Having one less thing to think about can free up your time and lower your overall stress. For instance, inventions like the dishwasher and washing machine revolutionized life at home—few people long for the days of manually scrubbing clothes. Even the programmable coffee maker was a significant step forward in convenience, allowing tired people to add water and coffee to the machine before bed in order to wake up to a steaming hot cup.

Similarly, putting your saving and investing on automatic is a small change that can lighten your mental load—and it may significantly impact your net worth over the long term.

Help automate investing with recurring investments

Recurring investing means making regular, automatic investments. The idea is to establish this routine of saving and investing regularly with no extra effort on your part.

Using recurring investments can help keep your savings plan on track no matter what else is going on in your life. At Fidelity you can set up automatic transfers from another account or bank and have that money automatically invested according to your instructions.

Benefits of recurring investments

- Reduces the temptation to spend

- Reduces the likelihood that you will overreact to market ups and downs

- Avoids spending time on an activity you may not enjoy that saps your brain power (thinking about money and investments)

- Eliminates the temptation to try to time the market (which history suggests reduces investor wealth)

- Helps your saving and investing stay on track while you live your life

Why automation can work

Suggesting recurring investments may not sound like a big investing insight. But it's a small trick that actually works because permanently changing behavior is hard. "People tend to stay the course that they’re on. This means that if you can make the decision to start, it’s easier to continue. But making decisions can be hard too; automation means you only have to make the decision once," says Brianna Middlewood, director of behavioral economics research at Fidelity.

Think about the most effective recurring investment plan around: the workplace savings plan. The money you contribute never hits your bank account. Since you don't see it come in or go out, you don't think about it. After the account is set up, all you need to do is check in and review your savings progress—and maybe rebalance your investments as necessary.

When it comes to investing outside of the workplace plan, you'll just need to open an account (if you don't already have one), choose your investments, and set up the transfer of money. Those steps may be easier than you think.

Read Fidelity Viewpoints: How to start investing

You can also use recurring investing to start dollar-cost averaging, where you invest your money in equal portions, at regular intervals, regardless of which direction the market or a particular investment is going.1 In other words, your purchases occur regardless of the changes in price for the stock or other investment, potentially helping reduce the impact of volatility on the overall purchase. It’s important to remember that dollar-cost averaging doesn’t assure a profit or protect against loss in declining markets. But it can serve as a risk management trading strategy if you end up buying more when the price is relatively lower and buying less when the price is relatively higher.

See if this strategy is right for you on Fidelity Learn: A newbie’s guide to dollar-cost averaging

