If you're like many people, you don't buy into the traditional definition of retirement. You may be planning an encore career or looking to maximize opportunities to travel. Hopefully, new adventures and new activities await you.

But remember, as you redefine your retirement, consider your retirement income plan, mapping it to a budget based on what you expect to spend—or can afford to spend—category by category throughout your retirement.

One of the biggest and most baffling questions you'll likely face is determining what kind of a retirement lifestyle you can actually afford. Some of your expenses will go down, but others may actually go up.

How will you really know the extent of all these expenses before you enter retirement? The good news is this task gets easier the closer you get to retirement if you've already created a retirement budget and explored what your lifestyle will be like in retirement. Then you can turn your "guestimate" of retirement expenses into a detailed retirement income plan either on your own or with an advisor.

"When estimating the cost of retirement lifestyles, most people seek to maintain their standard of living, which generally peaks in your late 40s to mid-50s," says Steve Feinschreiber, senior vice president of Financial Solutions at Fidelity. "Fortunately, many people who have saved adequately for retirement can fulfill their dreams because their overall expenses are generally reduced in retirement save one important category—health care."

The 80% rule provides a guideline of what you can afford in retirement

For many people, budgeting and estimating future spending is something that they find difficult and tedious. Many simply don't do any budgeting at all—not even trying the "back of the envelope" method. We recognize that, so we've taken the approach of looking at what people can generally afford in retirement based on their preretirement income.

If you know what your annual income is today, you can start the planning process by assuming you'll spend about 80% of the income you will be making before you retire every year in your retirement—that's known as your retirement income replacement ratio. So, for example, if your estimated preretirement income is $45,000, plan on spending about $36,000 annually in retirement.

Think about this 80% figure as a good jumping-off point, and then use your income, anticipated lifestyle, and health expectations to modify your number to help you generate an even more relevant estimate of retirement expenses.

"Each family's retirement situation is different," says Beau Zhao, director of Financial Solutions at Fidelity. "The amount of time until you retire, spending habits, travel plans, health conditions, and unexpected costs can all vary dramatically. That is why it is important to adjust the spending guidelines based on your own needs and wants.

"Let's say you plan to travel around the world after you retire. You may want to increase the 80% guideline to 90% or 100%," he adds.

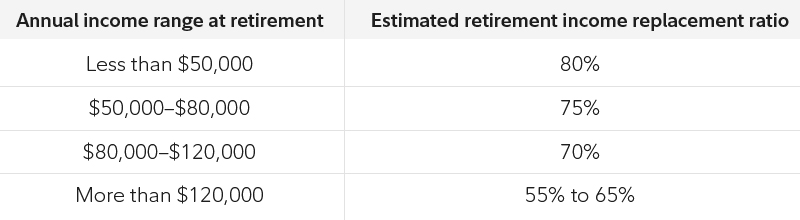

Determining your retirement income replacement ratio

When it comes to planning the income required to meet all your expenses in retirement, one of the big factors to consider is your current income. In general, the more money you make, the smaller a percentage of your working income you may need to replace when you stop working.

For instance, a person making less than $50,000 a year before they retire might need to replace 80% of their preretirement income on average in retirement, and cover $40,000 in expenses. Someone making $200,000 may need only 55% of their preretirement income to help fund a retirement lifestyle that could cost up to $110,000 in annual expenses.

"To get a sense of what you might need to fully cover your expenses, look beyond the 80% starting point. Try to narrow the range between 55% and 80%, factoring in your income, and then adjust your likely replacement income rate to get your number," says Zhao.

