Achieving retirement should be a celebration. A time when you can unplug from the daily grind once and for all, and instead focus on making the most out of each and every day.

But recent market and economic dynamics are adding an extra layer of uncertainty for those nearing or just beginning retirement. It's hard to feel confident in the size of your nest egg when economic and market uncertainty is in the news.

Experiencing so much uncertainty at once may make recent and pre-retirees feel that they have to do something in response. But if you have a sound financial plan that you've been following, you may very well still be standing on solid financial ground—despite the shifting economic and market landscape. Here's what to consider if you're in or nearing this critical transition.

1. Avoid making any emotional decisions

Once you're near or in retirement, it can feel as though your portfolio won't have enough time to recover from a market setback. However, resist the knee-jerk temptation to sell out of stocks when the market is going through a challenging period. "When markets feel volatile, the urge to react can feel compelling," says Naveen Malwal, institutional portfolio manager with Fidelity's Strategic Advisers LLC.

The problem is, it's nearly impossible to accurately predict short-term market movements. And investors who sell into a downturn often miss the market's subsequent recovery, putting a huge dent into their long-term return potential. Missing out on only the market's 10 best days over roughly 4 decades has historically reduced wealth by as much as 54%.1

Moreover, persistent inflation may mean that retirees need the growth potential of stocks as much as ever. "Historically, stocks have experienced positive returns even during periods of higher-than-average inflation, because many companies are able to pass on cost increases to consumers," says Malwal. "This can lead to earnings growth despite high inflation. And rising earnings have generally led to higher stock prices over the long run," he says. So avoid making permanent portfolio shifts in reaction to what are likely temporary market conditions.

2. Get a clear assessment of where you actually stand

When there's a general sense of unease in the air, it can give you a sense of unease about your finances. But what really matters for you are the numbers specific to your situation. If you're already working with a financial professional, this can be a good time to check in on your plan and make sure it holds up well under a variety of different market scenarios.

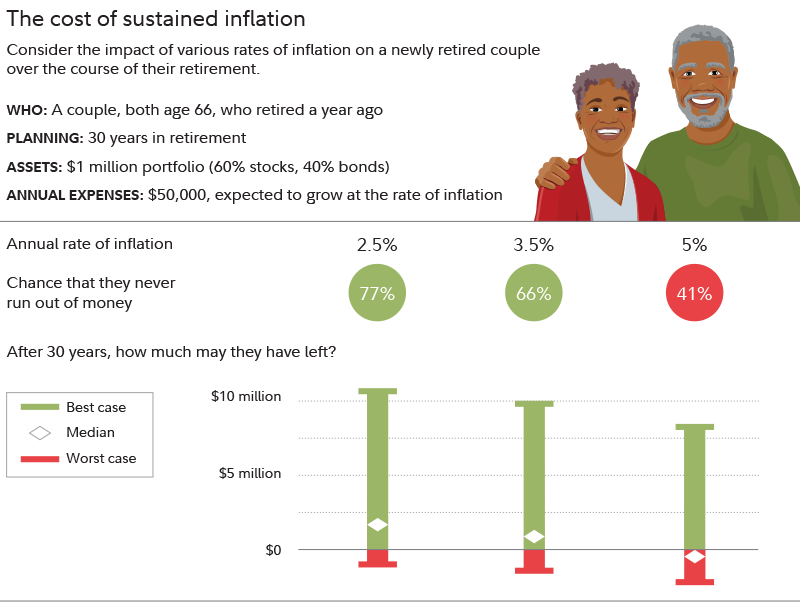

"One thing you can do is test the assumptions," says David Peterson, head of wealth planning at Fidelity. Suppose that inflation is the worry that really keeps you up at night. In that case, Peterson says, your financial professional can help you understand how your portfolio and spending may fare under a variety of different inflation scenarios.

The example below shows how the numbers might look under 3 different hypothetical long-term inflation rates for a recently retired couple. While modeling can't predict the future, it can help you understand how well-positioned you may be to make your money last. (Note that these are hypothetical rates for illustrative purposes only, and do not represent a prediction of future inflation. In particular, a 5% rate would be much higher than long-term historical average US inflation rates.)

If you aren't already working with a financial professional, this could be the time to consider starting (learn more about the planning options Fidelity offers). If you prefer and are more comfortable with do-it-yourself financial planning, retirement calculators may help you get a better picture of where you stand.

3. Potential adjustments if you're pre-retirement

If you haven't yet retired and your current plans leave you vulnerable to an eventual shortfall, one effective strategy is to keep working longer than planned (if you're able to), whether full time or even on a part-time basis. Working longer can let you save more, can give your portfolio longer to potentially grow, can help you benefit from delaying Social Security, and means you'll have fewer years in retirement to pay for. Extending your career even by 1 to 2 years could make a significant difference.

