Making a budget may not be the first thing you look forward to in retirement, but it's one of the most important things to do to start your retirement on the right path. Along with an income plan that can deliver a steady "retirement paycheck" and an investing strategy that allows a portion of your nest egg the chance to grow, a realistic budget—based on all the sources of income you have coming every month—is an essential building block of retirement.

If you're ready to begin putting together a retirement budget, here are some tips to help.

Think big picture

For many, the budgeting process stalls before it gets started often because they worry about the details of their discretionary (nice-to-have) spending, instead of looking at the big picture. Start by understanding your essential (must-have) expenses and how you can use guaranteed sources of income, like Social Security, pensions, and annuities, to pay for them.

Then, create your discretionary budget by focusing on categories of spending—such as travel, gifting, and entertainment—rather than trying to account for every dollar you'll spend. A good practice is to match these nice-to-have expenses with income from individual retirement accounts (IRAs) and other tax-deferred retirement savings accounts.

Get organized

Plan ahead and think about the life you want to live in retirement, based on what you can afford. You need to know the details of your recent spending patterns, and determine whether your overall spending will go up, down, or stay the same in retirement.

To start, tabulate your average monthly expenses like subscriptions, cell, and electric bills and know how much money is coming in versus going out. If you use credit cards, look at year-end summaries to see where you spent the most. Do the same with online bank statements. Next, identify your ongoing monthly bills and determine whether you need to continue all these services. Then, look through your past bills and online bank statements to identify work-related expenses that you may no longer have to pay now that you're retired. Lastly, categorize expenses into "essential" and "discretionary."

Essential expenses

Cover essentials first, starting with health care.

On average, according to the 2025 Fidelity Retiree Health Care Cost Estimate, a 65-year-old individual may need $172,500 in after-tax savings to cover health care expenses in retirement.

Health care: You may be covered by Medicare and an insurance plan from your former employer, but even so, your supplemental premiums and out-of-pocket costs may continue to rise, over time.

To learn more about health coverage before and after you're eligible for Medicare, visit Fidelity's Finding health coverage in retirement.

Housing: A good rule is to budget at least 1% of your home's value for annual maintenance. This means, if your home is worth $400,000, then budget approximately $4,000 per year for standard repairs, general upkeep, or accessibility upgrades.

Transportation: No longer having commuting costs is a big bonus of retiring, but your transportation costs won't drop to zero. Most people don't retire to sit around the house, so remember to include the cost of gas or public transportation for trips to activities, as well as vehicle maintenance expenses. If you are considering buying a new or used car, add that expense too.

Food: Although you may not be eating out at lunch with colleagues, overall expenditures on food will likely remain constant. Now that you're retired, it might be a great time to do some fun things like taking cooking lessons or entertaining for friends and family.

