Overview

- The Fidelity Account

- Compare Online Brokers

- Awards & Recognition

- Compare Service Levels

- Margin Loans

- Fully Paid Lending

- FAQs

-

Technology

-

Pricing

Investment Choices

General

-

How does cash availability work in my account?

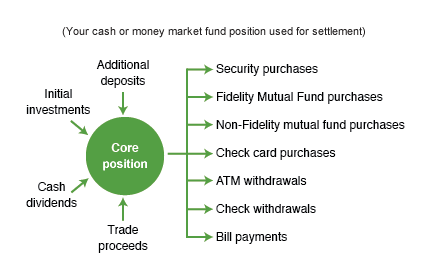

Opening a Fidelity account automatically establishes a core position, used for processing cash transactions and for holding uninvested cash.

How Your Core Position Works

When you sell a security, the proceeds are deposited in your core position. When you buy a security, cash in your core position is used to pay for the trade. This happens automatically—you do not have to "sell" out of your core account to make a purchase. Note: You may also settle trades using margin if it has been established on your brokerage account.

Your core position is also used for processing:

- Checks

- Electronic funds transfers (EFTs)

- Wire transfers

- Direct deposits

- Fidelity ATM, and Visa Gold Card transactions

- Payments made through Bill Pay service

-

What are the investment options for my core position?

Non-retirement accounts

Fidelity Government Money Market Fund (SPAXX), a taxable money market mutual fund investing in U.S. Government Agency and Treasury debt, and related repurchase agreements. Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity.1,2

Fidelity Treasury Fund (FZFXX), a taxable money market mutual fund investing in U.S. Treasury securities and related repurchase agreements. Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity.1,3

Taxable Interest Bearing Cash Option (FCASH), a free credit balance and is payable to you on demand by Fidelity. Fidelity may use this free credit balance in connection with its business, subject to applicable law. Fidelity may pay you interest on this free credit balance, and this interest will be based on a schedule set by Fidelity, which may change from time to time. As of December 12, 2025, the interest rate for this option is 1.82%.

Generally speaking, these are the options available to you at the time you open your account. However, certain types of accounts may offer different options from those listed here. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose.4

Retirement accounts

Fidelity Government Money Market Fund (SPAXX), a taxable money market mutual fund investing in U.S. Government Agency and Treasury debt, and related repurchase agreements. Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity.1, 2

Fidelity's FDIC Insured Deposit Sweep Program (the "Program")

Through the Program, the uninvested cash balance in certain Fidelity accounts is swept into an FDIC-Insured interest-bearing account at one or more program banks and, under certain circumstances, a money market mutual fund (the "Money Market Overflow"). For more information, please refer to the FDIC-Insured Deposit Sweep Program Disclosures (PDF). See the current interest rates available through the FDIC-Insured Deposit Sweep Program.After your account has been established, you can change your core position to any other core position Fidelity might make available for this purpose.4

Although you can have only one core position, you can still invest in other money market funds. If you would like to change your core position after your account has been established, you can do so online or by calling a Fidelity representative at 800-544-6666.

Learn more about Money Market Mutual Funds

1. You could lose money by investing in a money market fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not a bank account and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Fidelity Investments and its affiliates, the fund’s sponsor, is not required to reimburse the fund for losses, and you should not expect that the sponsor will provide financial support to the fund at any time, including during periods of market stress.

Fidelity's government and U.S. Treasury money market funds will not impose a fee upon the sale of your shares.

2. Normally at least 99.5% of the fund's total assets are invested in cash, U.S. Government securities and/or repurchase agreements that are collateralized fully (i.e., collateralized by cash or government securities). Normally at least 80% of the fund's assets are invested in U.S. Government securities and repurchase agreements for those securities. Certain issuers of U.S. Government securities are sponsored or chartered by Congress, but their securities are neither issued nor guaranteed by the U.S. Treasury. Investing in compliance with industry standard regulatory requirements for money market funds for the quality, maturity, and diversification of investments.

3. Normally at least 99.5% of the fund's total assets are invested in cash, U.S. Treasury securities and/or repurchase agreements for those securities. Normally at least 80% of the fund's assets are invested in U.S. Treasury securities and repurchase agreements for those securities. Investing in compliance with industry standard regulatory requirements for money market funds for the quality, maturity, and diversification of investments.

