Whether you're a seasoned philanthropist or you just started giving back, you have an opportunity to continue making an impact with smarter charitable giving—and it's as easy as picking the right asset.

When it comes time to support their favorite causes, many donors instinctively reach for their checkbook or cash. Instead, you can potentially maximize the impact of your giving for both you and the charity when you consider giving often overlooked non-cash assets, such as appreciated stocks in your portfolio, privately held business interests, or even cryptocurrency.

Because long-term appreciated holdings or investments may be prime assets for tax-efficient giving, exploring this strategy has the power to potentially take your philanthropy—and your overall financial plan—to the next level.

Give more than just after-tax proceeds

What if you could maximize your charitable impact and tax savings at the same time, all by using an asset that will give you a much bigger bang for your buck?

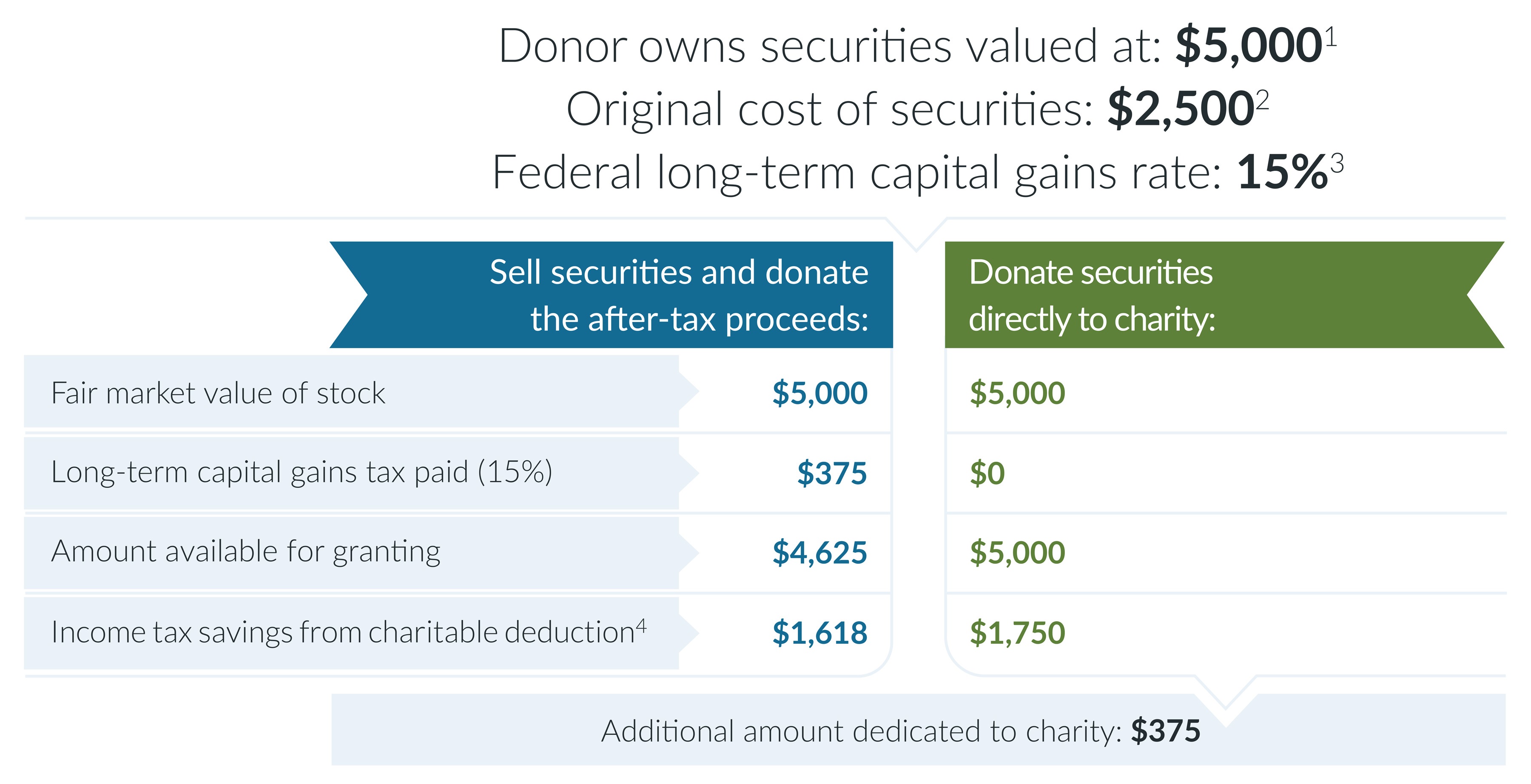

Consider this hypothetical example. As a charitably minded individual, say you make a $5,000 cash gift each year to your favorite charity. While you usually just write a check, you also hold stock with a current fair market value of $5,000 that you purchased at least one year ago for $2,500.

