Those who are considering adding crypto to their portfolio likely have a lot of questions. Among them: Has crypto historically been able to enhance portfolio returns, increase diversification, and hedge against inflation? Can it really offer these benefits, especially considering crypto's volatile history and recent instability?

Fidelity examined several theories related to bitcoin, the oldest and currently the largest cryptocurrency by market cap. In a recent study, we compared bitcoin's historical data to that of stocks, bonds, and gold in various contexts.

Below is a summary of the key findings. Keep in mind they're specific to bitcoin, may not apply to other cryptocurrencies, and are for educational purposes only.

Also note that all analysis is based exclusively on past data, which means the implications may shift as the number of people that own bitcoin changes and the broader cryptocurrency markets evolve.

A note about buying bitcoin

Before we proceed, remember that crypto is highly volatile, and may be more susceptible to market manipulation than securities. Crypto holders do not benefit from the same regulatory protections applicable to registered securities, and the future regulatory environment for crypto is currently uncertain.

Crypto is also not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation, meaning you should only buy crypto with an amount you're willing to lose.

Has bitcoin historically enhanced portfolio returns?

Fidelity found that bitcoin boosted a portfolio's returns during specific periods in the past, though it also came with substantial volatility.

From August 1, 2010 (when monthly pricing for bitcoin first became available) to March 31, 2024 (the study’s defined end date), bitcoin generated average annual returns of 178%. Note that a significant portion of these gains were made in the early days of trading, which may have experienced more volatility than it will see going forward.

In 2018, the bitcoin futures market launched, which enhanced pricing efficiency and brought in new market participants. Since that time, bitcoin has generated average annual returns of roughly 29.6%.

Of course, it's important to note that past performance is no guarantee of future results. Bitcoin is an emerging asset that comes with extreme volatility. Investors should keep in mind that its value has both the potential to significantly increase or decline in the future, as year-to-date performance has shown.

