What we offer

Product Resources

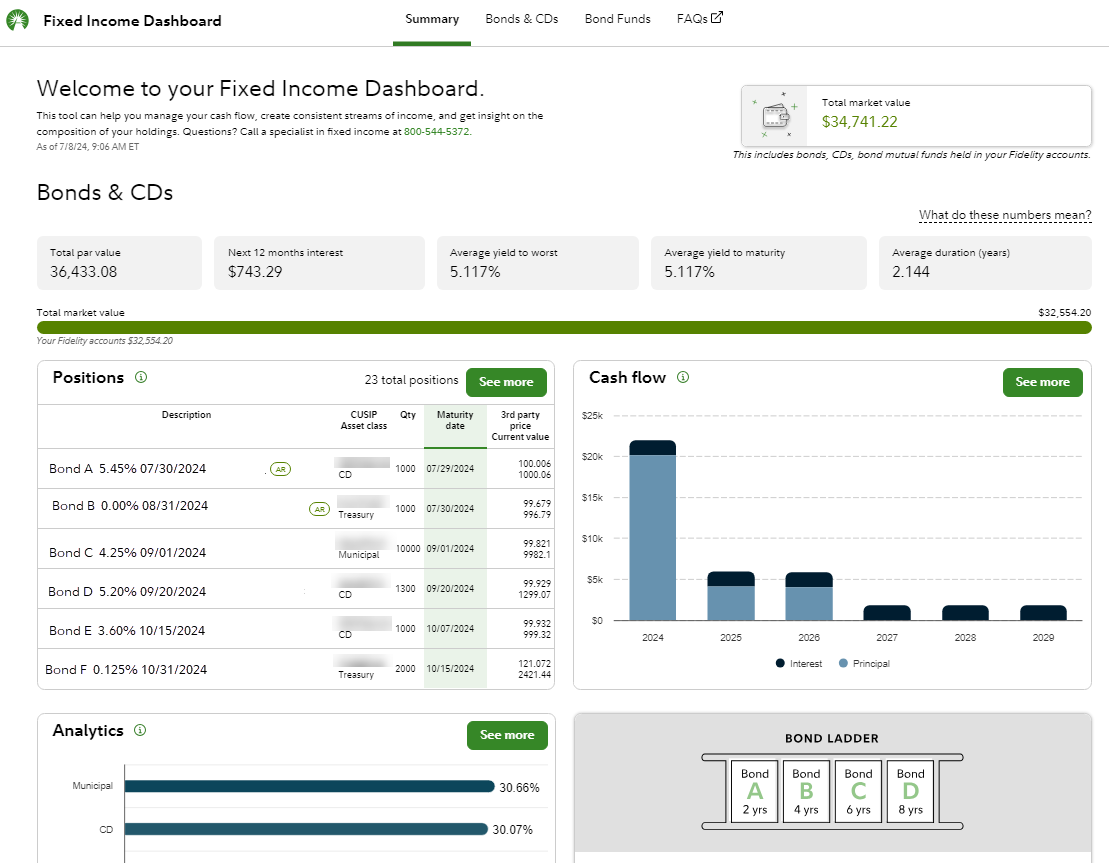

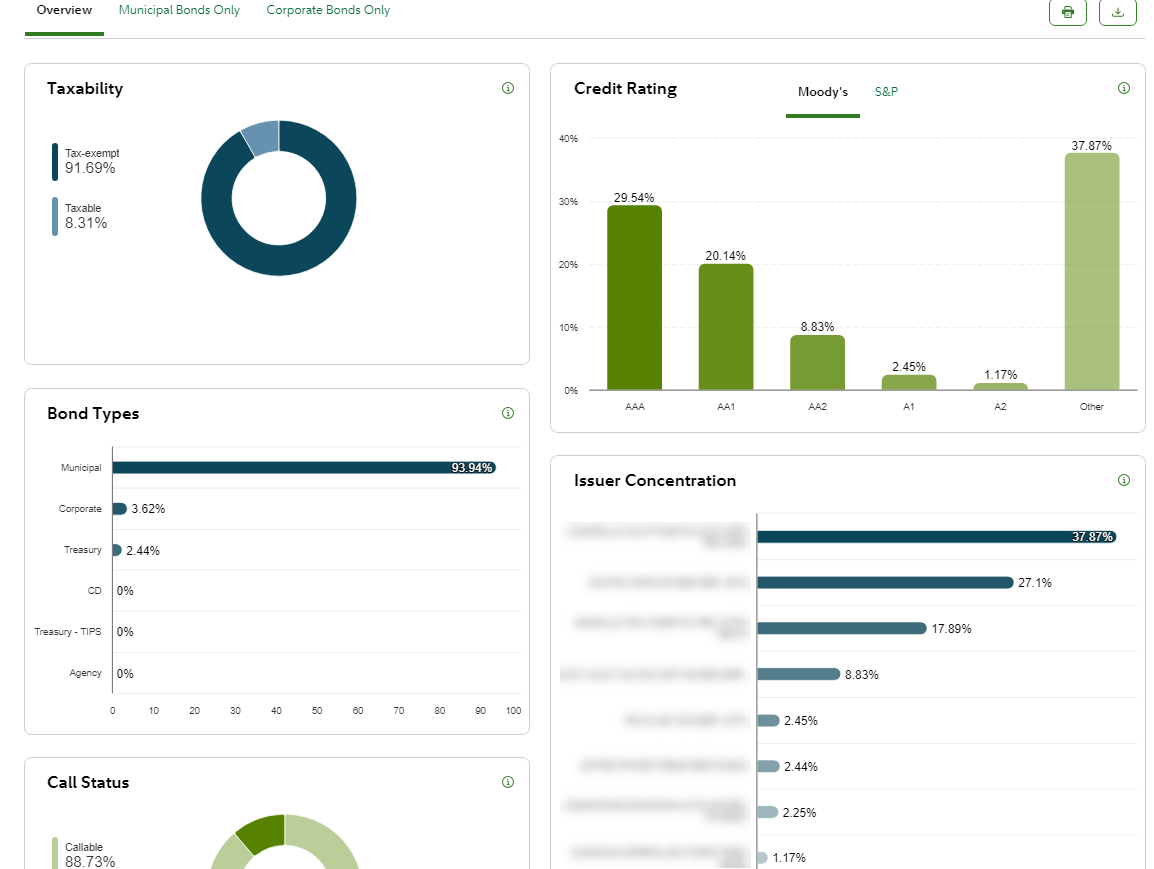

Fixed Income Dashboard

Fidelity's Fixed Income Dashboard can help you manage cash flow and understand the composition of your fixed income portfolio.

Questions?

