Since the Federal Reserve began raising interest rates to fight inflation in 2022, yields on certificates of deposit (CDs) have risen too. However, more recently, the Fed's leaders have begun to cut their policy rate, beginning with a half-percent cut in September 2024 followed by two additional cuts of 0.25% in November and December 2024. That change in the Fed's focus makes this a good time to consider locking in today's attractive CD yields before they move lower.

How does a CD work?

While stock and bond prices move up and down all the time as they trade on public exchanges, CD yields are fixed, so you can know how much you'll earn for defined time periods up to 20 years into the future. CDs are also FDIC insured, within limits.

When you buy a CD, you agree to leave your money in it for a specified period of time. In return, the bank agrees to pay you a fixed rate of interest during the time you own the CD until it matures and you get back the amount that you paid for it. That period of time can be as short as 1 month or as long as 20 years.

Interest rates on CDs with similar maturities can vary significantly, however, so you'll want to compare rates.

What drives CD rates?

The interest rates that banks pay on CDs are influenced by interest rates set by the Federal Reserve, among other factors.

Another important influence on how much CDs pay is the length of time between when you purchase them and when they mature and return your purchase amount to you. Generally, CDs with longer maturities pay interest at higher rates than do those with shorter maturities. (Note, however, that the CD yield curve can on occasion be inverted, which means that longer-term maturities may yield less than shorter-term maturities.)

Be careful with what are known as "callable" CDs. They often pay slightly higher yields but the issuer can redeem them prior to maturity and may pay you back less than the CD's full value. Issuers are more likely to call their CDs back when rates have fallen. This could mean that rates could well be lower when you look for new CDs than they were when you bought your original CD.

How to buy CDs

Brokered CDs may also reduce your risk because more of your cash may be insured by the FDIC than would be possible otherwise. Because CDs are issued by banks, they are insured by the FDIC, which protects depositors' money in case a bank fails. The FDIC insures bank deposits up to $250,000 per depositor, per bank, per type of account. If you have a joint checking account, an IRA, and a savings account at a single bank, the money in your accounts could be insured for up to $750,000.

Pros and cons of CDs

There are no "best" CDs; there are only those that best meet your needs. That means before you can take advantage of the benefits of CDs in a time of higher interest rates, you need to understand your personal and financial goals as well as your need for access to your cash.

Because CDs require you to give up access to your cash for a period of time in exchange for interest, you should only buy them with money that you are certain you won't need prior to the time when they mature. It may help to think of CDs as a middle ground between your longer-term investments and the cash that you may need for daily expenses or emergencies.

What is a CD ladder?

