When it comes to building wealth, most people think they need to make big moves—like maxing out a 401(k) or buying real estate. But the truth is, small, consistent actions can be just as powerful. Micro-savings—those small, regular deposits—can quietly build momentum, reduce stress, and bring your goals within reach.

Here are 3 smart ways to put micro-savings to work in your life, starting today.

1. Create “invisible” transfers for short-term goals

Saving for a vacation, a new laptop, or holiday gifts? Micro-savings can help you get there without feeling the pinch.

Set up an automatic transfer of $5–$20 per week into a separate savings account labeled with your goal. Many online banks and apps let you create multiple “buckets” or “vaults” so you can organize your savings by purpose.

Fidelity has a fun idea to help you boost your savings, called Smart Habits. It starts with $1 in the first week and builds to $52 in the final week. Read Fidelity Smart Money: The 52-week money challenge

Why it can work:

When savings are automated and out of sight, you’re less likely to spend them. And naming your goal makes it feel more real and motivating.

Pro tip:

Start small and increase the amount gradually. Even $10 a week adds up to over $500 a year—enough for a weekend getaway or a new phone. At Fidelity, you can set up recurring investments to automate your portfolio contributions.

But what about those surprise dollars you weren’t expecting?

2. Use windfalls and cashback as micro-wins

Got a tax refund, a rebate, or some credit card cashback? Instead of spending it, treat it like a micro-savings opportunity.

Redirect some—or all—of these small windfalls into savings or investments. Because this money isn’t part of your regular budget, saving it doesn’t feel like a sacrifice.

Why it can work:

It’s a painless way to boost your savings rate and build financial resilience. Plus, it helps you avoid the common trap of lifestyle inflation. Read Fidelity Viewpoints: 5 ways to outsmart lifestyle creep

Pro tip:

If you don’t have emergency savings, it can make good sense to save at least $1,000 for emergencies to get started. After that, aim to save enough to cover essential expenses for 3 to 6 months.

And if you’re thinking long term, investing might be a step to consider.

3. Investing for growth potential can start right away

If you’re saving money you won’t need to access for more than 3 years, investing for growth potential with stocks or stock funds could potentially help your money grow. The combination of consistent saving and growth potential over a long period of time is a proven way to help build wealth.