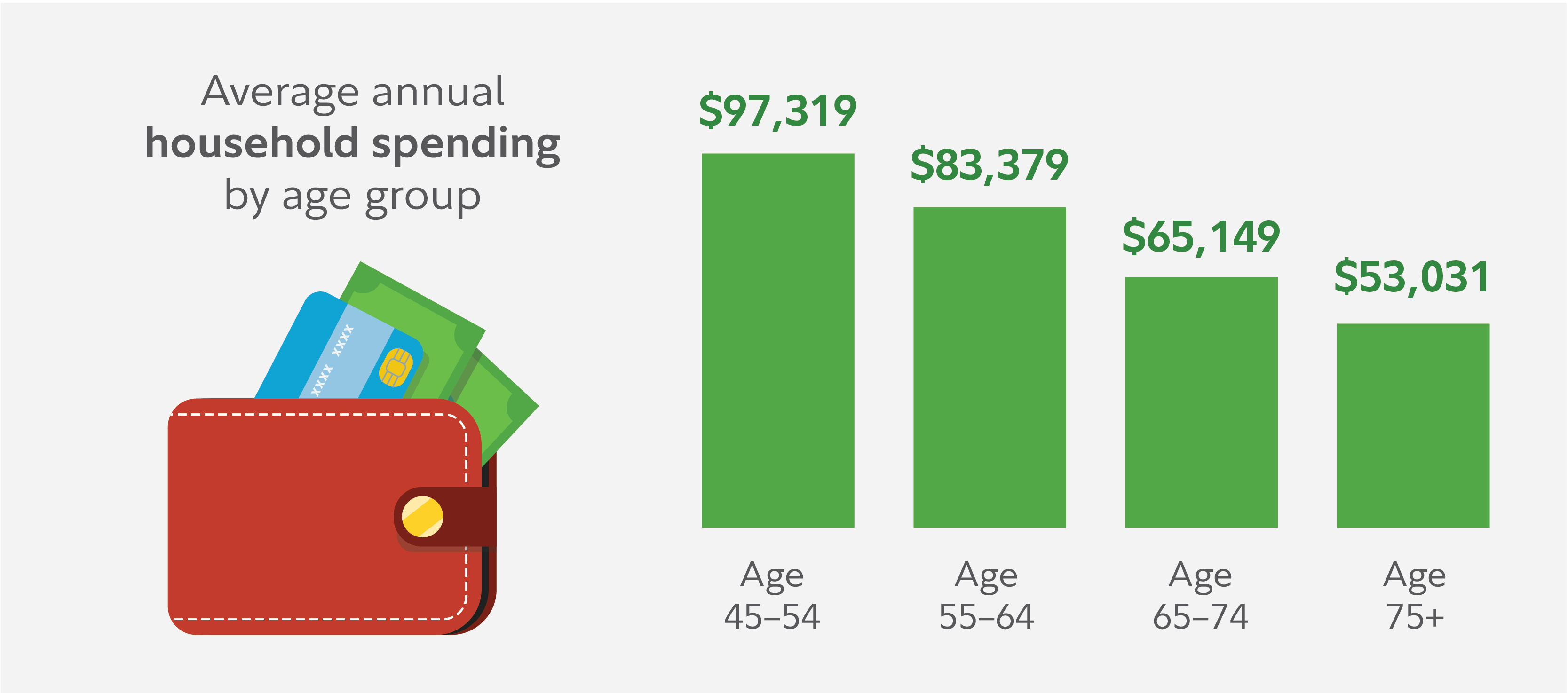

How your spending habits change in retirement

As people age, their spending patterns change, according to an analysis of Bureau of Labor Department data.2 On average, US households under age 55 spend almost $58,000 a year on a wide variety of expenses. Starting at age 55, spending tends to increase slightly, as some younger retirees travel or take on new pursuits. In the age range when most are retired at 65+, there is a significant drop in overall spending.

The makeup of spending also changes. While spending on food, entertainment, and transportation remains relatively stable, spending on housing tends to go down and spending on health care goes up.

