put upward pressure on interest rates, lower potential economic growth tends to create downward pressure. These opposing forces can make it challenging to predict where interest rates on bonds may go next, creating uncertainty for bond investors.

A bond ladder can help with managing this uncertainty. As with a CD ladder, building a bond ladder means buying bonds that mature at different intervals in the future. The strategy entails holding bonds until they mature, which can help investors worry less about any short-term fluctuations in price as a result of interest-rate changes. When a bond matures it allows you to take the cash and invest in the current interest rate environment.

"Laddering bonds may be appealing because it may help you to manage interest-rate risk, and to make ongoing reinvestment decisions over time, giving you flexibility in how you invest in different credit and interest rate environments," says Richard Carter, Fidelity vice president of fixed income products and services.

Use our bond ladder tool. Or shop for bonds now.

Annuities to consider

The guaranteed payout of a life annuity is always worth considering. It can help provide an additional cushion during periods of market volatility, because your income won't be tied to a source that depends on markets. Higher interest rates have also increased payout rates for annuities recently.

Among the options, you can consider a single premium immediate annuity (SPIA), which can provide immediate income in exchange for a lump-sum investment.1 It can offer a pension-like cash flow,2 and the guaranteed income isn't subject to market volatility. Immediate fixed income annuities even have optional features and benefits, such as a cost-of-living adjustment (COLA) to help keep pace with inflation and beneficiary protection such as a cash refund.

And for someone who is just a few years away from retirement, something called a deferred income annuity (DIA)3 can provide guaranteed income and a steady cash flow for life. While DIAs provide a fixed payout, the payout is deferred until a predetermined date in the future that you select.

With a DIA, you may also take advantage of periodic investing to secure income payments in varying interest-rate environments. Each investment you make enables you to lock in income that is added to your final cash flow payment when you are ready to start. Similar to dollar-cost averaging, you may potentially benefit from a range of interest rates.

Similarly, a deferred fixed annuity, also known as a single premium deferred annuity, or SPDA, can play a role in the conservative part of your portfolio by providing a fixed rate of return. A deferred fixed annuity guarantees a rate of return over a predetermined time, typically 3 to 10 years, similar to a bank CD, which can also offer a fixed rate of return for a set period of time. And just like a CD ladder, if you're not ready to begin drawing income, you can roll those assets into a new contract with a new guaranteed rate of return.

Good to know: Many CDs are FDIC-insured up to $250,000, whereas annuities are subject to the claims-paying ability of the issuing insurance company. When interest rates increase, that tends to drive up the rates offered by deferred fixed annuities.

Read more about annuities in Viewpoints: Understanding annuities and How to keep your retirement plan on track. Or shop for annuities now.

Diversify your portfolio

Investments including annuities, bonds, and CDs can add ballast to your retirement savings to help overall portfolio value, Peterson says. But he emphasizes that it's important to understand that their returns, which are closely tied to prevailing interest rates, are unlikely to provide the level of long-term growth and inflation protection that stock and other investments have historically helped provide.

Now's a good time to make sure you have the right mix of stocks, bonds, and other investments to meet your long-term goals for growth. It's impossible to time the market, and you shouldn't try to do that because of news headlines. But it's important to know that stocks often begin to recover, often rapidly, before the end of recessions. And during periods of high inflation, the recovery historically leads to higher returns than during lower-inflation periods. By staying invested, you won't miss the upswing.

During high-inflation periods, commodities tend to outperform bonds. When recession risk has become evident, fixed income has tended to perform better. Tilting a portfolio toward more defensive exposure (with a mix of stocks, bonds, and commodities) during a recession may provide diversification benefits regardless of whether there's inflation.

Read more about building a defensive portfolio in Viewpoints: Seeking shelter in stormy markets. Or explore our managed accounts.

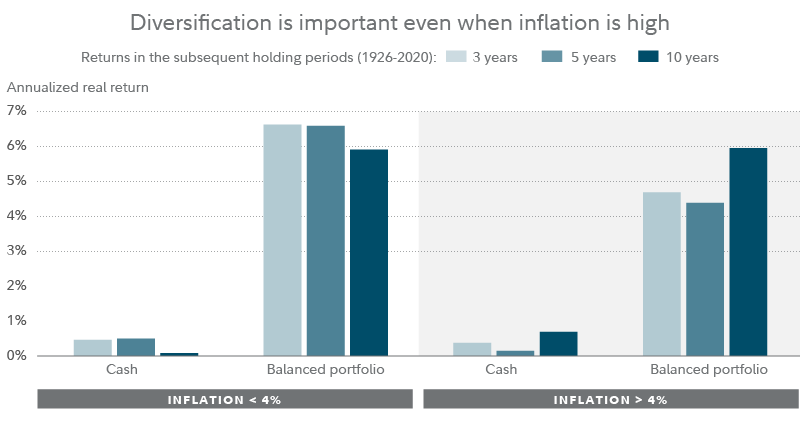

Staying invested, and not keeping too much of your portfolio in cash, is also important when inflation is persistent. For example, returns from a balanced portfolio have historically tended to outpace cash in high-inflation environments with market volatility. Over the past century, holding a balanced, diversified portfolio when inflation had already hit 4% (or above) has surpassed cash returns over the subsequent 3- to 10-year periods. Note: Diversification does not ensure a profit or guarantee against loss.

While no one can predict the future, you can plan for a challenging retirement environment that includes inflation and possibly a recession and a falling stock market by being proactive. Inflation and recession won't stick around forever. By planning now for them, you can ride out the storm and potentially find smooth sailing later.