The abrupt return of volatility to global stock markets is a reminder that what goes up can also come down. But simply remembering that stocks can fall as well as rise does not necessarily make the experience less uncomfortable. For many people, dips in the value of our savings can cause anxiety or even drive us to make panic-driven mistakes such as selling stocks in falling markets.

Fortunately, there are things you can do to help reduce the impact of market volatility on your portfolio, while still trying to capture some of the growth potential offered by investing. But as it's often said, there's no "free lunch" in investing. That means you'll likely have to give up some potential return in exchange for lower volatility.

What is defensive investing?

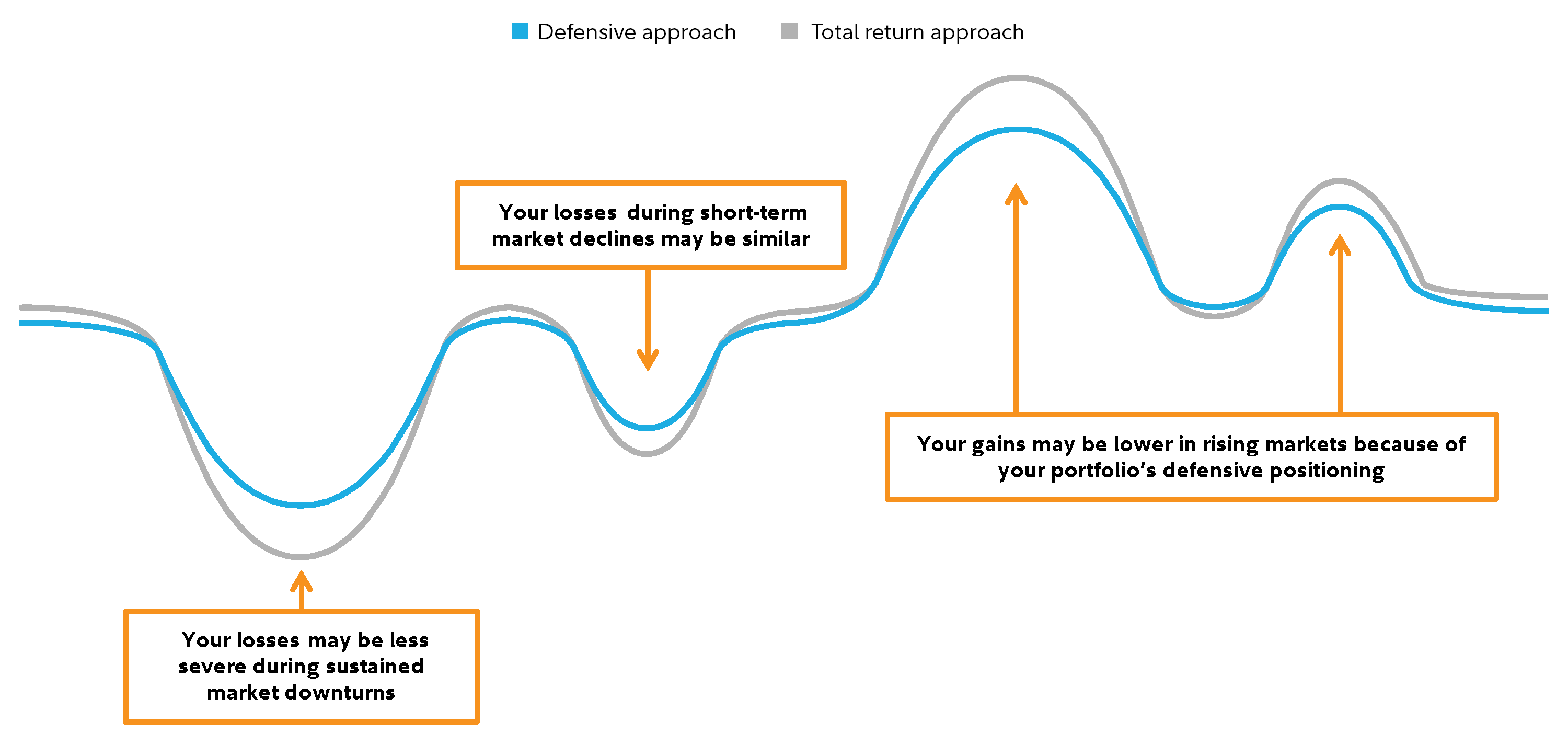

A professional investment manager can help you reduce your exposure to volatility by building what is called a defensive portfolio. Callum Henderson manages defensive strategies for Fidelity's Personalized Portfolios. He says, "A defensive investment approach attempts to reduce the impact of falling markets on an investor. Defensive portfolios aim to limit losses in a down market but will typically trail in a strong up market. Over longer time periods, a defensive portfolio aims to capture much of the growth of the market, but with a smoother ride."

Should you invest defensively or for total return?

