How is crypto different from cash?

Cryptocurrency vs. cash

The differences between crypto and cash

From volatility to protection and supply to control, cryptocurrencies are very different from cash. Here are some of the major differences to get you started in your research—note, this is not a full list.

Value and volatility

A dollar in your pocket today is still a dollar tomorrow.

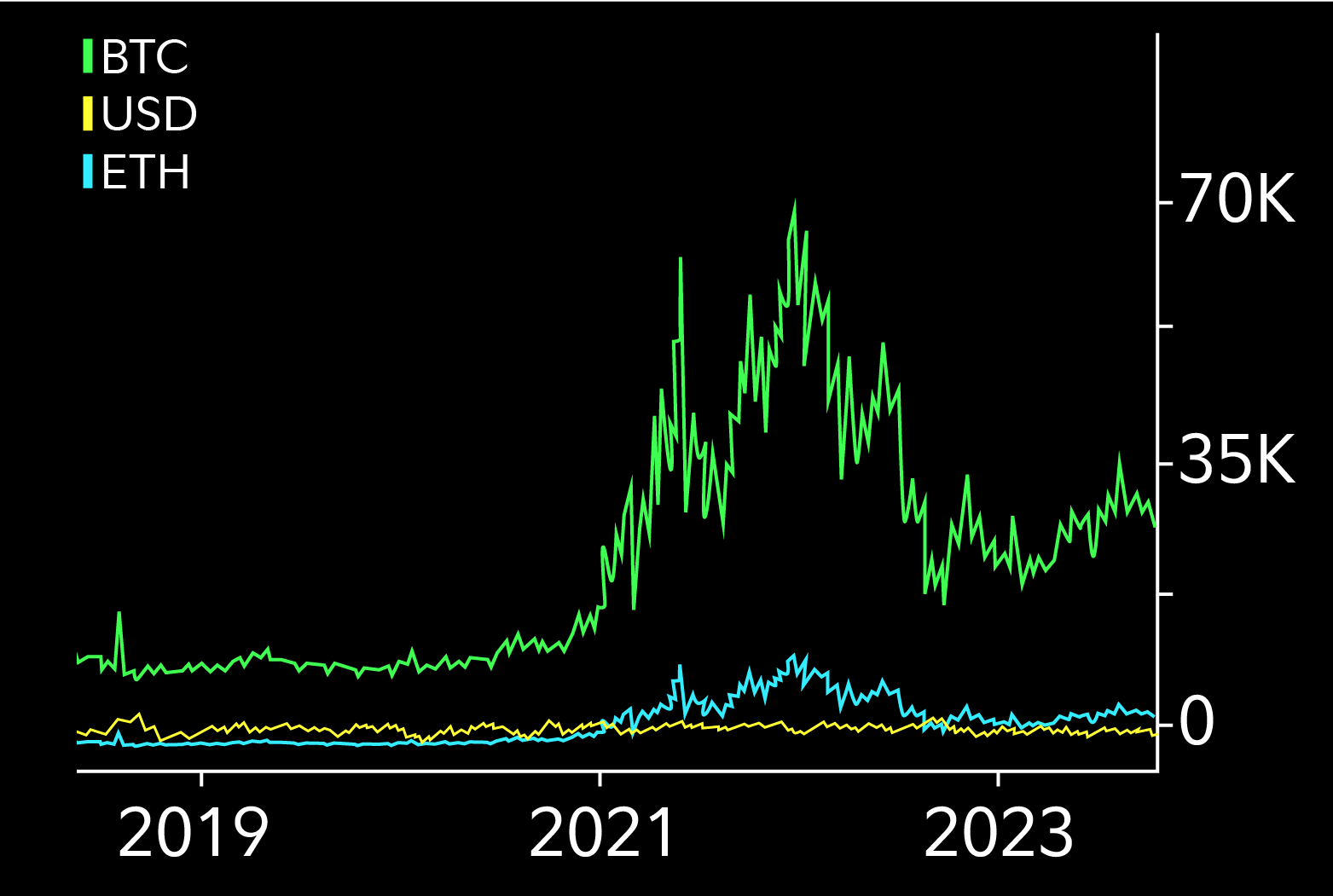

But the market value of cryptocurrencies is very volatile and can change from day to day and even minute to minute—though not all cryptocurrencies are the same. Below shows the market value of bitcoin, ethereum, and cash.

Above shows the market value of bitcoin, ethereum, and cash since 2019. Past performance is no guarantee of future results.

Control

Cash is a centralized fiat currency, meaning it’s issued, backed, and maintained by the government. Centralized means there is one person or entity with control. For example, digital cash transactions are made through a third party, like paying for something with your bank credit card or sending a brunch payment on your favorite payment service.

Cryptocurrencies, on the other hand, were created to be decentralized with the goal of removing third parties. All you need is an internet connection and a crypto wallet to complete a transaction directly to another person. And since all crypto transactions live on a blockchain, they cannot be changed, manipulated, or deleted and can be seen or tracked at all times.

Did you know?

The U.S. dollar was considered a “commodity currency” and was backed by gold until 1971.

Safety and security

Keeping your money in a bank or financial institution may reduce the risk of lost or stolen cash. They have strong, audited security measures in place. But printed cash can be counterfeited.

Cryptocurrencies can be stored two ways: self-custody or third-party custody. If providing your own custody, you are fully responsible for keeping your crypto safe. If using a third-party, like Fidelity Digital Assets® offering Fidelity Crypto®, they can manage security for you. But not all cryptocurrencies are created equally. Some networks have higher scam or hack risk than others.

Protection

The FDIC (Federal Deposit Insurance Corporation) is a government agency that insures cash deposits at member banks. This means if you deposit your money in a member bank, the FDIC will insure up to $250,000*.

There are no such organizations that protect against crypto losses. If you lose your crypto, there is no recovery or protection option.

Regulations

From the serial numbers to water marks, there are clear, established regulations around currencies like the U.S. dollar.

However, regulations for cryptocurrencies continue to evolve and could change at any time, which can cause uncertainty and volatility. Regulations also vary based on your location.

Supply

Governments control the cash supply. For example, in the U.S., the Federal Reserve can print new money and increase cash supply when they feel it would benefit the economy.

But because cryptocurrencies are not controlled by the government, their supplies may vary. For example, bitcoin has a finite supply, meaning only a limited amount will ever exist. Once all bitcoins have been released into circulation, no more will be created. Other cryptocurrencies, like ethereum, have an undefined supply.

Accessibility

You can withdraw cash at certain locations, like a bank branch or an ATM. But sometimes there can be restrictions, like banks closing on weekends or ATM withdrawal limits.

Cryptocurrencies are digital only, so you’ll never actually hold a bitcoin in your hand like you would a $20 bill. But blockchains are active 24/7, including nights, weekends, and holidays.

Acceptance

Usage of paper currency in the U.S. has been documented as early as 1690.2 It has evolved to the coins and bills we use today, but that means the cash system has been around for over 300 years.

The first successful cryptocurrency launched in 2009, so the crypto market is still new and has proven to be unpredictable and volatile.

The bottom line

There are many differences between cryptocurrencies and cash. Sure, you could potentially use bitcoin or ethereum to purchase things or hold it as an investment—but that’s it. They have intrinsically different properties and are not a substitute for each other.

Crypto vs. cash

Crypto vs. cash