- 800-544-5372 800-544-5372

- Chat with a representative

Key features

| Summary page |

|

|---|---|

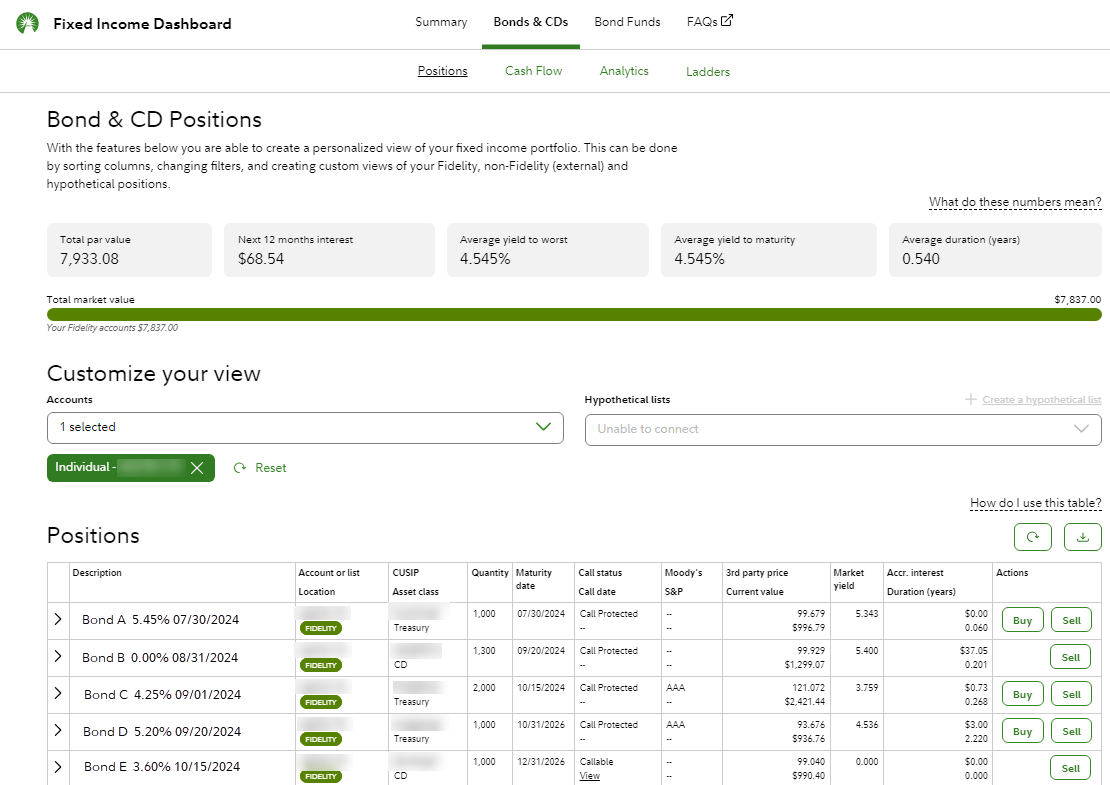

| Fixed income positions |

|

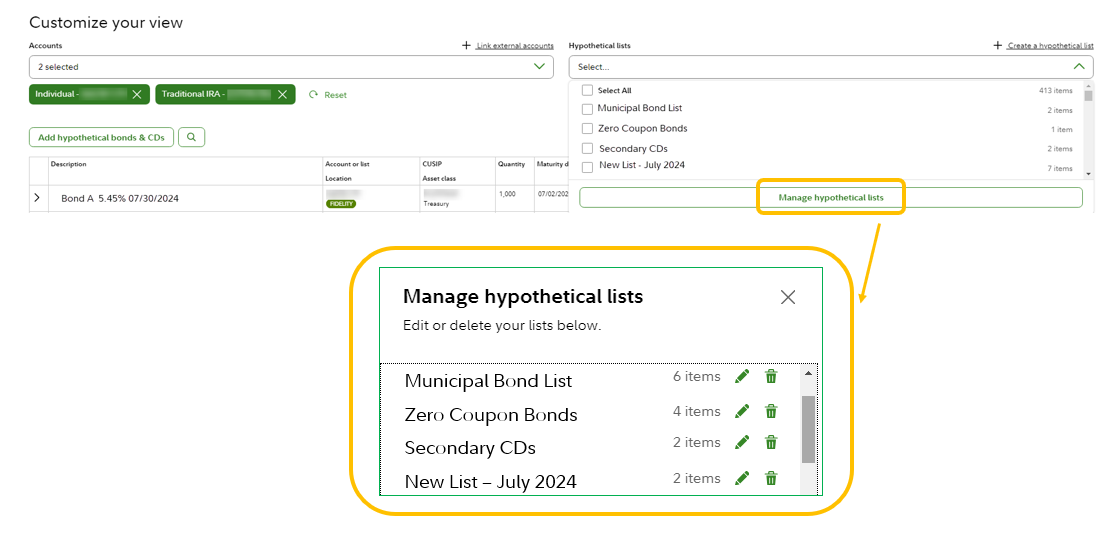

| Customize your view |

