Sometimes an investment that has lost value can still do some good—or at least, not be quite so bad. The strategy that changes an investment that has lost money into a tax winner is called tax-loss harvesting.

Tax-loss harvesting may be able to help you reduce taxes now and in the future.

Tax-loss harvesting allows you to sell investments that are down, replace them with reasonably similar investments, and then offset realized investment gains with those losses. The end result is that less of your money goes to taxes and more may stay invested and working for you.

"It can help a client reach their goals earlier," says Christopher Fuse, asset allocation portfolio manager at Fidelity.

If a professional is managing your investments, they may already be doing your tax-loss harvesting. If you're doing it yourself, it's always a good idea to consult a tax professional. If you’re already working with Fidelity, try our new Tax-Loss Harvesting Tool for step-by-step guidance to see if you can save on taxes while staying invested.

(Learn how one of Fidelity’s managed account solutions could help with tax-smart investing: Make tax-smart investing part of your tax planning.)

Turn market losses into potential tax savings

How tax-loss harvesting can help manage taxes

An investment loss can be used for 2 different things:

- The losses can be used to offset investment gains.

- Remaining losses can offset $3,000 of income on a tax return in one year. (For married individuals filing separately, the deduction is $1,500.)

Unused losses can be carried forward indefinitely.

"Volatile markets, like we experienced in 2020, 2022, and 2023 can be an opportunity. Tax-loss harvesting is very episodic; when it's there, we look to take advantage. We put those additional losses into what we consider to be a 'tax savings account.' Your losses may insulate your taxable gains for several years," Fuse says.

That sounds great, right? But there are some important details to know as you see how tax-loss harvesting might help lower your tax bill.

Short-term versus long-term gains and losses

There are 2 types of gains and losses: short-term and long-term.

- Short-term capital gains and losses are those realized from the sale of investments that you have owned for one year or less.

- Long-term capital gains and losses are realized after selling investments held longer than one year.

The key difference between short- and long-term gains is the rate at which they are taxed.

Short-term capital gains are taxed at your marginal tax rate as ordinary income. The top marginal federal tax rate on ordinary income is 37%.

For those subject to the net investment income tax (NIIT), which is 3.8%, the effective rate can be as high as 40.8%.1 And with state and local income taxes added in, the rates can be even higher.

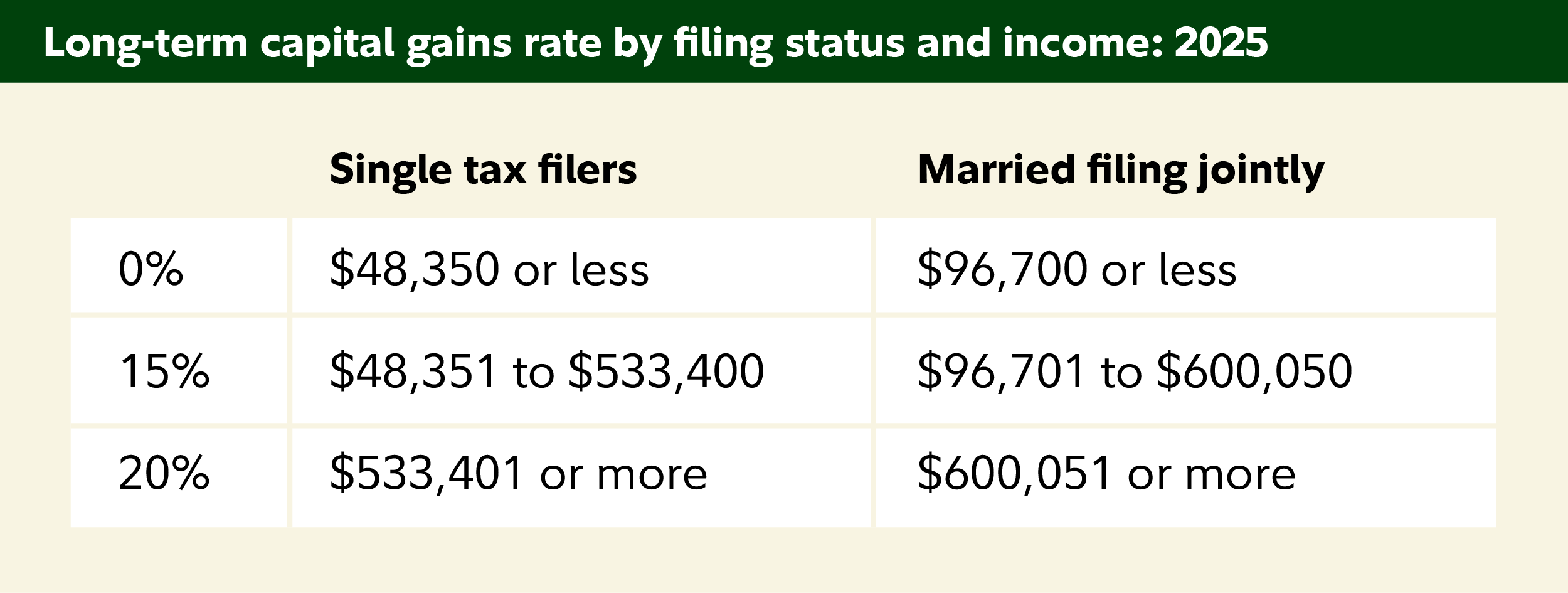

But for long-term capital gains, the capital-gains tax rate applies, and it can be significantly lower.

