Use recurring investments to help you reach your goals

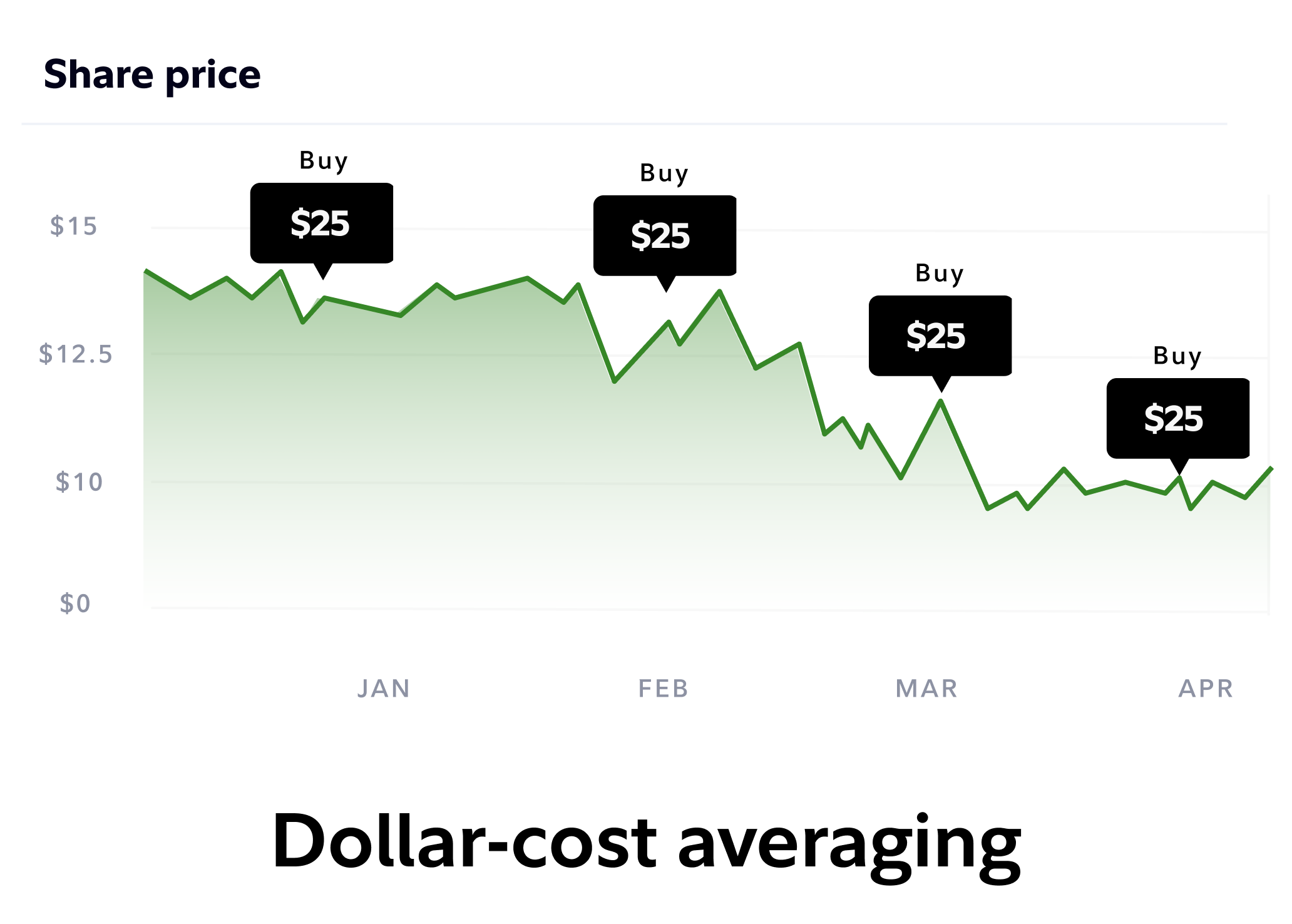

Set yourself up for success by making regular investments easy. Dollar-cost averaging1 can help mitigate market timing risk.

