Here's an understatement: Kids are expensive. According to the Brookings Institution,1 it could now cost an average of $310,605 to raise a little one to age 18. And that doesn't even count college costs. That's a lot of cash—but regularly saving a little bit starting when your children are young (or ASAP) could pay off over time. Knowing your options can also help you save for different goals, with some accounts even helping your kid learn about saving and investing along the way. Consider these accounts for saving money for your kids.

Savings account

A parent can open a savings account at a traditional or online bank for a child of any age, as long as the adult is the primary or joint account holder. It's easy to contribute money via in-person or digital bank deposits—or even automatic transfers from another account. More good news: The standard FDIC insurance amount for these accounts is up to $250,000 for each depositor.

In many cases, both the adult and minor account holders have the ability to access the money at any time for any reason. But parents may want to keep close tabs on account activity—and teach their kids about wise saving and spending habits. Besides the above standard offerings, the best savings accounts for kids have no minimum balance requirement, no monthly fees, and a better-than-average interest rate.

CD

If you're able to leave the money in for longer periods of time, you could consider stashing cash in a certificate of deposit (CD), which pays a fixed interest rate over a predefined term.

In exchange for being less liquid than cash held in checking, savings, or money market accounts, short-term CDs typically offer higher rates of return. Unfortunately, even the highest interest rates still might not beat inflation, which means your savings could lose buying power over time. Those under 18 are not allowed to purchase CDs for themselves, but an adult can do so on their behalf using a custodial account.

Custodial account

UTMA (Uniform Transfers to Minors Act) or UGMA (Uniform Gifts to Minors Act) custodial brokerage accounts allow an adult to invest money on a child's behalf. You can open a custodial brokerage account at a bank or brokerage firm.

A custodial account can be a great way to save on a child's behalf, or to give a financial gift. Basically, these are easy-to-open accounts used to invest in stocks, bonds, mutual funds, and more, all to give your child a better future. Be aware, though, of potential gift and estate tax implications even though there are no income or contribution limits like other savings options. To avoid triggering the federal gift tax (aka the tax on transferring money or property to someone else while receiving nothing, or less than full value, in return), you may contribute up to $19,000 annually if you file taxes as single filer or $38,000 for married couples filing jointly in 2025. You may not necessarily have to pay the gift tax if you contribute more than that, but then that contribution would count towards the lifetime gift-tax exclusion limit of $13.99 million for 2025.

Contributions to a custodial account are an irrevocable gift. Even though you, the parent, choose investments, custodial account assets belong to your child. Unlike "joint" savings accounts, for which the parent is listed as an owner, or CDs, you can't withdraw the money for yourself or transfer it to another person—assets may only be withdrawn if they are to be used to benefit the child. When your child reaches 18 to 25, depending on your state, you must turn over control of the account to your child, and they can withdraw money and use it for any purpose.

Though custodial accounts are taxable, for a child with no earned income, the amount of unearned income up to $1,350 is not taxed in 2025. The next $1,350 is taxed at the child's tax rate, which is generally lower than the parent's tax rate. Any amount above $2,700 is taxed at the parents' rate.

Traditional brokerage account

If you'd like more control than custodial accounts allow, you can open a traditional brokerage account in your own name and earmark the money for your child. This lets you access the money while your child is still a minor and keep control of it after your child reaches adulthood. Then, when you feel your adult child is ready for it, you can transfer the account to an account in your child's name. Or you could make your child the beneficiary of the account if you die or become incapacitated.

With greater adult control comes higher taxes, though. You're taxed on any earnings at your tax rate, rather than at your child's. You'll also need to keep in mind gift tax rules when you decide to turn over the account funds to your child, meaning it may not make sense to transfer all of the account's assets at once.

If your child is 13-17 years old, you could consider the Fidelity YouthTM Account. This teen-owned account lets teens make, manage, and invest their own money.

529 plan accounts

One of the better ways to save money for kids' education may be a state-sponsored, tax-friendly 529 account. While contributions to a 529 account are not federally tax-deductible, most states offer tax breaks for contributions. Plus, money in a 529 account may grow tax-deferred, and withdrawals made for qualified education expenses—and there's a wide range of what counts—are federal income tax-free. But if you use 529 money for something other than education expenses, you may have to pay federal income tax on top of a 10% penalty on any withdrawal of earnings.

Money left over in a 529 account can be rolled over to another qualifying family member (such as another child). Or the 529 beneficiary can withdraw up to $10,000 from the account to pay down student loans. As of 2024, 529 plans may roll over up to $35,000 to a Roth IRA if the 529 has been held for a designated beneficiary for at least 15 years. The Roth IRA receiving the funds must be in the name of the beneficiary of the 529 plan for this to work. The rollovers from 529 plans to Roth IRAs will be subject to annual contribution limits. Any funds that were contributed into the 529 plan account within 5 years of the 529-to-Roth IRA conversion (or earning on those contributions) are not eligible for conversion.

529s also stand out for the treatment they get in many programs' financial aid calculations: Money held in accounts owned by students, such as bank accounts and custodial accounts, is typically weighted much more heavily (up to 20%) than funds in parental accounts (up to 5.64%) when determining a family's estimated financial contribution in financial aid decisions. Because 529s are considered parental assets, this might lead to a child being eligible for more financial aid than they would if the same dollar amount were in an account the child owned.