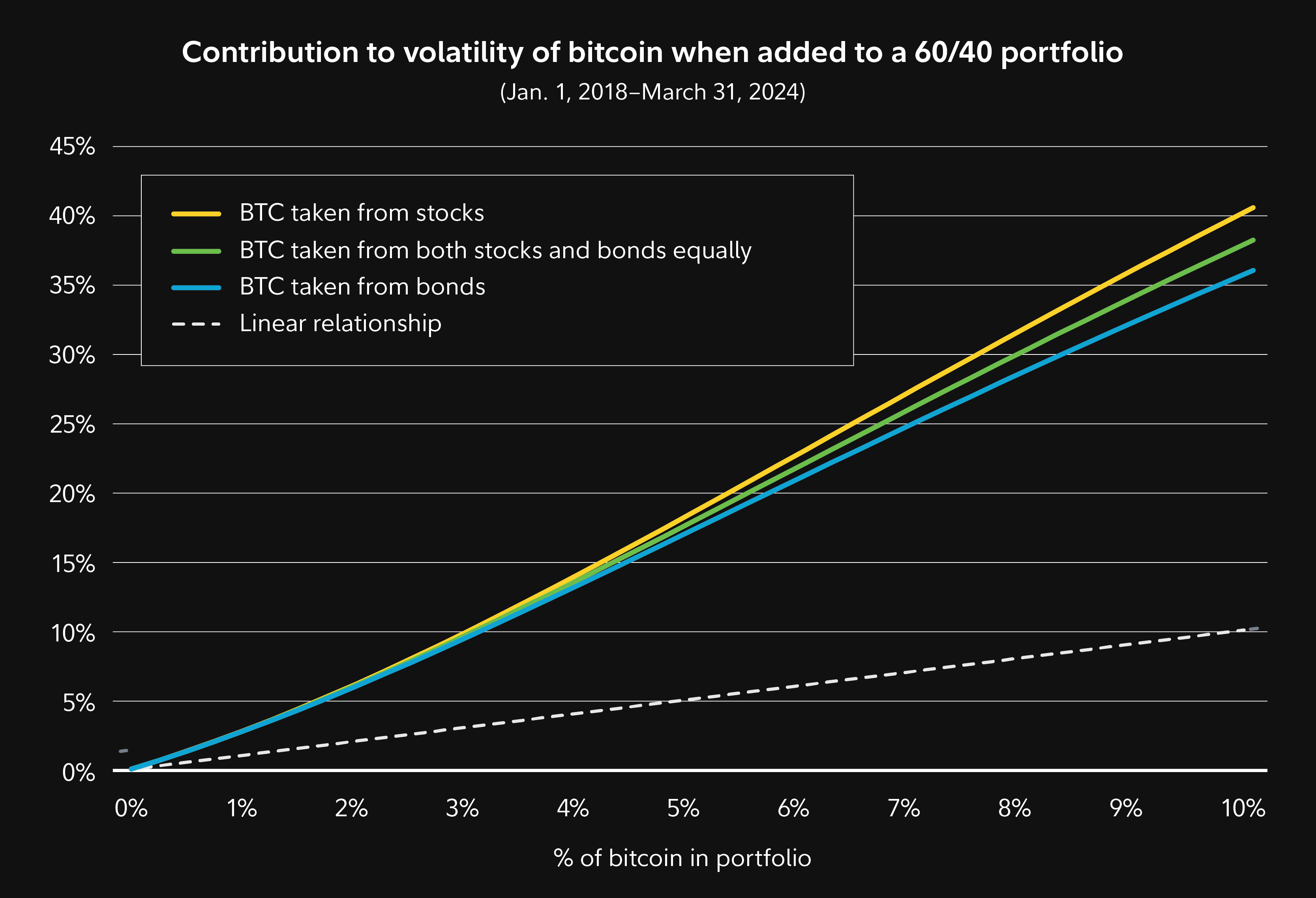

To help analyze bitcoin's risk, Fidelity ran a simulation that added varying amounts to a traditional 60/40 portfolio (i.e., a mix of 60% stocks and 40% bonds). This was based on historical performance of all assets from January 1, 2018 (after the first bitcoin futures contracts started trading) to March 31, 2024. The goal was to evaluate the proportion of risk bitcoin would account for if it replaced part of the stock portion, bond portion, or equal amounts of both stocks and bonds.

The study found that even a small allocation of bitcoin meaningfully increased volatility, which includes both increases and decreases in simulated prices. For example, replacing 1% of the stock or bond portion (or 0.5% from each) with bitcoin contributed about 2.7% of the portfolio’s overall volatility. The study also found that the risks increase exponentially. Replacing 5% of the stock portion, or 2.5% from both stocks and bonds, with bitcoin contributed 17.8% of portfolio volatility.

Did bitcoin increase portfolio diversification?