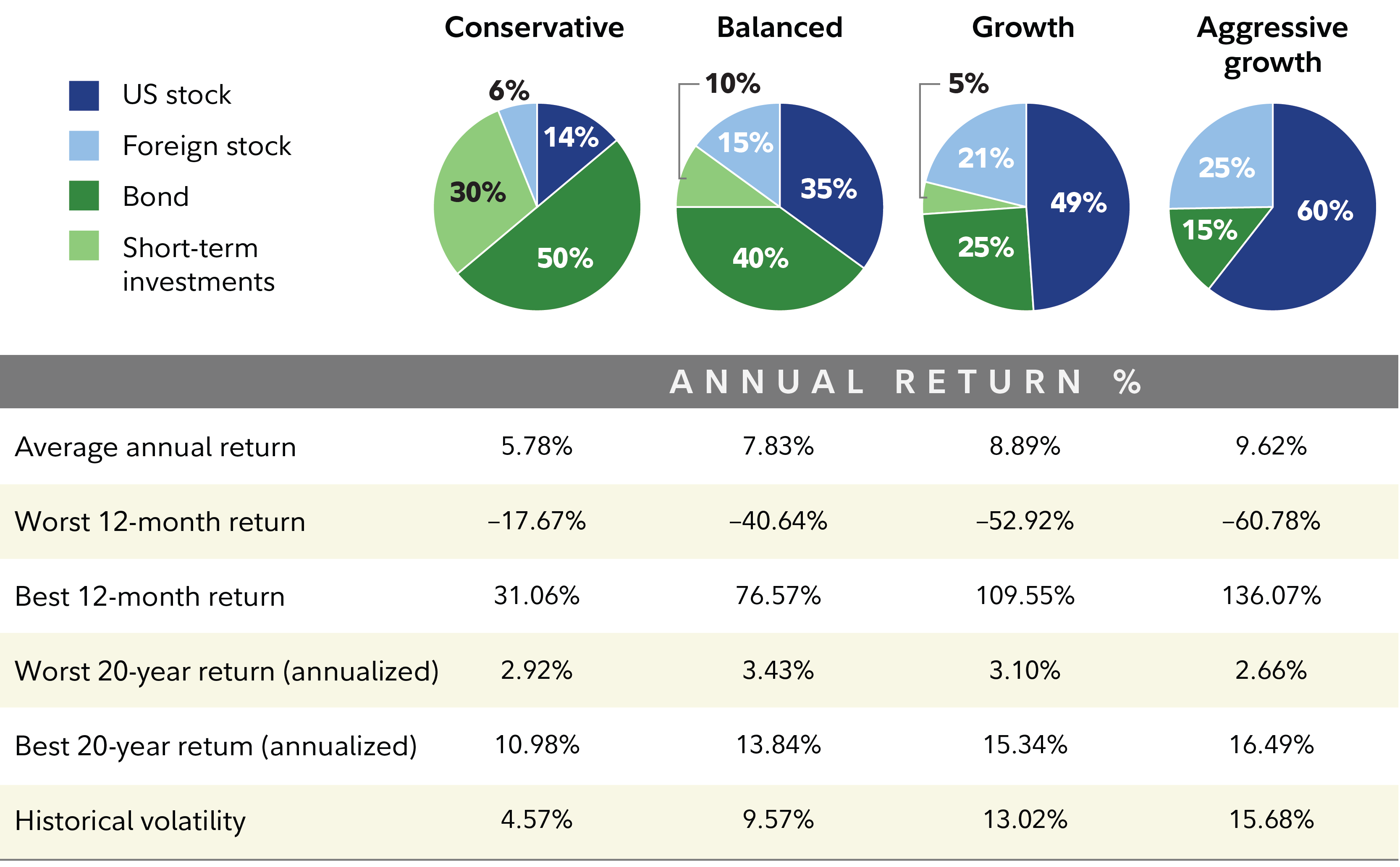

One of the best ways investors can seek to reduce exposure to volatility is by choosing a mix of stocks, bonds, and cash that has historically been less volatile than a typical portfolio. Your mix of assets should be chosen based on your financial and personal goals, the amount of time before you need to access the money in your portfolio, and the level of risk you are comfortable with. Most investors choose what is called a total return portfolio. That means a mix of assets chosen to seek the greatest possible return for a given level of risk. Typically, total return portfolios contain significant allocations to stocks and have historically delivered higher average returns, but also suffered bigger losses during down markets.

If you are uncomfortable with the amount of potential exposure to volatility that the stocks in your portfolio represent, you could move to a portfolio with a larger proportion of bonds. Historically, more bond-heavy portfolios have fallen less during market declines but have also experienced smaller gains over longer time periods.

Another option would be to try to change your pattern of returns, meaning you try to achieve similar or slightly lower returns over the long term, but with smaller drops and gains—essentially looking for a smoother ride. That's where a professionally managed defensive portfolio comes in. When building a defensive portfolio, a manager looks for stocks and bonds with specific characteristics that might be able to try to help reduce the volatility of your returns.

How to build a defensive portfolio

There are a number of ways to make a portfolio more defensive. One technique is to target stocks with lower levels of historical volatility. Some companies, due to industry, competitive position, or strong financials, have records of lower volatility in down markets. Targeting those stocks can help to limit downside risk during selloffs.

Similarly, a bond fund manager might select securities that can offer protection from specific risks that seem relevant for a given market environment. For example, if inflation is high, a manager might select Treasury inflation-protected securities (TIPS) to help protect the portfolio's value. If inflation and growth are both low, as in a recession, the manager might choose investment-grade bonds that could offer protection from the risk that the bonds' issuer might encounter financial difficulties and not be able to pay interest on its bonds.

How to play defense with defensive ETFs and mutual funds

If you are a do-it-yourself investor who wants to seek lower volatility, Fidelity also offers a variety of defensive mutual funds such as Fidelity® US Low Volatility Equity Fund (

Bear in mind, though, that a defensive portfolio won't eliminate day-to-day dips in the market. Instead, it's designed to help reduce losses in more severe down markets, without giving up much in terms of long-term performance potential.

"Investing offers a powerful tool for wealth creation, and can help you meet your goals," says Henderson. "But to capture that potential, you need to be able to live with your portfolio. If you are nervous about the markets, a defensive investment portfolio might help you be able to stick with your plan despite rocky markets."