2025 has generally been a strong year for stock investors. But for many investors in international stocks, the results have been exceptional.

After mostly trailing US stocks for more than a decade, international stocks sprang to life in 2025, with non-US stocks returning 30% for the year as of mid December,1 outpacing the S&P 500 Index® by double digits.

For 2026, one key question for investors is whether this shift marks the start of a durable trend or was just a flash in the pan. While past performance is never a guarantee of future results, Fidelity portfolio managers see several reasons for optimism about the future of international investing. Moreover, many have identified compelling potential stock opportunities that could thrive under a variety of market scenarios.

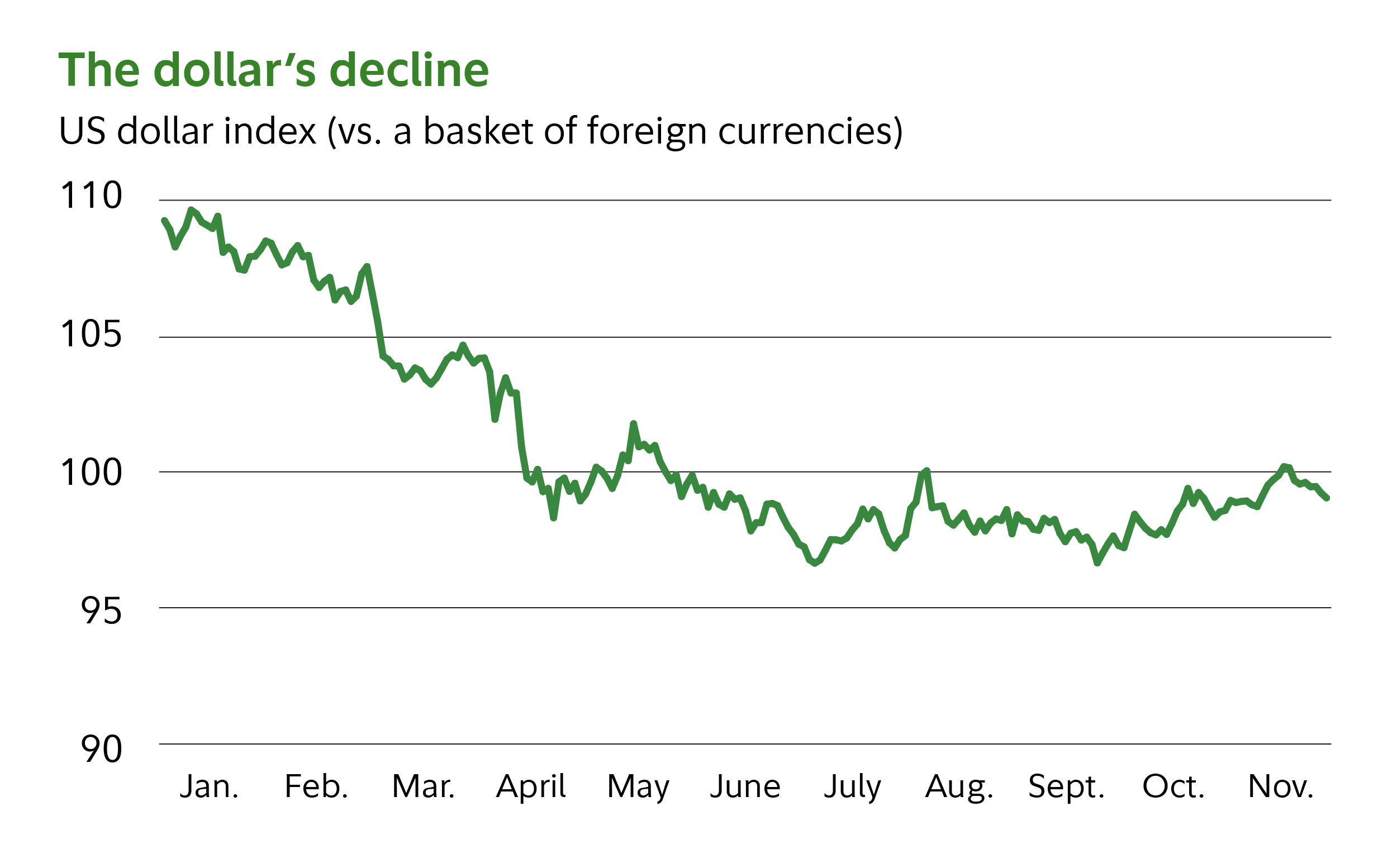

Making hay while the dollar declines

Among the most powerful forces behind the recent international winning streak has been the decline of the US dollar.

