What a lifetime income annuity can do

However, there is a way to create an income plan that lasts as long as you do. A lifetime income annuity can provide a guaranteed1 stream of income that lasts a lifetime and is not vulnerable to the inevitable ups and downs of the market.4

An added benefit is that by locking in some guaranteed income, you will have more flexibility to invest the remainder of your retirement assets for growth potential as part of a diversified income plan. Investors might want to consider an income annuity to cover the portion of their essential expenses not covered by other predictable income sources like Social Security or a pension.

"Many people may not realize that once your essential expenses are covered by guaranteed income, you may experience true peace of mind. This allows you to enjoy your retirement even more, giving you the freedom to spend on the fun things in life," observes Tom Ewanich, vice president and actuary at Fidelity Insurance Agency. "Additionally, you may invest your remaining assets for growth, rather than worrying about how to preserve and stretch your portfolio for the rest of your life."

A lifetime income annuity represents a contract with an insurance company that allows you to convert a portion of your retirement savings (an amount you choose) into a predictable stream of income for the rest of your life.

Having the backing of an insurance company can help mitigate 3 key retirement risks that, generally, can be very challenging to manage by yourself:

- Market risk – Regardless of whether the market goes up or down, the insurance company is obligated to provide you with income payments every year.

- Longevity risk – Rather than trying to figure out how much of your savings you can spend each year before running out of money, the insurance company assumes the responsibility for paying you as long as you live.

- Inflation risk – By including an annual increase option, where available, you can reduce the risk that inflation will diminish your purchasing power over time.6

To help manage costs, pay for only those features and benefits that you need to help you achieve your investment goal.

Let's take a closer look at a fixed lifetime income annuity and a fixed annuity with a guaranteed lifetime withdrawal benefit.

What is a fixed lifetime income annuity?

As part of a diversified income plan, an income annuity can provide you with guaranteed income, regardless of market downturns, for the rest of your life. Payments start immediately or at a future date that you select when you purchase the annuity. In addition, there are optional features you can choose to purchase such as protection for your beneficiaries and an annual payment increase feature to help your payments keep pace with inflation.

The trade-off with an income annuity is that you typically must give up control of the portion of the savings you use to purchase one. In exchange, you don't have to manage your account to generate income, and you can secure a predictable income that lasts the rest of your life. However, be sure to ask your financial advisor about withdrawal features that are available on some income annuities, which may alleviate liquidity concerns.

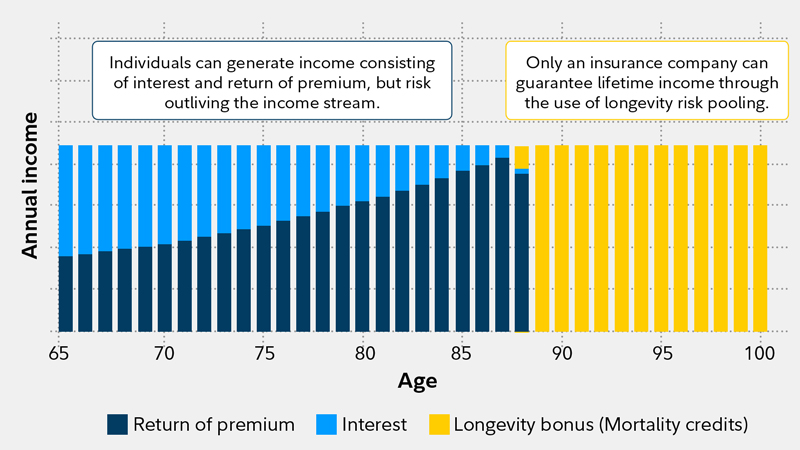

Fixed lifetime income annuities are often able to provide higher income payments than other products, such as bonds, CDs, or money market funds, due to the "longevity bonus" they can provide (see the chart below). While the payments from traditional fixed income solutions are limited to return of principal and interest from an investment, fixed lifetime income annuities also provide the ability to share in the longevity benefits of a "mortality pool." Effectively, assets from annuitants with a shorter life span remain in the mortality pool to support the payouts collected by those with a longer life span. Put simply, the longer you live, the more money you will receive.

Hypothetical example: Immediate fixed income annuity

This hypothetical example is for illustrative purposes only. It is not intended to predict or project income payments. Your actual income payments may be higher or lower than those shown here.

What are the payment options and features?

Fixed lifetime income annuities offer various options that pay different amounts of income, based on the level of beneficiary protection they provide. The most common payment options are:

- Life with a cash refund – You'll receive income payments for as long as you live. If you pass away before receiving payments that total your original investment, the difference between the original investment and the total payments received will be refunded to your beneficiaries. Because of this beneficiary protection, the payment amount under this option will generally be less than the life-only option described below.

- Life with a guarantee period – You'll receive income payments for as long as you live. If you pass away before your selected guarantee period ends, payments will continue to your beneficiaries until the end of the guarantee period. Because the company guarantees to make payments for a minimum number of years, the payment amount under this option will generally be less than the life only-option described below.

- Life only – You'll receive income payments over your lifetime. The life-only option offers the highest possible income payment because it's only for as long as you live; no money goes to your heirs. The key advantage is it provides the most income of all the annuity options, but most people prefer to have some beneficiary protection.

In addition to different payment options, annuities can include different features. One example is an annual payment increase option. This feature is based on a fixed percentage and provides for annual increases in the payment amount beginning on the anniversary following your initial payment. Note that the initial payment amount for an annuity with this option may be lower than an identical annuity without the option.

Use Fidelity's Guaranteed Income Estimator tool to see how the payment options might differ.

Beyond choosing from product features, there’s another product type that you could consider for your future income needs.

What is a fixed annuity with a guaranteed lifetime withdrawal benefit?

As part of a diversified income plan, a fixed deferred annuity with a guaranteed lifetime withdrawal benefit (GLWB) can provide guaranteed income for the rest of your life, starting when you're ready.

These annuities offer:

- Lifetime income – Avoid outliving your assets by guaranteeing a lifetime withdrawal benefit amount, beginning on a date you select.

- Flexibility – You choose when you would like to start receiving income, but if your situation changes and you need some or all your money sooner, you have the flexibility to access some of your contract’s accumulated value.5

From the time of purchase, you will know how much income you (or you and your spouse for joint contracts) are guaranteed at any age you decide to start lifetime withdrawals. Most importantly, you will have the security of a guaranteed cash flow, regardless of market fluctuations and downturns. Finally, in the event of your death, your beneficiaries will receive any remaining balance in your policy.

What's right for you?

Choosing a payment option means focusing on the specific features of a fixed lifetime income annuity and your personal goals. "Consider what's most important to you regarding your retirement plans. Do you need the most guaranteed income available or are you willing to accept a slightly lower payment to help provide additional protection for your beneficiaries?" says Ewanich.

Range of guaranteed lifetime income annuity options

How do lifetime income annuities fit into a retirement portfolio?

A lifetime income annuity can help diversify your retirement income portfolio, so a portion of your income is shielded from market volatility. Generally, Fidelity believes that investors should use no more than half of their assets to purchase income annuities. That's because even though these products provide guaranteed income for life, they may also require that you give up some liquidity and access to that part of your portfolio.

RMDs and annuities

Ultimately, your overall portfolio may benefit from a lifetime income annuity to help meet essential expenses throughout your retirement.