Few investors enjoy stock market downturns. Green arrows turn red, and suddenly nearly everything goes down—and down, and down. But stocks fall with regular frequency. With a little forethought, you can plan for these times in your investing strategy.

For a variety of reasons, some investors aren't emotionally or financially able to stomach big swings in the value of their investment accounts. So when the market starts to go down, investors with a low tolerance for risk may want to sell out of investments and wait for the danger to pass. But being out of the market when it ultimately rebounds—often when you least expect it—can undermine your long-term performance potential.

To learn about risk tolerance, read Viewpoints on Fidelity.com: 3 keys to choosing investments

If you're tempted to get out of the market when it's down, consider these tips to help deal with risk in your investment mix and stick with your plan for the long term.

1. Asset allocation and diversification

There are time-tested strategies aimed at managing the risk of a broad market downturn: asset allocation and diversification. They won't ensure a profit or guarantee against loss, but do provide the potential to improve long-term returns while managing market ups and downs for the targeted level of risk.

Asset allocation refers to your mix of investment types. The main types of investments are generally stocks, bonds, and short-term investments like money market funds, but alternatives like commodities and real estate can also be used. Your asset allocation sets the level of risk in your investment mix.

The practice of asset allocation helps you diversify across investment types, and that can help mitigate some of the stock market risk in your portfolio. Bonds and short-term investments tend to be less volatile than stocks, and including them in your investment mix can help smooth out the ride, dampening some of the wild swings that stocks can deliver.

Diversification means investing in a wide range of investments across and within those broader classifications of stocks, bonds, and short-term investments. Ways to diversify in stocks include company size by market cap, industry, and geography, for just a few examples. In bonds, you can diversify by type (government, corporate, and municipal), maturity, and other criteria.

Read Viewpoints on Fidelity.com: The guide to diversification

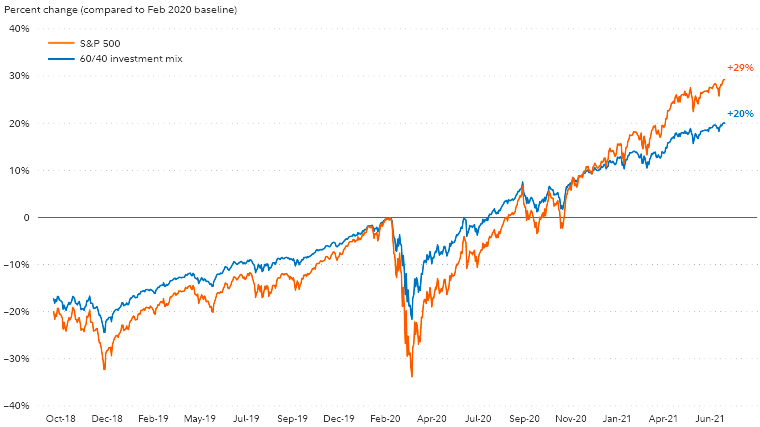

The following chart, Diversification can help smooth the ups and downs of your portfolio, shows an example from 2020 when stocks plunged dramatically for nearly 2 months. The S&P 500® Index fell further than a portfolio of 60% stocks and 40% bonds. On the other side, when stocks recovered, the index gained more ground more quickly than the 60/40 mix.

Diversification can help smooth the ups and downs of your portfolio

2. Reduce the amount of stock/increase bonds and short-term investments in your mix

If your investments keep you awake at night when volatility hits, shifting to a more conservative portfolio may make sense. In some cases, investors may be better served with a more conservative investment strategy—for instance, something may have changed in your life like your financial circumstances, your time frame, or your patience for the ups and downs of the market.

Let's say that you are a 35-year-old investing for retirement and your investment mix is 85% stocks and 15% bonds. For someone with decades until retirement, that could be appropriate, but you find it too harrowing. For some peace of mind, reducing the amount of stocks and/or increasing the amount of bonds or short-term investments could reduce some of the volatility you see in your account. That way you're still potentially benefiting from the growth stocks can provide but the exposure is limited to a smaller portion of your investment mix. By doing this, of course, you'd be trading the potential of higher returns for the potential of lower volatility.

