Few people say they learned how to manage money too early in life. It's a critical skill that can take time to develop. To get kids and teens started out on the right foot, help them put a portion of their earnings to work for their future by saving and investing.

While it may sound like a hard sell, young people say they're interested in investing, with 91% of teens in Fidelity's 2023 Teens and Money Study1 saying they definitely plan to invest in the future—and 3 out of 4 of them plan to start before graduating college or earlier.

Why get teens and kids involved with investing?

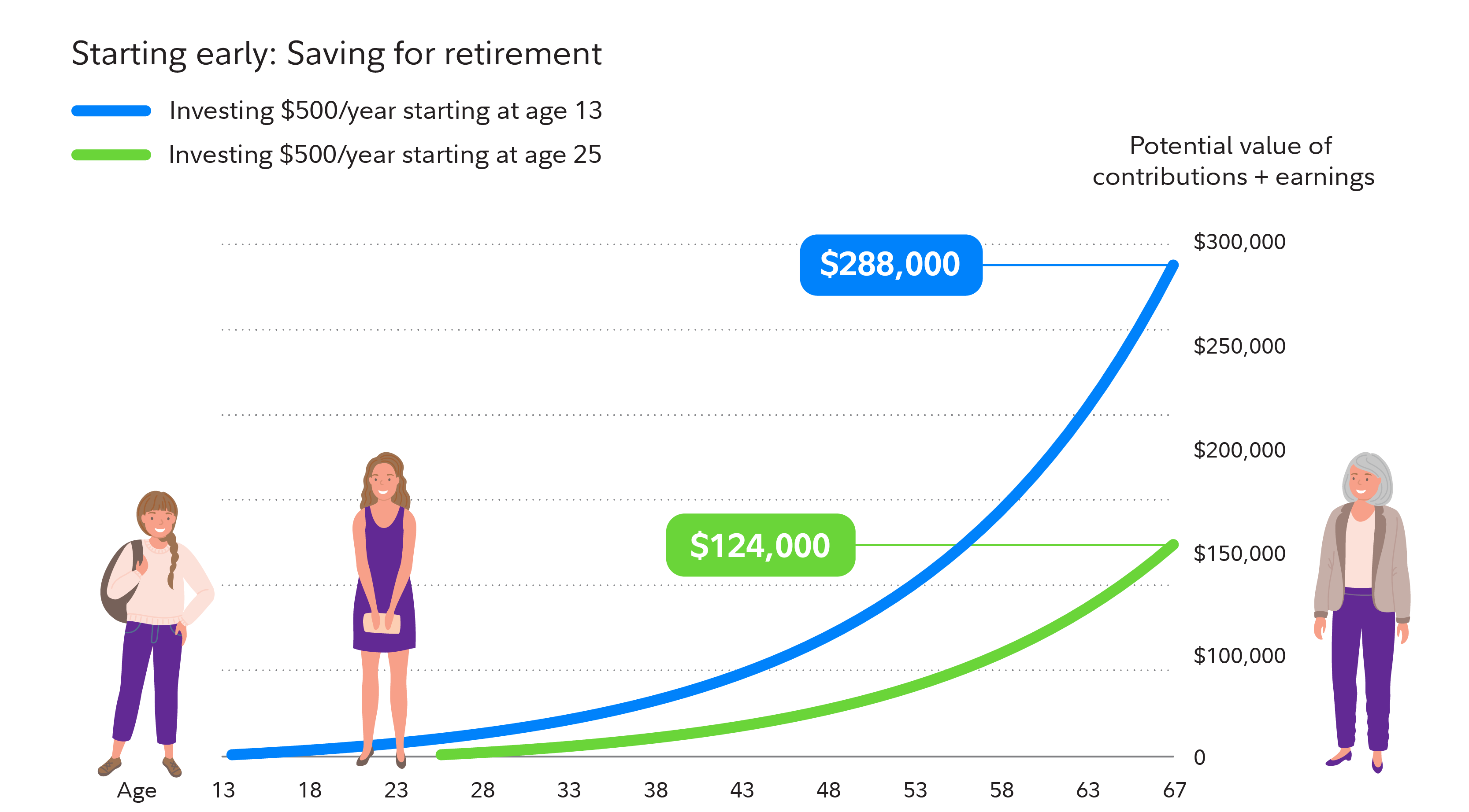

Time is the secret ingredient to potential investing success thanks to the compounding that can happen over years and years. Continually saving over time and investing for growth potential can help your money work hard. A diversified mix of investments that matches your time frame and goals may be one of the best ways to seek growth but there can be a catch—it can take time. The good news is the longer your time frame, the less you may need to save and potential compounding growth can do the hard work. The chart below assumes that someone is able to start saving at age 13. They save $500 per year from age 13 through 19. At age 20, they begin saving $1,000 per year and age 25 begin to save $3,000 each year until age 67. Someone who doesn't start saving before age 25 and contributes $3,000 each year until 67 would potentially end up with less money—all else being equal. The saver who started later may need to save more each year if they wanted to catch up with the early saver.