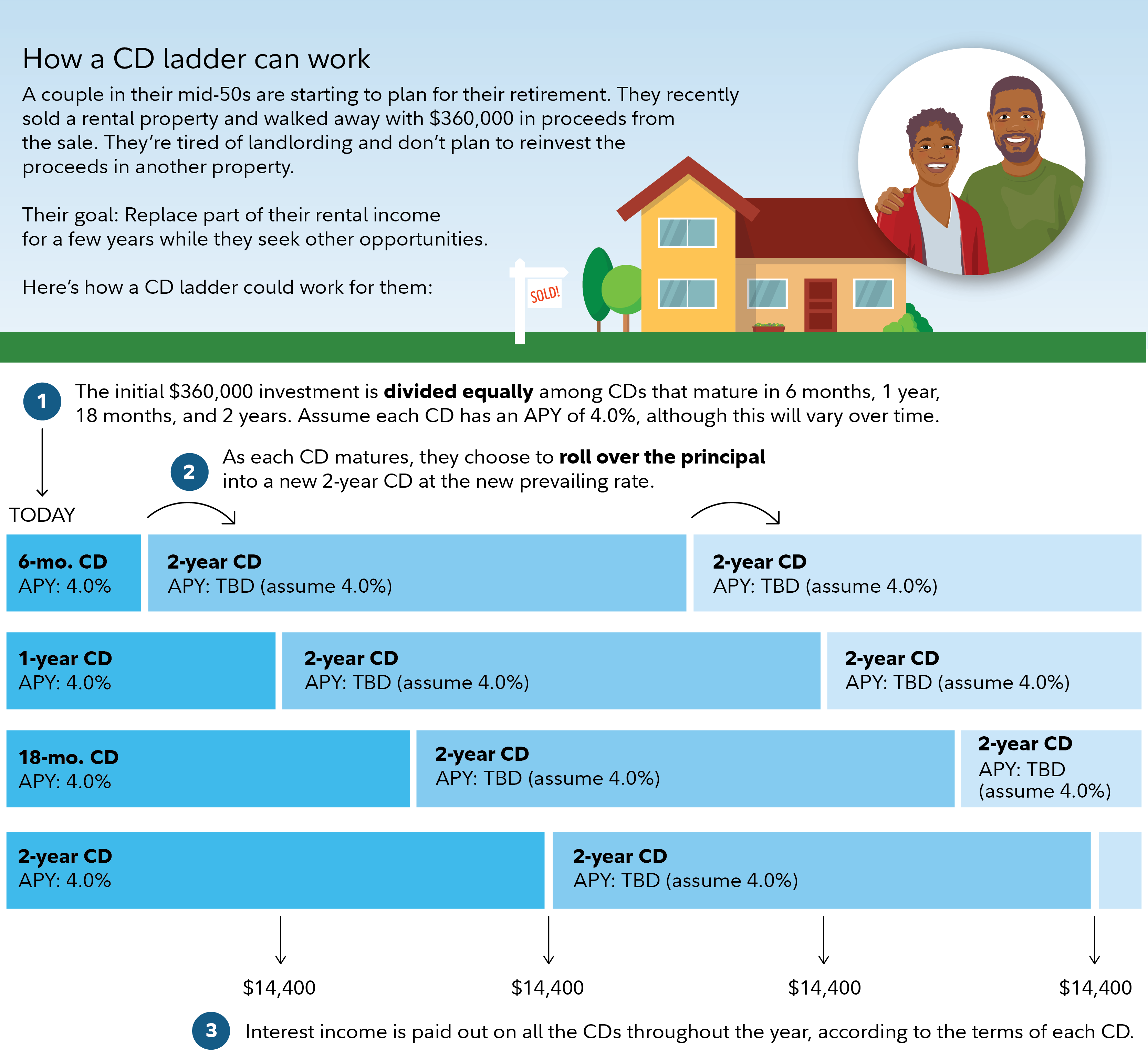

While CDs may currently require little trade-off between risk and reward, investing in them does require you to give up easy access to your cash in return for income. If you want to keep some of that liquidity while also maximizing yield, you may want to consider building what is known as a CD ladder. A ladder is an assortment of CDs with various maturity dates. It may include a mix of higher-yielding, longer-term CDs along with those that will mature sooner and return cash to you to use as you wish.

How to build a CD ladder

A typical ladder might include CDs that mature in 6 months, 12 months, 18 months, and 2 years. At 6 months, the first CD reaches maturity, the 12-month CD has 6 months remaining until it matures, and the 18-month CD has 12 months. At that time, you could then take the principal from the first maturing CD and use it to pay your bills, invest in stocks or bonds for the longer term, or extend your ladder by buying a new 2-year CD.

If you choose to extend your ladder beyond the maturity of the last CD in the bunch you originally bought, after 2 years, all the CDs with maturities of less than 2 years that you originally bought will have matured and been replaced by CDs that pay the full 2-year rate. A portion of your investment will also continue to mature every 6 months.

This ongoing maturing and reinvesting of the CDs in your ladder will mean that your CD portfolio will reflect changes in interest rates. If rates rise, your combined yield would rise over time as well. If rates fall, your yield would eventually decline, though you could choose to add longer-maturity, higher-yielding CDs if you believe lower rates are coming. Spreading your CD investments across a variety of maturities may be a way to hedge against this interest-rate risk.

CD ladder considerations

If you're considering a CD ladder, you also need to consider how frequently you would like to see your CDs revert to cash. When a CD matures, it will give you an opportunity to reevaluate your cash needs and investment opportunities before reinvesting in a new CD.

It's also important to know that if your needs for cash change unexpectedly, you may need to pay a penalty to access your money before maturity and you might not get the price you want if you try to sell your CDs in the secondary market. You need to determine how much liquidity risk you can take to select the maturity of the final rung of your CD ladder.

Whether you choose bank, brokerage, individual, or laddered CDs, the opportunity to lock in attractive, reliable yields with the peace of mind of FDIC insurance begins with research. Find out more at Fidelity's fixed income research page.