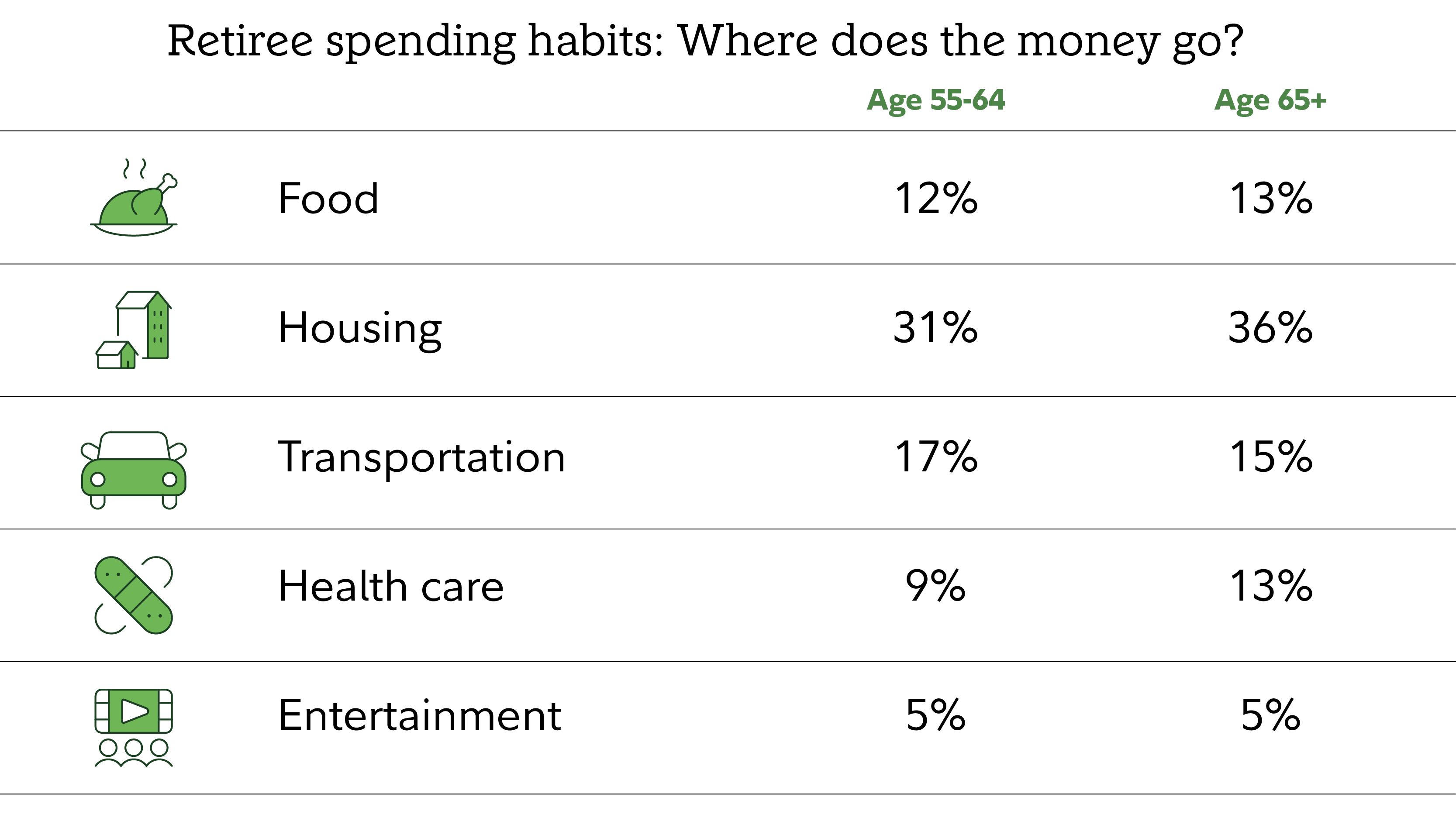

Note: The table illustrates the percentage of total expense the average household spends on food, housing (including utilities), transportation, entertainment, and health care. Data are based on the 2023 Consumer Expenditure Survey by the Bureau of Labor Statistics (BLS). From the survey, reported household income and expenditure were aggregated in the 5 categories. Aggregated spending amounts were then divided by the total reported expenditures to derive the average expenditures for each cohort. The percentages are the results of cohort average expenditures by average total expenses. Total household income by age segment may vary from year to year, resulting in higher or lower percentages of spending per category.

Discretionary spending

Once you have accounted for your "must-haves," you can begin budgeting for discretionary items, such as dining out, going to the movies, and those bucket-list adventures you've been dreaming of.

Travel: How you budget for travel will depend on the types of trips you're contemplating—weekend getaways, long vacations, or visits to family and friends. For short jaunts, you can build a monthly expense into your budget, putting the money you don't use into a pool for spending later. If you are planning for longer vacations, add a vacation fund to the budget.

Entertainment/dining out/gifting: You probably already have a good idea of how much it costs to go to the movies and dine out, but many people forget to include money they use to buy gifts for family and friends. If your budget allows for it, consider larger gifting priorities—such as giving money to future heirs to minimize inheritance taxes or contributing regularly to charities.

Stick to your income plan

A well-designed retirement income plan should be backed by an investing strategy that provides opportunities for your assets to generate earnings and helps your income keep pace with inflation. But investment returns will vary, and that, along with unexpected expenses, may require you to build some flexibility into your budget. One solution is to express your discretionary spending as a range. That way, you can choose to put aside unspent money in months when your costs are at the bottom end of the range and use it during months when your discretionary spending may be higher.

Tip: Fidelity suggests limiting withdrawals from retirement savings accounts to 4%–5% in your first year of retirement, and then adjusting this number in subsequent years.

Keep it simple

Remember why you retired—to have fun and do the things you never had time for when you were working! One way to simplify may be to consolidate your retirement accounts with a trusted financial services provider, which enables you to organize your income, investing, and spending in one place while potentially reducing fees.

If you need help with budgeting or reviewing your retirement earnings, consider working with a financial professional. If you are more of a DIY person, check out Fidelity’s online budgeting tools.