4. Additional options might be available by calling your representative.

-

Where can I find my account number(s)?

All brokerage securities held in an account are listed under a single brokerage account number. This number always has 9 characters and can be found in your portfolio summaryLog In Required.

A separate account number may be added to your account if you establish direct deposit.

See how to determine your routing and account numbers for direct deposit.

-

When are deposits credited?

Any deposits to your brokerage account are made to the core account, including:

- Your initial investment

- Deposited checks and direct deposit of pay

- Trade proceeds

- Cash dividends

Collection periods vary depending on the deposit method. The collection period for check and EFT deposits is generally 7 business days. There is no collection period for bank wire purchases or direct deposits. Trade proceeds vary according to the security being traded.1

1. We reserve the right to require equity of up to 100% of the proposed trade's value in any account. Fidelity may waive this requirement for customers with previous Fidelity credit history or mutual fund assets on deposit. First-time traders with Fidelity Brokerage Services LLC, are required to deposit at least 25% of the value of the trade. Retirement accounts require 100% of the proposed trade's value at the time the trade is placed.

-

When do trades, checks, bill payments, and check card purchases clear my core position?

- Trades are settled, and checks are cleared automatically, using the money in your core position or available margin. Trade settlements vary according to the security being traded. Settlement times for trades

- ATM withdrawals and debit transactions using the Fidelity Visa® Gold Check Card are debited immediately.

- Cash withdrawals are debited the same day.

- Payments made with Bill Pay normally take several days to clear.

-

How is interest calculated?

A benefit of the core position is that it allows you to earn interest on uninvested cash balances. Interest is calculated on a daily basis and is credited on the last business day of the month.

-

Where can I see my balances online?

You can see your available balance by viewing your portfolio summaryLog In Required and then selecting "balances" from the dropdown list. You can also arrange to have balance alertsLog In Required sent to you electronically.

-

What do the different account values mean?

Balance Description Update frequency Total account value

Total account value The total market value of all positions in the account, including core, minus any outstanding debit balances and any amount required to cover short options positions that are in-the-money Real-time Cash (core) Account settlement position for trade activity and money movement. Executed buy orders and cash withdrawals will reduce the core, and executed sell orders and cash deposits will increase the core. Overnight Cash credit/cash debit A cash credit is an amount that will be credited (positive value) to the core at trade settlement. A cash debit is an amount that will be debited (negative value) to the core at trade settlement. Intraday Held in cash The total market value of all long cash account positions. This figure is reduced by the value of any in-the-money covered options and does not include cash in the core position. Real-time Held in options The market value of all long and short options positions held in the account Real-time Cash available to trade

Cash available to trade The amount available to purchase securities in a cash account without adding money to the account. Executed buy orders will reduce this value (at the time the order is placed), and executed sell orders will increase this value (at the time the order executes). Intraday Cash (core) Account settlement position for trade activity and money movement. Executed buy orders and cash withdrawals will reduce the core, and executed sell orders and cash deposits will increase the core. Overnight Cash credit/cash debit A cash credit is an amount that will be credited (positive value) to the core at trade settlement. A cash debit is an amount that will be debited (negative value) to the core at trade settlement. Intraday Uncollected deposit Recent deposits that have not gone through the bank collection process and are unavailable for online trading. The normal check and electronic funds transfer (EFT) collection period is 7 business days. Overnight Committed to open orders The dollar amount allocated to pending orders that have not yet been executed (e.g., buy orders). The amount you have committed to open orders decreases your cash available to trade. Intraday Settled cash The portion of your cash (core) balance that represents the amount of securities you can buy and sell in a cash account without creating a good faith violation. This amount includes proceeds from transactions settling today minus unsettled buy transactions, short equity proceeds settling today, and the intraday exercisable value of options positions. Additionally, uncollected deposits may not be reflected in this balance until the deposit has gone through the bank collection process which is usually 7 business days. Intraday Cash available to withdraw

Cash available to withdraw Amount collected and available for immediate withdrawal. This balance includes both core and other Fidelity money market funds held in the account. This balance does not include deposits that have not cleared. Sell orders are reflected in this balance on settlement date and buy orders are reflected on trade date. Intraday Cash (core) Account settlement position for trade activity and money movement. Executed buy orders and cash withdrawals will reduce the core, and executed sell orders and cash deposits will increase the core. Overnight Other money markets All Fidelity money market funds, other than core, held as positions in the account Overnight Options balances