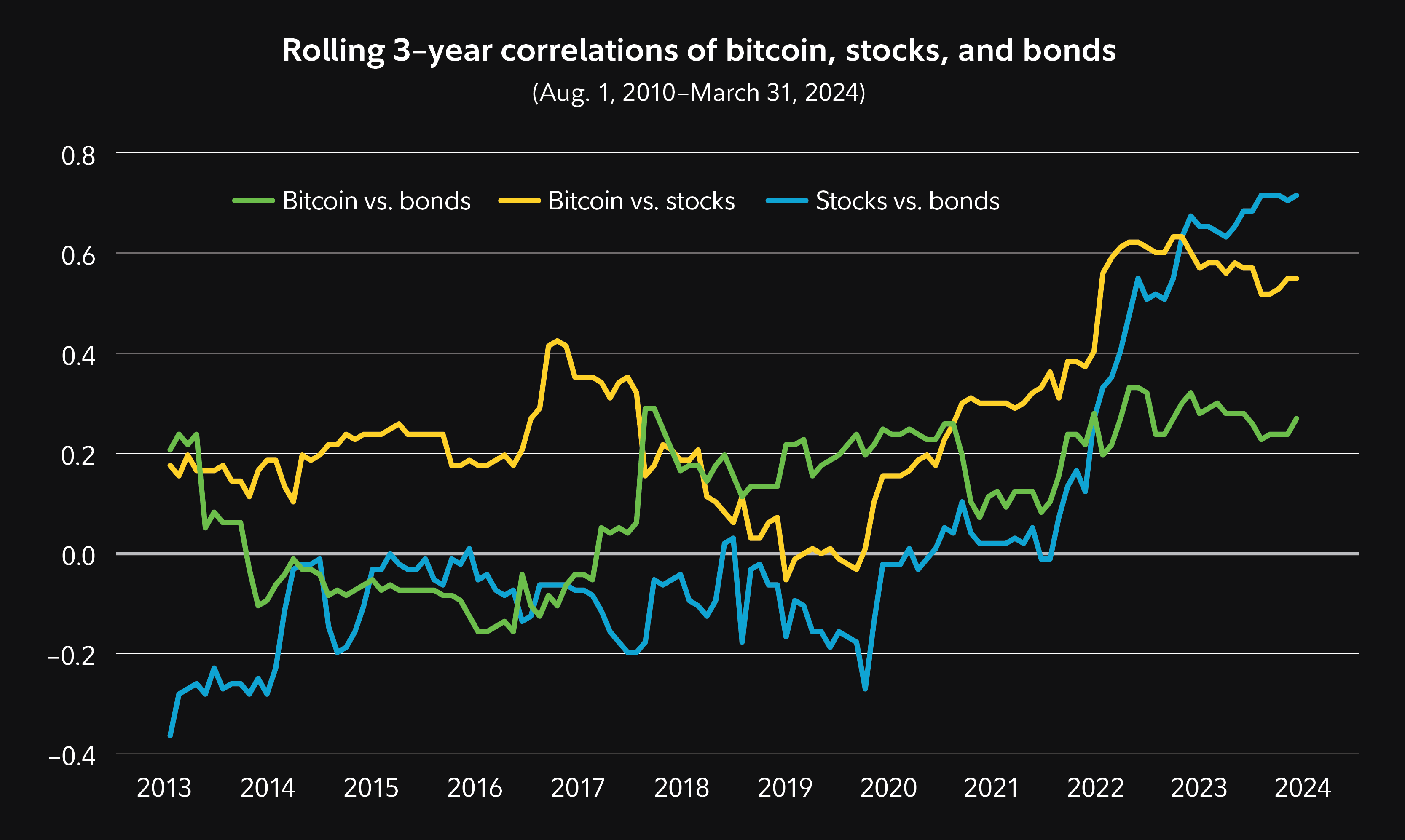

Based on historical data, Fidelity found that bitcoin did have the potential to help diversify a multi-asset portfolio. To study this, we used the timeframe from August 1, 2010 through March 31, 2024 to capture as much relevant data as possible.

During the most recent 3-year period for this data set, bitcoin’s correlation with stocks was 0.53, and 0.26 with bonds. Correlation is measured on a scale from -1 to 1, with -1 indicating a negative correlation, and 1 indicating a positive correlation. In simple terms, this means that bitcoin didn’t move perfectly in line with stocks or bonds during this period, and therefore could’ve helped enhance portfolio diversification during this period.

Of course, this doesn’t mean that it’s guaranteed to do the same in the future.

Another key question for investors to explore when evaluating risk is how bitcoin has performed during down markets compared to assets like stocks, bonds, and gold. To answer this, Fidelity looked at the performance of the S&P 500 during its worst months over bitcoin’s 13-year history, then studied the median returns of stocks, bonds, gold, and bitcoin in those months. Note that the study had a relatively small sample size to work with, and the following findings should be viewed within this context.

Fidelity found that in periods when stocks performed the worst, bonds and gold posted better median returns than bitcoin. However, bitcoin also significantly outperformed in months where stocks delivered top-quartile performance. Using the same methodology and looking only at months when stocks performed best, bitcoin tended to outperform stocks, bonds, and gold.

In simple terms, Fidelity’s analysis suggests that bitcoin tends to follow the big-picture direction of the stock market, but with greater magnitude. When stocks perform poorly, bitcoin’s price has typically fallen even harder. When stocks are strong, its price has historically outperformed.

Can bitcoin be a good hedge against inflation?

