When there's some downbeat economic or market news, it's no surprise that some investors may end up fleeing the market for what they believe is safety or keep their cash on the sidelines until it's clearer which way things may be headed.

Unfortunately, they may be undermining their long-term growth potential. Historically, when investors have given up on their long-term strategies and react to short-term developments in the market, their portfolios have suffered. For example, in 2023, the average equity fund investor underperformed the S&P 500 by 5.5%.1

"In my experience, disciplined investors who develop a financial plan and stay invested have typically had better success reaching their long-term-financial goals," says Naveen Malwal, an institutional portfolio manager with Strategic Advisers, LLC. "I have found that investors who keep waiting for the perfect time to invest often miss out on gains over time."

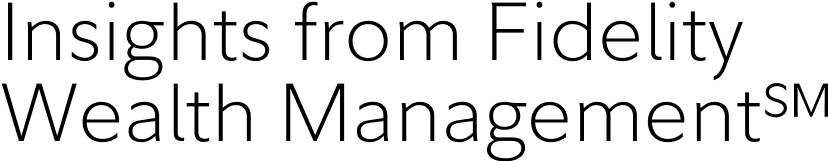

1. Over the long-term, stocks have grown through market volatility and recessions

While market corrections can feel scary, they don't necessarily indicate future losses. As the following chart shows, stocks have historically recovered even from major downturns and delivered long-term gains.

While recessions are certainly stressful and can present significant challenges to investors, they have often been relatively short and, historically, have been followed by larger, longer expansionary periods in which stocks have seen gains. "Since 1950, the US has gone through 11 recessions and many other challenges," says Malwal. "But stocks have finished higher than where they started in 5 out of 11 of those recessions, so not all recessions have led to stock market declines. Historically, stocks have shown an average annual return of around 15% since 1950, although they have also encountered setbacks.3"

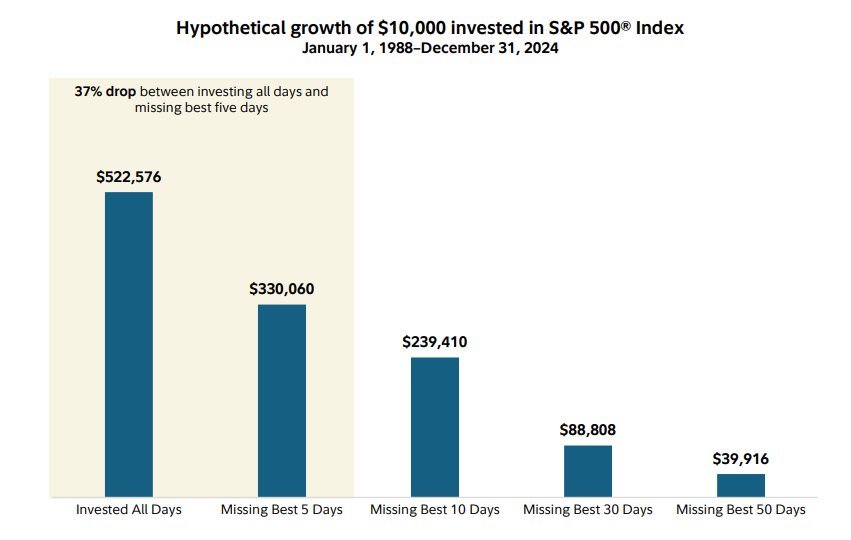

2. Missing out on best days can be costly

Counterintuitive as it may seem, some of the best days in the stock market have historically occurred during bear markets. "What we've seen historically is that investors who give themselves a time out of the market very rarely come back in at the right time," says Malwal. "Negative headlines can persist for some time. Investors typically wait for good news and by the time that happens, they've often missed some of the strongest days of market performance." Missing out on those big days can make a significant difference in your long-term return. As the chart below shows, a hypothetical investor who missed just the best 5 days in the market since 1988 could have reduced their long-term gains by 37%.4

3. Holding cash may also be risky

While keeping your money in cash may seem like a wise decision when uncertainty is high and markets seem unpredictable, the sense that it's risk free is somewhat of an illusion. Though your account balance may appear stable, inflation can eat away at its value over time, reducing your purchasing power. For example, if an investor puts $100 into a money market account today that returns 4% annually, it would be worth $104 a year later. However, at a 4% inflation rate, goods that cost $100 today will cost $104. "Historically, a diversified mix of stocks and bonds have provided a better chance of outpacing inflation over the long run, versus investing in short term instruments," says Malwal.

Maintaining composure is key

Understanding the relative effects that recessions, volatility, bear markets, and investor behavior have had on portfolios is a key component to making more informed decisions about when and how to invest. However, even this knowledge may not be enough to assuage investor anxiety when the market declines and portfolios suffer. Thankfully, there are methods available to help investors avoid reactive decision-making.

- Make sure you have emergency savings. Knowing you have enough money on hand to cover your essential expenses and any unexpected needs that might crop up in the event of an emergency can help give you the confidence to let your long-term investments remain in the market. To learn more about establishing and maintaining your emergency savings, read Fidelity's 3 ways to protect your money now.

- Consider dollar-cost averaging. Instead of investing large sums of money all at once, dollar-cost averaging involves investing a portion of that sum on a regular schedule, perhaps monthly, regardless of what direction the market is heading in. Over time, this may help you purchase more shares when prices are lower. To learn more about dollar-cost averaging during bear markets, read Fidelity's An investing strategy for down markets.

- Consider investing defensively. Some economic sectors have been particularly resilient in down markets, especially those that offer essential goods and services, such as utilities, health care, and consumer staples. While past performance is never indicative of future results, investing in defensive sectors such as these can help investors feel prepared for what may come.

- Explore a professionally managed account. With a managed account, investment professionals can help tailor a diversified portfolio in accordance with your goals and risk tolerance. These professionals manage your account based on these preferences and in accordance with a disciplined process of investing and asset allocation that helps to remove emotional or reactive decision-making from the equation. There are different types of professionally managed accounts, but all are geared toward providing you with the information, expertise, and resources to help stay on track during difficult market conditions. To learn more about professionally managed accounts, visit Fidelity® Managed Accounts.