For the past few years, attractive yields on high-quality bonds have offered opportunities to earn reliable income and help preserve the value of investors' portfolios.

But with the Federal Reserve cutting interest rates again, it may appear that the opportunity to build an income strategy from individual bonds is over. Surely a lower federal funds rate also means lower bond yields and less income than you may need, right?

Not necessarily. While there is a relationship between the Fed’s monetary policy and bond yields, a Fed interest rate cut does not mean that yields on all bonds in the market drop automatically. Bond yields—especially yields on bonds with longer maturities—can be influenced by a wide variety of factors that may matter more than a rate cut. For example, on the day before the September meeting at which the Fed’s leaders voted to lower rates, 10-year US Treasury bonds yielded 4.05%. Over the next few weeks, yields on money market funds, newly issued CDs, and other fixed-income products came down, but 10-year Treasury yields instead ticked upward, rising close to 4.20% by the end of September. And even though those same 10-year Treasury yields have now fallen to 4.00%, those who want to can still lock in yields that remain far higher than they have been for much of the time since the 2008 financial crisis may still be able to do so.

Beau Coash, Institutional Portfolio Manager with Fidelity’s fixed income investment teams, says yields on longer-maturity investment-grade bonds are unlikely to come down much in the year ahead. That means that a well-constructed bond strategy may deliver reliable income at a rate that outpaces inflation, which the Fed forecasts will gradually decline to roughly 2.55% over the course of 2026.

What's a bond ladder?

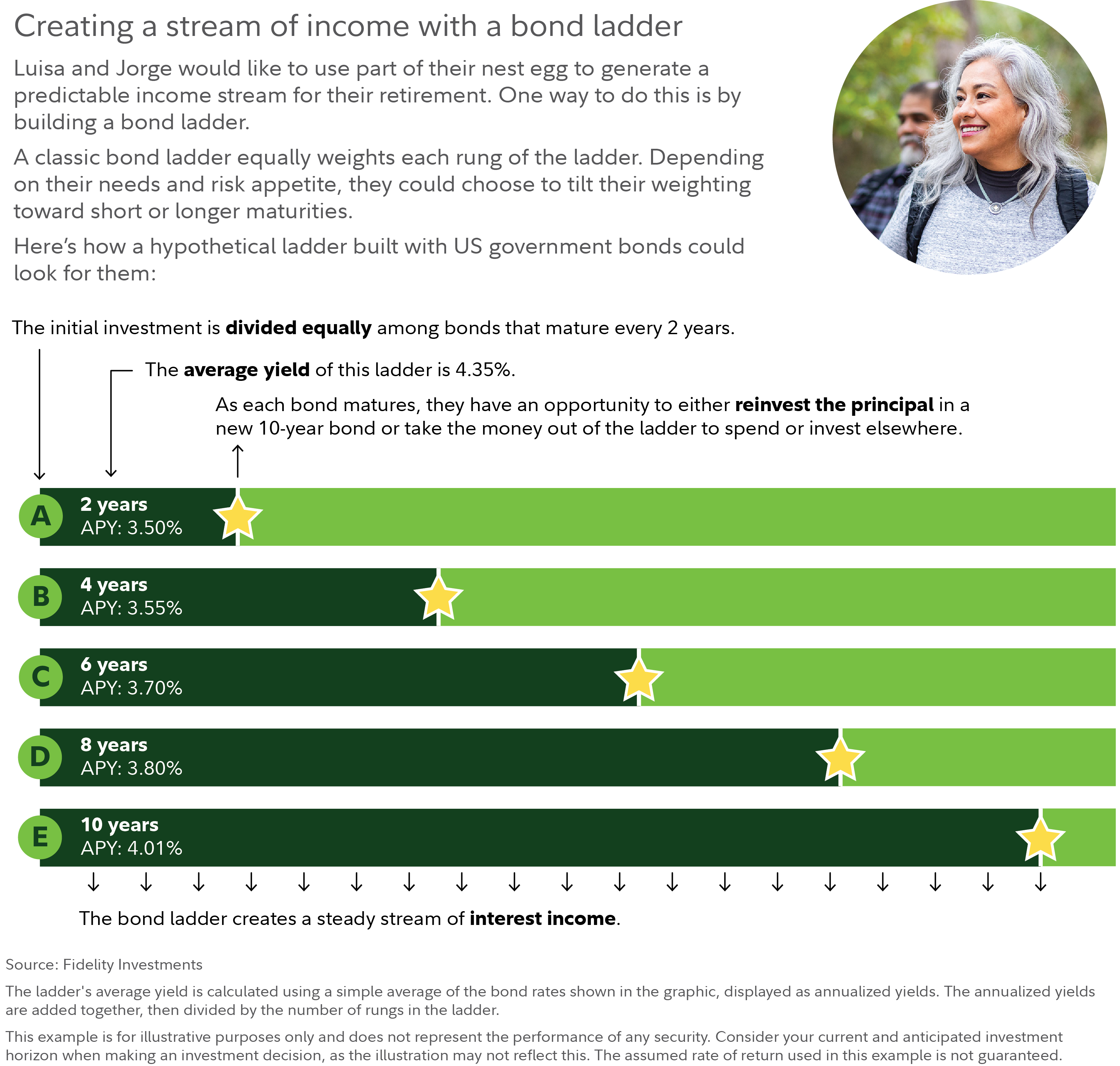

A popular way to hold individual bonds is by building a portfolio of bonds with various maturities: This is called a bond ladder. Ladders can help create predictable streams of income, reduce exposure to volatile stocks, and manage some potential risks from changing interest rates.