Options in-the-money Options that have intrinsic value. A call option is considered "in-the-money" if the price of the underlying security is higher than the strike price of the call. A put option is considered "in-the-money" if the price of the security is lower than the strike price. Real-time Cash covered put reserve The value required to cover short put options contracts held in a cash account. Cash covered put reserve is equal to the options strike price multiplied by the number of contracts purchased, multiplied by the number of shares per contract (usually 100). Cash available to buy securities, cash available to withdraw, and available to withdraw values will be reduced by this value. Intraday Cash spread reserve The requirement for spread positions held in a retirement account. For debit spreads, the requirement is full payment of the debit. For credit spreads, it's the difference between the strike prices or maximum loss. A $2,000 minimum equity deposit is required in addition to the debit requirement. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. The $2,000 minimum equity deposit is required when the first spread is established. Maintaining multiple spreads in the same account does not require multiple minimum equity deposits. Overnight Options balances appear if options agreement exists.

Update frequency explained

Real-time: Balances display values that change with market price fluctuations on the underlying securities in your account. Essentially, it is a complete recalculation based on price fluctuations of positions, trade executions, and money movement into or out of the account.

Intraday: Balances reflect trade executions and money movement into and out of the account during the day.

Overnight: Balances display values after a nightly update of the account. In some cases, certain balance fields can only be updated overnight due to regulatory restrictions. -

What is an interactive statement, and where can I see my interactive statement online?

An interactive statement gives you:

- Quick links to important information about your holdings—including quotes, research, and performance.

- Easy-to-read portfolio and transaction information.

- Links to valuable portfolio planning and analysis tools.

- The ability to customize your statement by adding or hiding accounts.

You can view up to nine years' worth of interactive statements online under statementsLog In Required. Your tax documents will still arrive by mail.

- Sign up for eDelivery

Save time, money, and space in your closet—sign up to receive an email noticeLog In Required whenever your next statement is posted on Fidelity.com. - You can also sign up to receive your Fidelity statements, trade confirmations, prospectuses, financial reports, and other documents electronically.

-

How do I add or change the features offered on my account?

Many account features can be added or changed online, including:

- Applying for ATM and credit cards.

- Establishing automatic investments and withdrawals.

- Signing up for electronic document delivery.

- Updating bank information.

- Signing up for Checkwriting.

- Signing up for bill payment.

- Reordering checks and deposit slips.

- Signing up for margin and options trading.

View a full list of account features that you can update

Some changes must be made with a signed paper form per industry regulations.

-

How do I give someone else the right to view or transact in my account?

You can add a trading authorization to allow another person to trade in your account:

- Limited trading authorization allows buying or selling securities in your account.

- Full trading authorization allows buying and selling securities as well as withdrawing money from your account. Full trading authorization has limitations for some types of accounts.

To get started, fill out a form available in account access rightsLog In Required.

-

How is my account protected?

Protecting your account assets

Fidelity's brokerage businesses (Fidelity Brokerage Services LLC and National Financial Services LLC [NFS]) are members of the Securities Investor Protection Corporation (SIPC), and brokerage accounts maintained with Fidelity are covered by SIPC, which protects brokerage accounts of each customer when a brokerage firm is closed due to bankruptcy or other financial difficulties and customer assets are missing from accounts.SIPC protects brokerage accounts of each customer up to $500,000 in securities, including a limit of $250,000 on claims for cash awaiting reinvestment. Money market funds held in a brokerage account are considered securities.

In addition to SIPC protection, Fidelity, through NFS, provides its brokerage customers with additional excess of SIPC coverage from Lloyd's of London together with Axis Specialty Europe Ltd. and Munich Reinsurance Co. The excess of SIPC coverage would only be used when SIPC coverage is exhausted. As with SIPC, excess of SIPC protection does not cover investment losses in customer accounts due to market fluctuation. It also does not cover other claims for losses incurred while broker-dealers remain in business. Total aggregate excess of SIPC coverage available through Fidelity's excess of SIPC policy is $1 billion.

