From social media to newsfeeds, crypto has generated a lot of buzz. And for good reason: its volatile prices have both boosted and damaged portfolios around the world in dynamic fashion. But just because it's becoming more well known doesn't mean it's well understood. Here's what you need to know about the basics of cryptocurrency.

What is crypto?

Crypto is a digital currency, meaning it runs on a virtual network and doesn't exist in physical form like paper money or coins. Cryptocurrencies are often built using blockchain technology, a shared digital ledger that provides a secure recordkeeping and processing system for all of their transactions.

Many crypto analysts think cryptocurrencies are notable for 2 main reasons. First, they can typically be transferred without using a third party, such as a bank. By contrast, popular peer-to-peer payment platforms, like Venmo, PayPal, or Zelle, require connections to bank accounts to run.

Second, they are designed to be decentralized, meaning they're generally not backed, controlled, or owned by any government, central bank, or corporation. Instead, decentralized cryptocurrencies operate according to computer software that anyone with internet access can download and use to monitor and verify transactions. The US dollar, on the other hand, is backed by the US government and regulated by the US Federal Reserve.

How does cryptocurrency work?

Let's start by looking at its name. The "crypto" in cryptocurrency refers to the software codes that protect, or encrypt, cryptocurrency networks, allowing them to offer secure transactions and maintain decentralization. Normally, a country's central bank is tasked with regulating its currency to ensure its value, and financial institutions, like banks and credit card companies, help in preventing fraud. Cryptocurrencies use encryption and blockchain technology to perform similar functions.

When a transaction takes place, a network of computers running blockchain software verifies that the payment is possible between the parties involved and then executes it. The blockchain also keeps a log of transactions to help ensure transparency within the network. To encourage people to verify blockchain transactions, those who verify transactions, called miners or validators, receive compensation when new transactions are added to a blockchain transaction log. Once a transaction is validated, recipients can access funds using their private key.

How does cryptocurrency have value?

Cryptocurrencies' values are generally based on supply and demand, meaning their prices are determined by how much others want to use or own a given coin, the supply of the crypto, and how useful people expect it to be in the future.

Crypto prices can also be influenced by news about how companies plan to use crypto, world events, and even how governments decide to legislate and regulate it.

What is cryptocurrency used for?

As a currency

One of the foundational aims of bitcoin, the oldest and currently largest cryptocurrency by market cap, is to be used as a medium of exchange (i.e., to be used to pay for goods and services).

Currently, however, users are more likely to treat it as a store of value, rather than as a medium of exchange. There are many possible causes for this, but one of the most significant reasons may be the extreme price swings digital currencies currently experience. Bitcoin has been known to fluctuate by double-digit percentage points in a single day.

Instead, stablecoins, a special type of cryptocurrency we’ll cover further below, have become the primary medium of exchange among digital assets.

Outside of bitcoin, altcoins (any cryptocurrency that isn’t bitcoin) can be used to transfer value and interact on DeFi (short for “decentralized finance”) platforms, where users expect and account for crypto’s volatility during transactions.

Crypto can also facilitate the flow of money from people in one country to those in another as anyone with internet can send it at any time for a very low cost without worrying about business hours, traditional currency conversions, or international wires.

This flexibility can be particularly helpful for sending money to friends and family.

As an investment/store of value

Due to some cryptocurrencies' historical price performance and potential to provide diversification among traditional assets, like stocks and bonds, cryptocurrencies have caught the eye of millions of individual investors.

Financial institutions, like large investment funds, brokerages, and banks, have also been leaning into crypto.