If yields are likely to fall, a bond ladder structure can help ensure that at least part of your bond portfolio is maintained at the (higher) yields that prevailed when you had originally invested in the ladder. Similarly, a ladder may be useful when yields and interest rates rise because it regularly frees up part of your portfolio so you can take advantage of new, higher rates in the future. If all your money is invested in bonds that mature on the same date, they might mature before yields rise or after they have begun to fall, limiting your options.

By contrast, bonds in a ladder mature at various times in the future, which enables you to reinvest money at various times and in various ways, depending on where opportunities may exist. Ladders can also offer some protection from the possibility that rising rates might cause bond prices to fall, since bond holders are paid the full principal value of the bond when it matures (assuming the issuer stays in business and can make good on its borrowing as they come due).

"Laddering bonds may be appealing because it may help you to manage interest-rate risk, and to make ongoing reinvestment decisions over time, giving you the flexibility in how you invest in different credit and interest rate environments," says Richard Carter, Fidelity vice president of fixed income products and services. (Note that the chart that follows is for illustrative purposes only and that yields are subject to changing market conditions.)

Things to know before building a bond ladder

Before building a bond ladder, consider these 6 guidelines.

1. Know your limitations

Ask yourself—or a financial professional—whether you have enough assets to spread across a range of bonds while also maintaining adequate diversification within your portfolio. You don't want all of your money in any one type of investment and even bond enthusiasts recommend leaving at least 40% of your portfolio in stocks. Bonds are often sold in minimum amounts of $1,000 or $5,000, so you may need a substantial investment to achieve diversification. It may make sense to have at least $350,000 toward the bond portion of your investment mix if you're going to invest in individual bonds containing credit risk such as corporate or municipal bonds.1 For smaller amounts, consider a Treasury or CD Ladder, where credit risk is considerably reduced.

Make sure that you also have enough money to pay for your needs and for emergencies. You should also consider whether you have the time, willingness, and investment acumen to research and manage a ladder yourself. If not, you may be better off getting help with your ladder or opting instead for a bond mutual fund or separately managed account.

2. Hold bonds until they reach maturity

You should have a temperament that will allow you to ride out the market’s ups and downs. That’s because you need to hold the bonds in your ladder until they mature to maximize the benefits of regular income and risk management. If you sell early, you will risk losing income and may also incur transaction fees. If you can't hold bonds to maturity, you may experience interest-rate risk similar to a bond fund with comparable duration, which you may want to consider instead.

How many issuers might you need to manage the risk of default?

| Credit rating | # of different issuers |

|---|---|

| AAA US Treasury | 1 |

| AAA-AA municipals | 5 to 7 |

| AAA-AA corporate | 15 to 20 |

| A corporate | 30 to 40 |

| BAA-BBB | 60+ |

3. Use high-quality bonds

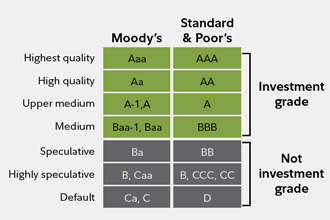

Ladders are intended to provide predictable income over time, so using riskier lower-quality bonds makes little sense. To find higher-quality bonds, you can use ratings as a starting point. For instance, select only bonds rated "A" or better. But ratings can change, so you should do additional research to ensure you are comfortable investing in a bond you may potentially hold for years. If you are investing in corporate bonds, particularly lower-quality ones, you need more issuers to diversify your ladder. The prior table suggests how many issuers you may need.

How do bond ratings work?

Moody's and Standard & Poor's are independent credit rating services that analyze the financial health of bond issuers. The ratings they assign help investors assess how likely an issuer is to be able to make principal and interest payments to bondholders.

4. Avoid the highest-yielding bonds

An unusually high yield relative to similar bonds often indicates the market is anticipating a downgrade or perceives that bond to have more risk than others, and has traded its price down and increased its yield. One potential exception is municipal bonds, where buyers often pay a premium for familiar bonds that may have higher yields from smaller—but still creditworthy—issuers.

5. Keep callable bonds out of your ladder

Part of the appeal of a ladder is knowing when you get paid interest, when your bonds mature, and how much you need to reinvest. But when a bond is called prior to maturity, its interest payments cease and the principal is returned to you, possibly before you want that to happen.

6. Think about time and frequency

Another feature of a ladder is the length of time it covers and how often the bonds mature and return principal. A ladder with more bonds will require a larger investment but will provide a greater range of maturities. If you choose to reinvest, you will have more opportunities to gain exposure to future interest-rate environments.

How to build a bond ladder

Here’s an example of how you can build a ladder using Fidelity's Bond Ladder tool. Mike wants to invest $400,000 to produce income for about 10 years. He starts with his investment amount—though he could also have chosen a level of income. He sets his timeline and asks for a ladder where bonds are maturing on a semi-annual basis. Then he chooses bond types. In order to be broadly diversified, each rung contains a range of bonds and FDIC-insured CDs with various investment grade credit ratings.

Mike chooses eligible bonds for each rung and, as he does so, the tool shows a summary of the ladder, including the total par and market values, the average yield to maturity, and yield to worst.

Displayed rates of return, including annual percentage yield (APY), represent stated APY for either individual certificates of deposit (CDs) or multiple CDs within model CD ladders, and were identified from Fidelity inventory as of the time stated. For current inventory, including available CDs, please view the CDs & Ladders tab.

While a well-diversified bond ladder does not guarantee that you will avoid a loss, it can help protect you the way that any diversified portfolio does, by helping to limit the amount invested in any single investment. Also, a bond ladder leverages the cash flow features of bonds in terms of their coupons and principal repayments: This gives it the potential to be an efficient and flexible vehicle with which to create an income stream tailored to the time period, with a payment frequency to meet your needs.

Need help building a bond ladder? On Fidelity.com, you can research fixed income solutions or fixed income tools and services. Prefer to talk to an expert? Call our specialists in fixed income at 800-544-5372.