The dollar was down by almost 9% for 2025 as of mid December, relative to a basket of global developed-market currencies.2 When the dollar falls, foreign-currency investments become more valuable to US investors, because each unit of foreign currency translates into more dollars.

Fueling that decline has been a global trend of dollar diversification—i.e., foreign investors seeking to diversify the mix of currencies and assets they own.

“There are several reasons why the rest of the world might want to diversify some of its dollars,” says Anu Gaggar, vice president of capital market strategy with Fidelity Institutional. The globe continues to shift away from US dominance toward a more multipolar balance of power. Many central banks around the world have begun diversifying their large holdings of US Treasurys. And many foreign nations are now spending on their home economies in ways that might help repatriate local investors’ assets.

Plus, after several decades of inflows to US-dollar assets from foreign investors, the dollar remains relatively expensive. “The dollar still appears overvalued relative to developed-market and emerging-market currencies, even after its decline in 2025,” says Jake Weinstein, senior vice president of Fidelity’s Asset Allocation Research Team (AART). Currency movements are complex and difficult to predict—particularly in the short-term. But Weinstein says that “on a longer-term basis, there’s room for the dollar to go lower.”

Attractive valuations and policy catalysts

A host of fundamental ingredients have also underpinned the recent resurgence of international.

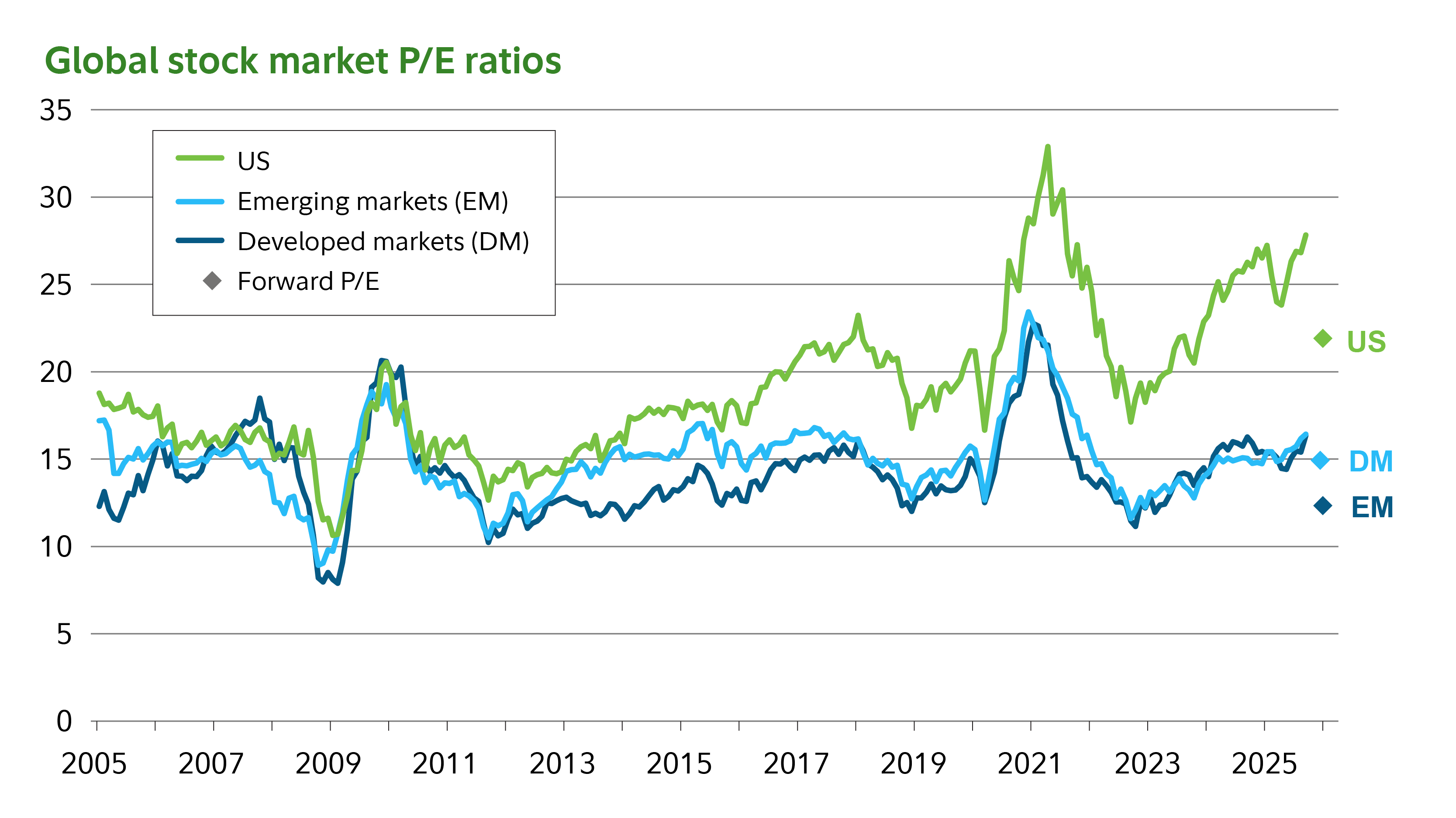

Foreign stocks began 2025 significantly cheaper than US shares. “After underperforming in general for about 15 to 20 years, the rest of the world is still really undervalued in terms of their currencies and especially their stocks,” says Dirk Hofschire, managing director of AART. Even after 2025 outperformance, non-US stocks were recently about 35% cheaper than US stocks, based on forward price-earnings (P/E) ratios.3

More-favorable monetary and fiscal policies were 2 catalysts that helped ignite a catch-up trade in Europe. European banks had faced prolonged challenges from austerity measures, deleveraging, and derisking following the eurozone crisis of the early 2010s. That situation was exacerbated by the European Central Bank’s sharp COVID-era cuts in interest rates, which reduced profitability by squeezing the interest banks could earn on loan portfolios.

“European banks went through a very long, tough stretch of zero or negative interest rates,” says Jed Weiss, manager of Fidelity® International Growth Fund (

But as interest rates have normalized in the past few years, the banks have been able to rebuild their balance sheets, return to solid profitability, and boost dividends—helping fuel standout recent performance, according to Sammy Simnegar, manager of Fidelity® International Capital Appreciation Fund (