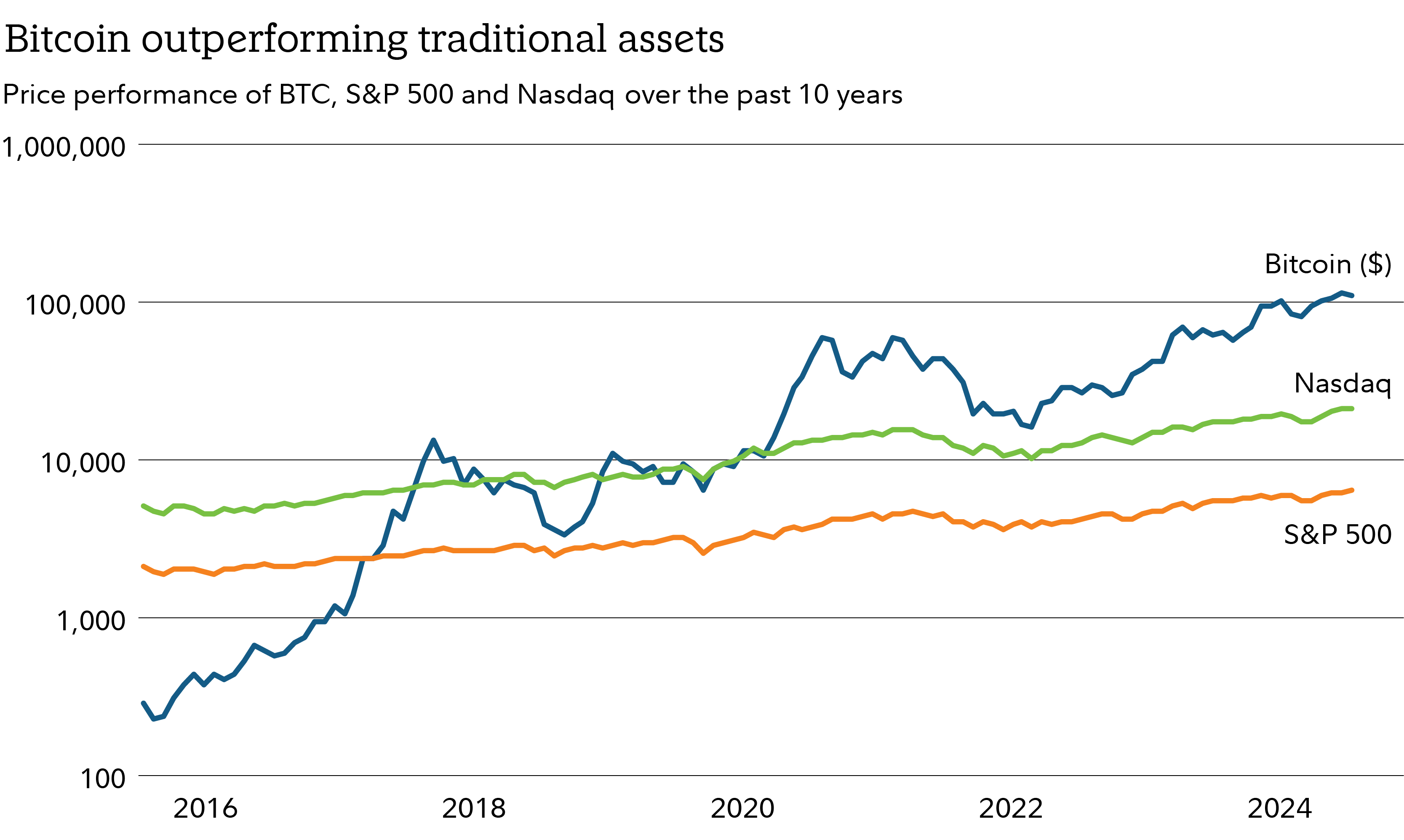

Despite its sometimes substantial day-to-day fluctuations in value, bitcoin has historically outperformed many traditional assets over the long term (though note that past performance is no guarantee of future results).

Thus, some investors also believe it can be used as a store of value to hedge against inflation and broader macroeconomic uncertainty.

Largest cryptocurrencies

Bitcoin

Bitcoin (BTC) is currently the largest cryptocurrency by market cap, and most well-known cryptocurrency in the world. Launched in 2009 by Satoshi Nakamoto, a pseudonymous person or group of people, it was the first cryptocurrency that allowed peer-to-peer transactions using blockchain technology. Bitcoin (with a capital B) refers to the network that bitcoin (with a lowercase b) runs on.

Bitcoin uses a proof-of-work system to validate transactions on the network. This means that transaction verifiers, or miners, compete to solve a mathematical puzzle using specialized computers through a process called "bitcoin mining." The reward for being first to solve the puzzle and mine a block of bitcoin is a predetermined amount of bitcoin. Bitcoin has a fixed supply of 21 million and a deflationary "halving" feature. With this halving feature, the reward for mining a block of bitcoin is cut in half approximately every 4 years.

Bitcoin's price has been far from steady. Between late 2021 and mid 2022 alone, for example, its peaks were as high as almost $70,000 in November and as low as just under $18,000 the following September.

Ethereum

Like bitcoin, ethereum (ETH) is both a software and a cryptocurrency powering its software's network. It is considered by many to be the most popular altcoin (short for "alternative coin," a.k.a., any non-bitcoin cryptocurrency).

Ethereum software enables many blockchain innovations, like smart contracts, non-fungible tokens (NFTs), and decentralized apps (dApps). While ethereum (the cryptocurrency) was designed to facilitate transactions on products built on and transactions occurring within the Ethereum network, some have turned to it as an investment.

The Ethereum network runs on a proof of stake system to validate transactions on the network. In this system, the blockchain randomly chooses one person with staked cryptocurrency to update the ledger. Ethereum has an unlimited supply, an aims to control inflation using a burning mechanism (where a portion of each transaction is deleted from the supply).

Stablecoins

As their name implies, stablecoins aim to combine the stability of cash with the efficiency of blockchain. They were developed in response to the volatility other cryptocurrencies experience, which can make them impractical for transactions. Most stablecoins peg their value to existing currencies, like the US dollar, and are generally required to keep a dollar in reserve for each stablecoin in existence. This helps stabilize their values, which has made them a popular medium of exchange in the crypto world.stablecoins were developed in response to the volatility other cryptos experience.

Risks of cryptocurrency

While the eye-popping short-term returns of some cryptos can make them seem like appealing ways to turn a profit, it's important to know the risks when buying, selling, and spending cryptocurrencies.

Crypto as an asset class is highly volatile, can become illiquid at any time, and is for investors with a high risk tolerance. In addition to significant and unexpected price swings, the laws surrounding cryptocurrencies are constantly evolving and the future regulatory environment is currently uncertain.

For example, current US tax code requires you to report transactions involving crypto, such as when you sell it for a profit and even when you exchange it to receive a good or service. If your crypto has increased in value since you purchased or received it, your transaction becomes a taxable gain that you must report to the IRS on your tax return. This could make buying everyday items with crypto at large scale unwieldy and cumbersome. There's still much that remains to be determined with crypto, from how people treat it—whether it's a store of value like a currency or an investable asset like a stock—to how governments view it. Future legislation may ultimately determine which way people use crypto as regulations may make certain uses impractical.

New legislation could also upend or have a significant impact on the price of any cryptocurrency. Crypto holdings are not insured, like money in a bank account, and therefore could be lost.

Platforms that buy and sell bitcoin may be unregulated, can be hacked, may stop operating, and some have failed. In addition, like the platforms themselves, digital wallets can be hacked. As a result, consumers can—and have—lost money.

Consider how many of these risks you are willing to take on before you purchase any cryptocurrency. Remember that it’s not insured by the Federal Deposit Insurance Corporation (FDIC) or the Securities Investor Protection Corporation (SIPC), meaning you should only buy crypto with an amount you're willing to lose.