When the 3.8% NIIT comes into play, the actual long-term capital-gains tax rate for high earners can be as much as 23.8%. And with state and local taxes added in, the rate can be even higher.

Gains and losses in mutual funds

If you're a mutual fund investor, you may have long-term gains in the form of mutual fund distributions. Keep a close eye on your funds' projected distribution dates for capital gains. Harvested losses can be used to offset these gains.

Additionally, mutual funds can also distribute short-term capital gains, which are treated as ordinary income for tax purposes. Unlike short-term capital gains resulting from the sale of securities held directly, the investor cannot offset them with capital losses.

Find out more on Fidelity.com: Mutual funds and taxes

Harvest losses to help enhance your tax savings

When looking for tax-loss selling candidates, consider investments that no longer fit your strategy, have poor prospects for future growth, or can be easily replaced by other investments that fill a similar role in your portfolio.

When you're looking for tax losses, focusing on short-term losses may provide the greatest benefit because they are first used to offset short-term gains—and short-term gains are taxed at a higher marginal rate.

According to the tax code, short- and long-term losses must be used first to offset gains of the same type. But if your losses of one type exceed your gains of the same type, then you can apply the excess to the other type. For example, if you were to sell a long-term investment at a $15,000 loss but had only $5,000 in long-term gains for the year, you could apply the remaining $10,000 excess to offset any short-term gains.

If you have harvested short-term losses but have only unrealized long-term gains, you may want to consider realizing those gains in the future. The least effective use of harvested short-term losses would be to apply them to long-term capital gains. But, depending on the circumstances, that may still be preferable to paying the long-term capital-gains tax.

Also, keep in mind that realizing a capital loss can be effective even if you didn't realize capital gains this year, thanks to the capital loss tax deduction and carryover provisions. The tax code allows joint, single, and head of household filers to apply up to $3,000 a year in remaining capital losses after offsetting gains to reduce ordinary income.

If you still have capital losses after applying them first to capital gains and then to ordinary income, you can carry them forward for use in future years.

Stay diversified, but beware of wash sales

After you have decided which investments to sell to realize losses, you'll have to determine what new investments, if any, to buy. Be careful, however, not to run afoul of the wash-sale rule.

The wash-sale rule states that your tax write-off will be disallowed if you buy the same security, a contract or option to buy the security, or a "substantially identical" security, within 30 days before or after the date you sold the loss-generating investment. People who receive stock or stock-like bonuses from their employer should also consider if their vesting date or employee stock purchase plan (ESPP) purchase date may fall within that 30-day window.

One way to avoid a wash sale on an individual stock, while still investing in the industry of the stock you sold at a loss, would be to consider substituting a mutual fund or an exchange-traded fund (ETF) that targets the same industry.

If you're not sure, you should consult a tax advisor before making the purchase.

Important to know: Wash-sale rules currently do not apply to cryptocurrencies, as they are not regulated as securities. That means you can sell coins whose value has declined, and buy them back immediately at the same price, potentially realizing the loss while still holding the asset. Pending legislation about cryptocurrency regulations may eliminate this loophole, however, so be sure to work with a tax professional to stay on top of changes.

Make tax-loss harvesting part of your year-round tax and investing strategies

The best way to maximize the value of tax-loss harvesting is to incorporate it into your year-round tax planning and investing strategy. Professional portfolio managers like Fuse who specialize in this area even build portfolios with their tax strategy in mind.

"In managing the asset allocation for our taxable portfolio, the team does not use big pieces like a large-cap fund of funds," says Fuse. "We want more individual investment pieces that can help us create tax efficiency. For example, we will look to invest in individual large-cap value, core, and growth funds. This allows us the opportunity to tax-loss harvest as individual securities and styles go in and out of favor."

Fuse is also careful to avoid running afoul of the wash-sale rule. "When we come up with positions, we try to avoid things that would be hard to replace. For instance, I might pick an energy ETF that is similar but not identical to multiple others in risk and return," he says.

Tax-loss harvesting and portfolio rebalancing are also a natural fit. In addition to keeping your portfolio aligned with your goals, a periodic rebalancing provides an opportunity to reexamine lagging investments that could be candidates for tax-loss harvesting.

If your employer awards stock or stock-like bonuses, selling for a tax loss in anticipation of new stock awards being announced can be a good strategy to ensure your stock-based bonuses don’t accumulate more than you intend. That could tip the balance of your portfolio to a heavier concentration in your company stock.

Select the most advantageous cost basis method

Finally, take a look at how the cost basis on your investments is calculated. Cost basis is simply the price you paid for a security, plus any brokerage costs or commissions.

If you have acquired multiple lots of the same security over time, either through new purchases or dividend reinvestments, your cost basis can be calculated either as a per-share average of all the purchases (the average-cost method) or by keeping track of the actual cost of each lot of shares (the actual-cost method).

For tax-loss harvesting, the actual-cost method has the advantage of enabling you to designate specific, higher-cost shares to sell, thus increasing the amount of the realized loss. Learn more about capital gains and cost basis.

Don't undermine investment goals

Remember this saying: Don't let the tax tail wag the investment dog. If you choose to implement tax-loss harvesting, be sure to keep in mind that tax savings should not undermine your investing goals. Ultimately, a balanced strategy and frequent reevaluation to ensure that your investments are in line with your objectives is the smart approach.

If you're interested in implementing a tax-loss harvesting strategy but don't have the skill, will, or time to do it yourself, a Fidelity professional may be able to help.