If you've been keeping up with tech and finance news, you may have seen the term "Web3" pop up. Some are calling it the next internet boom, while others believe it may be more of a fad. Investors have poured billions into it, while skeptics question whether its mission is feasible.

But what exactly is it?

What is Web3 and what does it have to do with crypto?

Web3 is everything related to crypto, blockchain, and the metaverse. From cryptocurrencies to smart contracts to virtual realities, Web3's goal is to build a decentralized internet.

In theory, this means no single company or organization controls these platforms and applications. Proponents believe a decentralized version of the internet can help solve tough questions involving censorship and privacy.

The movement has its roots in 2009 with the advent of Bitcoin, which was launched in response to the financial crisis of 2008. The vision was to create a currency that would be free from manipulation by any single entity or organization. As Bitcoin gained traction, others began applying its blockchain technology to other parts of the internet. And thus, Web3 was born.

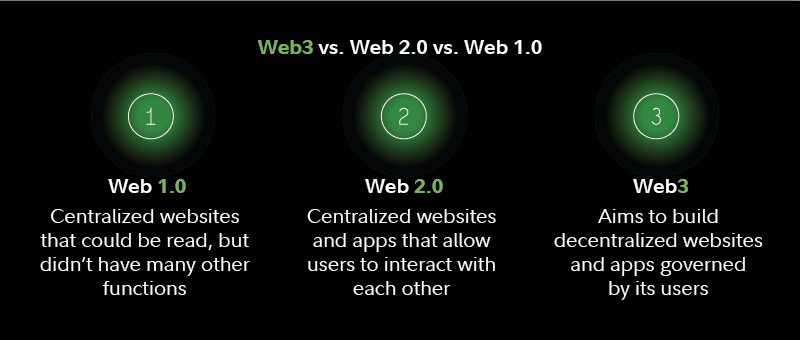

Web3 vs. Web 2.0 vs. Web 1.0

Web 1.0: The early days. The internet originally worked like a library or encyclopedia. Most websites during this era were simple pages run by organizations or companies. For the most part, they contained information users could read, but there wasn't much you could do on a website beyond that.

Web 2.0: New functions arrive. In the early 2000s, new websites and platforms popped up that allowed users to interact with the site owner, as well as other users. One of its most significant features is that it enabled users to become content creators. Web 2.0 includes social media platforms, blogs, eCommerce websites, video and photo sharing services, and smartphone applications.

Web3: A new age? What makes Web3 different may be summed up best by a single word: Decentralization. Web 1.0 and 2.0 are both run by centralized entities (i.e., organizations where all the decisions are made by a select group of owners and employees). Web3 envisions an internet that's governed by its users.

How does Web3 work?

Web3 companies build their products on blockchain technology. On a big-picture level, think of blockchain like a giant spreadsheet that is tracked and updated by millions of independent computers around the world. Anyone can review the information on a blockchain and, in theory, the data isn't owned by any single entity.

Let's clear up some ambiguity by looking at a few specific examples.

Potential uses for Web3

Supporters believe Web3 has a future in a variety of applications, including the following:

- Cryptocurrencies: The original Web3 use case, cryptocurrencies currently have a variety of usages. Some, like bitcoin, are strictly designed for financial transactions. Others, like ethereum, primarily serve as tokens for an application or platform. In all cases, all transactions are tracked and recorded on a blockchain.

- DeFi: Short for decentralized finance, DeFi platforms aim to allow users to complete financial tasks via a blockchain. This includes lending and borrowing, trading and betting, and generating interest. The goal is to cut out traditional third-party financial service intermediaries like banks and credit card companies.

- Smart contracts: Traditionally, executing agreements can involve several third parties. If Joan wants to sell John a house, the process might involve realtors and lawyers. Smart contracts are digital agreements that are programmed so that a predetermined action happens when certain requirements are met. For example, Joan receives payment once John receives the keys to the house. Smart contract supporters believe they can reduce the need for middlemen.

- NFTs and digital collectibles: Short for "non-fungible tokens," NFTs are essentially certificates of ownership that are tracked and updated on a blockchain. In simple terms, they're smart contracts that specify which items you own. At the moment, NFTs are most popular in the digital art niche, but supporters believe they may have a future in real-world items like real estate and supply chain management.

- Metaverse: The term metaverse may bring to mind an immersive virtual reality video game we will all lose ourselves in. But it can also include things like wearable tech, design and engineering software, and IT infrastructure. The concept is tied to Web3 because digital ownership (who owns what) in the metaverse can be verified on blockchains.

- DAOs: Short for "decentralized autonomous organizations," DAOs are essentially internet clubs that are run with cryptocurrencies. In general, those who hold the official DAO cryptocurrency are verified club members and may get voting rights on what the DAO does as an organization.

Potential limitations of Web3

Skeptics raise their eyebrows at the goal of decentralization, given how much of the current Web3 ecosystem is run on venture capitalist money or is being developed by corporations that want to retain some level of control. If centralized, third-party investors own a significant portion of these projects, can they ever truly be decentralized? And if the answer is no, what makes Web3 different from Web 2.0?

Another questionable aspect of a decentralized future may be that many Web3 companies are currently centralized. While many say they're working toward a decentralized future, skeptics caution that, compared to centralized structures, decentralization gives companies less control. They wonder whether this will make it difficult for Web3 companies to move toward decentralization.

A third major question is how evolving government regulations might change how Web3 operates. One possibility is that future laws require companies to retain a certain level of control, which would impact how decentralized they can become.

Finally, as with any new technology, there is skepticism around whether Web3's use cases can become viable solutions to the problems they're attempting to address. For example, it remains to be seen whether cryptocurrencies will be sustainable in the long run, given the volatility of the market and uncertainty around future regulations. Likewise, the DeFi world has already battled several turbulent events, including the collapse of one of its largest projects.

Ultimately, time will tell whether Web3 ushers in a new era of the internet or simply becomes a footnote in digital history. Nevertheless, while specific applications may come and go, blockchain technology may be here to stay.