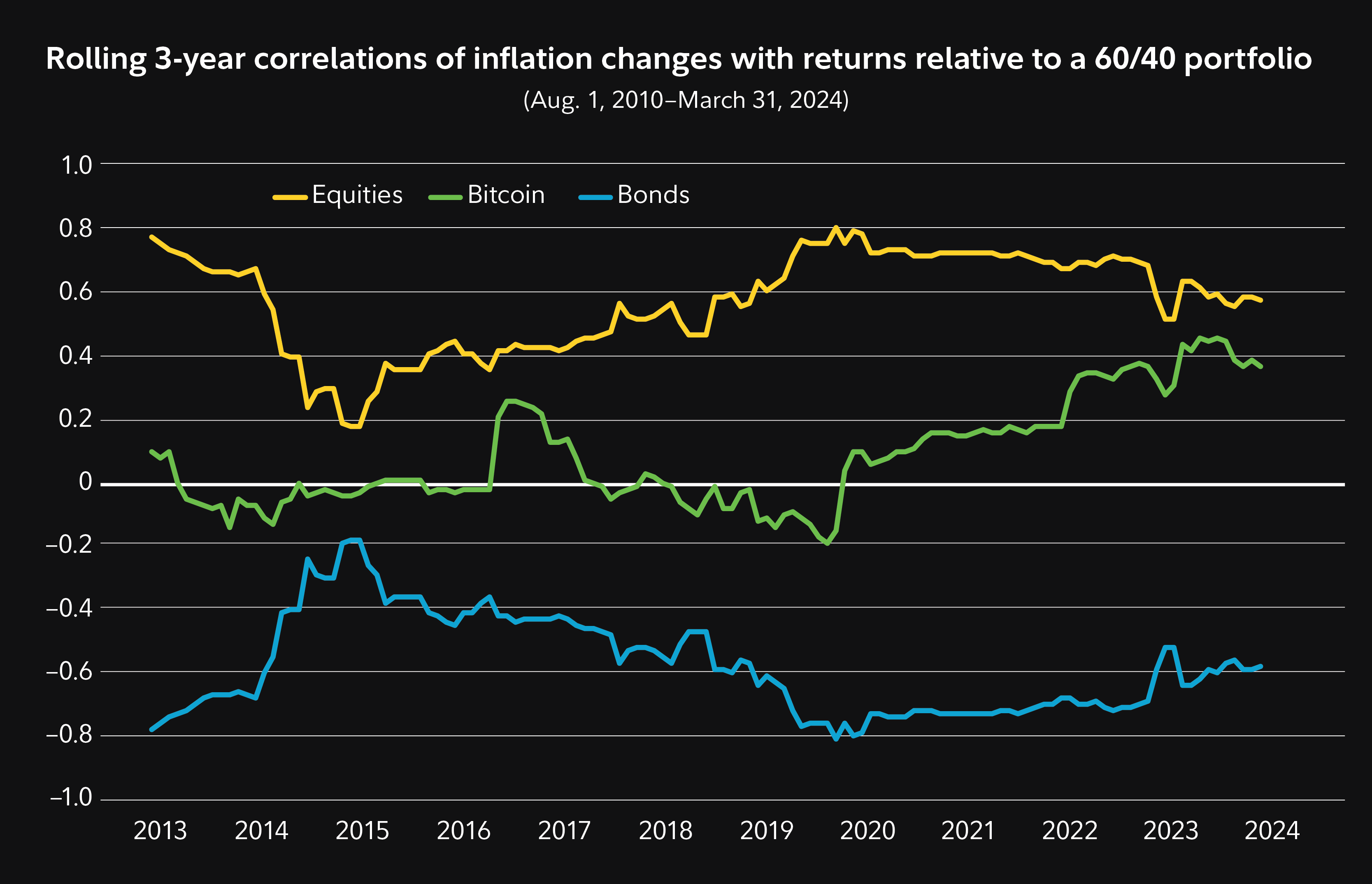

Some bitcoin advocates argue that it will one day become an inflation hedge. To study this possibility, Fidelity compared how equities, bonds, and bitcoin performed during periods of high inflation against a traditional 60/40 stocks/bonds portfolio.

Our findings showed that bitcoin has shown an increasing correlation to inflation changes, almost equal to that of equities. If the level of inflation remains high, bitcoin’s potential outperformance relative to equities could offer a way for investors to protect purchasing power.

Note, however, that this is based on limited data, given that inflation has been low throughout most of bitcoin’s history.

Considerations for adding bitcoin to your portfolio

If you're thinking about including bitcoin in your portfolio, the chart below may help you determine how much of your portfolio to allocate.

In this analysis, Fidelity looked at three portfolio types: a risk-averse portfolio (40/60 equities bonds mix), a traditional portfolio (60/40 equities/bonds mix), and a riskier portfolio (80/20 equities/bonds mix). We then determined what the return on bitcoin in each portfolio would need to be in order to justify different bitcoin allocation sizes while keeping overall simulated volatility constant. The analysis was based on historical returns, risk, and correlations for equities, bonds, and bitcoin from January 1, 2018 to March 31, 2024.

The study found that a traditional 60/40 investor would need bitcoin to earn 19.2% in average real returns per year to justify allocating 3% of their portfolio to bitcoin. Less risk-averse investors (80/20 mix) would need a 12.5% average real return per year to justify that same 3%, and risk-averse investors (40/60 mix) would need a 31.8% average real return per year.

Note that this isn't meant to be a prediction of any kind, since past performance is no guarantee of future results. It's just meant to show how investors' risk tolerances and convictions about bitcoin are important considerations.

Being aware of these numbers may help you determine whether bitcoin makes sense for your portfolio, assuming you understand the risks and want to add it to your investment mix. More importantly, each investor's situation is unique, and the decision to invest needs to align with your objectives, risk constraints, liquidity needs, and tax situation.

Summing it up

Fidelity's research given bitcoin's limited history has shown that it:

- Has outperformed traditional assets at times in the past, but with potential for extreme volatility.

- Has had the potential to enhance portfolio diversification, though correlations with traditional assets have fluctuated.

- May have potential to become an effective inflation hedge relative to equities.

Investors thinking about adding bitcoin to their portfolio should consider prioritizing risk, as the cryptocurrency market has been very volatile. Perhaps more importantly, it doesn't yet have the long-term histories of the stock and bond markets, which means it's tough to confidently estimate its returns.

One practical way to account for this is to think about your own return expectations for bitcoin, and invest in ways that are consistent with your risk tolerance. Also remember that bitcoin is still an emerging asset, and its impact on portfolios may evolve over time. As such, consider investing with a long-term horizon in mind. This may help you stomach the dramatic ups and downs while the crypto market looks for stability.

Finally, remember that crypto is highly volatile, and may be more susceptible to market manipulation than securities. Crypto holders do not benefit from the same regulatory protections applicable to registered securities, and the future regulatory environment for crypto is currently uncertain.

Crypto is also not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation, meaning you should only buy crypto with an amount you're willing to lose.