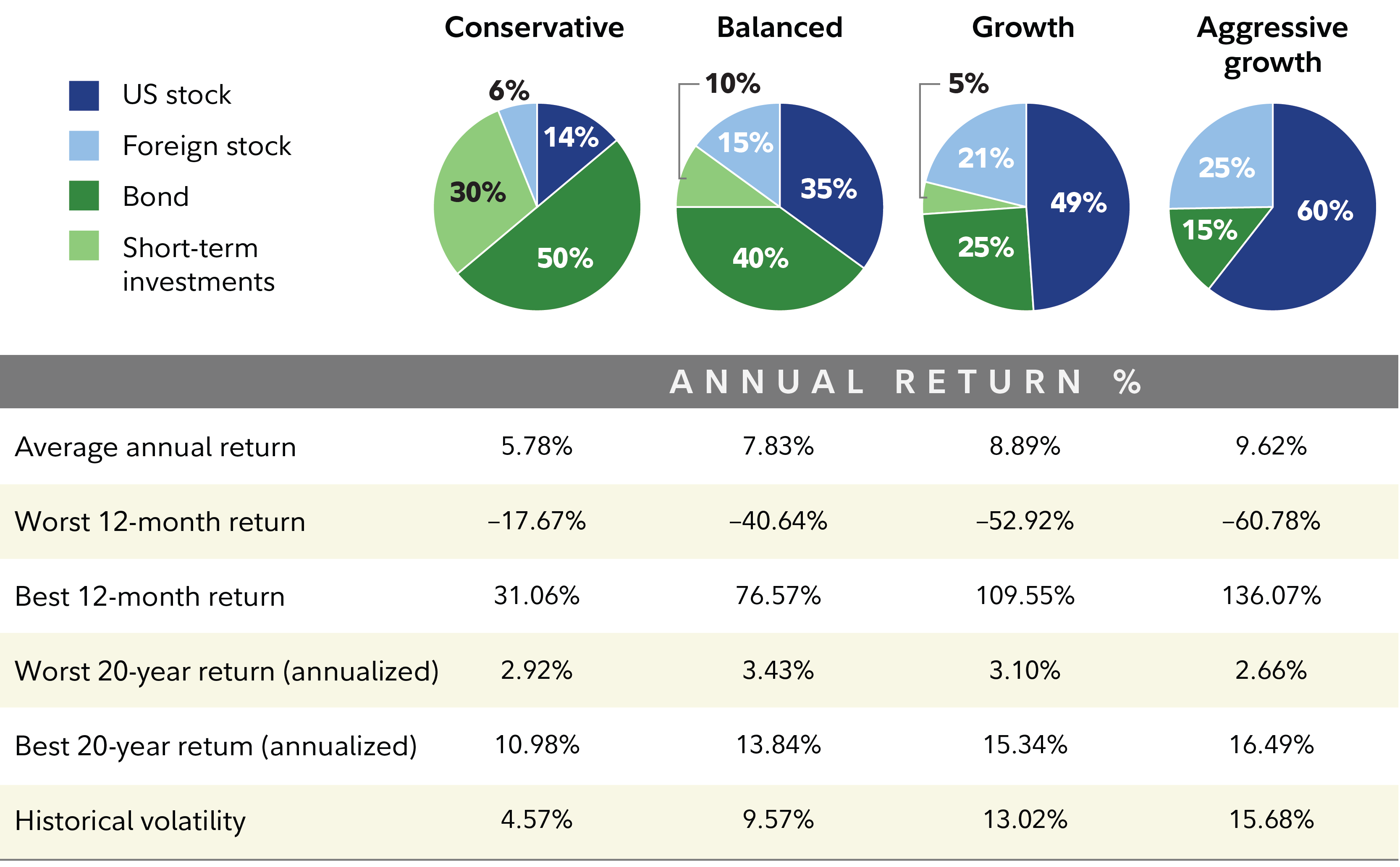

But in the short term the stock market can be unpredictable, which is why it makes sense to invest in a way helps manage your risk.

Investing all your money in the stock of one small company is very risky. You might lose all your money, or you might earn a high return on that investment.

Investing in short-term investment options or bonds generally lower risk than investing in stocks, but it's important to understand there is no guarantee of a positive return. That’s why a diversified mix—aligned with your goals, risk tolerance, and financial situation—can help manage investment risk.

Why it can work: Investing can help your money grow a couple of ways. First, the value of your investment may go up. Compound interest and compounding returns can also help the value of investments like savings accounts, stocks, and mutual funds, to grow over time. As your investment earns money, the earnings can be reinvested. With time, the hope is that those earnings begin to earn money too, potentially creating a powerful compounding effect.

Pro tip: Start investing with what you can—even if it’s just a few dollars a week. Fidelity lets you buy fractional shares of US stocks and ETFs starting at just $1. That means you can invest by dollar amount instead of needing to buy a full share. It can be a simple way to begin building a diversified portfolio, even on a tight budget.

Reminder: Saving in tax-advantaged accounts can help bolster savings. In general, for retirement goals, consider saving as much as possible in a 401(k), 403(b), or other tax-advantaged accounts before turning to taxable brokerage accounts.

Other tax-advantaged accounts include health savings accounts, IRAs, 529 college savings plans, and tax-deferred annuities. To see how small amounts can add up, read Fidelity Viewpoints: Just 1% more can make a big difference

Every little bit helps

Micro-savings won’t make you rich overnight—but they can help you build better habits, reduce financial stress, and make steady progress toward your goals. Whether you’re saving for something fun or something foundational, the key is consistency.

Start small. Stay consistent. You may be impressed by the results.