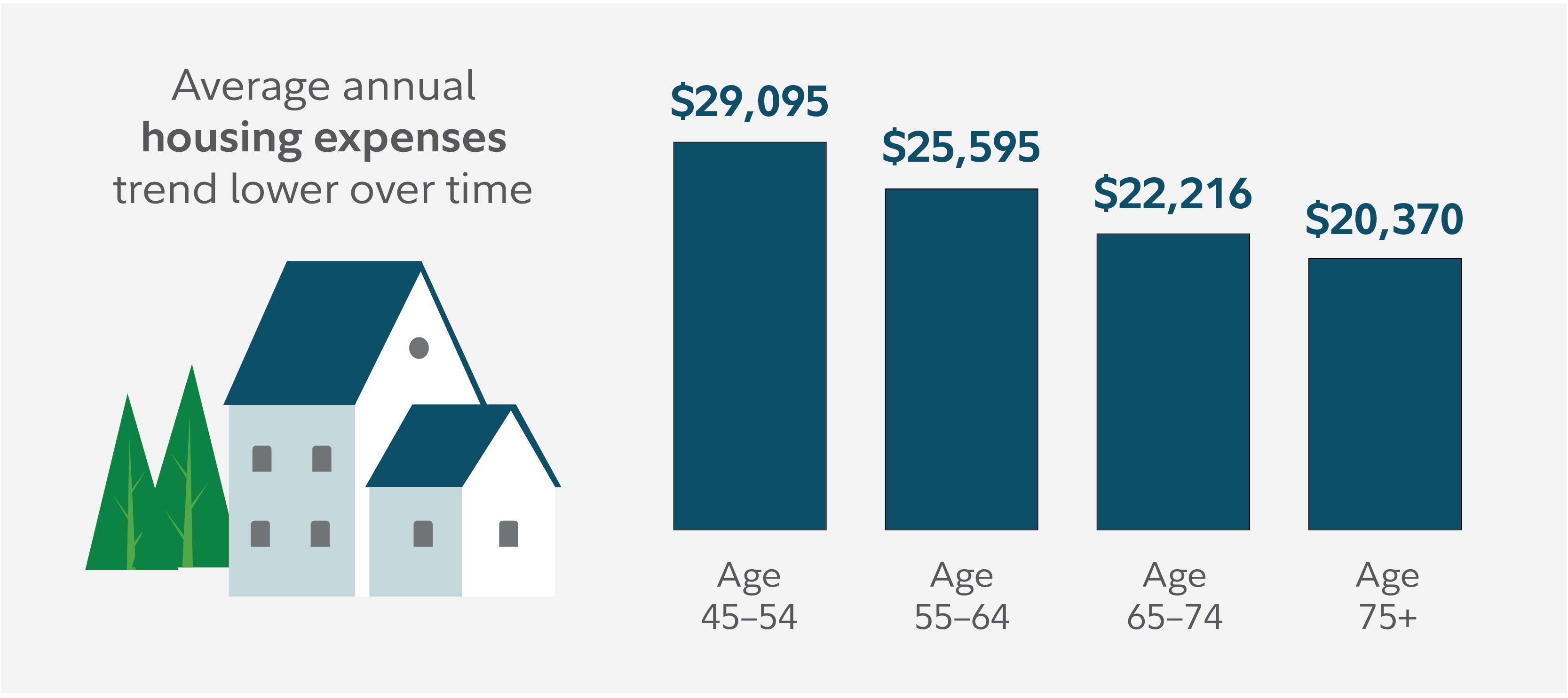

Expect to spend less on housing in retirement

Many retirees overestimate housing costs. In fact, average housing costs drop over time among retirees, as many downsize, move to cheaper parts of the country (or world), or find other creative ways to trim housing costs or pay off their mortgage (see chart).

"There are a number of housing decisions to consider as you transition from working to full-time retirement," says Feinschreiber. "Work with your advisor to develop a housing strategy—with several different options— as you project where you'll plan to live over the next 20–30 years. Whether you plan to downsize, relocate, or age in place—or consider such options as cohousing or living with one of your children–you can expect your overall housing cost to decline as you age."

