In March, President Trump signed an executive order establishing a Strategic Bitcoin Reserve for the government of the United States. The mandate officially designated all bitcoin and a number of other cryptocurrencies currently held by the government as reserve assets.

While the full impact of the executive order may remain to be seen, 2025 made one thing clear: Crypto is finding mainstream acceptance. It can no longer be viewed as just a volatile form of speculation for “degens” (short for “degenerate,” a term crypto traders call themselves due to the wild nature of crypto markets and the mentality needed to survive them), but a store of value legitimized by the US government.

What could that mean for the crypto markets as we head into 2026? Could the deep pullback we’re currently seeing in prices mean the bull run is over? And could it be it too late to invest in crypto? Here are several key trends to watch.

Will more countries adopt crypto reserves?

Many countries around the world currently hold some amount of crypto, but few have officially established crypto reserves, which involves designating the crypto they hold as strategic financial assets designed to serve national interest.

This started to change in 2025 (the most notable example being President Trump’s executive order in March) and could progress in 2026.

For example, in September, Kyrgyzstan passed a bill establishing their own crypto reserve. Elsewhere, more countries are starting to at least explore the possibility. Brazil’s Congress recently advanced a bill that would allow up to 5% of the nation’s international reserves to be held in bitcoin (though it remains to be seen whether the bill becomes law).

“Fidelity Digital Assets® thinks more countries may buy bitcoin in the future due to game theory,” says Chris Kuiper, Vice President of Research, Fidelity Digital Assets®. "If more countries adopt bitcoin as part of their foreign exchange reserves, then the pressure for other countries to also do it could increase, as they may feel competitive pressure."

What could this mean for prices? “Any additional demand for bitcoin may push up the price in terms of simple supply-demand economics,” says Kuiper. “But of course the key will be how much more incremental demand there is, and whether other investors are selling or holding.”

Will corporations continue buying cryptocurrencies?

Governments aren’t the only potential source of new demand in 2026. Corporations may increasingly get in on the action, some of which started adding bitcoin and other cryptocurrencies to their balance sheets in 2025. Thus far, one of the most publicized examples has been software and analytics company Strategy—formerly known as MicroStrategy (

“There is clearly an arbitrage opportunity, where some corporations can use their position or access to capital markets to raise capital and use it to purchase bitcoin,” says Kuiper. “Some of this stems from investment mandates and geographic and regulatory issues. For example, investors who may not be able to buy bitcoin directly may choose to gain exposure through these corporations, or the securities they offer.”

At face value, corporations buying crypto increases market demand, which can help boost asset prices. But investors should be aware of the risks as well. “If these companies choose to or are forced to sell some of their digital assets—for example, if a bear market occurs—this could of course put downward pressure on the price of bitcoin or other digital assets that some of these companies hold,” says Kuiper.