Breadth of recurring transactions

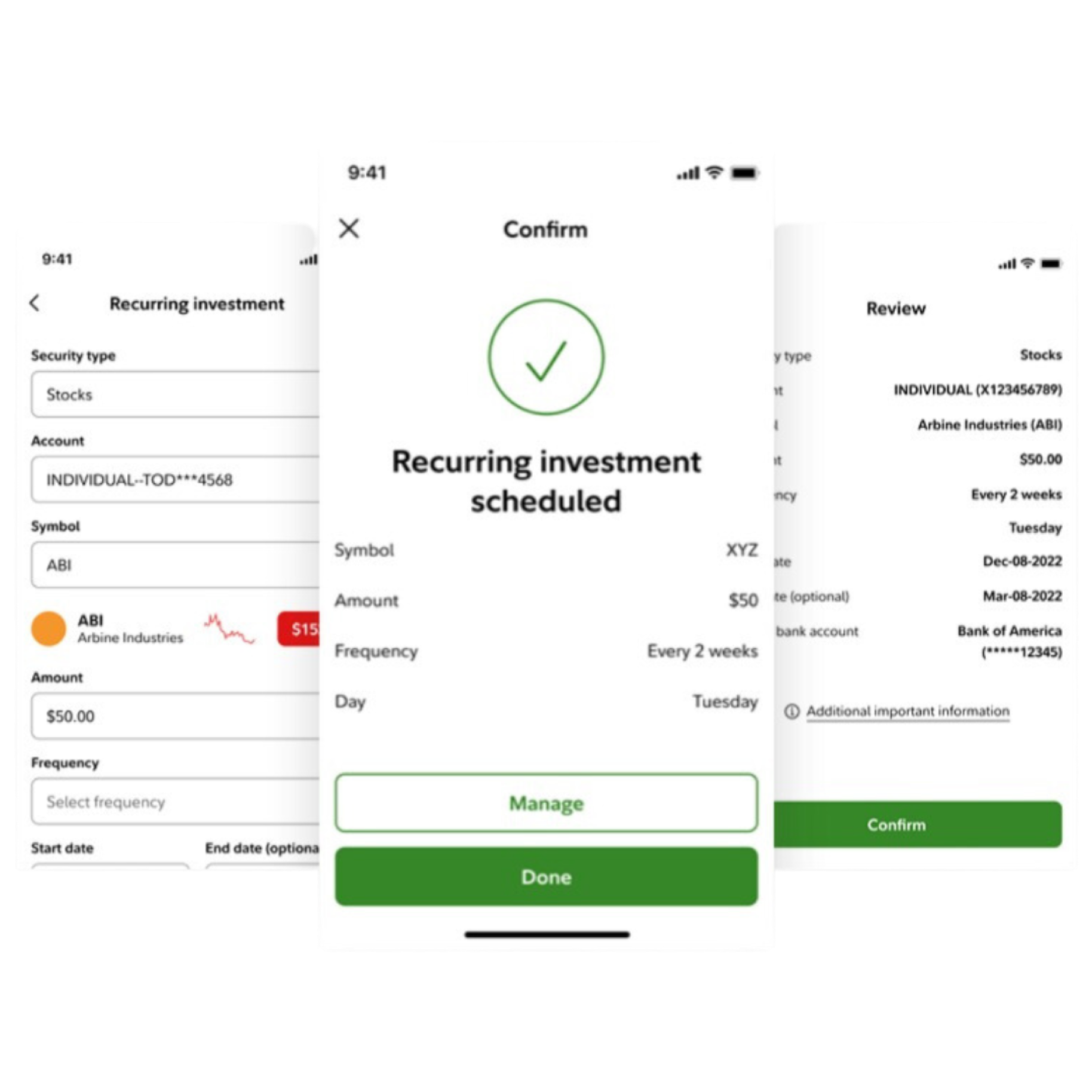

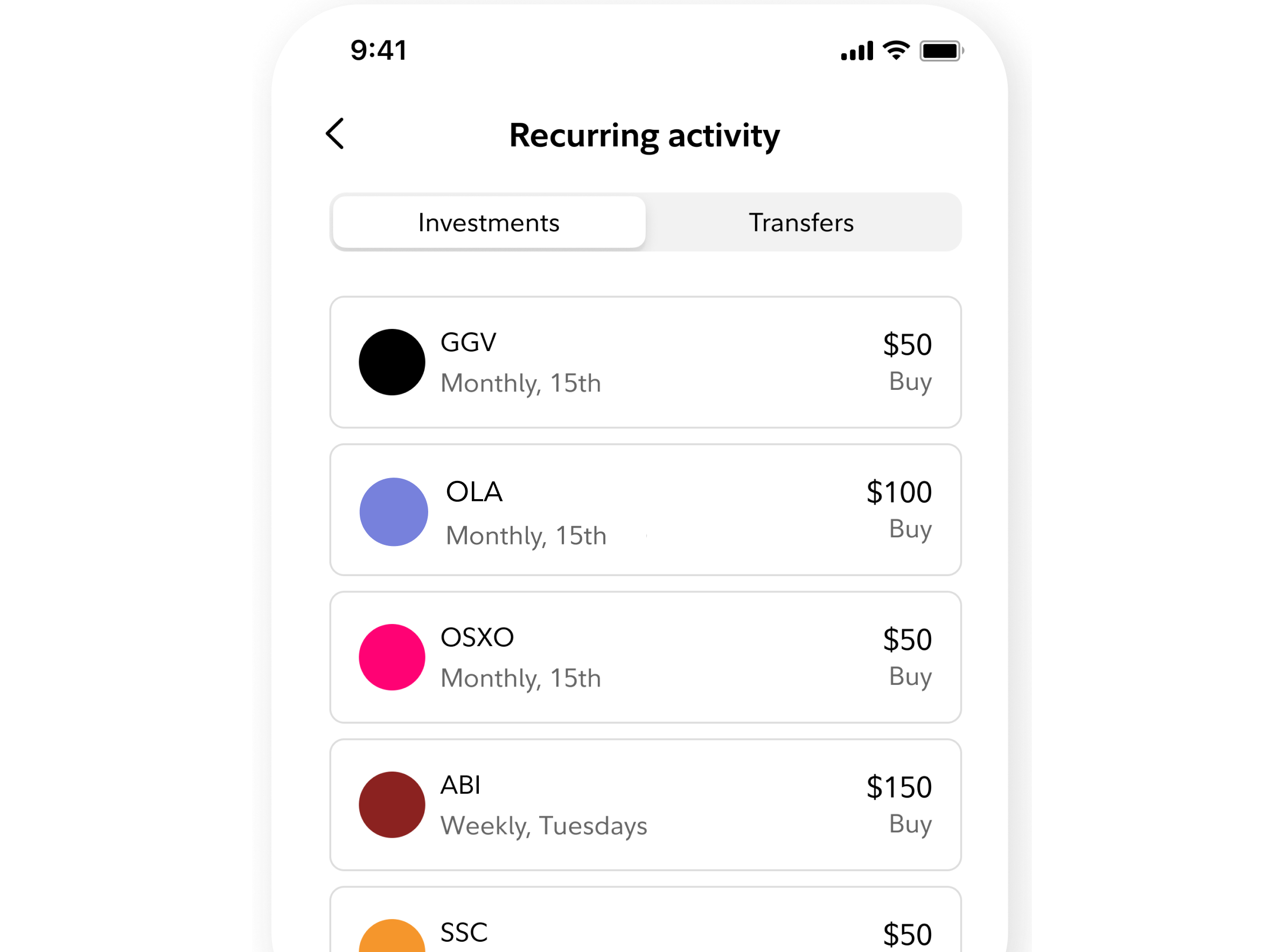

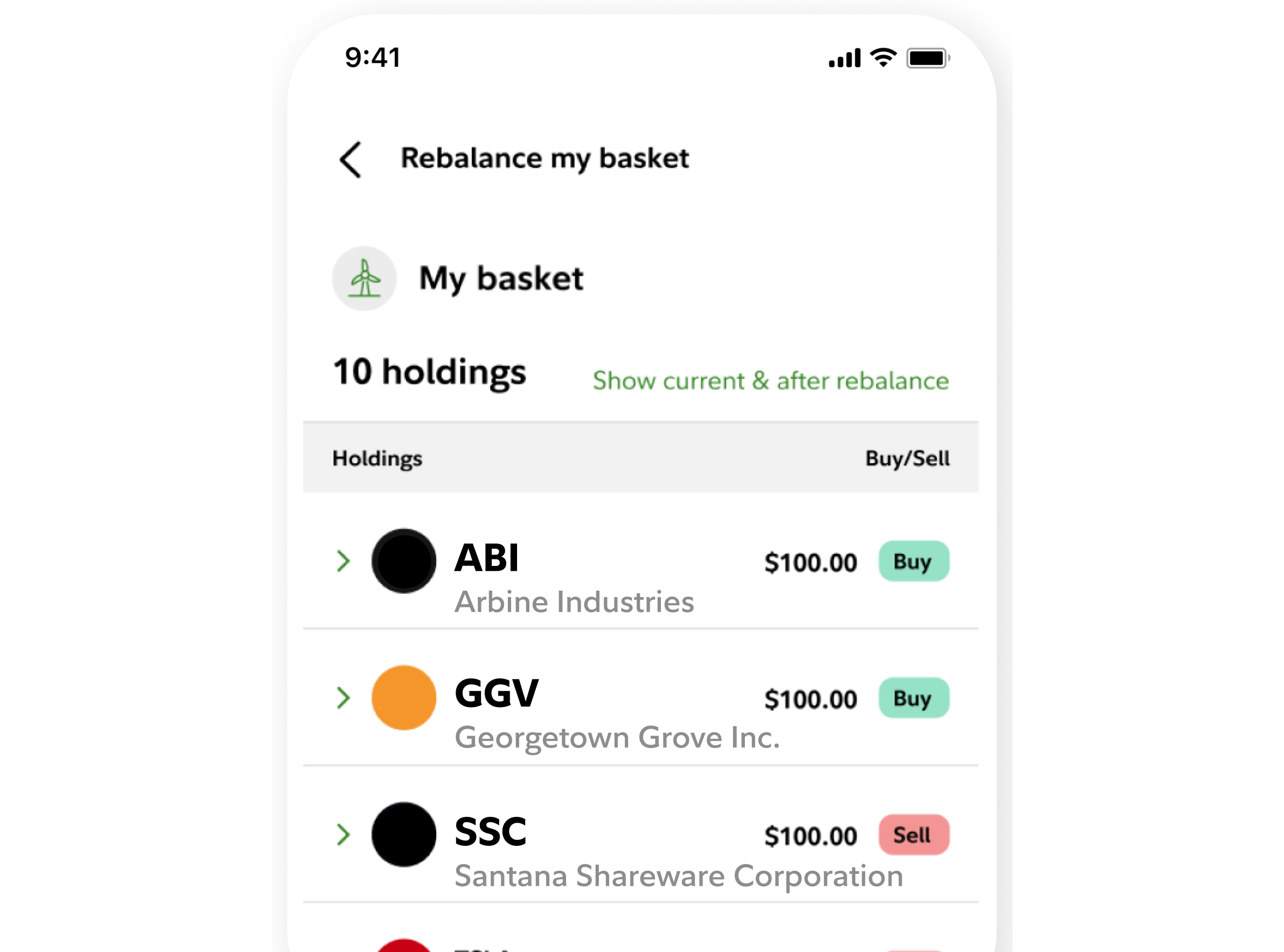

Choose recurring investments in stocks, mutual funds, ETFs, and Fidelity Basket Portfolios directly from your Fidelity account or your bank.

On your schedule

Set the amounts, frequency, and timing of your recurring investments, and change them whenever you need to.

Flexibility at no cost2

Easily manage your recurring investments and transfers in one place, for free. No commissions for online US stock and ETF trades.3

Harness the power of recurring investments

Build a lasting routine

Apply the principles of seasoned investors for potential growth. Recurring investments can help you benefit from the potential of compounding returns to help grow your portfolio over time.

Frequently asked questions

To help you quickly find the answers you need, we've curated responses for the questions we hear most often.

Start an investing routine that can last

Set up automatic trades of stocks, mutual funds, ETFs, or baskets to invest regularly and help grow your portfolio.

Why choose Fidelity?

Affordable accounts

We put you first by charging no fees or minimums to open a brokerage account4 to help you spend and save smarter.

We are here to help

Our dedicated team of professionals are here to help when you need them.

Tools for every solution

From managing your everyday finances to planning for your child's college education, we offer support to help you plan.