Perhaps your first thought is to sell the long-term appreciated stock, pay the capital gains tax, and then donate the net cash. Assuming a 15% capital gains rate, you'd only have $4,625 in net proceeds to donate, compared to the stock's current fair market value of $5,000 or your $5,000 check.

This hypothetical case study is provided for illustrative purposes only, It does not represent an actual donor but is meant to provide an example of how a donor-advised fund can help individuals give significantly more for the causes they care about. Information provided is general and educational in nature, and should not be construed as legal or tax advice. Fidelity Charitable does not provide legal or tax advice. Content provided relates to taxation at the federal level only, and availability of certain federal income tax deductions may depend on whether you itemize deductions. Rules and regulations regarding tax deductions for charitable giving vary at the state level, and laws of a specific state or laws relevant to a particular situation may affect the applicability, accuracy or completeness of the information provided. Charitable contributions of capital gains property held for more than one year are usually deductible at fair market value. Deductions for capital gains property held for one year or less are usually limited to cost basis. Consult an attorney or tax advisor regarding your specific legal or tax situation.

In this instance, contributing the stock directly to the charity is a more effective donation than just giving the after-sale proceeds: You have more money to give to support the charity's mission.

Maximize both your tax benefits and charitable impact

Donating your stock directly to the charity also unlocks 2 key tax benefits for you: It may eliminate the capital gains tax you are facing on the sale of the stock, and the stock donation is tax deductible at the current fair market value. As a result, the most long-term appreciated stock in your portfolio is often the best to donate because it offers the greatest potential tax benefit. However, be mindful that you may want to rebalance your portfolio after the donation to align back to your target asset allocation.

You could also maximize your charitable gift. Because the charity does not need to pay the capital gains tax, it can now sell the stock you donated for its current fair market value of $5,000 and keep 100% of the proceeds.

In this example, whether you donate cash or appreciated public stock, the charity receives $5,000. But only your donation of stock allows you to give the same amount while also realizing those key tax benefits.

Apply the formula to other appreciated assets

When considering which asset to give as part of this strategy, you can look beyond the traditional publicly traded securities in your portfolio. Vested shares in your company stock derived from an equity compensation program could be a powerful source of charitable funding. Long-term appreciated private company C- or S-corp stock, private equity partnership interests, or Bitcoin and other cryptocurrencies can also help you realize the same tax benefits.

Key considerations when donating complex assets include whether an asset can be transferred and liquidated, how long the process will take and what timing makes the most sense, how to determine its fair market value, and how much an appraisal will cost. Consider working with an organization that has a team of seasoned professionals who focus on processing complex asset donations. Their expertise can be helpful as you navigate how to make the most effective and impactful gift.

Make the gift hassle-free

While some charities may be willing to accept non-cash gifts directly, doing so requires technical administration and costs to the charity to review, accept, and process the contribution. Bringing more complex assets into the picture could even further complicate that process for the charity. Ultimately, those extra steps could reduce the amount of your donation and provide fewer funds for your chosen cause.

When you're considering making this type of donation, leveraging a charity with both a donor-advised fund (DAF) program and a specialized complex asset team can be a smart move. The charity will have the guidance and resources to manage your complex contribution from end to end.

Whether you want to give long-term appreciated public stock or a complex asset, combining a non-cash donation with a donor-advised fund vehicle helps you streamline your giving—enabling you to support multiple charities from a single tax-advantaged charitable gift while keeping recordkeeping and administration simple throughout the year.

Your portfolio may contain powerful assets that you can use to fund your giving while you wisely manage your financial future. Tap into smarter charitable giving with assets beyond cash, and you can make more of a difference for the causes you care most about.