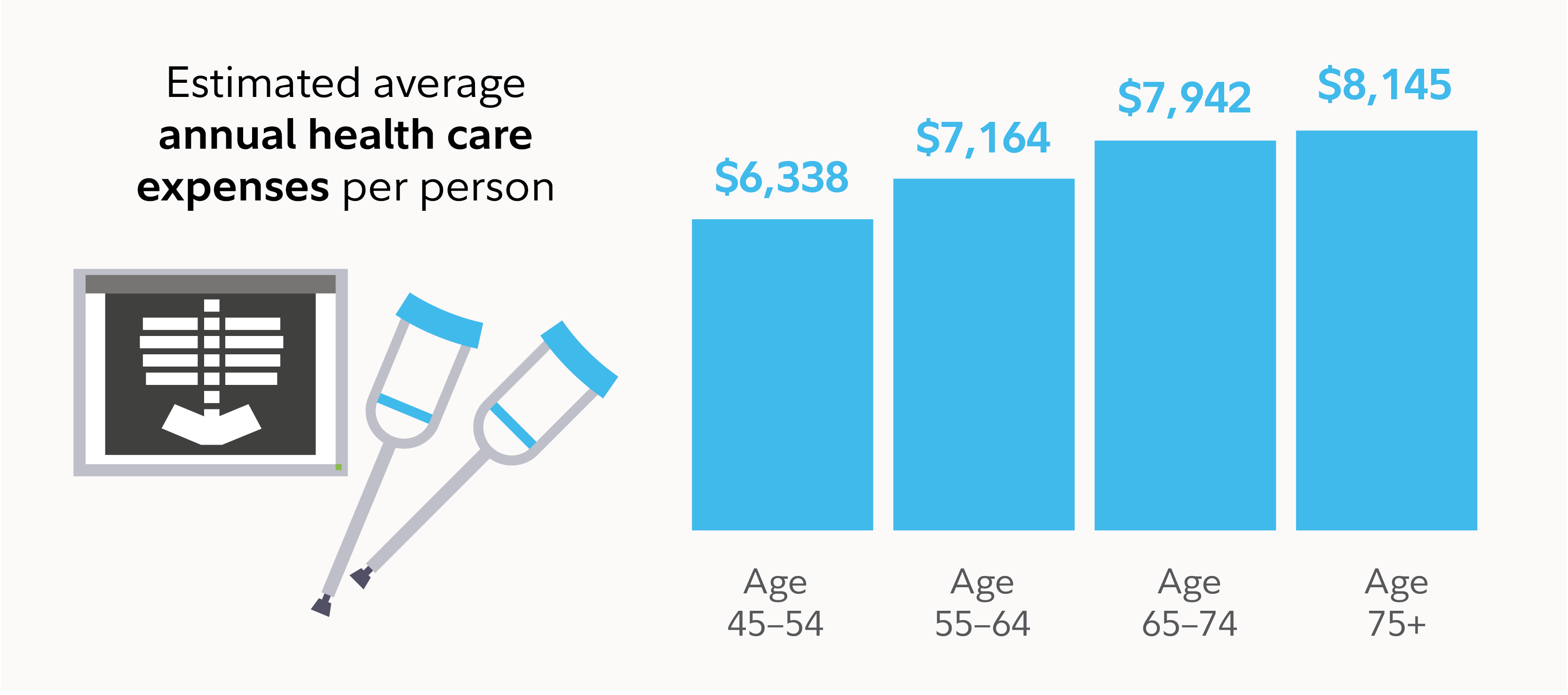

Plan for higher health care costs, especially if you live longer

Although you may be able to accurately estimate your entertainment, food, and transportation costs in retirement, health care is the one major outlay that is unpredictable and expensive.

Fidelity estimates that on average a 65-year-old retired couple needs $330,000 in assets set aside today (after tax) to pay for expected health care expenses through average life expectancy.3 For planning purposes, you may want to factor in an even higher number, because many people experience above-average expenses—often due to chronic illnesses, longevity, or long-term care costs.

Tip: According to research by Fidelity Financial Solutions, you should plan on factoring in approximately 15% of your retirement expenses will be related to health care expenses, year in and year out. In general, the more health issues you expect, the higher the retirement income replacement rate you may want to work into your retirement income plans.

Your lifestyle choices can impact your bottom line

Lifestyle is another big factor to consider in estimating how much you will spend in retirement. You might choose activities that are relatively easy on the wallet, such as spending more time with grandkids, reading, or gardening. But increasingly people want to tap into their savings to create a more active lifestyle that includes travel, adventure, and new activities.

These decisions have a big impact on your bottom line. If you're a jet setter who plans to see the world or take up new activities, expect to ratchet up your income replacement rate significantly. Or if you are looking ahead to enjoying the simple life, this number may be significantly lower.

"We often hear about people who are worried about the stock market taking a chunk of their savings in the first few years after they stop working due to market volatility, asset allocation, or poor market performance. What they may not realize is that their own travel plans could eat up just as much of their savings," says Zhao.

Tip: Our research suggests if you plan an active lifestyle in retirement, ratchet up your overall retirement budget by 15 percentage points compared with a less active lifestyle—a difference that would equate to tens of thousands of dollars in savings at the time of retirement.

Ask the right questions before you retire

As you look ahead to a successful retirement, consider working with your financial advisor to map out a retirement income plan that works for you—and your expected lifestyle. As you explore options for your retirement plan, here are a few questions for you and your spouse/partner to discuss with your advisor:

- Should you pay off your mortgage before you retire?

- Are you funding your grandchildren's college expenses?

- How much expensive travel do you have planned?

- Do you plan to relocate in retirement?

- What impact might health issues or taxes have on your retirement planning?

- Do you have a housing strategy that details locales, living options, and amenities for the next stages of your life?

Knowing when and if you'll have to make adjustments to your spending habits in certain categories of spending can help give you the confidence to live the retirement lifestyle that you've been planning for over many years.