Chances are you shouldn't overhaul your portfolio in reaction to recent developments. But it never hurts to check in on whether your portfolio is well-positioned for the long term. In the face of complex uncertainties, a well-diversified portfolio that includes some guaranteed income, cash, fixed income, and inflation protection, may help you withstand potential future inflationary pressures or market volatility. Here's why each of those areas is important to consider:

Guaranteed income – One approach is to make sure that your essential expenses in retirement are fully covered by guaranteed income sources like pensions, Social Security, and annuities. This can help provide certainty of maintaining a reasonable standard of living no matter what the market does, and peace of mind in times of volatility. The pre-retirement years can be a good time to evaluate what guaranteed sources you expect to have and make a plan to potentially cover any shortfalls with annuities.

Cash and fixed income – Holding sufficient cash and bonds in retirement can potentially help you avoid having to sell stocks at a bad time, like if you need to take withdrawals during a down market. For example, the so-called bucketing strategy calls for keeping a few years of expenses in cash and in bonds (such as 2 years of expenses in cash and 8 years of expenses in bonds), which can potentially provide a multi-year runway for your stock portfolio to bounce back from any decline.

Inflation protection – You can build inflation protection into your portfolio in a variety of ways, including with a healthy allocation to stocks, with exposure to real estate and commodities, with an allocation to Treasury Inflation-Protected Securities (TIPS), and potentially with annual-increase features on any annuities you hold. Granted, all of these investments come with particular risks to understand; for example, commodity investments can be volatile, and real estate investments can be illiquid. Rolling annuities or laddered fixed income products could be other strategies to consider. (Read more about how to protect your money from inflation).

4. Potential adjustments if you're in retirement

For many people, heading back to work at this point is no longer an option (or at least, not an appealing one). Instead, the most powerful move you may be able to make is to reduce expenses. If your planning reveals that your portfolio can't sustain your current level of spending, then consider whether moving to a lower-cost area (potentially combined with downsizing) could bring your plans back into balance. If you're a homeowner, this could also let you unlock some of the appreciation that home prices in many areas have enjoyed over the long term.

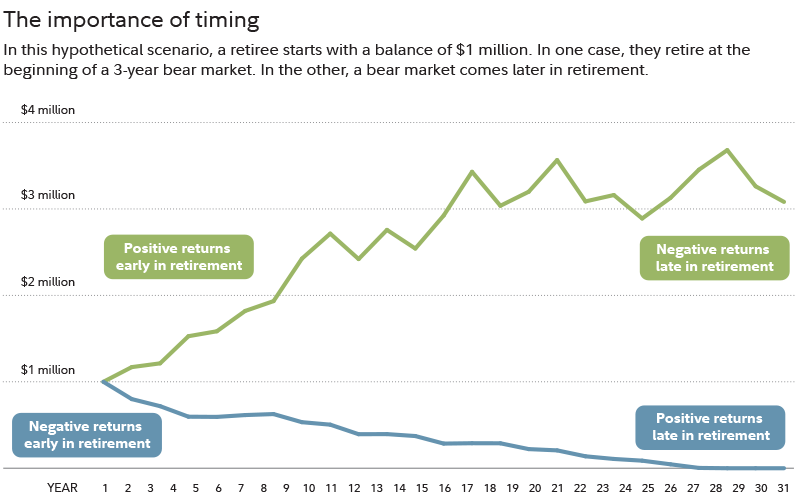

As for your portfolio, once you're in retirement it may be even more important to try to avoid selling stocks during a pullback. If you're in the early years of retirement, you may be vulnerable to so-called "sequence of returns risk." This is the risk that the market hits a downturn in your initial years of retirement.

As the chart below shows, hitting a downturn in your first retirement years—and selling stocks into the downturn—can cause a permanent erosion of your wealth that your portfolio may never fully recover from. By contrast, bear markets that fall later in retirement, after a series of positive returns, generally don't have such a severe effect on hypothetical or modeled planning outcomes.

Rather than selling stocks into a decline, try to pull other levers during those critical early years. If your stock portfolio is down but your bonds have gained or held steady, you may be able to trim your bond holdings to generate cash instead (and rebalance your portfolio in the process). Or perhaps you can temporarily reduce spending while you wait for your stock portfolio to recover.

Retirement may not be quite as smooth sailing as you'd once dreamed. But with a solid plan, you should be able to navigate whatever lies ahead.