Excessive fees. Late payments. Supply chain challenges. Blockchain enthusiasts believe all these problems can be solved with smart contracts. In fact, many believe they will revolutionize entire industries.

So what exactly are smart contracts and what do they have to do with crypto? Let's explore how they work, and what aspects skeptics are unsure about.

What is a smart contract and how does it work?

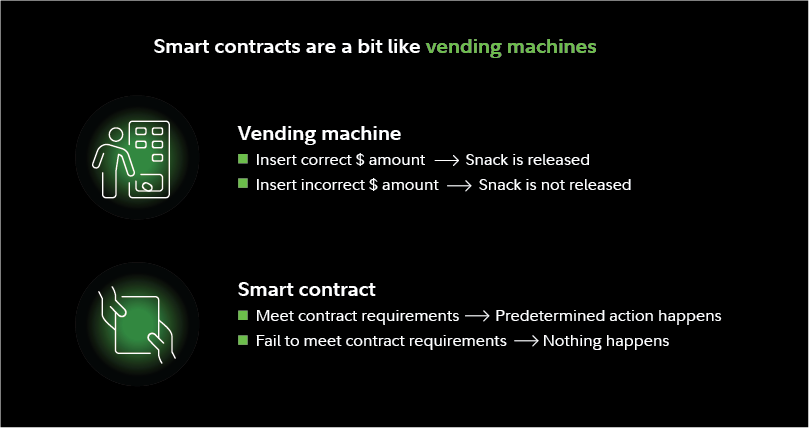

A smart contract is a digital contract that can be programmed so that a predetermined action happens once certain requirements are met.

Think of it like a vending machine. A snack will only be released when the correct amount of money is inserted. And of course, if an incorrect amount is inserted, the snack isn't released. Smart contracts follow the same logic. Instead of physical machines, however, they're virtual agreements.

Smart contracts are built and stored on blockchains like Ethereum. Once they're active, the terms of the contract can't be changed, which may help reduce the risk of fraud and manipulation. They're also decentralized (i.e., they aren't executed by a central authority or third party), and can be audited and verified by the public.

Let's look at a real-world example of how they work. One of the biggest challenges farmers face is extreme weather. Unforeseen disasters like floods and droughts can wreak havoc on agricultural industries and rack up billions of dollars in damage every year.

One solution that can help increase financial stability for farmers is climate-based insurance. However, the cost of paying the claim can be greater than the claim itself. In developing countries, claims are typically for very small amounts, but implementing insurance payments requires underwriters, lawyers, and other parties—which can be expensive for many.

Enter: Smart contracts, which can be programmed to release payments to farmers under specific weather conditions, like when the region experiences a certain number of days of drought or flooding. This removes the need for intermediaries to manage every payment, which can make implementing climate insurance more cost effective.

Potential use cases for smart contracts

One of the most significant applications for smart contracts is currently in DeFi (short for "decentralized finance"). DeFi projects aim to replace traditional financial institutions with blockchain technology. A few specific examples include:

- Loans, mortgages, and other lending products: Supporters believe smart contracts can make the lending industry more efficient by removing the need for lengthy application processes and third-party intermediaries. Who owes who how much and when payments are due can be outlined clearly via smart contracts, and payments can be automatically collected and released.

- Payments: Whether it's payroll, accounts receivable, or royalty payments, smart contracts can automate the distribution of payments to ensure accuracy and timeliness. This could also help cut down on the administrative costs required to manage these items.

- Decentralized exchanges: Supporters believe decentralized exchanges can make trading more trustworthy for participants. These exchanges run on smart contracts rather than through a centralized organization.

- Real estate transactions: Smart contracts can act as escrow by holding and releasing payments according to defined terms. Traditionally, buying and selling real estate can involve multiple intermediaries, which can make the process expensive and inefficient. Smart contracts may open the door for faster and more cost-efficient transactions that don't require third parties. They can also be used to verify ownership of the property more efficiently than existing methods.