|

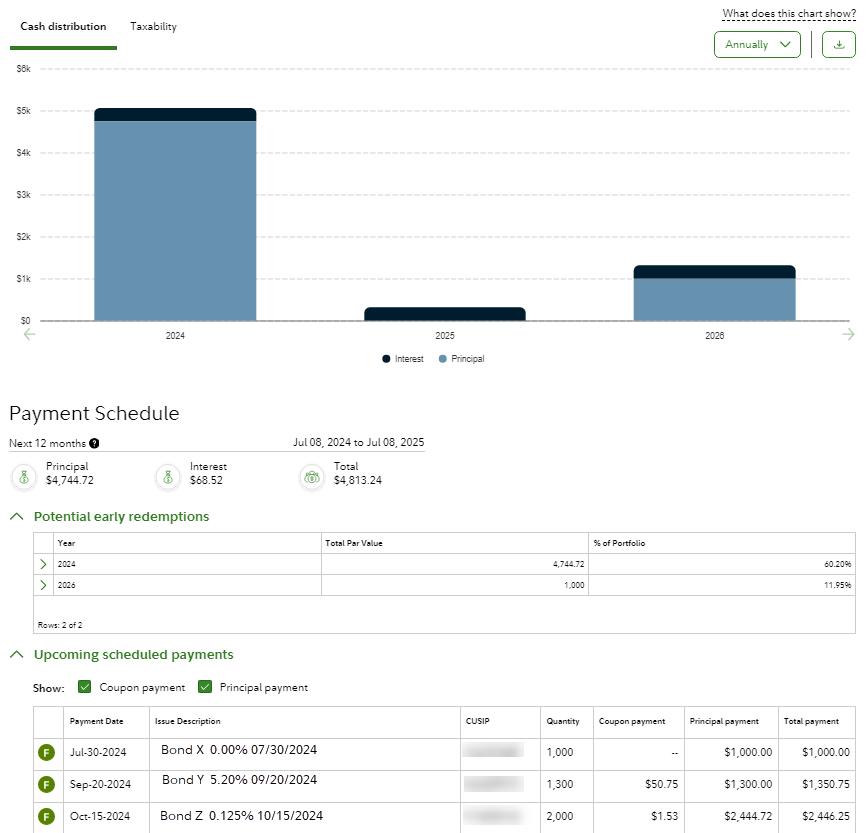

| Cash flow calculations |

|

| Analytics |

The analytics charts can help you identify different types of risk or diversification opportunities within your portfolio, such as

|