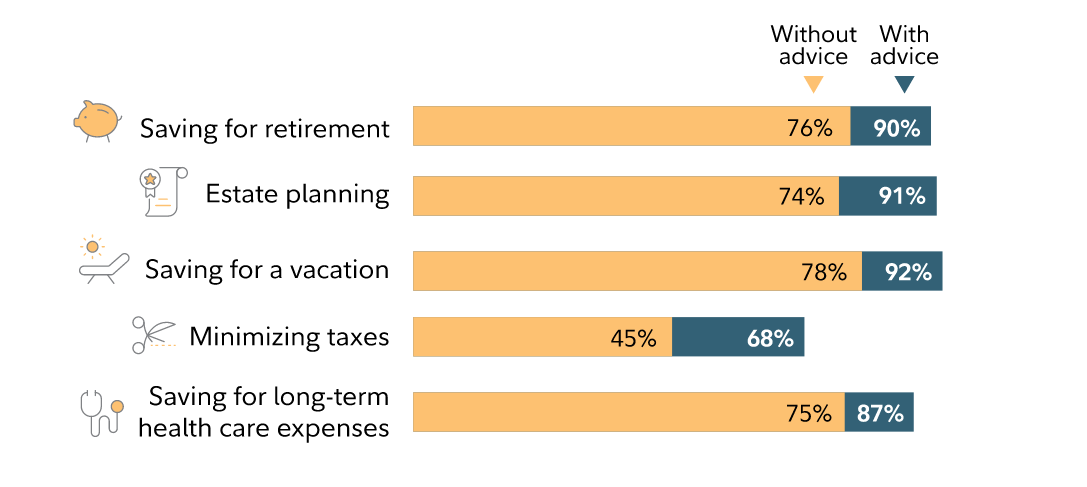

When we make big decisions in life, most of us look for a source of expertise and guidance to help us make thoughtful choices to meet our individual goals and needs. In fact, investors who get professional financial advice are more likely to feel confidence about achieving their goals.1

Percentage of investors who say they feel confident about reaching their goal

Furthermore, industry studies estimate that professional financial advice can add up to 5.1% to portfolio returns over the long term, depending on the time period and how returns are calculated.2 But for most investors who choose to work with an advisor, advice is not just about investments. It's also about helping you pursue your goals, grow your wealth, and take care of the people who matter most to you.

Here are 3 ways a good advisor can help make a difference in helping you reach your goals.

1. Works with you to create a personalized investment plan

When you work with an advisor, you generally receive support from a dedicated professional who can help you bring your plan to life. An advisor will ask you about your personal and financial goals, and work with you to help answer questions such as:

- Are your spending and cash flow appropriate?

- What does financial protection mean to you, and how important is it?

- What does growth mean to you, and how important is it?

- Are your investments aligned with your preferences?

- How will you manage your investment portfolio?

Together, you can develop a documented investment plan that articulates your long-term goals, short-term needs, risk tolerance, and personal values. This plan can act as a guide for future decision-making, and provides the advisor with information necessary to help you devise and document an appropriate asset allocation and, if applicable, a tax-sensitive investment strategy to help you invest in the asset classes and accounts that best suit your objectives and risk tolerance.

Having a documented investment plan can be a big help in staying the course in times of uncertainty or volatility and can help an advisor provide the guidance and encouragement you may need to stay on track to avoid the sometimes costly mistakes investors can make during volatile markets.

2. Can help identify opportunities to help protect and grow your assets

An advisor who understands your long-term goals is well-positioned to help you identify strategies and techniques that can help you grow and protect your wealth.

This may include:

- Tax-loss harvesting. Investment losses can help you reduce taxes by offsetting gains or income.

- Retirement income planning. Preparing for your future needs is essential to ensuring you can maintain your lifestyle throughout your lifespan.

- Tax-smart withdrawals. Reducing the amount you pay in taxes can potentially help extend the life of your retirement savings and open up options for wealth transfer.

- Roth IRA conversions. Converting some of your IRA savings to a Roth IRA may potentially reduce taxes on withdrawals in retirement.

- Health savings accounts. An HSA offers triple tax savings,3 where you can contribute pre-tax dollars, pay no taxes on earnings, and withdraw the money tax-free now or in retirement to pay for qualified medical expenses.

- Advanced college savings strategies. Accelerated gifting and, when possible, opening a 529 within a trust can help optimize savings and may enhance your growth potential.

- Charitable donation strategies. Gifting assets, rather than selling them and donating the after-tax proceeds, can help maximize your gift and provide a larger charitable deduction.

- Professional management. If you prefer, you can engage a professional to help you manage your investments in a tax-smart manner in accordance with your goals, supported by annual reviews designed to keep your plan on track.4

3. Builds a relationship with you to better plan for your specific needs

By getting to know you, your family, and your feelings about investing and your future, an advisor can better plan for your specific needs and help you adjust, amend, or extend your plan to keep it relevant as your circumstances change. An advisor can also help you evolve your plan as you prioritize new goals or manage life events, and help you manage risk and consider opportunities as markets or tax laws change.

By scheduling regular check-ins, perhaps quarterly or semiannually, an advisor can help you to review whether your objectives and needs have remained the same or whether circumstances require you to update your plan.

This can also be an opportunity for the advisor to connect you to specialists with experience with estate tax planning and personal trust services, to help develop a plan designed to help you keep more of your money and may be able to help protect your legacy for generations to come.

A good advisor is a partner on your financial journey

Financial advice is more than just numbers and investments. It's a process that can help you make a plan, chart your progress, and hopefully achieve your personal and financial goals—while feeling more confident along the way.