Another critical catalyst was the abrupt shift in fiscal policy in Germany, Europe’s largest economy and the one with the greatest capacity to increase public spending. Partly in response to US criticisms that European governments were underspending on defense, Germany passed a comprehensive investment package to boost spending on the military, infrastructure, and green energy projects over the next decade—with an estimated value of as much as $1.3 trillion in total spending.4

“This marks the most significant fiscal spending package since German reunification and is a testament to a tectonic fiscal transformation taking place,” says Faris Rahman, manager of Fidelity® Europe Fund (

“Europe is attempting to shift from an austerity mindset to a growth mindset,” Rahman says. “That could create positive knock-on effects.”

Banks, defense, and infrastructure

Against this setup, Fidelity portfolio managers have been identifying potentially attractive investment opportunities in Europe—and further afield in Japan and emerging markets.

For instance, even after the powerful rebound in shares of European banks, Rahman still sees good potential value in the sector. “The banks continue to be very interesting because, at 9 to 10 times P/E, they’re at a discount to US counterparts.” He says the rebound has primarily been driven by earnings growth rather than valuation expansion, as investors are still wary of the sector after its long winter. But the banks’ return on equity has already improved from single digits to low double digits and could keep climbing—while potential loan growth and valuation expansion may still lie ahead.

Meanwhile, rising military budgets have lit a fire under defense contractors’ stocks. “The call to arms has transformed companies that were virtually dormant for decades into darlings on the outlook for defense spending in Europe and beyond,” says Bill Bower, manager of Fidelity® Diversified International Fund (

Military spending could be an enduring theme given that NATO members have pledged to ramp up defense spending to 4% of gross domestic product (GDP) and defense-related infrastructure spending to another 1% of GDP by 2035. Expanding defense order books could bolster revenues for dual defense and civil contractors across the continent, says Simnegar. Stocks exemplifying this investment thesis have included France’s Safran (

Because NATO’s spending surge targets infrastructure as well as defense, it could also stimulate demand for cement for roads, bridges, and rail lines, notes Rahman. He’s particularly drawn to the cement market because of its favorable economics: Europe’s carbon credit system constrains supply, demand is expanding, the industry is consolidated, and shipping the bulky, heavy material from afar isn’t practical.

