Some bitcoin traders plan for it. Many long-term crypto holders eagerly anticipate it. Bitcoin miners don't typically look forward to it.

We're referring, of course, to the Bitcoin halving, a hotly anticipated event that happens roughly every 4 years. The halving commands attention from hardcore crypto enthusiasts and casual followers alike because historically, it has led to big movements in bitcoin's price. So what is it, and why does it generate so much hype?

What is the Bitcoin halving?

The Bitcoin halving is a programmed event that cuts the amount of mining rewards in half each time 210,000 blocks have been mined, which occurs approximately every 4 years.

Remember that Bitcoin runs on a blockchain, which is like a giant spreadsheet that keeps track of every transaction, as well as who owns how many bitcoin. This spreadsheet is updated by millions of independent miners around the world, who carry out the task using computers. When a miner is chosen to update the blockchain, they are paid in bitcoin (BTC) for their effort.

The halving cuts the amount the miner is paid in half.

How does the Bitcoin halving work?

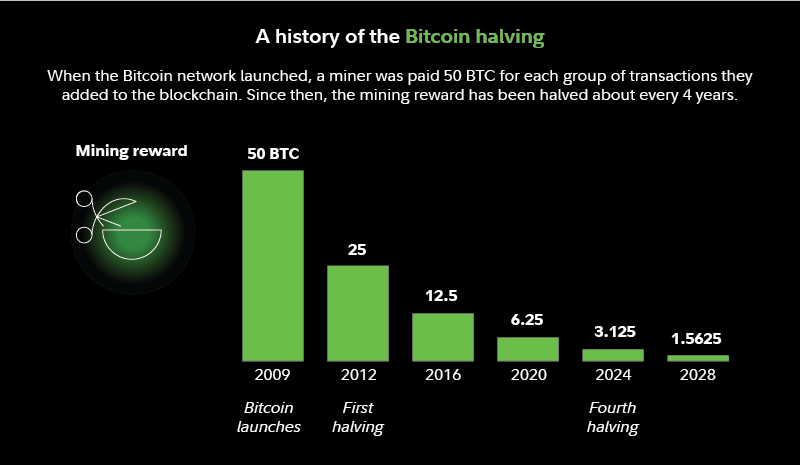

When the Bitcoin network first launched in 2009, the mining reward (i.e., the amount a miner was paid for adding one group of transactions to the blockchain) was 50 BTC. The first halving took place in 2012, cutting the reward to 25 BTC. In 2016, it was halved again to 12.5 BTC. In 2020, this became 6.25 BTC. In 2024, 3.125 BTC.

This event was programmed into the core Bitcoin code by "Satoshi Nakamoto," the pseudonym used by Bitcoin's creator, and can't be changed.

Why do Bitcoin halvings happen?

The goal of halvings is to stabilize bitcoin's ability to act as a store of value. Let's explore what that means.

Bitcoin was created to be an alternative to traditional fiat currencies like the US dollar. One of the disadvantages of fiat currencies, according to crypto advocates, is that they may not be not reliable stores of value due to inflation. Your dollar bill may be worth $1 today, for example, but in 10 years, that same dollar could only hold $0.70 of purchasing power.

In contrast, crypto advocates believe bitcoin is a currency that will maintain or grow its value over time, meaning anyone can buy and hold without fear of inflation. Of course, skeptics believe this is not a realistic claim.

One way the Bitcoin network hopes to achieve this is through its hard cap of 21 million bitcoin, meaning there will only ever be 21 million bitcoin in existence. Unlike the central bank model that fiat currencies are subject to, where an unlimited amount of new money can be injected into or withdrawn from the system, bitcoin's absolute supply is limited.

But how it reaches that 21 million hard cap also matters. Recall that new bitcoins are released into circulation through mining rewards. Every time a miner adds a new block to the blockchain, the total number of bitcoins in circulation inches closer to the 21 million max.

It is commonly viewed that injecting new money supply into circulation can cause inflation. Bitcoin hopes to avoid this through the halving, which allows it to reduce the amount of new supply that is released as time goes on. The hope is that this strategy will curb inflation. Whether it's effective over the long run remains to be seen.

What are the Bitcoin halving dates?

Halvings have happened in November 2012, July 2016, May 2020, and April 2024. Another halving will take place some time in 2028.

What happens when there are no new bitcoins left?

One concern is whether the Bitcoin network will survive once all 21 million bitcoins are in circulation. The last bitcoin is projected to be mined in 2140, after which there will be no more mining rewards, though miners will still receive transaction fees for their efforts. Once that happens, will there still be enough incentive for miners to continue updating the blockchain? And if not, can it survive?

Advocates believe the transaction fees will continue to make it profitable for miners to mine, which will enable the network to stay active and up to date. Skeptics, however, doubt whether that will be the case, as mining operations are typically expensive due in large part to significant energy requirements.

Of course, 2140 is over 100 years away, and a lot can change in a century. There are many factors that can affect the situation that we just won't know about until we get closer to that date. For example, one factor that could significantly impact the situation is how much energy and mining computers will cost in the 22nd century.

Why are Bitcoin halvings important?

To many crypto market participants, halvings are considered important because they aim to prevent inflation, which is one of Bitcoin's core purposes.

This event also generates hype because, historically, bitcoin's price has made new all-time highs following halvings. For example, on the day of the 2012 halving, its price was roughly $12. Following the halving, it entered a strong uptrend, hitting $266 by April 2013. Similarly, on the day of the May 2020 halving, its price was roughly $8,700. After the halving, it entered another strong uptrend that ultimately topped out at roughly $69,000.

However, those thinking about buying bitcoin based on a halving-centric strategy should be mindful of potential risks. First, past performance is no guarantee of future results. The next halving could always be the first where bitcoin's price subsequently falls rather than rises.

Also, remember that, in general, bitcoin and other cryptocurrencies are highly volatile, and may be more susceptible to market manipulation than securities. Moreover, crypto holders do not benefit from the same regulatory protections applicable to registered securities, and the future regulatory environment for crypto is currently uncertain. Crypto is not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation, meaning you should only buy crypto with an amount you're willing to lose.