This is just one example of how starting early can help with saving for retirement—shorter-term goals like education or buying a home can benefit too! Find out how teens and even young children can start saving and investing for their future today.

Although investing and compounding may help you grow your money, please remember that investing involves risk. You could lose money, investment returns are likely to fluctuate, and investing on a regular basis does not ensure you’ll make more money. These examples are hypothetical and don’t reflect the performance of any specific investment. Illustrations assume no withdrawals and continuous saving over the entire period shown.

This hypothetical example of an early saver assumes the following: (1) A $500 contribution is made on January 1 every year from age 13 to 67. It does not take into account SECURE Act 2.0 indexing of catch-up contributions, which will be implemented on January 1, 2025. (2) An annual rate of return of 7%, and (3) the ending values do not reflect taxes, fees, or inflation. If they did, amounts would be lower. Illustrations with a 7% rate of return also come with risk of loss.

This hypothetical example of a later saver assumes the following: (1) A $500 contribution is made on January 1 and every year from age 25 to age 67, (2) an annual rate of return of 7%, and (3) the ending values do not reflect taxes, fees, or inflation. If they did, amounts would be lower. For hypothetical illustration only. Investing involves risk, including risk of loss. Source: Fidelity Investments.

1. Fidelity Youth® Account

Teens can start investing on their own at age 13—with some help from a parent or guardian through the Fidelity Youth Account. The parent or guardian must have an account with Fidelity and open the Fidelity Youth Account for the teen. Unlike a custodial account, where the custodian (in this case the parent) makes the investment decisions on the minor’s behalf, the Fidelity Youth Account is a brokerage account that is owned by the teen, who makes all the investment decisions.

Tip: You and your teen can also practice choosing investments and placing a trade in a risk-free environment with Learn to Invest with Fidelity®

"The parent or guardian has access, they have transparency," Kelly Lannan, Vice President, Branch Leader at Fidelity explains. "But they do not need to do things like approve trades. This experience allows a teen to learn by doing."

Extra perks include a debit card with no ATM fees in the US.2 Plus there are no subscription fees, account fees, or minimum balance requirements.3

Learn more: Introducing Fidelity Youth®

2. Roth IRA for Kids

The Fidelity Roth IRA for Kids is a custodial account which means that it's managed by an adult (the custodian) and then the account is transferred to the child at a certain age (generally between 18 and 25; it varies by state).

The main requirement is that a child needs to have earned income. But earnings can come from anywhere—from household chores to a part-time job. Just keep track of how much was earned and what the job was.

"Let’s say your 9-month-old child stars in a commercial and they earn money. They're going to get a 1099 as a contractor, so the IRS can clearly track that. But babysitting money or mowing the lawn also counts, so that is where we recommend tracking these things. You can use a spreadsheet or an app for taking notes to have some kind of documentation," Lannan explains.

Note that the child does not have to use all of their income to contribute to a Roth. If mom, dad, or other relatives want to contribute up to the amount the child has earned that is fine—but you can't contribute more than the child has earned.

What to know:

- The Roth IRA for Kids is the same as a Roth IRA. Contributions have the potential to grow tax-free and withdrawals after age 59½ are tax-free.4

- Contributions can be withdrawn anytime, tax- and penalty-free.

- Withdrawals of earnings before 59½ could be subject to taxes and a 10% penalty but there are exceptions to that rule if 5 years have passed since the first contribution to the Roth IRA for Kids:

- Earnings can be withdrawn penalty-free (but not tax-free) to pay for qualified higher education expenses.

- Up to $10,000 can be withdrawn tax- and penalty-free for a first-time home purchase.

- Money saved in a Roth IRA for Kids is not counted as a student-owned asset for financial aid purposes.

There are even more ways to save for kids including 529 college savings plans, custodial accounts, and the ABLE account. Compare all the options in one place: Saving and investing for a child