“Virtually no new factories for cement are coming online due to the carbon credit system, and the demand side is ramping up because of the fiscal stimulus,” he says. Germany’s Heidelberg Materials (

The AI boom ripples around the globe

The most powerful theme driving the US market in recent years has been the artificial intelligence (AI) boom, which has propelled the share prices of Magnificent 7 behemoths including NVIDIA, the dominant chip designer for AI, and hyperscalers like Microsoft, Google, and Amazon. (Learn more about how Fidelity’s US fund managers have been riding the AI revolution.)

The international market doesn’t yet have multitrillion-dollar tech stocks such as these, but it does have manufacturers that are dominant players in AI’s food chain and infrastructure—the pick-and-shovel companies—that often trade at much lower valuations than analogous US stocks.

“AI is a global phenomenon," says Yasmin Landy, a Fidelity institutional portfolio manager focusing on international stocks. "From chip fabrication to AI application, innovation is taking place in many parts of the world."

For example, while NVIDIA is a leading chip designer, it relies on Taiwan Semiconductor Manufacturing Co. (

Rahman notes that ASML Holding (

Sam Polyak, who focuses on emerging markets as co-manager of Fidelity® Total International Equity Fund (

Polyak observes that China is home to some of the most innovative social media and e-commerce businesses in the world. For example, Alibaba (

Powering the AI surge

The AI rush is creating a global boom in data centers and stimulating demand for power generation, particularly from natural gas. “Data centers demand a ton of energy,” says Rahman. Established power and infrastructure companies abroad, typically selling at considerable discounts to US counterparts, may be particularly well placed to provide the necessary power generation and electrification infrastructure.

Two illustrations of this theme in Europe, says Rahman, are Germany’s Siemens Energy (

Japan’s corporate awakening

Japanese stocks may not dominate headlines as much as AI stocks do, but several Fidelity managers say Japan has quietly become one of the most compelling areas of potential opportunity abroad for 2026. After decades of modest growth and corporate inertia, Japanese corporations have been showing signs of meaningful reform—streamlining operations, returning capital, and benchmarking themselves against global peers.

“Japan has been restructuring slowly but impressively,” says Bower. He points to companies like Hitachi (

Beyond governance reform, Japan also offers exposure to global franchises and niche leaders. Weiss highlights Recruit Holdings (

“Things are changing,” Weiss says. “Rome wasn’t built in a day, but the direction of change has been very positive.”

Diversification, not market timing

It’s impossible to know in advance whether international stocks will have another banner year in 2026. Rather than trying to predict short-term returns, investors would do better to develop a thoughtful investment plan that’s tailored to their goals, time horizon, and risk tolerance.

From that perspective, there’s a strong case to be made for holding some amount of international stocks. “There are diversification benefits that can come from adding international stocks to a US portfolio,” says Scott McAdam, an institutional portfolio manager with Strategic Advisers, LLC, the investment manager for many of Fidelity’s managed accounts.

McAdam adds that stocks tend to move to some degree with the economies and business cycles of the countries where their issuers operate. Since US and foreign business cycles aren’t synchronized, the correlation of their stocks isn’t one-to-one, meaning there can be diversification benefits from adding foreign stocks to a US equity portfolio. For example, Fidelity’s AART estimates that as of the fourth quarter of 2025, China and parts of Europe were earlier in the business cycle than the US, which tends to undergird earnings growth.

Moreover, as Weiss points out, non-US companies make up a large proportion of the world's listed stocks. Not considering them could amount to a missed opportunity.

"Ignoring international is a bit like buying a US stock fund that only invests east of the Mississippi," he says. "It's a large opportunity set.”

More on the funds mentioned above

Investors can learn more about the mutual funds mentioned in this article, including fund objectives and most recent complete holdings, by visiting the fund summary pages on Fidelity.com:

- Fidelity® Diversified International Fund (

) - Fidelity® Europe Fund (

) - Fidelity® International Growth Fund (

) - Fidelity® International Capital Appreciation Fund (

) - Fidelity® Total International Equity Fund (

)