If you want to contribute more to a 529 account in a single year without counting against your lifetime gift tax exemption, the account can be “superfunded.” You can fund a 529 plan with up to 5 years’ worth of contributions all at once. That means an individual can contribute up to $95,000 in a single year to a particular 529 plan in 2025, up from $90,000 in 2024.

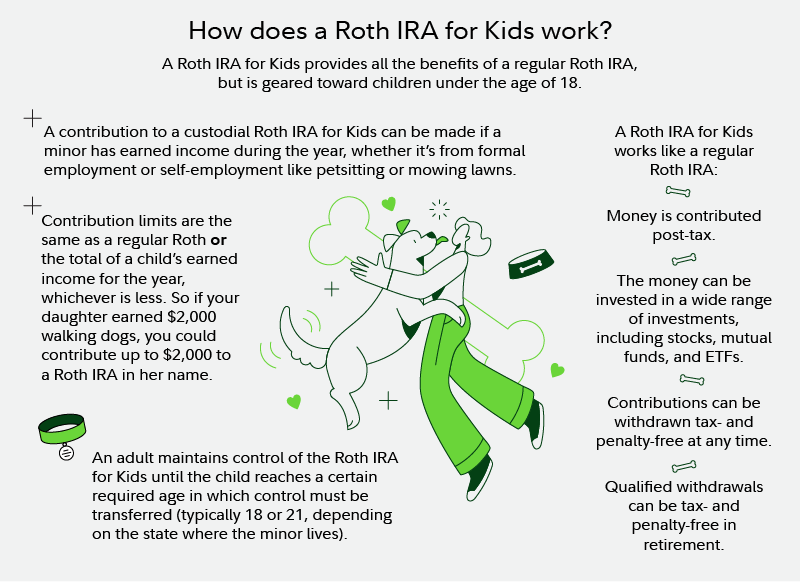

Roth IRA for Kids

You might be surprised to see a retirement account as a way to save for a child. But custodial individual retirement accounts (IRAs), particularly Roth versions, can be powerful ways to prepare for your child's future, provided they have earned an income in the year they want to make contributions. Keep in mind though that earned income doesn't have to be from a traditional job with a W-2 and could be money earned from smaller gigs like babysitting or cutting grass. Contributions cannot exceed earned income, but a parent can offer a match themselves as a contribution to give their kid a retirement savings boost.

IRAs can be advantageous accounts for children for a few reasons:

- They hypothetically have a very long time to benefit from compounding on funds put into an IRA.

- Because kids' earned income level is usually much lower than adults', they likely won't have to pay many, if any, taxes on money before it's put into their Roth IRA. This means they may be able to lock in what is essentially a tax-free growth potential of never-taxed money in a Roth IRA. This includes funds that may have compounded for years.

- While they are officially designated as retirement accounts (and normally may incur penalties or taxes when tapped before age 59½), certain withdrawals before a child's golden years are allowed penalty-free. These include eligible educational expenses, like college tuition, and up to $10,000 for a first-time home purchase or up to $5,000 during the first year following the birth or adoption of a child. To avoid penalties, a child's first contribution to a Roth account must have been at least 5 years before the withdrawal; withdrawals of earnings also may still be subject to any applicable taxes.

- Contributions made to a Roth IRA (but not the earnings) can be withdrawn penalty-free at any time. This, combined with the exceptions for major life events, like college, homebuying, and new parenthood, can make Roth IRAs flexible accounts.

Trusts

Despite their reputation, trusts are not just for the monocle-and-top-hat set, and they can be a helpful way to save for kids.

Trusts are legal agreements that allow a third party to hold assets on behalf of a beneficiary or beneficiaries, and there can be conditions for using the assets.

Trusts can be revocable or irrevocable, depending on the objectives that the family is trying to accomplish. A revocable trust is commonly used for estate planning purposes. As the name implies, the trust is revocable and can be changed, amended, and even revoked until the grantor (the person that created the trust) passes away. Irrevocable trusts, on the hand, typically cannot be changed once created. Parents could create irrevocable trusts during their lifetimes and name their children as primary beneficiaries, with flexible distribution provisions that include paying for a child's health, education, maintenance, or general support. Or parents could include provisions in their revocable trust (which becomes irrevocable once the parent dies) that similarly provide for their children. Depending on the terms of the trust, there can be estate tax savings and assets in the trust may be protected from a beneficiary's creditors.

Both education and special needs trusts can help ensure your child gets the money they need for future expenses. With an education trust, you could set up the trust with the condition that withdrawals are to be used only for education costs once the child reaches a certain age (usually 18). These kinds of trusts may offer more flexibility than 529s in terms of the investments you can pick and how withdrawals are managed, though it does mean forfeiting the tax-free growth of any investments when used for educational purposes. For special needs trusts, parents can put money aside for their child's future care and set conditions for when and how the money will be used.

Still, trusts are not something to be entered into lightly: Setting one up could cost about $1,000 to more than several thousand dollars, depending on the complexity of the situation and assets involved.

The bottom line on saving for kids

Setting aside money for the children in your life helps prepare them for whatever future they choose. But providing them with a future nest egg is only part of the battle—you also want to take time now to help them build good money habits, like we cover in these 5 tips or our guide to raising savvy investors.

The Fidelity YouthTM Account gives teens power to make their own money moves—while giving parents visibility into their teen's account.