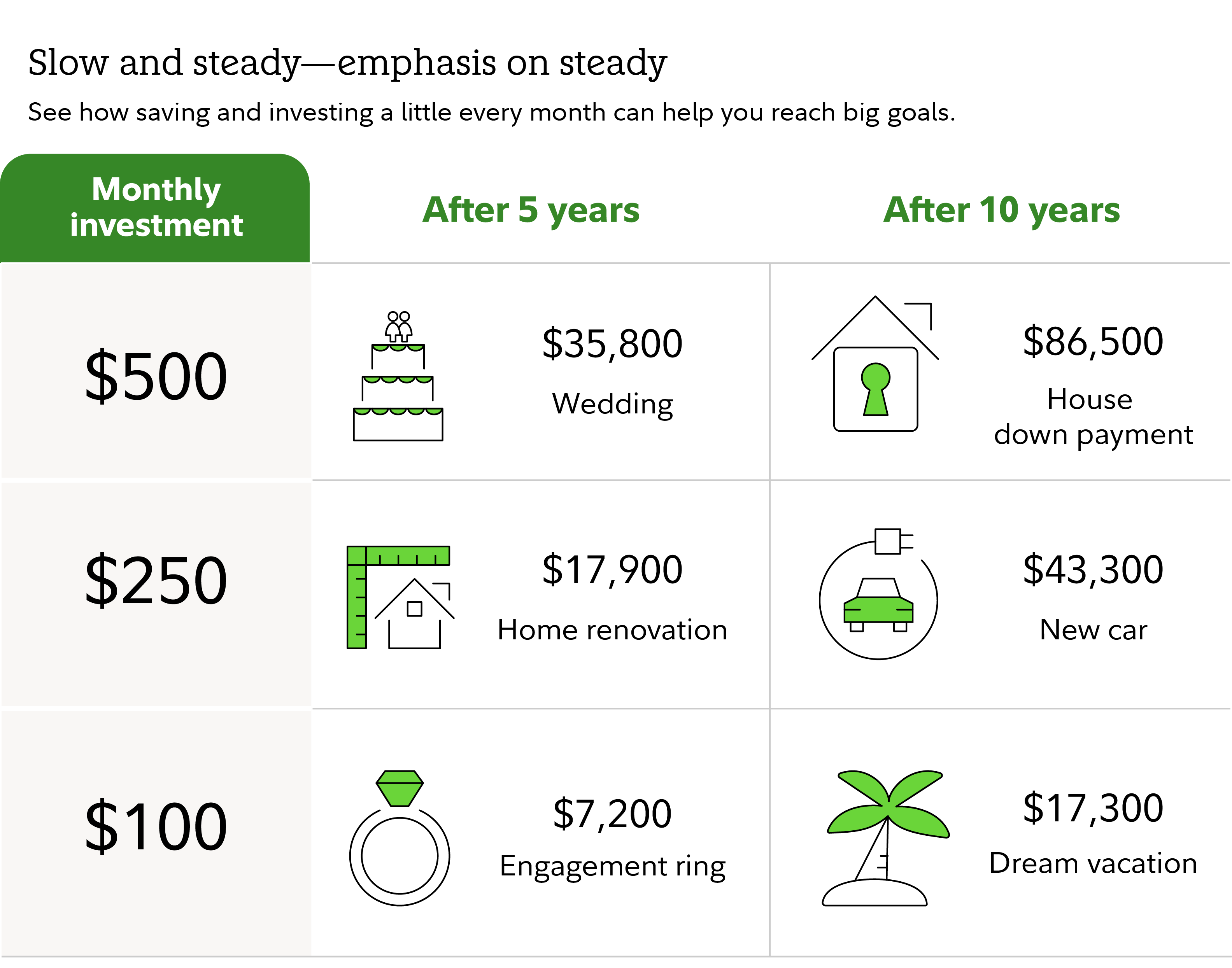

Saving regularly and investing your savings can be a powerful combination. The illustration below shows the potential outcome after saving and investing consistently over time.

How to get started with recurring investing

It can make sense to start with a financial plan. It doesn't have to be extremely detailed or extensive if you're just starting out—but the idea is to understand how much you need to save, or how much you have available to save, and then how you should invest that money. And you may have several different accounts that are invested differently to reach separate goals.

Recurring investments in a Fidelity account

At Fidelity, you can make contributions and buy investments in one step, if you already have a bank account linked. Or you can set up recurring investments with the cash available in your account.

Recurring investments are available for mutual funds, exchange-traded funds, stocks, and Fidelity Basket Portfolios in your brokerage, retirement, 529 savings, or other eligible retail Fidelity accounts.

Set your investing on repeat: Get started with recurring investments

Here are a few options for moving money to Fidelity and other financial institutions.

- From your paycheck: Your employer may offer the ability to set up direct deposit from your paycheck into multiple accounts. You can have part of your check sent to a bill-paying account and part to an investment account if that's available. Once the money is in the investment account, you can buy your investments or set up recurring investments.

- From your bank account: If your investment account is at a different institution, you can generally set up transfers on either end—from the bank or the investment account.

How to deposit money into your account at Fidelity: Moving money to Fidelity

Automatic investing with a managed account

If you want help choosing and managing investments, a managed account can offer ongoing management from professionals, with different levels of direct support at varying costs.

Managed account options include a robo advisor or hybrid robo advisor, like Fidelity Go®, an all-stock portfolio with tax-loss harvesting built in, like Fidelity FidFolios®, and full-service investment professionals who can help customize your planning and investing, like personalized investment management.

At Fidelity, once your managed account is set up, you can add extra money at any time—including through direct deposit or recurring transfers. Then the funds will be invested according to your investment plan.

Overcoming investment reluctance

Investing can be complicated and it can be scary for a lot of people. There are many small obstacles your brain presents as reasons to avoid doing it. These obstacles are called cognitive biases and they're patterns of thinking our brains rely on to make quick decisions.

For instance, "One bias is 'loss aversion,' or people’s tendency to be more sensitive to the danger of loss than they are to the possibility of gains. There’s also the bias we call 'temporal discounting.' This refers to people’s tendency to place greater value on getting money today versus waiting for more in the future," Middlewood says.

Studies have found that if you ask some people if they would like $100 today or $125 in one year, many people will take $100 today instead of more money later. A bird in the hand is worth 2 in the bush, as the old saying goes.

Then there's the question of timing. Investors often delay getting into the market on the hope that there will be a better time to invest. But research has shown that missing the best days in the market could reduce long-term returns. Remember another old saying, "It's about time in the markets, not timing the markets."

Read Fidelity Viewpoints: 7 investing myths and realities

"These and other biases aren’t necessarily bad, but they can make people shy away from investing, which comes with embracing risk of loss and waiting for future payoffs—things humans often struggle to do," Middlewood says.

That's why making it automatic can help. You make the decisions once and then move on with your life—if you don't think about investing again for 3 months, your savings plan is still hopefully on track.

"From a psychological standpoint, automation is a way to combat the human biases that may hamper your ability to decide whether to invest, how much to invest, how often to invest, and so forth. That said, the downside of inertia here is that some people make the choices once and never update. Pair automation with a reminder to check in on your savings goals later, and avoid another human tendency, forgetfulness," says Middlewood.