- Renting and leasing: Terms for a lease can be clearly defined and enforced via an automated smart contract. The same contract can collect payments and security deposits from the tenant and release them to the landlord, all without a third-party intermediary. This can improve the efficiency of the management process.

In addition to transactional use cases, smart contracts can also be used to improve identification processes. Information in smart contracts is stored on a blockchain, which means it can be tracked by the public, and can't be changed once it's recorded. Supporters believe these features can be used to improve use cases that include the following:

- Digital ownership: Another currently popular application for smart contracts is the verification of ownership for digital assets. For example, NFTs (non-fungible tokens) enable collectors to "own" digital art. Smart contracts use blockchain technology to keep track of who owns what.

- Financial services: Banks and other financial institutions can use smart contracts to streamline their auditing processes. Also, the ID verification and transactional benefits discussed above can make it easier to serve their customers.

- Supply chain management: Companies can use smart contracts to efficiently track every step of their production and manufacturing processes. For example, when an item moves from plant A to plant B, employees at plant A sign the smart contract to confirm the item has been sent, and employees at plant B sign to confirm they have received it. Consumers who prioritize ethical or health/cleanliness standards can also use this information to gain transparency on the products they buy.

- ID verification: Because information recorded on a blockchain can't be altered, smart contracts can help reduce identity fraud, verify memberships, and improve security for other scenarios involving IDs. For example, elections can create smart contracts with a fixed number of votes, then assign one vote to each participant. This could help prevent the possibility of bad actors voting twice.

- Insurance: Faster claims processes, simplified administrative tasks, and fewer fraudulent claims are all benefits smart contracts could bring to the insurance industry. Data stored on the blockchain can help make patient and customer data tracking much more efficient.

- Health care: Smart contracts can make it faster and easier for doctors to share patient data necessary to coordinate treatments. This can help them efficiently communicate across multiple health care providers, as well as get patients the care they need faster.

What is a dApp?

A dApp (short for "decentralized app") is a software application that runs on smart contracts. For more context, consider the apps on your smartphone. Chances are they're operated by a centralized corporation or business. DApps, however, aim to create apps that aren't controlled by single entities. This includes everything from internet browsers to smartphone apps to entire exchanges.

Many of the use cases discussed above are being built with dApps.

Potential disadvantages of smart contracts

One of the selling points of the smart contract concept is the ability to make agreements without third parties. But skeptics point to a few potential issues.

- Currently, syncing with real world data can be difficult. In many of the use cases discussed above, smart contracts will only be effective if they can accurately read real-world information (i.e., climate insurance requires accurate weather data). Blockchains typically don't have this function built in, though there are Web3 projects that are working on bridging this gap.

- Parties may want to change contract terms. Contracts published on blockchains can't be changed. This can help prevent manipulation, but it can also be a hurdle if both sides agree to revise the terms. In this case, a new smart contract would have to be created, which can cause logistic and legal complications.

- Many legal agreements may not be truly automatable. While certain tasks like making payments and tracking supply chains are relatively straightforward, many legal contracts for other purposes are written with intentionally subjective language that leaves room for interpretation. For these cases, smart contracts may not be able to adequately enforce these agreements without the involvement of a third party (i.e., a lawyer).

- Auditing a smart contract may be hard for those without programming knowledge. Reading a smart contract requires understanding computer code, which can be more difficult to understand than reading terms and conditions.

- The long-term reliability is still unknown. This technology is still new. Though security may be gradually improving, we've also seen how crypto platforms and blockchain networks can sometimes fall victim to hackers and cybercriminals. In light of this, there's debate on whether smart contracts are as secure as traditional contracts.

Ultimately, time will tell if smart contracts endure. If adoption of blockchain technology continues to grow, smart contracts may become more popular as well. In the meantime, it's likely that more use cases will pop up in the coming years.