Within Fidelity's excess of SIPC coverage, there is no per-account dollar limit on coverage of securities, but there is a per-account limit of $1.9 million on coverage of cash awaiting investment. This is the maximum excess of SIPC protection currently available in the brokerage industry.

Both SIPC and excess of SIPC coverage is limited to securities held in brokerage positions, including mutual funds if held in your brokerage account, and securities held in book-entry form. Neither SIPC nor the additional coverage protects against loss of market value of the securities.

Note: Certain assets are not eligible for SIPC protection. Among the assets typically not eligible for SIPC protection are commodity futures contracts and precious metals, as well as investment contracts (such as limited partnerships) and fixed annuity contracts that are not registered with the U.S. Securities and Exchange Commission under the Securities Act of 1933.

In accordance with the SEC rule 15c3-3, often known as the "Customer Protection Rule," Fidelity protects client securities that are fully paid for by segregating them and ensuring that they are not used for any other purpose, such as for loans to investors or institutions, corporate investment purposes, and spending. This practice helps ensure that customers have access to these securities at all times. Customer assets may still be subject to market risk and volatility.

Protecting your personal information

When you use the Fidelity web site, we want to make sure you have the peace of mind that comes with knowing that your information is safe and secure. That's why we only allow access to your account using confirmed information, such as your Social Security number or a username and password that you've created. We generally recommend using a username and password instead of your Social Security number as that combination can offer increased protection. However, no matter which mode of access you choose, we protect your information using the strongest encryption available to us. We also offer the same encryption when you access your accounts using your mobile device. Review our security measures to learn more about how Fidelity protects your information.Furthermore, we also offer protection for your assets in the case of unauthorized activity in your account. For more information, please see our Customer Protection Guarantee.

Customers residing outside of the United States

-

Are all of Fidelity's products and services available to customers residing outside of the United States?

No, our product and service offerings for customers and prospective customers who reside outside of the United States are limited. While the questions below provide a general overview of those limits, because so much is dependent on the particulars of your specific situation, we suggest you call us at 800-343-3548 to learn about how they apply to you. If you are calling us from outside the United States, please visit Fidelity Phone Numbers, For Customers Traveling Abroad to see a list of available international phone numbers available.

-

I'm not a resident of the United States and I don’t have any existing accounts with Fidelity. Can I establish a relationship with Fidelity?

Unfortunately, we do not open accounts for any new customers residing outside the United States.

-

I’ve recently moved outside the United States. What does that mean for me?

Regardless of where you move, the following applies:

Fidelity does not provide discretionary asset management services to customers who reside outside the United States. If you move outside the United States, your discretionary asset management relationships will be terminated, and certain mutual funds held in those accounts may be liquidated as part of that termination.

The services provided by our representatives are limited to those that are ministerial or administrative in nature. Among other things, this means that our representatives do not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition.

Customers residing outside the United States will not be allowed to open new 529 Savings Plan Accounts or Health Savings Accounts (HSAs), or to continue to contribute to existing 529s or HSAs.

Customers residing outside the United States will not be allowed to purchase shares of mutual funds.

There are additional restrictions that may apply, depending on the country where you now reside. Customers in certain countries may be limited to selling their existing holdings and withdrawing the proceeds from their accounts. They will not be able to make deposits in their accounts, or buy any additional securities. In most other countries, the restrictions will be less onerous, but customers may still experience certain limitations (for example, margin lending or options trading may not be permitted, or a certain type of account will experience trading restrictions).

-

You mention that I can no longer purchase mutual funds. What about my dividend and capital gain reinvestments? Can I continue to reinvest shares through this program?

Yes, you can continue to reinvest your dividends and capital gains.

-

Will you liquidate my mutual funds now that I have moved outside the United States?

Other than certain holdings in previously discretionary managed accounts, you can continue to maintain your mutual fund holdings until you decide to sell them.

-

How do I vote in a shareholder meeting?

Once the voting window has opened, you will see your specific security and the related due date and can access details and documents by clicking Vote at https://www.fidelity.com/proxyvotingresults.

More information

Stock FAQs

Learn more about international stock trading and IPOs.

Fidelity Trader+™ FAQs

Get details on our most powerful trading experience yet. Available at no cost across your devices.

Fidelity Learning Center

Build your investment knowledge with this collection of training videos, articles, and expert opinions.