Looking for a convenient way to manage a child's money until they grow up? Whether the money comes from gifts, transferring shares, an inheritance, or earnings, a custodial account is one way to save and invest for a child. Money put into custodial accounts becomes the property of the child and can only be used for their benefit.

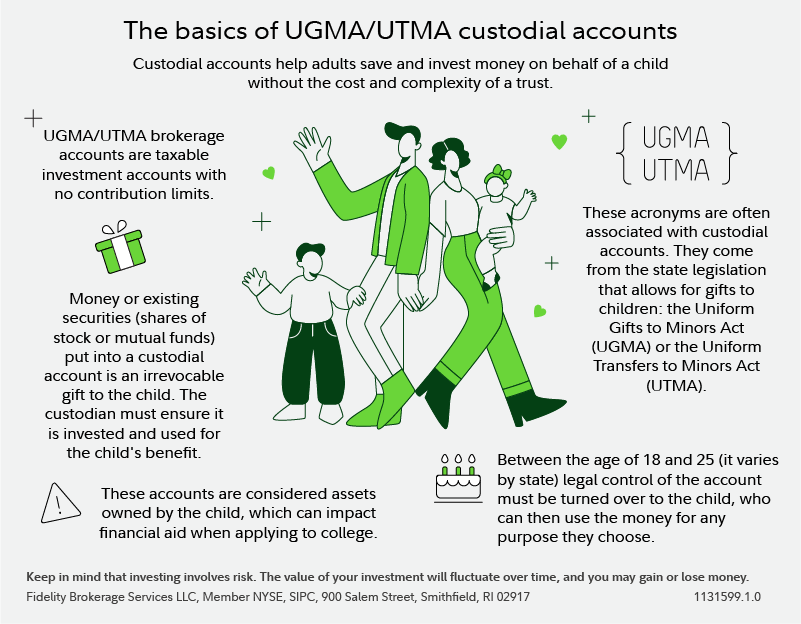

The state legislation that allows for gifts to children is the Uniform Gifts to Minors Act (UGMA) or the Uniform Transfers to Minors Act (UTMA). One or both of those acronyms are often associated with custodial accounts.

Advantages of an UGMA/UTMA account

The major advantage of custodial accounts is that they are a great way to save on a child's behalf or to give a financial gift. To add, you don't have to set up a trust to do so, which can be costly and may require an attorney.

Custodial accounts can be used for anything that benefits the child. Funds can be used to cover the cost of their education or other expenses in their future — there aren't any restrictions on what the money can be used towards. For example, savings are not strictly relegated to qualified education expenses.

How does an UGMA/UTMA account work?

UGMA/UTMA brokerage accounts are taxable investment accounts with no contribution limits. A portion (up to $1,350 in 2026) of any earnings from a custodial account may be exempt from federal income tax, and a portion (up to $1,350 in 2026) of any earnings in excess of the exempt amount may be taxed at the child's tax rate, which is generally lower than the parent's tax rate. You're also able to transfer existing shares of stocks, mutual funds, or other securities from your own account into a custodial account.

At Fidelity, the UGMA/UTMA brokerage account offers comprehensive trading and a wide range of investments, including stocks, bonds, mutual funds, exchange-traded funds, options, CDs, and more.

Setting up UGMA/UTMA account

Custodial accounts are also relatively easy to open and can be done through a quick online process. The adult custodian opens the account for a specific child. The adult can then add money to the account and choose investments. When the child reaches a certain age (generally between 18 and 25, varying by state), assets and control of the account must be transferred to them.

Anyone can contribute to a custodial account—parents, grandparents, friends, other family—with no contribution limits, making them valuable gift opportunities for major milestones and celebrations. Individuals can contribute up to $19,000 free of gift tax in 2026 ($38,000 for a married couple). There's also no minimum to open an account, though certain investments may require a minimum initial investment.

Control of UGMA/UTMA account

UGMA/UTMA brokerage accounts are considered assets owned by the child, which can impact financial aid when applying to college. Also, no matter what kind of custodial account, the custodian must transfer the account to the child at a relatively young age (generally between 18 and 25, varying by state), after which the money can be used for any purpose.

At some financial institutions, like Fidelity, the account will be restricted once the child passes the state-mandated age and control has not been transferred. Though it is a mandatory process, it has to be initiated by the custodian. If the account was restricted because of a delay in transferring control, any restrictions would be lifted once ownership was transferred.

At Fidelity, the custodian must transfer the account to the child within an allotted period of time once the child reaches a certain age (generally between 18 and 25, varying by state). The custodian will be notified by Fidelity when the transfer needs to be initiated.

UGMA/UTMA brokerage account considerations

UGMA/UTMA brokerage accounts can make sense when saving and investing on behalf of a child, but there are some important things to know about the accounts.

Irrevocable gift. Money put into a custodial account belongs to the child—it's called an irrevocable gift. At the age mandated by the state, the custodian (often a parent) must transfer control to the child. At that point, they can do whatever they want with the money.

The gift tax may be a consideration. There's no limit to the amount you can put into an UGMA/UTMA. Beginning on January 1, 2026, an individual may make gifts in an amount up to $19,000, in total, on an annual basis to any recipient without making a taxable gift, and married couples who elect to gift-split may annually gift a combined $38,000 per recipient without making a taxable gift.

Realized earnings are taxable. Earnings are subject to taxes. Income from investments is considered unearned income by the IRS. For children, unearned income above $2,700 is taxed at the parent's rate in 2026. If interest and dividend income is less than $13,500 in 2026, the parent can include that income on their return.

Little control over how the money is used. Once the assets are transferred, the child can use them for any purpose. Each state has different rules for determining when the child must take control of the account.

Financial aid may be impacted. Financial aid can be adversely affected by custodial accounts. They are considered assets owned by the child.

Is a custodial account right for me?

When choosing an account, it's important to consider your goals and needs as well as that of the child. There are situations where a custodial account makes a lot of sense and could make planning easier. For instance, if your child inherits or is gifted money, you could use a custodial account to manage the money until they grow up and can manage it on their own. For people who need more control over the money, a preferable alternative could be setting up a trust.

Conversely, if you are a parent saving your own money for a child's education, a 529 account may make more sense than a custodial 529 or an UGMA/UTMA. That's because 529 accounts offer a greater degree of flexibility and control, as well as tax benefits.

Before opening a custodial account, evaluate your goals, those of the child, and take stock of all your options to make sure that it's the right type of account for you. It may be a good idea to consult with your attorney or a tax professional to help choose the best option for your situation.