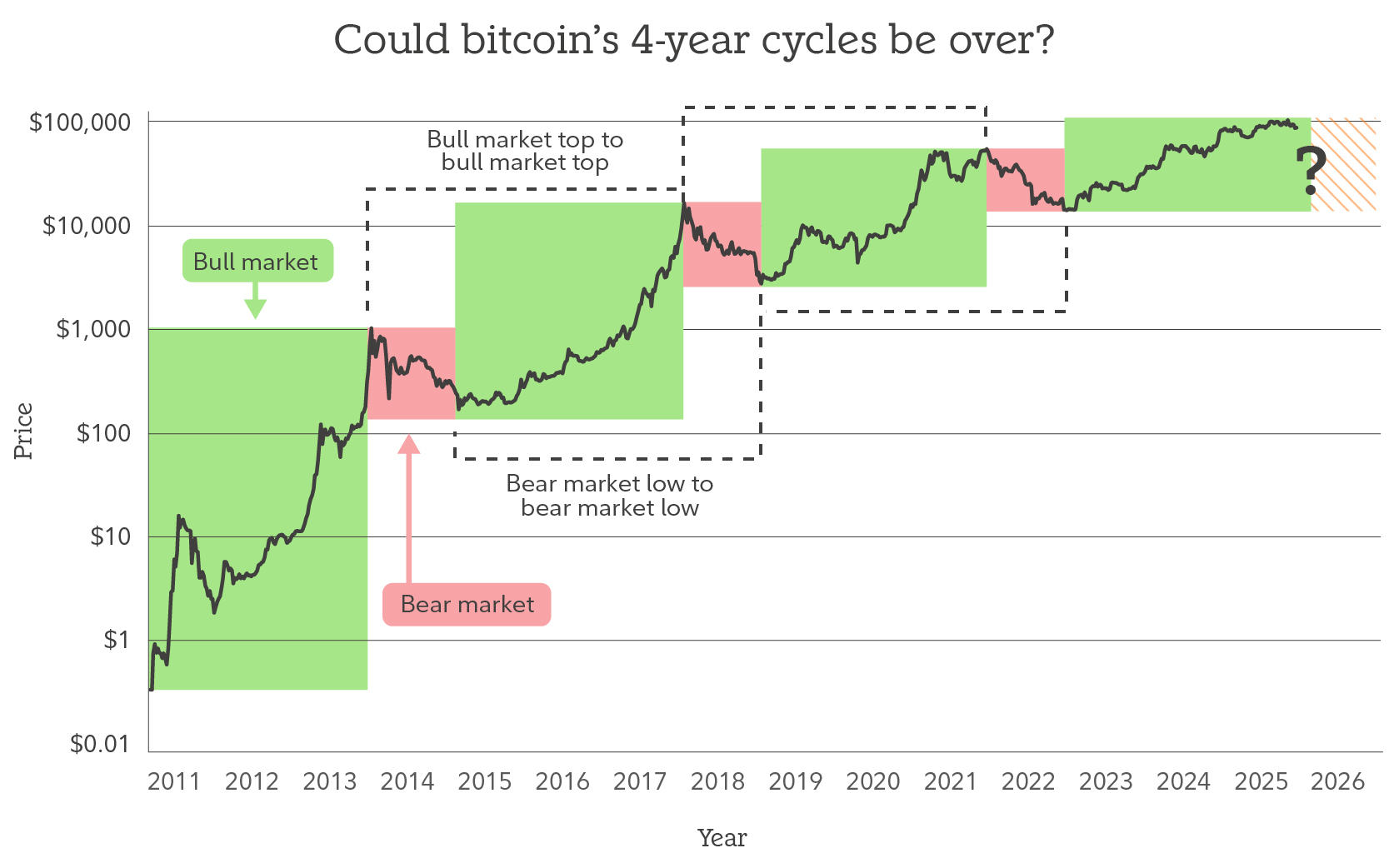

Could 4-year cycles be over?

During bitcoin’s brief history relative to traditional investments like stocks and bonds, its price has moved in roughly 4-year cycles (measured from bull market top to bull market top, or bear market bottom to bear market bottom). It formed bull market tops in November 2013, December 2017, and November 2021, as well as bear market bottoms in January 2015, December 2018, and November 2022. These cycles have been accompanied by significant price swings. The first cycle saw a drop from $1,150 to $152, the second, from $19,800 to $3,200, and the third, from $69,000 to $15,500.

And as bitcoin behaves, the rest of the crypto market has tended to follow—in many cases in even more dramatic fashion.

Currently, we’re right around the 4-year mark of the current cycle, as the last bull market topped in November 2021. And over the last month, crypto prices have been dropping. So could the current bull market have topped?

If the 4-year cycle repeats, we could be at or near the end of the current bull market for bitcoin. However, some crypto investors think this historic trend is coming to an end, and that the current drawdown in price is just a temporary pullback before the market resumes its uptrend.

What does this mean, specifically? Some investors believe that while there will still be pullbacks in price, any drops will be substantially less volatile than they have been in the past, and could be small enough that they won’t feel like full-blown bear markets. Others believe we could be entering a supercycle, where the bull market continues for years into the future. For reference, a supercycle in commodities in the 2000s spanned nearly a decade.

Kuiper doesn’t think these cycles are altogether dead, as the fear and greed that create them haven’t magically disappeared. However, he notes if the 4-year cycle was to repeat, we would need to have already put in the all-time high of the cycle, and be continuing into a full-blown bear market. While the drawdown in November has so far been severe, he notes we may not know until 2026 whether it confirms a 4-year cycle. The current drop in price could be the start of a new bear market, or it could just be a bull market drawdown that resolves in new all-time highs, like what we’ve seen a few times so far this cycle.

Whether these predictions come true remains to be seen, and we may not know for sure until well into 2026.

Is there still time to buy bitcoin?

While a lot of uncertainty for cryptocurrencies remains, one thing has become more clear: The crypto market is entering a new paradigm. “We continue to see a shift to an entirely new cohort and class of investors, and I think this will continue in 2026,” says Kuiper. “We’ve seen traditional money managers and investors begin to buy bitcoin and other digital assets, but I think we’ve only scratched the surface in terms of the possible amount of money that they could bring into this space.”

In light of this, investors who haven’t entered the market may be wondering if it's still a good time to buy bitcoin.

For Kuiper, it depends on your time horizon. If you’re hoping to capture gains in the short or medium term (4 to 5 years or less), there’s a chance you may be late, especially if this cycle ends up following historical precedent.

“However, on a very long-term time horizon, I personally do not think you can ever be fundamentally late to bitcoin if you are thinking of it as a store of value,” says Kuiper. “As long as its hard supply cap remains in place, I believe potentially every purchase of bitcoin is putting your labor or savings into something that won’t lose value due to inflation resulting from government monetary policy.”