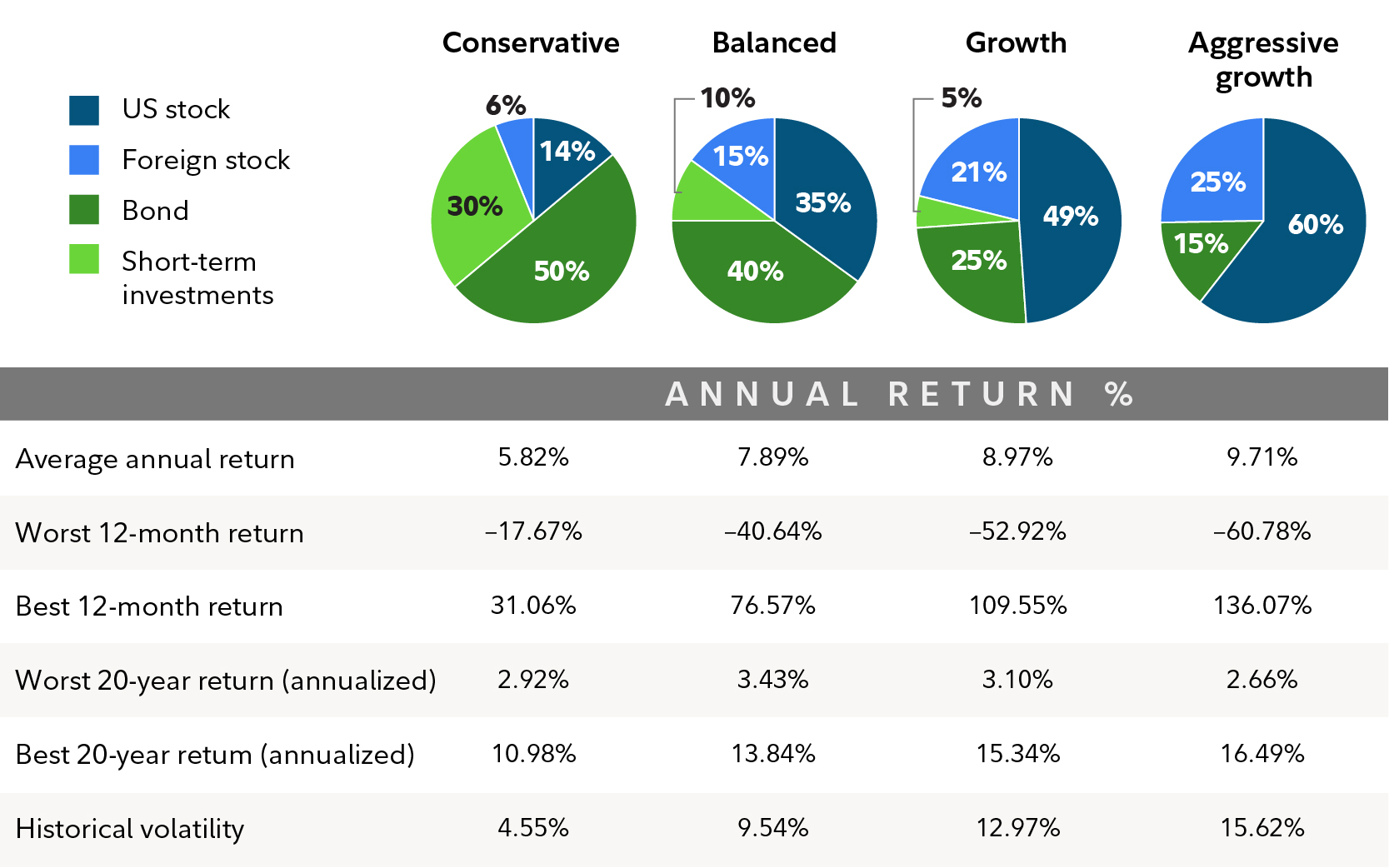

The sample asset mixes shown in the next graphic, Choosing an investment mix, combine various amounts of stock, bond, and short-term investments to illustrate different levels of risk and return potential.

Choosing an investment mix

3. Let someone else handle the investing for you

Fidelity offers a range of mutual funds, ETFs, and managed accounts that can help you reach your goals. There are a range of options, from straightforward investment management to comprehensive planning for your full financial picture.

One investment strategy worth considering is a defensive approach. For risk-averse investors who struggle to stick with investments when the market drops, a defensive approach may help avoid selling early, locking in losses, and undermining their opportunity for longer-term portfolio growth. To read more about defensive investing, read Viewpoints on Fidelity.com: Seeking shelter in volatile markets

“For people who are retired and concerned about things like stability of principal or certainty of income, the guarantees inherent in different types of annuity products can provide an additional level of security and peace of mind, especially during periods of market volatility," says Stefne Lynch, vice president of annuity product management and client communication at Fidelity Insurance Agency.

Staying invested throughout retirement can be particularly important, as the growth potential from stocks can help ensure that your money lasts. Getting an objective opinion from an investment professional can help you understand where you stand and what to consider when economic conditions seem uncertain.

Read Viewpoints on Fidelity.com: Thinking of retiring into this market?

People who are still working could also benefit from a defensive approach if the prospect of a market downturn keeps them on the sidelines.

Learn more about creating your own investing strategy in our video: How to build an investing strategy

4. Consider doing nothing

People feel the pain of losses more acutely than they feel the joy of gains. So if you have a diversified, appropriate mix of investments that aligns with your time horizon, risk tolerance, and financial situation, besides periodically rebalancing your portfolio, it can make sense to just tune out the news and avoid the noise.

To meet your goals, a certain rate of return over time may be needed. Stocks have historically provided that growth potential.

Risk vs. reward

A successful investing strategy is a balancing act between risk and potential rewards. But the best strategy can only be as successful as the investor's ability to execute it. If your investments keep you up at night or if you know that a stock market downturn may prompt you to sell, you may need a different approach. After all, your investment strategy should be one that you'll be able to stick with. Ample research has found that selling investments with a plan to get back in the market once the tumult clears can often lead to suboptimal results. Losses that were only on paper get locked in and there's a high likelihood of missing the best days in the market, which can negatively affect long-term returns. If you're not sure how to build your own investment mix, consider connecting with a Fidelity financial professional for more help.